Despite recent questions about Amazon's viability, the U.S. eCommerce leader remains on top of all the others in terms of market cap, which reflects consumer sentiment and investor confidence.

The fact that the following eCommerce companies on the list operate two of China's largest marketplaces is certainly no coincidence. Rather, their favorable positioning demonstrates the enormous reach and profitability of the business model when applied correctly.

As the distance between the bottom ranks is shrinking, it will be interesting to see which emerging players will make the list the next time. Are Temu and Shein worthy of the top spots?

Top eCommerce Companies by Market Capitalization in 2024:

Which eCommerce companies are the most valuable in 2024? At ECDB, we share their names and explain their latest growth strategies.

July 30, 2024

Most Valuable eCommerce Companies 2024: Key Insights

Amazon on Top: Amazon, rebounding from a declining market cap in 2022, reaches the value of US$1.9 trillion in 2024. The U.S. eCommerce giant outpaces its closest competitors – the Chinese Alibaba and PDD Holdings – which take the second and third spots.

Major Players: China's Meituan (US$83 billion) and the Argentinian marketplace MercadoLibre (US$82 billion) rank next, cementing their names as major eCommerce players globally. The Canadian company Shopify takes the sixth spot with a market cap of US$77 billion.

Rounding Out the Top 10: Copart, JD.com, Sea, and Coupang Inc. take the remaining positions in the top ten, with market caps ranging between US$36-49 billion.

There are many ways to evaluate eCommerce companies—from their revenues to profits or yearly growth. Market cap is yet another useful indicator of a company’s worth for investors.

Here are the top ten most valuable eCommerce companies by market cap in 2024.

Top eCommerce Companies by Market Cap

The ranking of the top 10 eCommerce companies by companiesmarketcap.com currently includes players from the U.S., China, Argentina, Singapore, Canada, and South Korea. The undisputed number 1 is, of course, the U.S. eCommerce giant Amazon.

To understand what makes these companies so valuable and influential, let's take a detailed look at the top 5 eCommerce companies by market cap.

1. Amazon

With a staggering market cap of US$1.9 trillion, Amazon leads the top 10 global eCommerce companies.

Amazon is enhancing its AI-driven recommendations, making shopping more personalized and intuitive by considering broader user behavior. The company's "Climate Pledge Friendly" program also boosts visibility for eco-friendly products, aligning with rising consumer demand for sustainability. Amazon's social commerce efforts include platform updates to mimic social media and partnerships with platforms like Facebook and Instagram.

Additionally, Amazon is expanding globally through its Amazon Global Selling program, simplifying cross-border transactions with new tools. Lastly, advancements in advertising, such as Amazon DSP, provide sellers with more targeted and automated ad campaigns.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

2. Alibaba

Alibaba, a Chinese company, comes in the third spot with a market cap of US$187 billion.

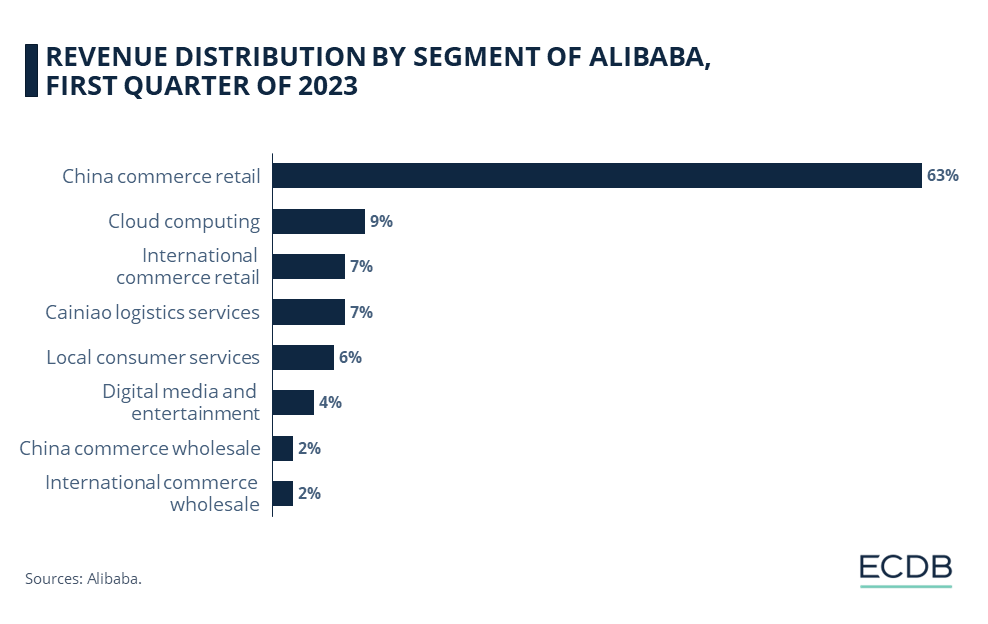

The retail giant has been focusing on enhancing its international commerce and AI capabilities. In Q4 2023, Alibaba's International Digital Commerce Group saw a 45% year-over-year revenue growth, driven by cross-border initiatives and platforms like AliExpress.

This growth highlights Alibaba's commitment to expanding its global footprint and improving logistics through partnerships with companies like Cainiao for faster delivery times.

Additionally, Alibaba has been investing heavily in AI. The company’s Cloud Intelligence Group recorded significant growth, with AI-related revenues increasing by triple digits. These advancements are part of Alibaba’s strategy to leverage generative AI for enhancing supply chain efficiency and customer experience.

3. PDD

Another Chinese company PDD takes the third position with a market cap of US$177 billion.

The parent company of Pinduoduo and Temu is rapidly expanding its global presence. Temu, PDD’s cross-border eCommerce platform, has launched in several new markets including France, Germany, Italy, and various countries in Europe, Africa, and the Middle East. This expansion has driven Temu to become one of the top downloaded apps in multiple regions.

In China, PDD's grocery delivery service, Duoduo Maicai, is also contributing to growth and is expected to reach profitability soon. The company has been investing heavily in technology to combat counterfeit goods and improve its service offerings.

4. Meituan

Meituan, the last Chinese company in the top 5, ranks fourth with a market cap of US$83 billion.

Aiming to rival giants like Alibaba and JD, the company is actively expanding its eCommerce offerings. Recently, Meituan launched a new direct sales model, opening several "self-operated stores" to sell various products, ensuring better control over product quality and delivery. They have also relaunched its shopping review feature, now called Guangguang, to tap into content-driven eCommerce trends. This feature, similar to Taobao’s review platform, aims to boost traffic and conversion rates by leveraging user-generated content and recommendations.

Additionally, Meituan is enhancing its cross-border eCommerce operations with a global shopping channel offering products from countries like the U.S., Japan, and Australia. This move aligns with its strategic shift towards broader retail and technology integration.

5. MercadoLibre

MercadoLibre, an important player in Latin America, holds the fifth position at US$82 billion.

The company is significantly expanding its operations in Latin America, with substantial investments planned for 2024. The company announced it will invest US$4.6 billion in Brazil, its largest market, marking a 21.1% increase from the previous year. Additionally, MercadoLibre is set to hire 6,500 people in Brazil and 18,000 across Latin America to bolster its growth efforts.

The company's growth strategy also includes significant investment in Mexico, where it plans to spend US$2.5 billion in 2024, up from US$1.6 billion in 2023. This investment will help enhance its eCommerce platform and Fintech services, which include digital payments and financial solutions through MercadoPago.

Other Companies in the Top 10

Canadian company Shopify takes the sixth spot with a market value of US$77 billion. The U.S. company Copart is next with US$49 billion, followed by JD.com from China with US$41 billion.

Singaporean company Sea stands ninth with US$38 billion, while the South Korean Coupang rounds off the list, taking the last spot with a value of US$36 billion.

No comments:

Post a Comment