What is Greystar?

The company that forked over $43.7M for what they bought into - Unbound spent the last year and a half acquiring the 154 acres located near the northeast corner of Pecos and Sossaman roads and obtaining approval from Mesa’s planning and zoning board for a development named Unbound Gateway.

The company that forked over $43.7M for what they bought into - Unbound spent the last year and a half acquiring the 154 acres located near the northeast corner of Pecos and Sossaman roads and obtaining approval from Mesa’s planning and zoning board for a development named Unbound Gateway.

Unbound purchased 18 acres in September 2021 and remaining 136 acres in January 2022 for a combined total of $27.1 million.

Greystar, an international development and management company, broke ground today on Gateway Grand, a more than two-million-square-foot, three-building industrial park at the northeast corner of Sossaman and Pecos Roads in Mesa.

"Mesa is experiencing substantial economic growth, especially in this area of our city," said Mesa Mayor John Giles. "This industrial park will offer another great option for manufacturing businesses looking to locate in Mesa, with the benefits of solid infrastructure and easy access to the airport, freeways and planned railroad extension."

Gateway Grand is located in the City of Mesa's Pecos Advanced Manufacturing Zone, which is just south of Phoenix-Mesa Gateway Airport, and within minutes of both State Route 24 and the Loop 202. Building A will be 1,095,961 square feet, with buildings B and C being 537,429 square feet each. All three buildings will feature 40-foot ceiling heights.

The industrial park is expected to be completed by May 2023 and will be adjacent to the forthcoming Pecos Industrial Rail and Train Extension planned by Union Pacific Railroad, which will provide significant rail freight access to companies in the area.

"This area continues to grow into a hub for economic growth, making it one of the most critical areas in the East Valley," said District 6 Councilmember Kevin Thompson. "Greystar understands its importance, and I could not be more thrilled that they chose Mesa to open their new industrial park, Gateway Grand."

Qualified companies locating at Gateway Grand may take advantage of the City of Mesa's Foreign Trade Zone providing reduced or deferred tariffs and duties, and reduced property taxes.

"Greystar Logistics is pleased to break ground on our first Class-A industrial project in Arizona. The immediate access to intermodal transportation, an educated workforce, and high population growth has created the ideal ecosystem for advanced manufacturing and logistics companies expanding their operations. Our corporate neighbors are on the forefront of progression, and we're excited to attract likeminded employers to the area," said Billy Cundiff, Greystar Managing Director. "It's been a pleasure working with the City of Mesa, and we look forward to delivering this successful project."

The builder for this project is Derek Builders. For leasing opportunities, contact CBRE representative Jackie Orcutt at 602-735-1978; Kevin Cosca, 602-735-5672; Pete Wentis, 602-735-5636; or Jonathan Teeter, 602-735-1929.

RELATED CONTENT

The news in a press release: 20 acres sold for $2.25MThe City of Mesa has 11 census tracts that have been designated Opportunity Zones by the U.S. Department of Treasury. Last year on 12 Dec 2018 the City of Mesa releasedMesa Opportunity Zone Investment Prospectus http://www.mesanow.org/news/public/article/2227"Our Opportunity Zones provide a boost in returns for private, tax-free investment in low-income areas with economic need," Mayor John Giles said.

"Investment in these areas will bring great benefit to our residents and private investors alike."_________________________________________________________________________ _________________________________________________________________________

Readers might want to take note that water is a precious resource here in the desert and the East Valley.

On top of the $150,000,000 for SBWTP and the $200,000,000 for the GWTP, take a look>

As you can see in the infographic to the right, the taxpayer burden for costs in the City of Mesa's FY17/18 Wastewater Treatment Bond Projects in this fiscal year's budget amount to $45,3000,000 > 23.9%.

Together with the costs of water at $80,9000,000 (42.5%) they consume 2/3 or 66.3% of the entire Budget Pie.

Wastewater costs more than 2X as much as the total amount spent on Parks and 5x as much as money spent on Electric.

________________________________________________________________________

Abundant Water and Waste Water Capacity – The City of Mesa maintains a substantial water and wastewater infrastructure network in the Zone, and is continuing to expand to accommodate for future industry growth.

The City is investing over $150 million to construct the Signal Butte Water Treatment Plant, which will add an additional 24 million gallons per day (MGD) of pumping capacity to the area by Summer 2018.

In addition, a $200 million expansion of the existing Greenfield Water Reclamation Plant will also enhance wastewater capacity in the area by 14 MGD, bringing the total plant capacity to 30 MGD.

http://www.mesaaz.gov/business/economic-development/business-districts-maps/mesa-gateway-area/pecos-advanced-manufacturing-zone

Major Employers

- Bridgestone Americas – R&D facility conducting research and developing manufacturing process to produce rubber from the Guayule plant

- CMC Steel – Micro steel mill producing rebar from recycled steel

- CRM Rubber – Producer and supplier of crumb rubber to the asphalt industry. Largest crumb rubber producer in the western U.S.

- FUJIFILM – Manufacturer of chemicals for the semiconductor industry

- Matheson TriGas – Producer and supplier of industrial gasses used in manufacturing industries such as steel, fabrication, medical, water treatment, semiconductors, chemicals and food freezing

- Metso – Provider of industrial equipment repair and field services for the mining, aggregates, and process industries

- Mitsubishi Gas Chemical – manufacturer of chemicals for the semiconductor industry

- TRW Vehicle Safety Systems – Manufacturer of airbag components

The two companies that are mentioned in response to Councilmember Freeman's question are included in the map image here:

......................................................................................................................................................

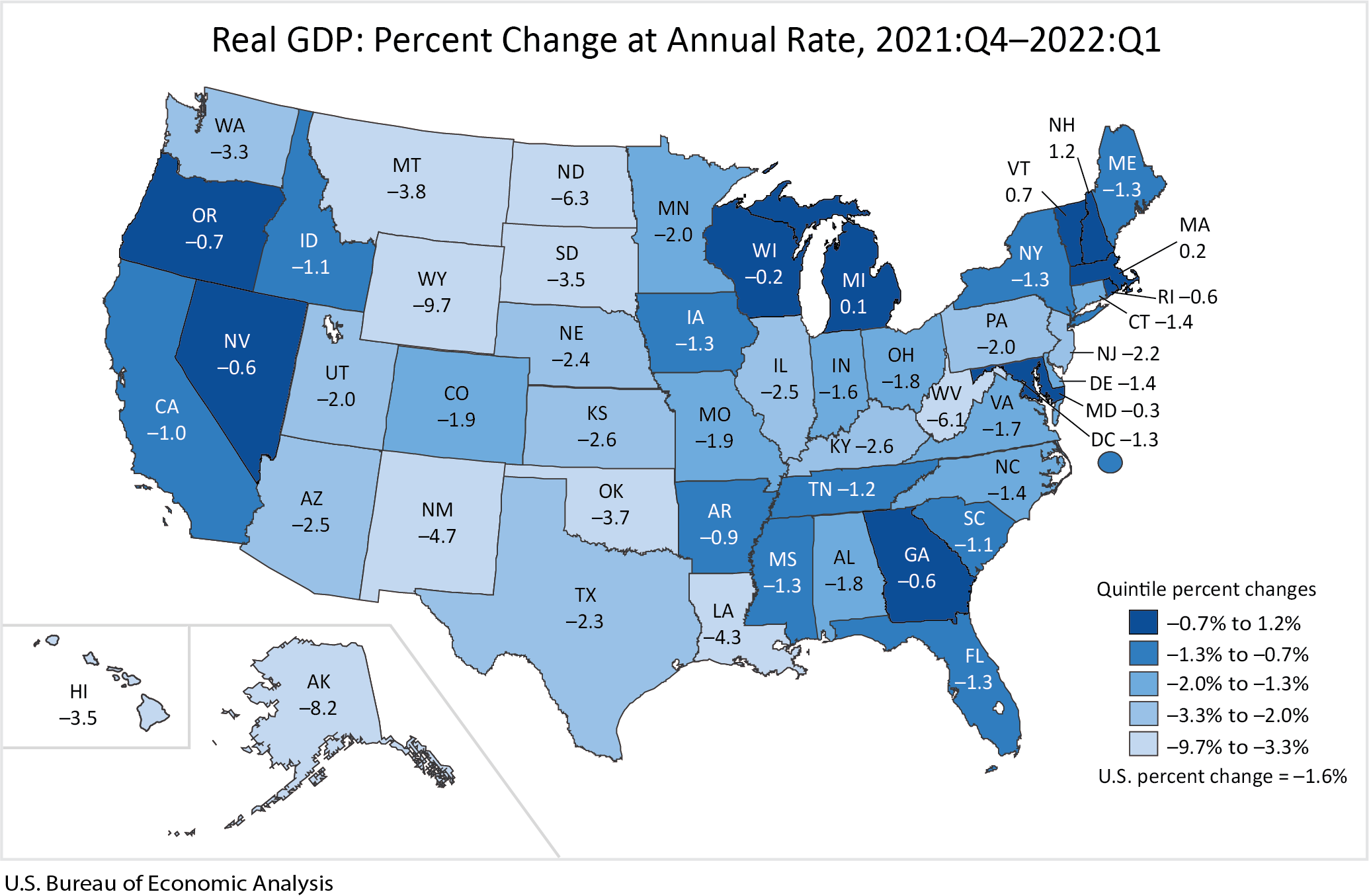

Now that we have President Biden really focusing on that, how will that translate into Arizona?

Chris responded, there are couple of things that are going to happen.

- First of all, the Rescue Act monies coming into the state at both state level and county level total $870 million dollars in two increments starting May 11 and then many localities will see dollars.

Treasury hasn’t released yet how those dollars can be spent so we have been working with the country and other partners on different options at this juncture to ensure that these dollars can be spent wisely and in a sustainable way over time.

Treasury hasn’t released yet how those dollars can be spent so we have been working with the country and other partners on different options at this juncture to ensure that these dollars can be spent wisely and in a sustainable way over time.

Economic Development Advisory Board Meeting Minutes May 4, 2021 Page 5 of 8

- In relation to infrastructure and the debate in Washington around the dollar amounts.

We have been talking to the Department of Transportation as well as Commerce to grasp if this will be more like the readiness programming under Obama when projects were ready, they were submitted, and it was like they will fund everything they can predicated on those projects that were shovel ready or if it will be done in a different kind of manner.

That has not been made clear yet.

> We could see $6 trillion dollars out on the market in 18 months between PPP, Rescue Act and now if the infrastructure bill goes as planned, a massive amount of capital.

> We could see $6 trillion dollars out on the market in 18 months between PPP, Rescue Act and now if the infrastructure bill goes as planned, a massive amount of capital.

> We have looked at whether GPEC should hire a consultant group to help our communities navigate that process. There will be so much capital and questions of if we will get our fair share of those resources.

We are evaluating whether we should be diving in deeper, we just don’t know yet.

We have work to do on that if it passes.

Chair Kasselmann thanked Chris for joining us, his enlightening updates and context and perspective on what we should be paying attention to moving forward.

You mentioned the City of Mesa’s development competitiveness and Mesa’s responsiveness has been noteworthy and that speaks highly of the City, Mayor, Council, Bill, and his staff.

That was great to hear.

The growth over the past two to three years has really been remarkable, continue to push that path forward.

=======================================================================================

5. Hear an Update on the Pecos Industrial Rail Access and Train Extension (PIRATE)

JD Beatty provided an update on the Pecos Industrial Rail Access and Train Extension project, better known as the PIRATE project.

We have made a lot of progress since the last update.

PIRATE is located just south of the Phoenix Mesa Gateway Airport and extends from the existing Union Pacific main line along Rittenhouse Road all the way to our eastern border near CMC Steel, Fuji Film, Mitsubishi Gas Chemical, and others.

It is a six-to-seven-mile rail spur off the main rail line to serve industrial customers.

This has been a very strong public/private partnership since the beginning.

Sally Harrison with the Mesa Chamber of Commerce has been a key part of the process as well as the City, Union Pacific, CMC Steel, Fuji Film, Pinal County, Queen Creek, SRP, and MAG.

We have really had a lot of public support.

The latest route has emerged from a lot of negation with public and private owners of the area and is not 100% final. The line comes up from Rittenhouse and crosses over Pecos and Sossaman, follows the fence line of Phoenix Mesa Gateway Airport and crosses over properties owned by several large property owners.

Negotiations are ongoing between Union Pacific and the property owners, which is not an easy process and the bulk of the efforts over the last year.

Moving east crossing Ellsworth it is a straight line from Ellsworth through Crimson over to Signal Butte to CMC Steel. In August of last year CMC Steel announced a huge expansion.

The PIRATE project will not only serve existing industry but would also open several thousand acres of land for rail served development.

Why rail and why here?

Mesa has existing heavy industry at the end of this line to serve, but it is also the 2,000 plus acres of land this will unlock to be rail served.

There aren’t any rail served sites in the East Valley that any industry would be able to find and only a few in the west valley and Phoenix. We have started to see a huge influx of rail interest in the last six to eight months. While we had a lot before, we are seeing even more now.

A lot of that interest, I believe, is due to the TSMC project.

Some large projects that are looking in that area are only looking because there is a chance that rail could be there.

When you combine roads, runway, rail, and rivers – we have three of the four multi-modal capabilities.

Public safety would be improved as well.

Right now, CMC Steel is loading 4,000 trucks a month with rebar and steel from their facility.

About 1,000 of those truckloads currently go to downtown Phoenix and are transloaded, shipping product throughout the southwest. These are heavy trucks that damage roads and are public safety issues.

With this rail spur, those 1,000 truckloads would no longer be on the roadways.

Local industries would be able to take chemicals off the roads as well.

It is statically accurate that rail is a safer way to transport those goods than roadways and decreases traffic in the long run.

Economic Development Advisory Board Meeting Minutes May 4, 2021 Page 6 of 8

A timeline of the project was shared:

2016 to 2019 – Stakeholder & property owner outreach, coordination & fact finding;

May to December 2019 – RFP for consulting issued, Rounds Consulting, MODE Public Affairs & ECONorthwest engaged and funded by SRP, Pinal County and CMC Steel;

March 2020 – Economic Impact Analysis completed;

June 2020 – Submitted for 2020 BUILD Grant & CRISI Grant;

October 2020 – Notified by USDoT of unsuccessful bids, received “recommended” rating;

April to July 2021 – Refine project narrative and grant submittal for Rebuilding American Infrastructure with Sustainability and Equity (RAISE) Grant.

The cost of the project has increased to approximately $88 million, which is up from last year’s $59 million, some of which includes an increase in land prices.

The construction timeline is estimated to be 12 to 16 months, target Q3 - Q4 of 2023 for project completion.

This timeline is on track for expansions and new large projects that have a need for rail in this area.

Where are we going and what are the immediate next steps?

- Union Pacific is currently working on securing property/options for the physical path and route with assistance from the City and partners.

- By and large we have most of the route and property owners on board with the location.

- Union Pacific continues to work on the engineering and design to present to the Surface Transportation Board, the Federal oversight that provides guidance on the project.

- Gathering further support and buy-in from stakeholders to strengthen RAISE Grant application.

The Board members thanked JD for the presentation and update.

=========================================================================

March 2022

MESA, ARIZ. — Greystar has acquired a 154-acre industrial development near Phoenix Mesa Gateway Airport from Phoenix-based Unbound Development. The acreage sold for $43.7 million.

Located in Phoenix, the asset consists of six different parcels and provides Greystar with a Class A industrial development opportunity.

Unbound spent the last year and a half acquiring the 154 acres located near the northeast corner of Pecos and Sossaman roads and obtaining approval from Mesa’s planning and zoning board for a development named Unbound Gateway. Unbound purchased 18 acres in September 2021 and remaining 136 acres in January 2022 for a combined total of $27.1 million.

Greystar will utilize the development team that Unbound had assembled, with Derek Builders as general contractor, Deutsch Architecture Group as designer and Hunter Engineering as civil engineer. The development will feature approximately 2.2 million square feet in three buildings, including a 1.2 million-square-foot building, a 517,029-square-foot building and a 476,229-square-foot building.

Greystar Real Estate Partners

From Wikipedia, the free encyclopedia

(This page was last edited on 9 January 2022, at 21:15 (UTC)

HISTORY: Founded in 1993 by chairman and CEO Bob Faith, and headquartered in Charleston, South Carolina, Greystar has over 14,000 employees,[5] and 51 offices in the US, Europe, Latin America and Asia-Pacific region.

The company began operating in the UK in 2013.[6] In July 2017, Greystar announced it would acquire Monogram Residential Trust's 14,000-unit portfolio of 49 rental communities in ten states, for $3 billion.[7]

In June 2018, Greystar announced that it would acquire EdR, a manager of college housing communities in the US, for $4.6 billion.[8]

In 2019, the company was sued for violating consumer protection laws. In an Los Angeles County Superior Court filing, Greystar was charged with gathering extensive personal identifying information about its tenants without their knowledge or consent. At five Greystar-owned apartment buildings, the company collected information about its tenants' "character" and "general reputation."[9]

In 2022, Greystar operated in nine countries: China, France, Germany, Ireland, Mexico, the Netherlands, Spain, the United Kingdom, and the United States.[2]

Greystar was the largest apartment management company in the United States in 2021, with over 669,000 units of apartment infrastructure.[3] The firm's business model is alleged to be adding to Ireland's housing crisis.[4]

ADEQ is actively pursuing primacy of the Underground Injection Control (UIC) program from EPA, which regulates injection wells, including drywells. Once granted UIC primacy from EPA in the future, ADEQ would take over UIC Class V well inventorying, which includes drywells in its scope. Additional information will be provided at that time.

ADEQ is actively pursuing primacy of the Underground Injection Control (UIC) program from EPA, which regulates injection wells, including drywells. Once granted UIC primacy from EPA in the future, ADEQ would take over UIC Class V well inventorying, which includes drywells in its scope. Additional information will be provided at that time.

:max_bytes(150000):strip_icc()/what1-3c8fbae37f4d4271bf8bb2b681572e91.jpg)

In Phoenix, Arizona, residents are feeling the heat of climate change: Average temperatures in the desert city are now 2.5 degrees hotter than they were in the middle of the last century, and they keep going up. As staff writer Adele Peters writes, that isn’t just uncomfortable, it’s deadly. To deal with its extreme temperatures, the city has been launching a few solutions, from miles of “cool pavement” to solar canopies that offer residents a discount on their energy bills, which can be high from cranking the AC.

In Phoenix, Arizona, residents are feeling the heat of climate change: Average temperatures in the desert city are now 2.5 degrees hotter than they were in the middle of the last century, and they keep going up. As staff writer Adele Peters writes, that isn’t just uncomfortable, it’s deadly. To deal with its extreme temperatures, the city has been launching a few solutions, from miles of “cool pavement” to solar canopies that offer residents a discount on their energy bills, which can be high from cranking the AC.