- "If the U.S. doesn't help standard-set and provide guidance on issues like privacy and cybersecurity, we could be headed into a fractured digital currency ecosystem that threatens the smooth operation of international finance," Josh Lipsky, director of the Atlantic Council's GeoEconomics Center, tells Axios.

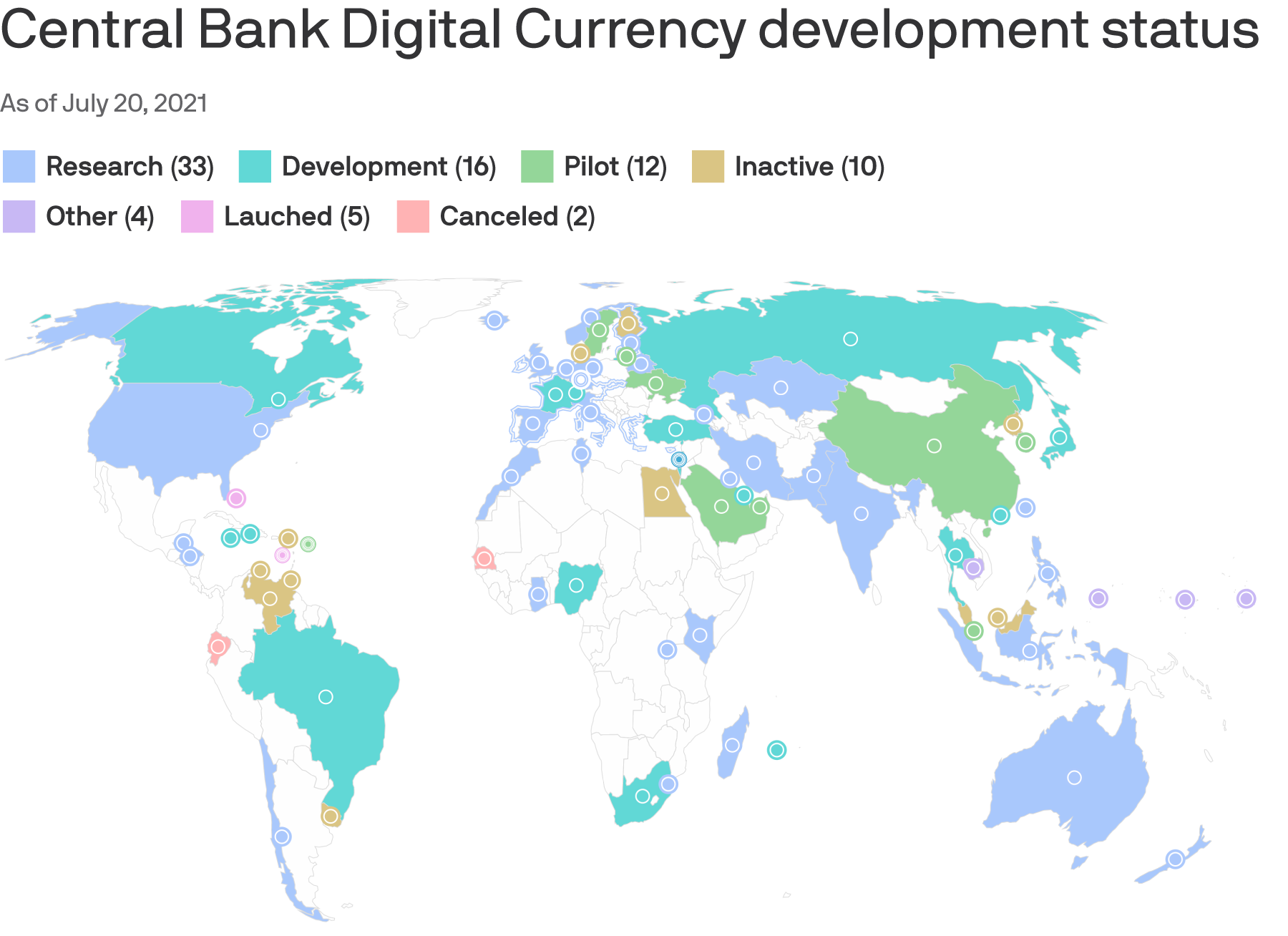

Driving the news: The Atlantic Council, a think tank that will testify at a July 27 Congressional hearing on CBDCs, gave Axios a first look at its new interactive map showing just how many world governments are now considering it.

The backstory: CBDCs are digital versions of existing currencies — legal tender issued, governed and backed by a central bank.

State of play: China is furthest along among major global powers, having launched its pilot digital yuan in April.

- A total of 16 other countries are in the pilot phase or have launched, and another 15 countries have CBDCs in development.

- The U.S. is one of 33 countries still in the research phase.

What's next: Fed chair Jerome Powell has said that the U.S. central bank won't issue a CBDC without Congressional approval.

- In response, Congressional committees have stepped up their inquiries. Tuesday's hearing is before the House Financial Services Committee and will focus on national security implications.

The bottom line: The U.S. doesn't need to create a digital dollar immediately in order to have an impact on the development of digital currencies, Lipsky says.

- But it should engage with groups like the G7 and G20 nations to set standards for security and privacy, he adds

Central Bank Digital Currency Tracker

SCROLL TO EXPLORE

What exactly is a Central Bank Digital Currency (CBDC)?

A CBDC is virtual money backed and issued by a central bank. As cryptocurrencies and stablecoins have become more popular, the world’s central banks have realized that they need to provide an alternative—or let the future of money pass them by.

81 countries (representing over 90 percent of global GDP) are now exploring a CBDC.

In our original report published in May 2020, only 35 countries were considering a CBDC.

China is racing ahead, including by allowing foreign visitors to use digital yuan if they provide passport information to the People’s Bank of China during the upcoming Winter Olympics.

Of the countries with the 4 largest central banks (the US Federal Reserve, the European Central Bank, the Bank of Japan, and the Bank of England), the United States is furthest behind.

> 5 countries have now fully launched a digital currency. The Bahamian Sand Dollar was the first CBDC to become widely available.

> 14 other countries, including major economies like Sweden and South Korea, are now in the pilot stage with their CBDCs and preparing a possible full launch.

Without new standards and international coordination, the financial system may face a significant currency exchange problem in the future.

Fri, Feb 19, 2021

What precisely will the US Treasury Department do about the rise of digital currencies? Secretary Yellen and Federal Reserve Chairman Jerome Powell should quickly harness the potential of these evolving financial tools, including a US-backed digital dollar.

Tue, Apr 20, 2021

Digital payment systems are bringing millions of unbanked and underbanked online and rapidly revolutionizing global finance.

But new technology brings new challenges. From cybersecurity to sanctions evasion to money laundering. Should more governments step in and create their own Central Bank Digital Currencies (CBDCs)? What are China’s ambitions for its digital yuan? Can a transatlantic cooperative project can set new standards on digital currencies and ensure stable and transparent cross-border payments?

No comments:

Post a Comment