Bet on Fed Rate Going to 1.5% Nets $10 Million After Wild Ride

(Bloomberg) -- A bold options bet on sharp Federal Reserve interest-rate cuts appears to have been closed out for a $10 million profit, quadruple the initial stake, after it became nearly worthless for a time.

Most Read from Bloomberg

$335,000 Pay for ‘AI Whisperer’ Jobs Appears in Red-Hot Market

Scotiabank Economist Excoriates Trudeau, Freeland Over $32 Billion Spending Boost

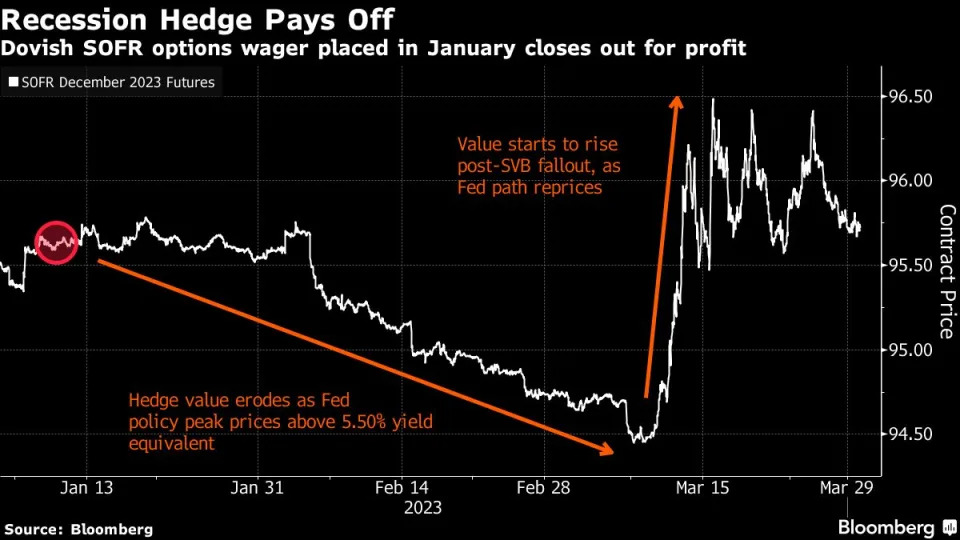

Banking turmoil in recent weeks pushed the trade — which was placed in January and wagered the Fed would take its benchmark rate as low as 1.5% by the end of the year — back into the money after the position lost almost all of its value in February.

The bet was a 100,000-contract call spread in Secured Overnight Financing Rate options, initially purchased for approximately $3.75 million. Wednesday’s sale of 20,000 of them appeared to mark a near-complete unwind of the original trade, following two other big sales of the structure since last week.

The combined sales would have netted around $10 million in profit, according to Bloomberg calculations. Changes in open interest following the transactions suggested a link between the original purchase and the recent sales, though the trader’s identity could not be confirmed.

At the time of the Jan. 11 bet, the December 2023 SOFR futures contract implied a yield for the Fed’s benchmark of around 4.38% by year-end. By March 8, that yield had risen to 5.54% amid signs of inflationary pressures that led Fed officials to adopt a more aggressive stance.

In the ensuing days, the yield on the December contract plunged below 4% as the failure of Silicon Valley Bank and other lenders prompted traders to bet on aggressive rate cuts. As of Wednesday, at the time of the trade, it had rebounded to about 4.25%.

Most Read from Bloomberg Businessweek

SVB’s Collapse Shows the World’s Favorite Safe Asset Isn’t Risk-Free

College Students Are About to Put a Robot on the Moon Before NASA

A Credit Crunch Is the Last Thing the Strained US Economy Needs

China Lent Heavily to Developing Nations. Now It’s Helping Them Manage Their Debt

©2023 Bloomberg L.P.

No comments:

Post a Comment