OOPS, Stagflationary Numbers Out of US!

US economy expands at 1.6% rate in Q1, trailing all forecasts.

- Main growth engine – personal spending – rose at a slower-than-forecast 2.5% pace.

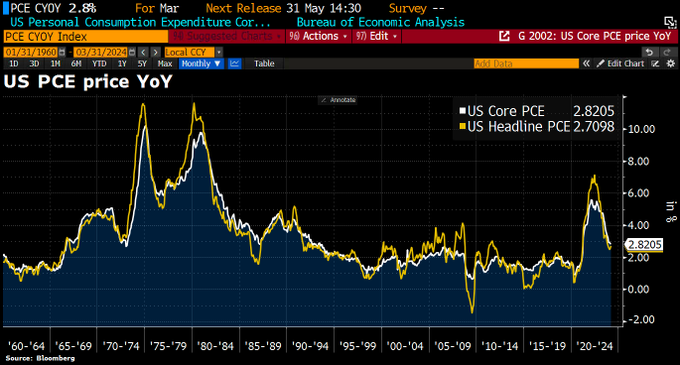

BUT a closely watched measure of underlying inflation advanced at a greater-than-expected 3.7% clip.

POST SCRIPT:

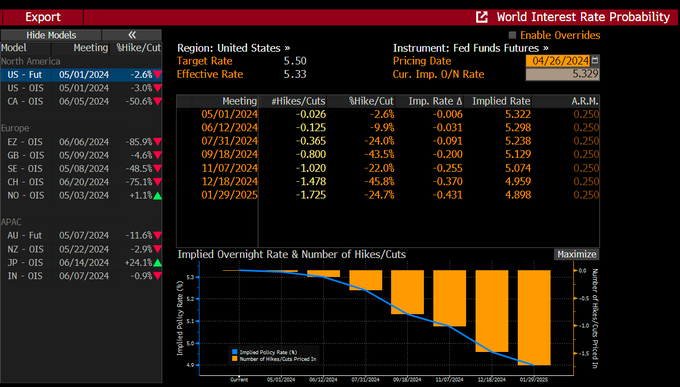

Slower than expected GDP and higher-than-expected Personal Consumption Expenditure (PCE) Prices triggered initial negative reaction in stocks.

- Core PCE prices up to 3.7% quarter over quarter from 2% in Q4 2023, above 3% expected.

- VIX up ~5%

.gif)

No comments:

Post a Comment