Stock market plunges again as Trump threatens massive tariffs on European wine

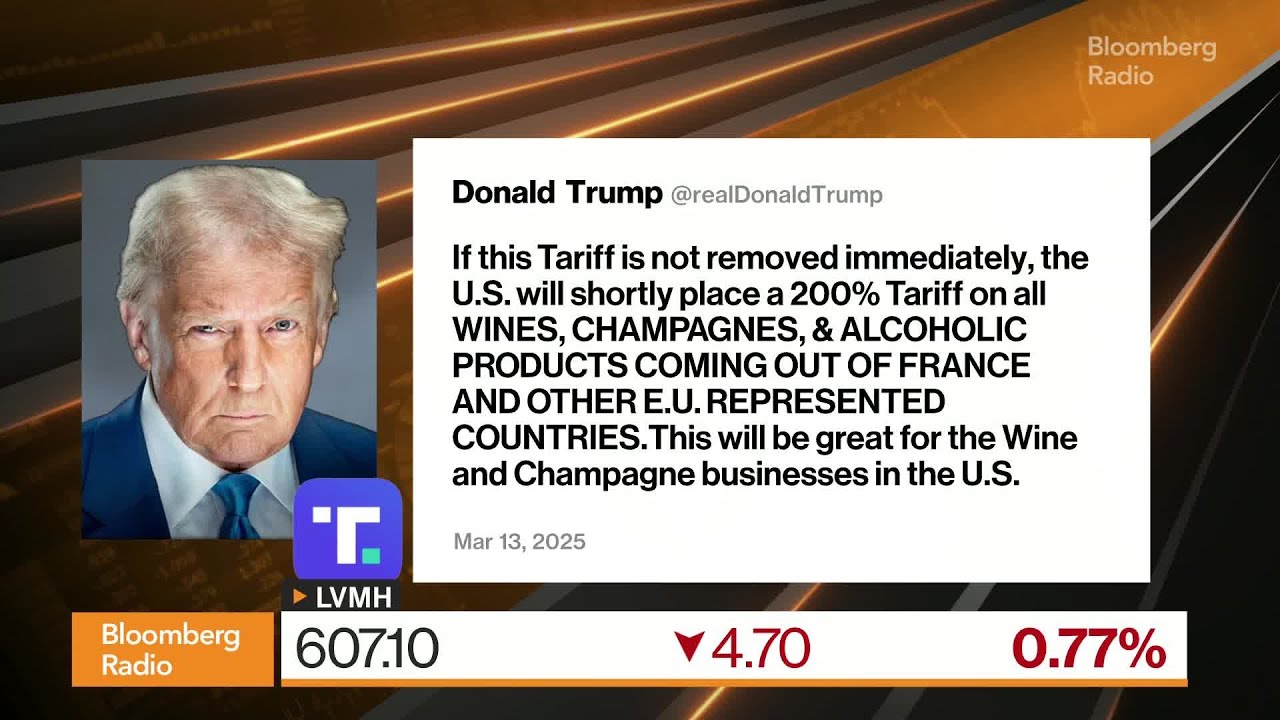

Corks were not popping on Wall Street on Thursday, as stocks plunged again following Donald Trump’s threat to impose a 200% tariff “on all wines, Champagnes, and alcoholic products” from European Union countries if the trading bloc makes good on its threat to retaliate for steel and aluminum tariffs announced by the US president by adding a 50% tariff on American products, including Kentucky bourbon.

The sharp drop in the S&P 500 meant that a the index is now in “a correction” — a term used when when stocks falls 10 percent or more from their peak.

While the Wall Street Journal blamed the drop on “investors on edge over new tariff threats”, pro-Trump media outlets further to the right, like Newsmax, sought to play down the president’s role in the plunging markets. “This correction is overdue”, a guest on the far-right network assured viewers on Thursday. “Nothing to do with Trump. Nothing to do with tariffs”.

As the New Yorker staff writer John Cassidy noted in a podcast interview this week, the downturn began in the middle of February “when it became clear that Tump was serious about these tariffs, a lot of people on Wall Street thought he was bluffing”.

Cassidy went on to explain that Trump appears to be wedded to a dream of undoing globalization and returning to a period in the 19th century when the United States was closer to being an autarky, a self-sufficient country, closed off from the rest of the world.

That seems to jibe with Trump’s claim, in his announcement of the 200% tariff on Champagne, a form of sparkling wine that is only produced in the Champagne region of France, “This will be great for the Wine and Champagne businesses in the US”.

No comments:

Post a Comment