Web3 is generating a lot of hype — but what

exactly is it? From the metaverse to decentralized finance to NFTs and

beyond, we break down what Web3 is today and what it could mean for the

future of the internet.

Imagine an internet built, powered, and owned by its users instead of a few major tech companies.

Social media users could monetize their own data. Content

creators could receive crypto payments directly every time someone views

their latest post. Ride-sharing platforms could be owned by the

drivers.

GET THE LIST OF BLOCKCHAIN 50 COMPANIES

The Blockchain 50 is our annual ranking of the 50 most promising companies within the blockchain ecosystem.

This is the promise of Web3, a decentralized internet built on an open, permissionless blockchain network.

The internet as we know it now is centralized — data flows

through and is stored in data centers owned by a handful of companies. A

few powerful players control the most widely used services and

platforms. But in Web3, data storage and flow take place on networks

that run on many computers without a single entity controlling them.

Online services from e-commerce to social media to gaming are provided

and controlled by democratic groups of developers, creators, and users.

Three use cases are already gaining traction today:

-

- Decentralized finance (DeFi): an ecosystem of smart

contracts that allows participants to offer and access financial

services in a peer-to-peer format, without relying on traditional

intermediaries like banks, credit unions, or brokerages

- Non-fungible tokens (NFTs): digital assets — which can range from images to songs to videos — that are verified through blockchain technology

- Decentralized gaming: token-based gaming economies and

virtual worlds powered by blockchain technology. Most decentralized

games integrate NFTs in some capacity.

While a fully decentralized internet may still be a distant

vision — and critics say the idea is little more than hype — its

implications could be far-reaching.

In this report, we break down the elements of Web3, its use cases, and what it could mean for the future of the internet.

TABLE OF CONTENTS

- How does Web3 work?

- dApps aim to cut out the middle man

- DAOs govern Web3 apps and communities

- Decentralized networks own and control data on Web 3

- Decentralized identifiers (DIDs) verify Web3 users

- What is Web3 today?

- DeFi powers Web3 financial products and services

- NFTs could have use cases beyond art and gaming

- What could Web3 impact in the future?

- Metaverses

- Digital content

- Dispute resolution

- Social media

- What are the challenges facing Web3?

- Web3 is a digital Wild West

- DAOs are vulnerable to abuse and centralized control

- Total decentralization is difficult to implement — and could leave Web3 on shaky ground

- Cryptocurrencies still face formidable hurdles

How does Web3 work?

Decentralized apps (dApps) aim to cut out the middleman

Web3’s primary aim is to remove the middleman. It’s a simple goal with massive implications.

An idealized Web3 ride-sharing app, for instance, would connect

riders directly with drivers. Payments would go directly to the driver

without the app taking a slice. Juggernauts like Uber would be out of

luck.

The middleman would be replaced by a decentralized app, or a

dApp. These apps run on peer-to-peer networks, such as blockchains, and

use code-based smart contracts to facilitate agreements between parties

without the need for pre-established trust. In theory, these apps

wouldn’t be owned by any single person or company.

To be considered decentralized, an app must meet the following criteria:

-

- It is fully open-source, with data stored on an open blockchain and with no single entity owning a majority of the app’s tokens.

- It generates tokens, which are required for using the app and awarded to users in exchange for their contributions.

- It adopts protocol changes only upon the majority consensus of the majority of its users.

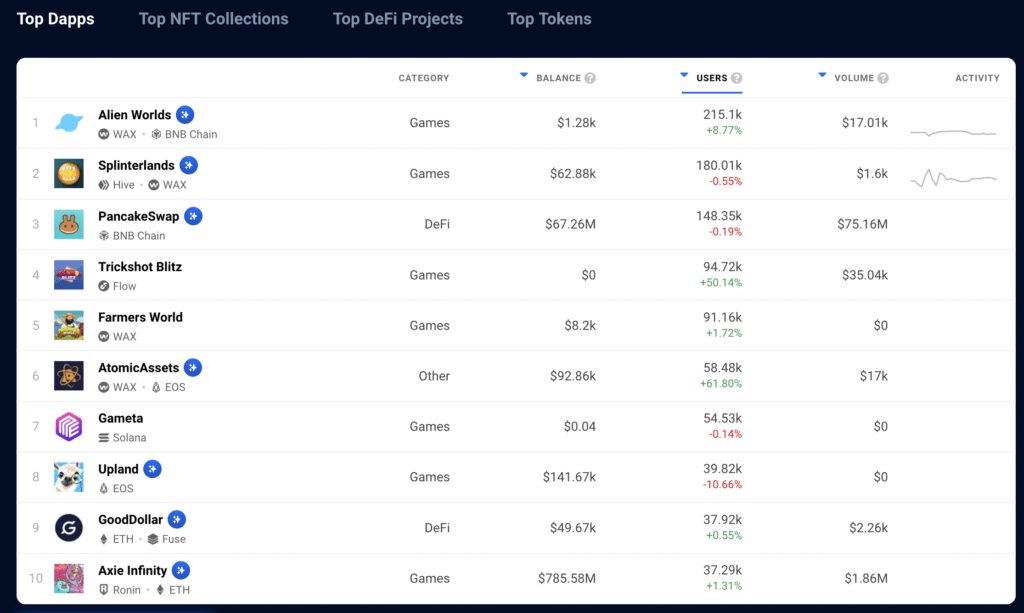

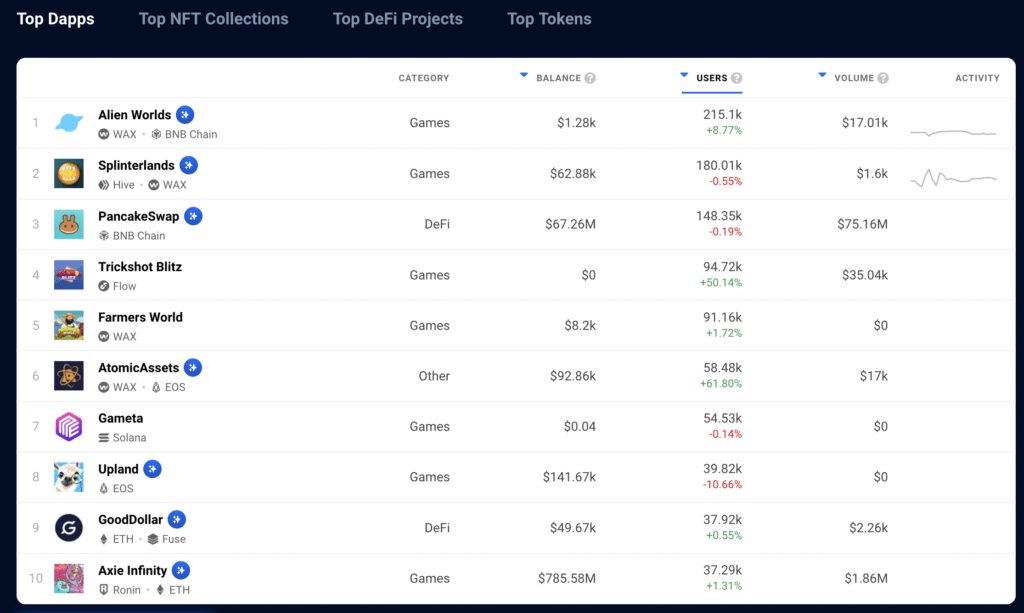

There are over 11,000 dApps on DappRadar, a dApp store. However, most dApps today are not technically decentralized — the entity that created them still typically runs or owns them (falling short of the prevalent Web3 narrative).

Source: DappRadar

Similarly, dApps don’t tend to completely run on a blockchain

like Ethereum, as that can be complicated, time-consuming, and

expensive. This was illustrated by the congestion crisis caused by CryptoKitties

in December 2017. As more players joined the game, the number of

transaction requests on the blockchain piled up. The number of network

requests on Ethereum increased sixfold in the first week of December, and transaction processing fees skyrocketed.

Today, many dApp developers either keep the main user interface

on a traditional website and send only transaction requests to the

blockchain through an API or build on “side chains” — separate, smaller

blockchains that can interact with larger blockchains.

Still, dApps offer some benefits that

traditional apps can’t provide. For example, they can be more resistant

to control or censorship by governments or other organizations. They’re

also open-source, which removes a barrier to developers building out a

dApp ecosystem. And because dApps use blockchain tech, cryptocurrencies

can easily be integrated in.

DAOs govern Web3 apps and communities

But how will dApps (and other Web3 initiatives) be governed if

no one is in control? Enter: decentralized autonomous organizations

(DAOs).

A DAO is a blockchain-based way to manage a group. Rules are

written into smart contracts — which can include self-executing code

tied to certain events or conditions.

The DAO structure embodies the collective ownership and decentralized aspects of Web3. In the full Web3 vision, DAOs will replace companies as the bodies that run online platforms. Many Web3 startups have roadmaps for transition into a DAO structure.

One example of a DAO is Opolis, which was created for independent workers and evolved from a digital employment cooperative.

Opolis provides its members with automated payroll, health

insurance, retirement plans, and other benefits typically offered by

employers but not made available to freelance contractors. Its members

voted to create a DAO in 2021 and contributed funds to the liquidity

pool for its token, $Work, on an exchange. Although Opolis received $5M in seed funding, only the cooperative members have voting rights.

Decentralized networks change how data is handled

Web3 platforms host data on distributed networks instead of on

central servers. The idea is that decentralized data will prevent a few

companies from controlling the internet.

One of the most popular peer-to-peer storage networks is the

InterPlanetary File System (IPFS). Computers around the world connect to

the system and act as nodes that store the data and make it available

to users who request it. IPFS isn’t blockchain-based and its records are

neither immutable nor permanent.

Filecoin

is similar to IPFS, but it’s built on a blockchain-based protocol.

Anyone can join the network to provide storage from their open hard

drive space and earn Filecoin tokens by doing so.

One downside to data decentralization, however, is that it can

cause bottlenecks in app usage. Retrieving data from a massive network

like IPFS or from the blockchain takes time, which limits the usability

of Web3 apps. As a result, developers are looking for workarounds.

One example is The Graph,

a protocol for indexing and querying blockchains and distributed

file-storage networks like the IPFS. The Graph aims to make it possible

for the user-facing side of a Web3 app to run smoothly even while

querying distributed data.

Decentralized identifiers (DIDs) verify Web3 users

Another challenge for Web3 is how to verify and track user

identity. This is where a decentralized identifier (DID) comes into

play.

A DID is a string of numbers and letters that underlie apps

called “identity wallets.” These wallets contain verified credentials

and other data that a user generates on the blockchain. The identity

wallet grants its owner access to applications.

DIDs work across different Web3 platforms and can be used to

prove ownership of NFTs, social media accounts, and other assets on the

blockchain.

Spruce lets users create a decentralized identity across blockchains including Ethereum, Polygon, and Solana. Synaps

encrypts digital identity attributes and decentralizes the storage of

identification documents, like ID cards and passports. This is

particularly useful for secure identity verification for Know Your

Customer requirements.

Identity wallets are also useful in professional settings. For

example, a developer can share verified academic credentials, as well as

proof that they contributed to certain open-source projects or created

digital assets.

GET THE LIST OF BLOCKCHAIN 50 COMPANIES

The Blockchain 50 is our annual ranking of the 50 most promising companies within the blockchain ecosystem.

What is Web3 today?

DeFi powers Web3 financial products and services

While a fully decentralized internet is still a distant vision, DeFi (decentralized finance) is already gaining some momentum.

DeFi refers to an ecosystem of smart contracts that allow

participants to offer and access financial services in a peer-to-peer

format, without relying on traditional intermediaries like banks, credit

unions, or brokerages. It does this using dApps.

Types of DeFi protocols include:

-

- Decentralized exchanges (DEXs) — users trade cryptocurrencies

- Lending and borrowing platforms — users deposit assets that are lent to borrowers and gain rewards/interest from the fees paid by borrowers

- Asset management & yield — depositors are rewarded for staking tokens, contributing to liquidity pools, or yield farming

- Derivatives — smart contracts that derive their value from an underlying asset are used for hedging or speculation

- Payments — users pay each other in crypto tokens

- Insurance — users can get protection for their crypto wallets, DeFi deposits, and smart contracts

- NFT lending — users put up NFTs as loan collateral

Trading is one of the more popular use cases of DeFi. Pancake Swap,

a decentralized exchange (DEX) on the Binance Smart Chain, is one of

the most popular DeFi apps with 2.4M active users in June 2022 alone.

Another popular DEX is Uniswap, which says it surpassed $1T in lifetime trading volume in May 2022 — less than 4 years since its launch.

NFTs could have use cases beyond art and gaming

Non-fungible tokens (NFTs) are another well-known Web3 application.

NFTs

provide a blockchain-based record of ownership of digital assets —

which can range from images to songs to videos. Each NFT represents a

unique and immutable entry in a ledger and can function a bit like a

title deed. Exchanging NFTs allows a way to trade “ownership” of digital

assets.

Creators can sell NFTs directly to their fans to help monetize their work or put them up for sale on NFT marketplaces like OpenSea or Rarible.

Using smart contracts baked into an NFT, creators can also add some

conditions, like setting it up such that they automatically receive

royalties whenever their NFT is traded — no matter how many times it is

bought and resold.

NFTs can be used in many different ways, though early use cases have centered on art and gaming.

Web3 gaming models typically involve a play-to-earn (P2E)

component facilitated by NFTs and tokens. Users can buy NFT-linked

assets like game skins, weapons, characters, and avatars. Players can

then sell or trade these on NFT marketplaces or swap them for

cryptocurrency on DeFi exchanges.

One of the most popular NFT games is Ethereum-based Axie Infinity, created by Vietnam-based studio Sky Mavis. The game reportedly generated $1.3B in revenue in 2021.

Users buy NFTs representing in-game creatures called Axies which can

then be traded or used in battles. The most expensive Axie sold for a whopping $820,000 in July 2021.

But the envisioned use cases of NFTs in Web3 extend beyond art

and entertainment, with some developers thinking that professional

certifications or DAO memberships, for example, could be facilitated by

NFTs.

What could Web3 impact in the future?

The metaverse

Another much-hyped tech concept that often gets discussed alongside Web3 is the metaverse.

The metaverse is the idea of shared worlds driven by virtual

products and digital experiences that are highly immersive and

interactive. A Web3 metaverse is blockchain-based and built on open

standards, and is sometimes called an “open metaverse.”

No single entity is meant to control an open metaverse.

One example of a metaverse is Decentraland,

a world governed by its users through a DAO. Using Decentraland’s

software development kits, users can build their own spaces,

experiences, content, and collectibles on the virtual land. Ownership of

these assets is represented by NFTs, while transactions are made using

Decentraland’s MANA token.

Source: Decentraland

Gaming and fashion companies are early adopters of the

metaverse, often collaborating to create limited-edition game skins and

character accessories. On Blankos Block Party, an open metaverse game,

you can socialize in a Burberry-themed resort and buy Burberry-branded

accessories for your avatar. Users can also make and sell their own

characters and accessories as NFTs.

Tech giants are also staking their claim in the metaverse field. Facebook’s parent company Meta is investing heavily

in developing immersive, 3D worlds as well as virtual reality (VR)

headsets and augmented reality (AR) glasses. Apple looks set to join the

race as well. The Cupertino-based company is reportedly building a

headset that will provide users with AR and VR experiences.

Digital content

One of Web3’s major promises is the possibility of giving

content creators control over how to use, distribute, and monetize their

content online.

LBRY

is a protocol that lets users publish content, set a price, and receive

payment directly without going through a publisher or a social media

site. Users can also choose to share their content for free. Similarly, DTube is a blockchain-based, community-controlled platform that focuses on publishing and sharing content.

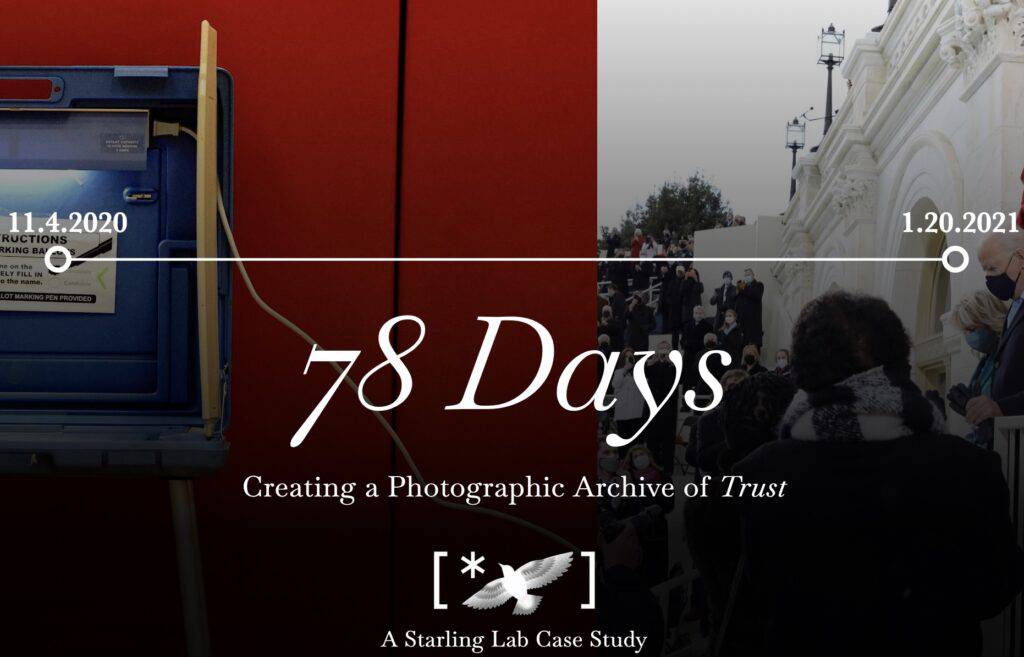

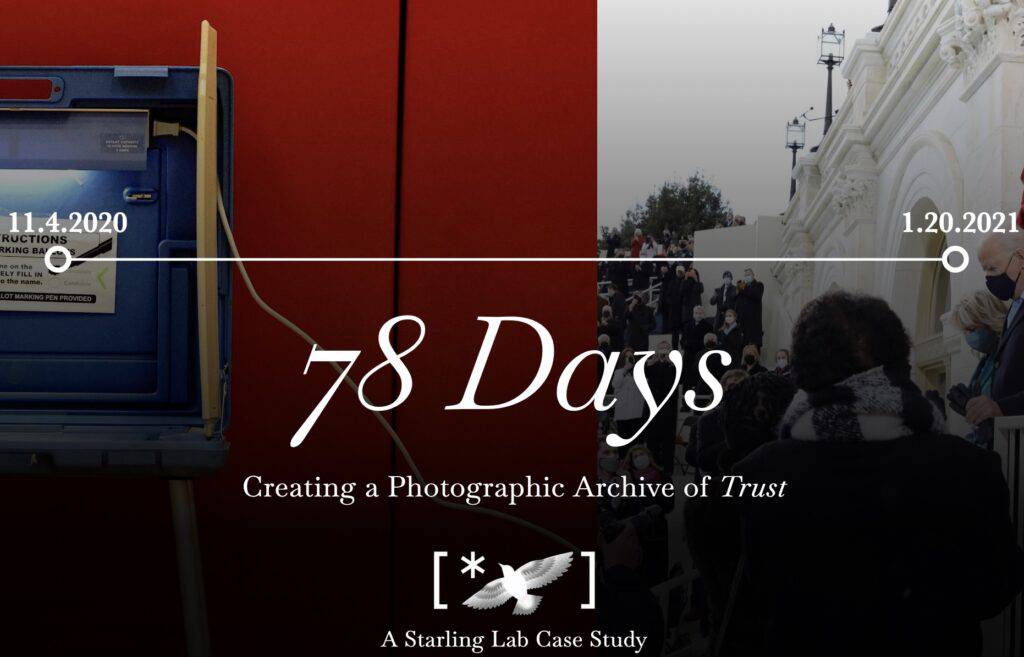

Source: Starlinglab.org

Other content-driven Web3 use cases focus on preserving historical records. For example, The Starling Lab

uses cryptography and blockchain to preserve authenticated photographs,

articles, and data sets that record war crimes, human rights

violations, and genocide testimonies. One of its initial projects was

copying the USC Shoah Foundation’s Holocaust archive and uploading it to

Filecoin.

The company is also working with a human rights group to

encrypt and authenticate social media content documenting the war in

Ukraine and to preserve a record of it on the blockchain.

Dispute resolution

Some proponents think that Web3 could even also have implications in settling minor disputes.

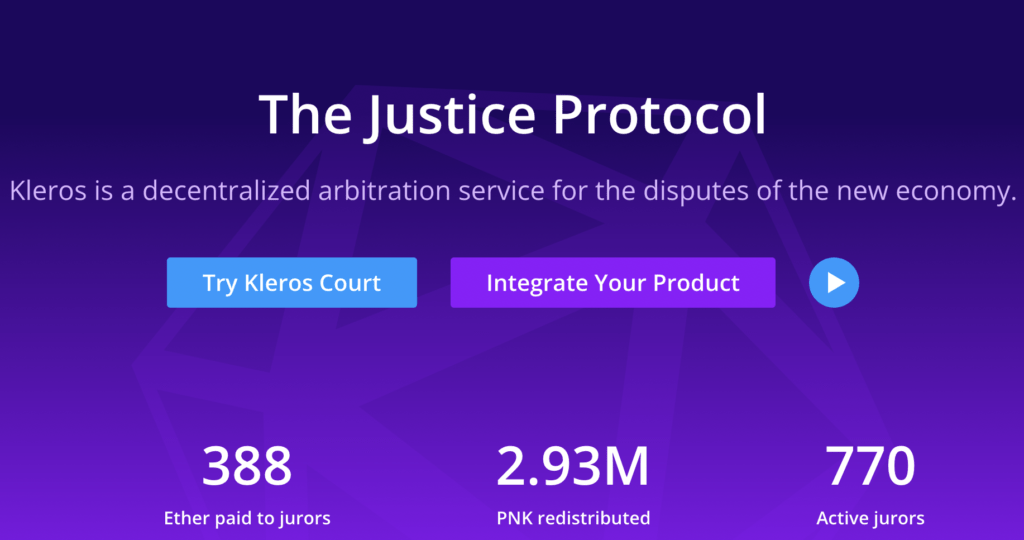

One startup in this space is Kleros, an Ethereum-based decentralized dispute resolution protocol that can be used on smart contract platforms. Kleros selects

a group of “jurors” that decide on a dispute, like contract breaches

between freelancers and companies or a conflict of interest within a

DAO. The whole process — including the final decision — is recorded on a

blockchain, and jurors receive the PNK token as a reward for their

service.

Source: Kleros

Aside from online contexts, Kleros has been used in a

real-world setting for arbitration on a tenant-landlord dispute. The

court in Mexico, where the dispute took place, recognized and enforced

the arbitral award recommended by the jurors on Kleros.

Social media

Some of today’s popular social networking platforms have begun evolving to maintain relevance in Web3. For example, Reddit is reportedly testing tokenizing karma points,

so users who earn them can influence the Reddit sub-communities to

which they belong. There’s still centralization here, though, as Reddit

owns and controls the platform.

New decentralized networks are also emerging. Aether

is touted as a Web3 alternative to Reddit. Its communities are

open-source and self-governing, with the power to elect and impeach

moderators by voting. Users can also audit how the platform is moderated

and earn tokens through participation.

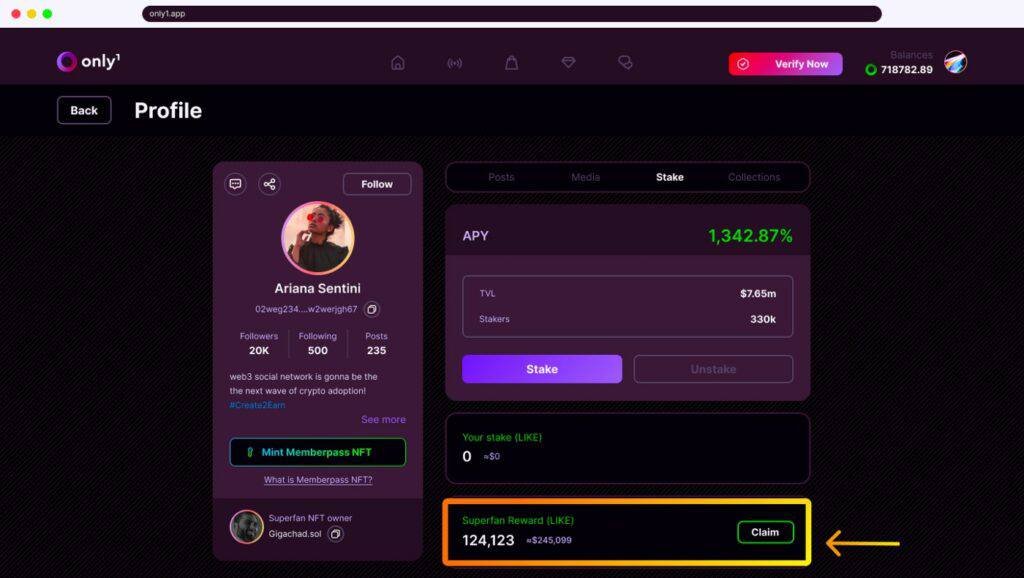

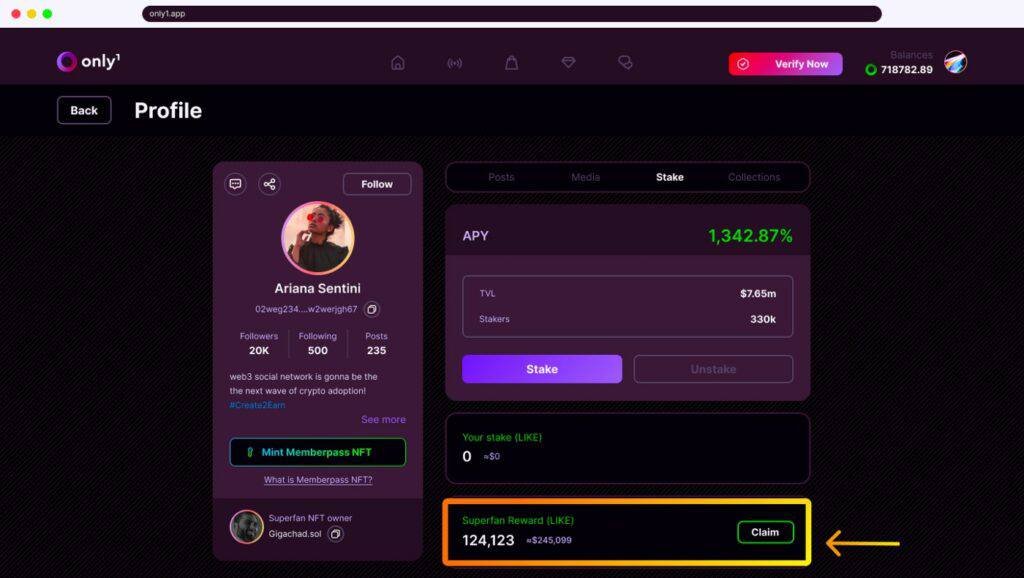

Other Web3 platforms are offering even more capabilities. Only1,

for instance, is an NFT-laden social media platform with a range of

features, including user profiles, superfan NFTs, a messenger service,

an NFT marketplace, and more. Creators can create NFTs that enable their

fans to access exclusive text, images, and videos.

Source: Only1

GET THE LIST OF BLOCKCHAIN 50 COMPANIES

The Blockchain 50 is our annual ranking of the 50 most promising companies within the blockchain ecosystem.

What are the challenges facing Web3?

Web3 is a digital Wild West

One of the primary risks associated with Web3 is the lack of regulatory oversight and rampant cybercrime. Because Web3 is blockchain-based, transactions are easier to keep anonymous. This can help protect users’ privacy but it also makes it more difficult to trace cybercrime culprits — while making it easier for them to sell ill-gotten assets.

Billions of dollars in cryptocurrency have already been stolen

this year. From January to April alone, $1.7B worth of cryptocurrency

was stolen — and 97% of those hacks took place on DeFi protocols,

according to Chainanalysis.

The majority of DeFi protocol hacks that took place from June 2020 to

June 2021 were made possible due to vulnerabilities overlooked by

developers, according to Cointelegraph. In a culture that prioritizes rapid project deployment, smart contracts can be shipped with critical vulnerabilities. These

contracts are typically open-source and public, so it’s easy enough for

hackers to scrutinize them for ways to manipulate a protocol. Instead

of targeting numerous victims through common email-focused methods like

phishing scams, hackers can attack the protocols directly to extract

cash.

DAOs are vulnerable to abuse and centralized control

Similar concerns around oversight and security surround DAOs.

DAO proponents say their structure promotes democracy and transparency

in decision-making, while critics say it is more akin to a pyramid

scheme that can concentrate power in just a few participants while

extracting wealth from unsuspecting members. Notorious DAO implosions

and the subsequent loss of millions of dollars have not helped boost

their reputation.

A famous attack on The DAO, which was a crowdfunding campaign launched in 2016, resulted in participants losing more than $50M worth of Ether. More recently, in October 2021,

just 20 hours after the launch of AnubisDAO, the $60M worth of ETH in

its liquidity pool vanished, only to reappear in a single crypto wallet.

Some investors accused the project’s creators of fraud, while others suspected a phishing scam.

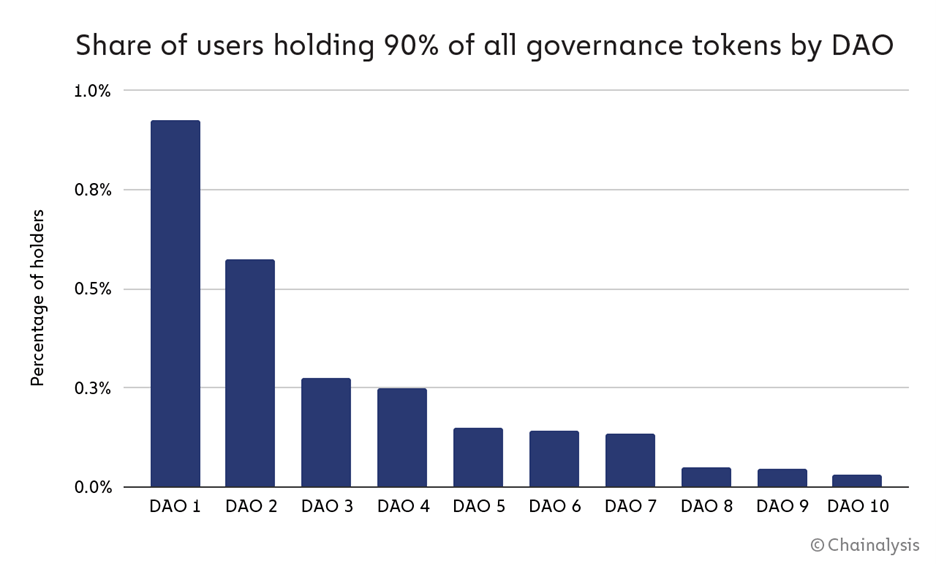

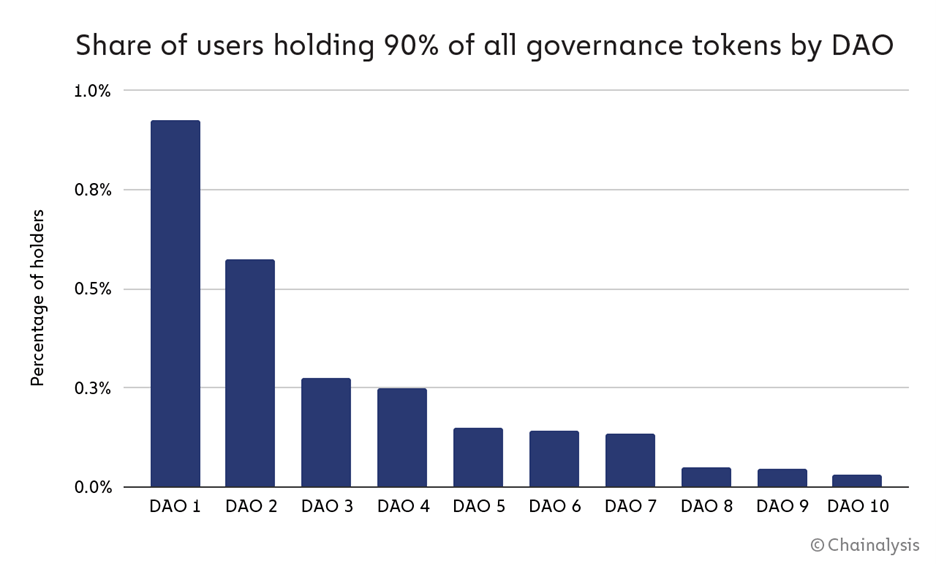

Malicious attacks aside, one issue with DAOs is that

participants can buy more tokens to increase their influence over

decisions. This has resulted in a concentration of power in many DAOs.

The governance token distribution of 10 major DAOs revealed that 90% of voting rights went to less than 1% of users, according to Chainalysis.

Source: Chainanalysis

The threshold for creating a proposal related to the DAO’s

governance is even higher. The same study found that only 1 in 1,000 to 1

in 10,000 of holders across the 10 DAOs have enough tokens to even

submit a proposal.

Gitcoin, a DAO-governed platform that crowdsources funding for Web3 projects, aims to work around this issue through quadratic funding,

where every additional token you put toward the same vote has less

value than the previous one. However, quadratic funding reduces but

doesn’t eliminate the possibility of decisions being controlled by a

single actor or by a few coordinated actors.

Total decentralization is difficult to implement — and could leave Web3 on shaky ground

Even if complete decentralization of the internet can be achieved, it would come with significant logistical issues.

For example, because of its consensus mechanism, blockchain is pretty slow. Ethereum currently supports only 30 transactions per second — though upcoming upgrades aim to increase this significantly.

Using the blockchain can also be expensive. As of March 2022, the average cost for running a transaction on Ethereum

(also known as a “gas fee”) was $15. In 2021, the mean cost often

reached $50, while some complicated transactions reached prices of more

than $200.

Further, it’s cumbersome for crypto wallets, mobile platforms,

and dApps to interact directly with blockchains themselves, so they

often don’t. Instead, they rely on APIs built and controlled by a

handful of companies. But these workarounds increase the surface area

for potential cyberattacks, can become points of failure, and typically

involve handing power to third parties — working directly against the

lofty aims of a “trustless” internet.

Cryptocurrencies still face formidable hurdles

Since crypto tokens are integral to dApps and DAOs, Web3 is vulnerable to the weaknesses of cryptocurrencies. As the May 2022 crypto crash revealed, it doesn’t take much to send the crypto sphere into freefall.

It started with the de-pegging of UST, Terra’s algorithmic stablecoin, from the US dollar. The value of Luna, UST’s sister coin, plummeted to $0. Amid

factors like a stock market downturn, rising inflation, and increased

regulatory scrutiny, confidence in the crypto market shattered — also

weakening assertions that cryptocurrencies provide a natural hedge

against broader market turmoil. Within a single day, the entire crypto

market lost over $200B. The price of bitcoin fell to a 16-month low.

Cryptocurrencies tied to utility tokens saw their values

plummet as a result of the crash. Within a month of the depeg, the price

of Filecoin and Solana fell by almost 50%, while Ether dropped from more than $2,700 to about $1,900 —

and they are currently continuing to fall. For dApp builders and users,

this means receiving less value for their contributions.

Bitcoin also continues to suffer. Some analysts predict

that the coin will hit a market bottom either at the end of 2022 or the

beginning of 2023. As the crypto crash continued in June, crypto

exchanges Coinbase, Gemini, BlockFi, and Crypto.com laid off a significant proportion of their employees, while lending platform Celsius even paused all withdrawals and transfers.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)