That all changed in April, and theories abound as to what’s behind it. The retail mania has cooled as economic restrictions eased. Stimulus bets got settled. A brief bout of selling sparked higher yields was becalmed by a chorus of Federal Reserve officials. Economic data is starting to help justify valuations. There are just fewer major issues left to drive massive market bets.

No matter, say money managers, the tranquility won’t last.

“We were going 100 miles an hour and now we’re back within the speed limit,” Arthur Hogan, chief market strategist at National Securities, said by phone. “We’re going to see a resurgence of volumes and volatility because this year is going to be like no other year that people have ever seen in terms of economic growth, earnings growth, inflation, a brand-new framework for the Federal Reserve.”

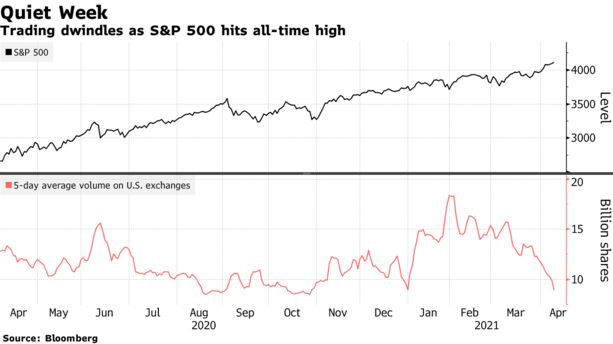

> After a 1.4% rally Monday, the S&P 500 ground out three more records to end the week as trading volumes slowed to pre-pandemic averages.

> The index notched a third straight weekly gain, and the Cboe Volatility Index slipped to its lowest level in 14 months. Fading bets on Fed hikes spurred the biggest weekly drop in 5-year Treasury yields since June.

Bond markets show similar expectations for fireworks -- short interest in the $14 billion iShares 20+ Year Treasury Bond exchange-traded fund as a percentage of shares outstanding rose to the highest level since 2017 this week, IHS Markit Ltd. data show, even as the ETF rallied.

Meanwhile, Wall Street prognosticators think the advance that pushed S&P 500 to dot-com-era valuations is likely exhausted for the year. At an all-time high of 4,128.80, the index closed Friday ahead of the average year-end target of 4,099 from strategists tracked by Bloomberg.

Skeptics have cited everything from rising yields to stretched valuation and potential tax hikes as reason for caution. Tobias Levkovich, chief U.S. equity strategist at Citigroup Inc. whose 2021 target sat at 3,800, expects the Fed to start rolling back monetary stimulus later this year and earnings guidance to weaken, posing headwinds for stocks and stoking volatility.

“Sentiment is in very worrisome territory as is valuation, yet money flows continue to push indices higher,” Levkovich wrote in a note earlier this week. “Huge fiscal stimulus and supportive central banks have created the notion of there being no need to be risk averse,” he added. “Indeed, all developments are perceived as positive news. Yet, such one-sided views are not usually a good starting point.”

No comments:

Post a Comment