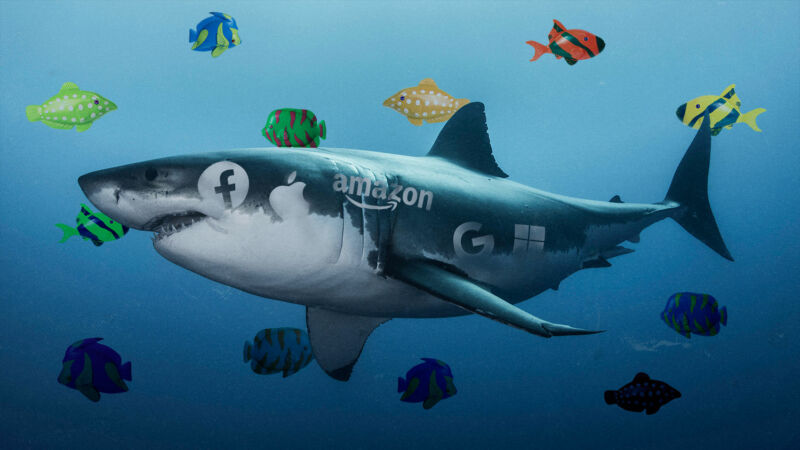

I think of serial acquisitions as a Pac-Man strategy—the collective impact of hundreds of smaller acquisitions can lead to a monopolistic behemoth

Big tech companies snap up smaller rivals at record pace

"Pac-Man" buying spree comes as US regulators look to clamp down on some acquisitions.

The glut of acquisitions comes amid much tougher scrutiny from the White House, regulators and members of Congress, who have accused large technology companies—particularly Apple, Facebook, Google, Amazon, and Microsoft—of stifling competition and harming consumers.

The Federal Trade Commission is investigating Facebook’s long-completed acquisitions of Instagram and WhatsApp, and the organization has warned that it could scrutinize other transactions even after they have gone through. It has the power to unwind deals if it deems them illegal and to block others in the future. . .

TRUST-BUILDING EXERCISE?

The FT’s data analysis shows that despite such warnings, the dealmaking has increased pace since the end of the report’s timeframe. Since the start of the year, tech companies have inked a record 9,222 transactions to buy start-ups worth less than a billion dollars, about 40 percent above the 2000 levels.

Barry Lynn, director of the Washington-based Open Markets Institute, said: “This was entirely foreseeable—in hard times, the companies which are already entrenched get that much more entrenched.

“This dealmaking is bad because it makes these corporations that much more powerful. It increases their power over the people who work for them, over capital markets and investors, and it blocks off the kind of competition that can bring innovation.”

.png)

No comments:

Post a Comment