Intro: Woooooo-Hoodooo!

The class of negative yielding bonds has quietly vanished, from some $18 trillion down to less than $2 trillion.

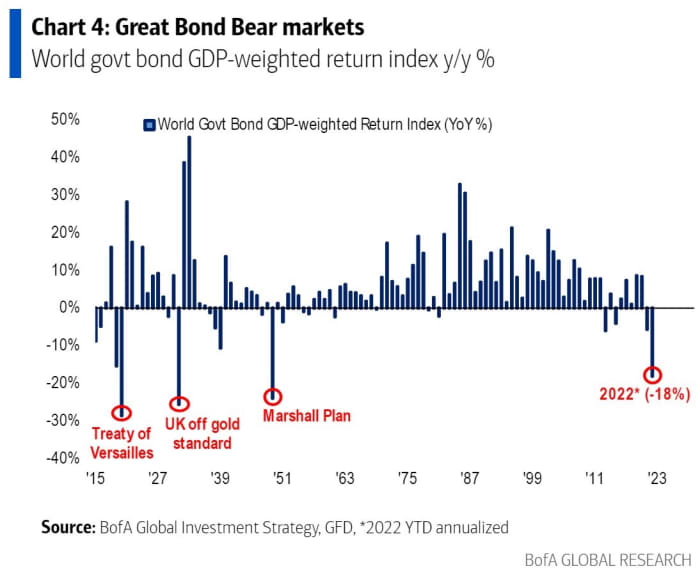

The previous bond bear markets were from 1899 to 1920, and from 1946 to 1981.

All In One Chart

"The yield on the 10-year Treasury TMUBMUSD10Y, 2.465% has shot up 84 basis points this year. Yields move in the opposite direction to prices.

The previous bond bear markets were from 1899 to 1920, and from 1946 to 1981.

(Image caption: US President Harry Truman signs the Marshall Plan into effect on April 03, 1948 in Washington the day after the US Congress passed the Economic Cooperation Act that authorized it. AFP/Getty Image)

Michael Hartnett, chief investment strategist at Bank of America, in his weekly flow show report declared the big picture is one of “deflation to inflation, globalization to isolationism, monetary to fiscal excess, capitalism to populism, inequality to inclusion, US dollar debasement.” He said long-term yields will surpass 4% by 2024.

He noted the class of negative yielding bonds has quietly vanished, from some $18 trillion down to less than $2 trillion.

The yield on the 10-year German bund TMBMKDE-10Y, 0.582%, which started the year at -0.12%, has climbed to 0.58% on Friday."

3:50 Watch : Netflix Drops Out of Fight to Buy Warner Bros. Netflix Drops Warner Bros. Bid, Leaving Paramount the Winner Netflix sh...

No comments:

Post a Comment