✓ What to do with the stock

The current macroeconomic and demand environment has caused the stock to drop, but we believe the chip-making industry is still growing. For F3Q22, TSMC reported revenue growth and beat estimates, and we don’t expect the company’s growth to slow down as it remains the best-positioned foundry player with a solid customer base. We believe the stock pullback and the depressed valuation create an attractive entry point to invest in the foundry industry, and recommend investors buy at current levels.

✓ Word on Wall Street

Wall Street is overwhelmingly buy-rated on the stock, and we agree with that sentiment. Of the 34 analysts covering the stock, 32 are buy-rated, and the remaining are hold-rated. TSMC is trading at around $390. The median price target is $600, and the mean price target is $618, with a potential upside of 54-58%.

World-leading chip makers TSMC threatened by Taiwan water crisis

"TSMC, the world's largest semiconductor manufacturer (opens in new tab), has been enacting emergency drills this week to prepare its workforce for a fight against the elements. The current water scarcity plaguing Taiwan has the potential to severely stunt production from the leading manufacturer's foundries, but TSMC has a truck or two up its sleeve—no that wasn't a typo.

TSMC is a monster wafer company, one that caters to all the top players such as Intel, AMD, Apple, Samsung, and Nvidia, to name a few. With high demand (opens in new tab) rolling in, the company undoubtedly uses a whole lot of water and energy to meet the needs of its customers.

✓According to local sources (opens in new tab) (via ComputerBase (opens in new tab)), as of tomorrow the region of Tainan—where two of the company's Gigafabs, a smaller wafer fabrication plant, and an advanced backend factory are situated—will be on orange alert. That's the second-highest alert level, and TSMC is going to have to take fast action should the drought start affecting production.

To be precise, an orange alert means a rollout of initial water rationing measures that would limit "total water use as well as reducing water supplies," while a red alert would mean "water supplies only being available to certain areas at certain times."

RECOMMENDED VIDEOS FOR YOU...

Thankfully, the Vanguard International Semiconductor Corporation (VIS) and the United Microelectronics Corp (UMC) have arranged for emergency water tankers to make deliveries to TSMC, in order to alleviate stresses in the event of a red alert. Emergency manoeuvre testing has been underway over the past week, but there is no note on whether the test runs have been a success.

✓✓ Hopefully, the company's planned expansions to the USA and Japan, among other corners of the world, will provide more stability. Spreading resources out is going to be the best way to prevent looming catastrophes, especially as so much of the world depends upon the work TSMC does."

✓ TSMC’s customer inventories are at a 25-year high, Mehdi Hosseini, an analyst at Susquehanna, said.

✓ The inventory crash will sustain throughout the first half of 2023, he added.

The main impact of the inventory correction on TSMC will come during the first half of 2023, CEO Wei said.

Geopolitics of chips

Most of the analysts on the call had questions regarding geopolitical issues between the U.S. and China that are forcing a shift in the world’s semiconductor supply chains.

. . .Despite the higher cost of chip production at its new sites in the U.S. and Japan, the company said it will maintain gross margins of 53% and higher over the long term. TSMC’s gross profit in the third quarter of 2022 exceeded 60%.

"Taiwan Semiconductor Manufacturing Co. (TSMC) is cutting its 2022 capacity expansion budget to $36 billion from the original $40 billion announced in July, as outlook for demand from smartphone and other consumer electronics makers dims.

The world’s leading maker of advanced chips for Apple iPhones and other smartphones says demand for its leading-edge 7-nm chips has slumped, impacting the utilization rate of that node. The company offered no numbers on utilization—a key metric of profitability.

“While the ongoing semiconductor inventory correction will affect our first-half 2023 utilization rate, we expect our business to be supported by stronger demand for our differentiated, leading, and advanced specialty technologies” starting around the second half of 2023, TSMC CEO C.C. Wei said during the company’s Q3 earnings call on Oct. 13 with industry analysts.

Wei said 2023 will be a growth year for TSMC, while the overall semiconductor industry will shrink. He declined to offer details. Utilization of TSMC’s 7-nm and 6-nm nodes will drop through the first half of 2023 from the past three years, he added.

Slowdown comes on heels of solid growth

The slowdown reverses strong growth that started in 2020, when the Covid pandemic drove demand for expansion of datacenters and mobile electronic devices as part of the work-from-home trend. Semiconductor shortages have widely impacted systems makers including automobile and defense companies. . ."

READ MORE ^

Taiwan Semiconductor Warns of Weaker Demand Despite Profit Surge

Taiwan Semiconductor Manufacturing 2330 +4.30% reported third-quarter revenue and profit ahead of consensus expectations but warned of weakening demand as reduced consumer spending threatens chip makers.

The world’s largest contract chip maker reported quarterly revenue of 613.14 billion Taiwanese dollars, up 48% from the prior year, and net income of 280.87 billion Taiwanese dollars, up 80%. Taiwan Semiconductor (ticker: TSM) said revenue in U.S. dollars was $20.23 billion, up 36% from the prior year.

PonyWang

We are bullish on the Taiwanese Semiconductor Manufacturing Company (NYSE:TSM). We love businesses with a singular focus. In TSM’s case, it is a pure-play foundry business. TSM is considered the manufacturer of choice for leading semiconductor companies worldwide. We don’t believe the geopolitical tensions change that TSMC is the best-positioned chipmaker in the semiconductor industry, with a roughly 53% market share of the global foundry market. TSMC controls the chips-to-order foundry market for some of the world’s most crucial semiconductor companies- Nvidia (NVDA), Advanced Micro Devices (AMD), Broadcom (AVGO), and Apple (AAPL). Even under the current macroeconomic environment, we believe TSMC is well-positioned to grow for several years. With TSMC opening fabs in Arizona, the company is taking steps to de-risk from geopolitical tensions in Asia. We believe TSMC is cheap at current levels and recommend investors buy the stock.

Still the face of pure-play foundry

Global digitalization is underway now more than ever, which translates to more demand for semiconductor chips, especially those made by TSMC. TSMC is the world’s largest contract manufacturer of semiconductor chips required to power our phones, cars, and refrigerators, among all other aspects of daily life. Hence, we don’t see demand for the chip-maker weakening meaningfully. However, TSMC is not immune to semiconductor cycles. TSMC reported a 47.9% Y/Y increase in revenues in its latest quarter, despite the semiconductor industry slowdown.

Weakening consumer demand has been the central theme for 2022, and TSMC is not immune to market volatility. TSMC is specifically exposed to the decline in PC and smartphone demand. The following graph from the company’s 3Q22 earnings outlines TSMC’s revenue by platform.

Global PC shipments have declined 19.5% over the past year, and PCs are forecasted to decline again in 2022. Smartphone shipments are also forecasted to drop by 6.5% in 2022.

Despite current macroeconomic headwinds, TSMC reported revenue and gross margins ahead of estimates last week, leading the stock to rally after its results last week. TSMC stock is still down around 37% YTD. We attribute TSMC stock fall to weakening consumer demand within the industry at large. We believe the stock pullback creates an attractive entry point to invest in the world’s leading chipmaker.

Raising ASP as it makes smaller and smaller chips

TSMC has a massive advantage with its process technology, as it allows the company to manufacture chips cost-efficiently with the highest transistor density with high quality/yield. With shrinking transistor sizes, the costs of manufacturing advanced process nodes are increasing. 3nm process node chips are more complex to manufacture, and TSMC is raising the prices for these newer chips. TSMC raising ASP for advanced process nodes will benefit the company in the future. We expect the higher ASP will make the company more resilient to market downturns as it provides more cushion to weather storms. AAPL has already contracted TSMC to produce the 3nm chip tech next year. We’re optimistic that TSMC will increasingly gain shares on advanced process nodes going forward.

Regional concentration is an issue for now

More than half the global made-to-order chip foundry capacity is concentrated in Taiwan, which is increasingly becoming an issue as the “tech wars” between the US and China unfold. Geopolitical concerns about China potentially invading the Island are intensifying, specifically, after US House Speaker Nancy Pelosi visited Taiwan this August. Regional concentration is an issue, but we believe it is only an issue for now.

We believe the regional concentration is easing as TSMC cooperates with the US’s CHIPS Act and plans to bring chip-making to US soil. TSMC has announced that its foundry business will expand and manufacture 5nm chips in Arizona. The company has already invested $12B in building its Arizona-based fabs. We believe TSMC is taking the necessary steps to dilute its regional concentration going forward.

Too valuable to invade: global silicon shield

Media and financial pundits are hyping concerns over the possible Chinese invasion of Taiwan with a lot of “what if China invades?” talk. We believe TSMC is too valuable to China for it to invade the Island anytime soon. China still consumes the bulk of the global chip supply, with 36% estimated to come from Taiwan in 2021. We believe Taiwan’s chip-making value provides it with a global silicon shield that will deter any invasion in the intermediate term.

Valuation

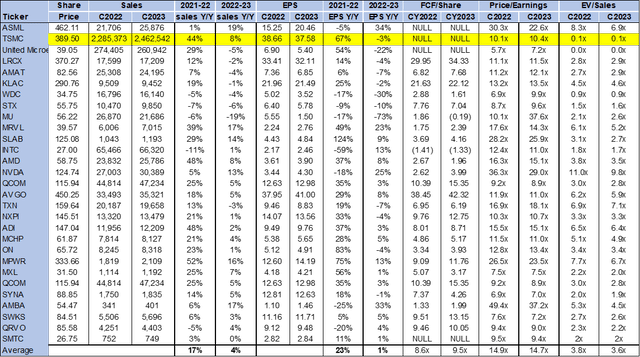

TSMC stock is relatively cheap, trading at 10.4x C2023 EPS of $37.58 on the P/E basis compared to the group average of 14.7x. The stock is trading at 0.1x EV/C2023 sales versus the peer group average of 3.6x. The following chart illustrates the semiconductor peer group valuation.

RELATED CONTENT

Shortage of 50-Cent Chips Holds Up $50,000 Cars, TSMC Chief Says

(Bloomberg) -- An endemic shortage of chips costing anywhere from 50 cents to $10 is slowing down swathes of the $600 billion semiconductor industry, Taiwan Semiconductor Manufacturing Co.’s top executive warned Tuesday.

The persistent deficit of such low-end chips is holding up production in key segments of the supply chain, Chief Executive Officer C. C. Wei told attendees at a tech symposium. ASML Holding NV of the Netherlands is struggling to obtain $10 chips for its extreme ultraviolet lithography systems, or EUVs, he said. TSMC has dozens of the machines, which are critical for packing more power onto smaller slivers of silicon. Elsewhere, a 50-cent radio chip has been holding up the production of $50,000 cars, Wei said, without elaborating.

The world’s largest contract chipmaker can no longer meet demand for low-end chips at legacy factories, and it is building new plants, Wei said, suggesting that even mature chips may cost more in the months ahead. These include a new 28-nanometer factory in China that will begin production in the fourth quarter, according to TSMC Vice President Y. L. Wang. Shortages are showing up as a result of automakers adding more features to cars and increasing the silicon used by 15% every year, while smartphones now require two to three times the number of power management chips they did five years ago, Wei said.

“The age of an efficient, globalized supply system has passed,” he said, noting that production costs are also increasing due to more countries racing to build fabs at home. “Costs are swiftly rising, including inflation.”

While demand is generally dwindling, logistics snarls and chronic component shortages continue to plague some industry players. Applied Materials Inc. said this month its order backlog is increasing as it struggles to get enough supply of semiconductors to make its equipment, while Nvidia Corp. said it encountered trouble getting support chips including power converters and transceivers to make as many data center products as it wanted to.

It is possible that by the end of the year or early next year, “we are more in control of those supply constraints,” ASML CEO Peter Wennink told analysts after reporting results in July. “Having said that, there are no guarantees there.”

Stockholder | Stake | Shares owned |

Capital Research & Management Co.... | 0.49% | 25,496,467 |

The Vanguard Group, Inc. | 0.32% | 16,617,785 |

JPMorgan Investment Management, I... | 0.32% | 16,549,493 |

Fiera Capital Corp. (Investment M... | 0.31% | 15,875,702 |

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

No comments:

Post a Comment