Driven by data if they have it

State data shows how plentiful jobs are in Biden's economy

The job market is humming nationally, but zoom in and you get another extraordinary snapshot: Many states across the country are experiencing all-time lows in unemployment.

Why it matters:

Labor market boom times are supporting local economies, with parts of

the country experiencing tighter conditions than some residents have

seen in their lifetimes.

By the numbers: From Pennsylvania to Washington to Alabama, 17 states saw jobless rates hit new record lows or hold at a previously notched low in June, according to the Bureau of Labor Statistics.

- That group includes New Hampshire and South Dakota. Both are tied for lowest unemployment rates in the nation at 1.8% in June, both ticking down from 1.9%. (Nationally, the unemployment rate was 3.6%).

- Fourteen other states, including Florida (2.6%), Kentucky (3.8%) and Montana (2.4%), have unemployment rates hovering 0.1 or 0.2 percentage points above all-time low levels.

The intrigue: The strong labor market conditions may be politically awkward for red-state politicians who are touting big job gains and have also criticized the state of the economy under the Biden administration.

- That dynamic was on display after the state-level employment data was released Friday. Republican governors of South Dakota and Mississippi praised record-low unemployment rates — a fact the White House gleefully pointed out to reporters.

- Axios' Hans Nichols found that a number of these states are also benefiting from the manufacturing jobs boom, something to which Biden-era legislation has contributed.

What to watch: There are signs of deteriorating labor market conditions in a few states — a reality not reflected at the national level.

- That includes the nation's most populous state, California. The unemployment rate has jumped 0.8 percentage points to 4.6% since hitting a record low in August 2022.

- Nevada had the highest jobless rate among U.S. states in June, at 5.4%.

Go deeper

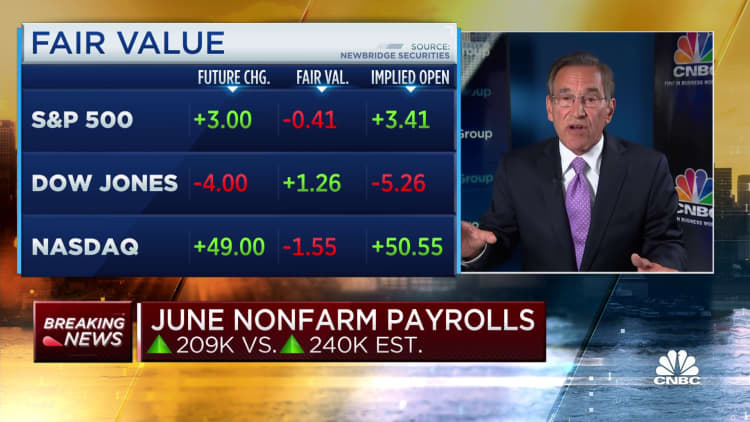

US Jobs Report June 2023: 209,000 Jobs Added, Unemployment Rate Falls to 3.6%

- US job gains moderated in June while wage growth remained firm, showing a strong enough labor market to keep the Federal Reserve on track to raise interest rates this month.

- Nonfarm payrolls increased 209,000 — the smallest advance since the end of 2020 — after downward revisions in the prior two months, a Bureau of Labor Statistics report showed Friday.

- The unemployment rate fell to 3.6%.

Updated on July 7, 2023 at 9:37 AM EDT

www.cnbc.com

Employment growth eased in June, taking some steam out of what had been a stunningly strong labor market.

- Nonfarm payrolls increased 209,000 in June and the unemployment rate was 3.6%, the Labor Department reported Friday.

- That compared with the Dow Jones consensus estimates for growth of 240,000 and a jobless level of 3.6%.

The total, while still solid from a historical perspective, marked a considerable drop from May's downwardly revised total of 306,000 and was the slowest month for job creation since payrolls fell by 268,000 in December 2020. The unemployment rate declined 0.1 percentage point.

Closely watched wages numbers were slightly stronger than expected. Average hourly earnings increased by 0.4% for the month and 4.4% from a year ago. The average work week also increased, up 0.1 hour to 34.4 hours.

"Overall, the job market is outstanding and is getting back to a balanced, sustainable level," Chicago Federal Reserve President Austan Goolsbee said on CNBC's "Squawk on the Street."

- Job growth would have been even lighter without a boost in government jobs, which increased by 60,000, almost all of which came from the state and local levels.

- Other sectors showing strong gains were health care (41,000), social assistance (24,000) and construction (23,000).

Leisure and hospitality, which had been the strongest job growth engine over the past three years, added just 21,000 jobs for the month. The sector has cooled off considerably, showing only muted gains for the past three months.

The retail sector lost 11,000 jobs in June, while transportation and warehousing saw a decline of 7,000.

There had been some anticipation that the Labor Department report could show a much higher-than-anticipated number after payrolls processing firm ADP on Thursday reported growth in private sector jobs of 497,000.

Markets moved lower following the release of the jobs report, with futures tied to the Dow Jones Industrial Average off nearly 90 points. Longer-dated Treasury yields were slightly higher.

"A 209,000 increase in payrolls can hardly be described as weak," said Seema Shah, chief global strategist at Principal Asset Management. "But after yesterday's ADP wrongfooted investors into expecting another bumper jobs number, the market may be disappointed."

- The labor force participation rate, considered a key metric for resolving a sharp divide between worker demand and supply, held steady at 62.6% for the fourth consecutive month and is still below its pre-Covid pandemic level.

- However, the prime-age participation rate — measuring those between 25 and 54 years of age — rose to 83.5%, its highest in 21 years.

A more encompassing unemployment rate that includes discouraged workers and those holding part-time jobs for economic reasons rose to 6.9%, the highest since August 2022.

At the same time, the unemployment rate for Blacks jumped to 6%, a 0.4 percentage point increase, and rose to 3.2% for Asians, a 0.3 percentage point rise.

In addition to a downward revision of 33,000 for the May count, the Bureau of Labor Statistics sliced April's total by 77,000 to 217,000. That brought the six-month average to 278,000, down sharply from 399,000 in 2022.

"This is a strong labor market where demand for higher paying jobs is clearly the trend," said Joseph Brusuelas, chief economist at RSM. "So, I think it's no longer appropriate to talk about an imminent recession, given those strong gains in jobs and wages."

The jobs numbers are considered a key in determining where Federal Reserve monetary policy is headed.

Policymakers see the strong employment market and the supply-demand imbalance as helping propel inflation that around this time in 2022 was running at its highest level in 41 years.

- They are using interest rate increases to try to cool the economy, but the labor market thus far has defied the central bank's tightening efforts.

In recent days, Fed officials have provided indication that more rate hikes are likely even though they decided against moving at the June meeting.

- Markets widely expect a quarter percentage point increase in July that would take the Fed's benchmark borrowing rate to a targeted range between 5.25%-5.5%.

- The outlook was little changed following the jobs data release, with traders pricing in a 92.4% chance of a hike at the July 25-26 meeting.

- The June report "suggests labor market conditions are finally beginning to ease more markedly," wrote Andrew Hunter, deputy chief U.S. economist at Capital Economics. "That said, it is unlikely to stop the Fed from hiking rates again later this month, particularly when the downward trend in wage growth appears to be stalling."

The rise of gig workers is changing the face of the US economy

- The last time the Bureau of Labor Statistics officially tracked workers with alternate job arrangements was 2017.

- But workplace experts say the number of gig workers is growing, and and their impact is being felt throughout the economy.

- It could even be distorting government economic data, they say. For example, easy-to-access work through mobile phones may be keeping the national unemployment rate lower than it would be without the rise of these workers. It may also be a factor helping more people avoid bankruptcies, providing a fallback option for those who have been laid off from work in recent years, they say.

Millions earn money from online platforms

- Recent data indicates that the number of people working with these platforms has grown, too.

- A paper published by the University of Chicago in May that tracked earnings through tax filings found that the number of people who report income from platform-based gig work to the IRS has exploded in recent years from just over one million workers to nearly five million — a clear indication of just how many more people use tech platforms to help earn a living.

- DoorDash currently has more than two million monthly active Dashers, according to Jenn Rosenberg, a company spokesperson. More than 13 million Dashers have used the platform since it launched a decade ago.

- Flex, a trade association representing DoorDash, Grubhub, HopSkipDrive, Instacart, Lyft, Shipt and Uber, estimates that more than 23 million Americans have earned money through an online platform in the past 12 months.

“It’s a backstop in a lot of ways, and it always is an alternative. If you don’t want to work in a restaurant or the other kinds of service work, you could do this instead,” he said.

The economic impact

Despite the fact that many gig workers don’t have access to benefits like workplace-provided health insurance or retirement benefits, which come from a traditional 9-5 job, there are some advantages to online gig work.

- “It allows people to search longer for their next job. If they are laid off, they have more of a safety cushion beyond unemployment insurance and relying on family and friends and their savings,” said Erica Groshen, the former commissioner of the Bureau of Labor Statistics.

Limo falls into that category. He began using platforms like Uber, DoorDash and Grubhub part-time to help pay for college but began his full-time gig work after a contract to work as an electrical technician ended last year. He sees the work as temporary, though. “Once I make a certain amount of income, then I will not need to do this,” he said.

A 2020 study from the Massachusetts Institute of Technology found that platforms like Uber and Lyft may help reduce the strain on unemployment insurance and help hold down personal debt by comparing unemployment data, credit data from Equifax and car registration data. The study found that laid-off workers with access to Uber were less likely to apply for unemployment insurance benefits and rely on borrowing money.

- According to DoorDash and Uber, most of their workers do the job part time to supplement other sources of income. According to Doordash, 90% of their workers work fewer than 10 hours per week for the platform. As of the first quarter of 2023, Uber said 48% of their “earners” average fewer than 10 hours per week online, and 71% average fewer than 20.

The lack of data poses challenges

- The last BLS survey on workers in short-term jobs and alternative working arrangements found that just 1% of the workers used an app to work.

- Susan Houseman, director of research at the W.E. Upjohn Institute for Employment Research in Kalamazoo, Michigan, said she believes the federal government significantly undercounted workers in the survey.

- Groshen said that official government data on the working situations of gig economy participants would greatly benefit lawmakers looking to regulate the industry.

- In June, New York City announced a minimum wage of $17.96 for app food delivery workers. DoorDash, Grubhub and Uber sued the city, saying the law would harm customers and delivery workers. Earlier this month, a judge temporarily blocked the law’s enforcement.

- In 2020, California passed Prop 22, which allows ride-hailing and delivery drivers to be treated as independent contractors with some added benefits, including a minimum earnings guarantee.

The lack of quality data also impacts the broader economy in another way:

- It prevents the Federal Reserve from getting a complete picture of America’s workforce. The Fed’s two primary goals when setting monetary policy are price stability and maximum stable employment, and a lack of reliable information on the gig economy labor force may be handicapping the central bank, said Groshen, who was a member of the Federal Reserve System for 27 years.

.gif)

No comments:

Post a Comment