The Bank of Israel to sell up to $30bn to support shekel

Israel’s shekel fell to a near eight-year low in early trading, prompting the country’s central bank to step in to support the currency.

- The Bank of Israel said it will sell up to $30bn of foreign currency in the open market to maintain stability.

- According to Reuters, this is the central bank’s first ever sale of foreign exchange

In addition to the $30 billion program, and as necessary, the Bank will provide liquidity to the market through SWAP mechanisms in the market of up to $15 billion.

It is now trading at 3.89 to the dollar, up from 3.8388 on Friday night, having hit 3.921 earlier today, the weakest since early 2016

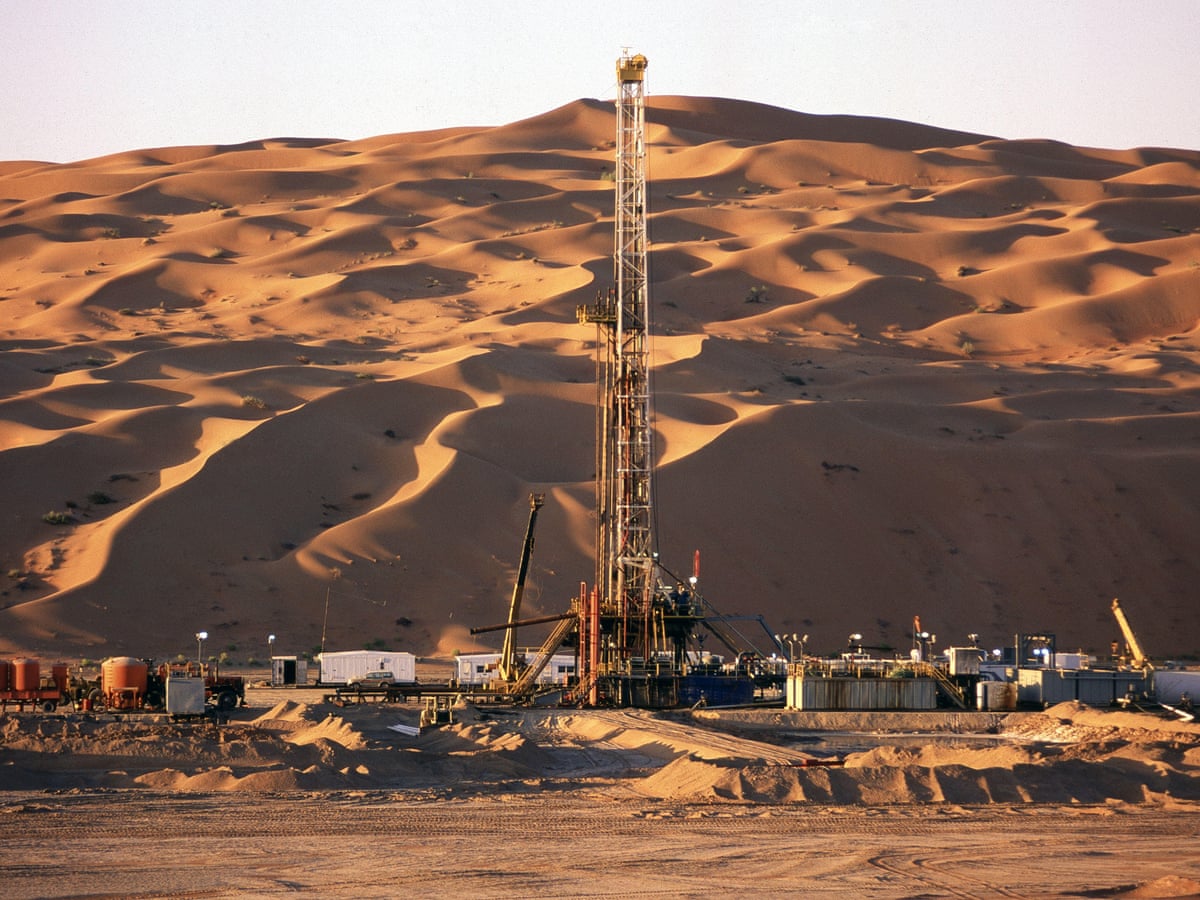

The oil price has jumped over 3% this morning as financial markets are rattled by the Israel-Hamas war:

Brent crude has jumped back to $89 per barrel this morning, recovering a chunk of last week’s losses, on fears that the surprise Hamas attack on Israel could escalate further, lifting tensions across the Middle East and hitting output from leading oil producers.The risk of sanctions and oil supply shocks in the Middle East has driven up both gold and crude prices, reports Kyle Rodda, senior financial market analyst at Capital.com

Rodda adds:

The human impacts are far more consequential than anything happening in the markets, especially regarding the growing civilian casualties that have already occurred and are likely to increase as tensions escalate.

For those with open positions in the market, there could be ongoing volatility as the situation unfolds. Crude prices could be one barometer of the situation as instability in the region increases, impacting trilateral talks between Israel, the US, and Saudi Arabia and relations between the West and Iran.

Hedge fund manager Pierre Andurand, argues that the oil market could tighten over time, but there is little immediate threat to supplies.

Writing in X (formerly Twitter), Andurand explained: Many people asked me if the Hamas attacks on Israel will have an impact on oil prices. As the Levant is not a large oil producing region, it is unlikely to impact oil supply in the short term. And therefore one should not expect a large oil price spike in the coming days. But it could eventually have an impact on supply and prices.

Global oil inventories are low, and the Saudi and Russian production cuts will lead to more inventories draws over the next few months. The market will eventually have to beg for more Saudi supply, which I believe, will not happen sub $110 Brent.

Wall Street is set to open lower, with the Dow Jones industrial average set to fall around 0.7%.

The agenda

10.45am BST: Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel awarded

11am BST: Ireland’s industrial production for August

1pm BST: Mexico’s inflation rate for September

The dash for safe haven assets has pushed the dollar up against both the pound and the euro this morning.

Sterling has lost half a cent, to $1.219 against the dollar, while the euro is also half a cent lower at $1.0535.

Today’s jump in the oil price will fuel inflationary worries.

- ‘‘The shocking attacks in Israel have sent the price of oil soaring, as investors assess the potential for the conflict to disrupt supply in the Middle East, if other countries are drawn in.

- With the Israeli government warning of a long and difficult war, there are concerns that deep and incessant retaliative strikes on Gaza could potentially bring Iran into the conflict and have an impact on the flow of energy in the region.

Nerves are showing signs of being frayed again just as investors had started to breathe a sigh of relief that the US might be heading for a softer landing, despite the high level of interest rates.

>

>

.jpg)

No comments:

Post a Comment