- The macro-financial assistance includes 1 billion euros in emergency funding to be delivered this year.

- The remaining 4 billion euros will be subject to approval by the European parliament, the official said.

The European Union on Sunday, March 17 announced a €7.4 billion aid package for cash-strapped Egypt as concerns mount that economic pressure and conflicts in neighboring countries could drive more migrants to European shores.

The deal, which drew criticism from rights groups over Egypt’s human rights record, was signed Sunday afternoon in Cairo in a ceremony attended by Egyptian President Abdel Fattah el-Sissi, European Commission President Ursula von der Leyen and leaders of Belgium, Italy, Austria, Cyprus and Greece.

El-Sissi met separately with von der Leyen and other European leaders before the signing ceremony on Sunday afternoon.

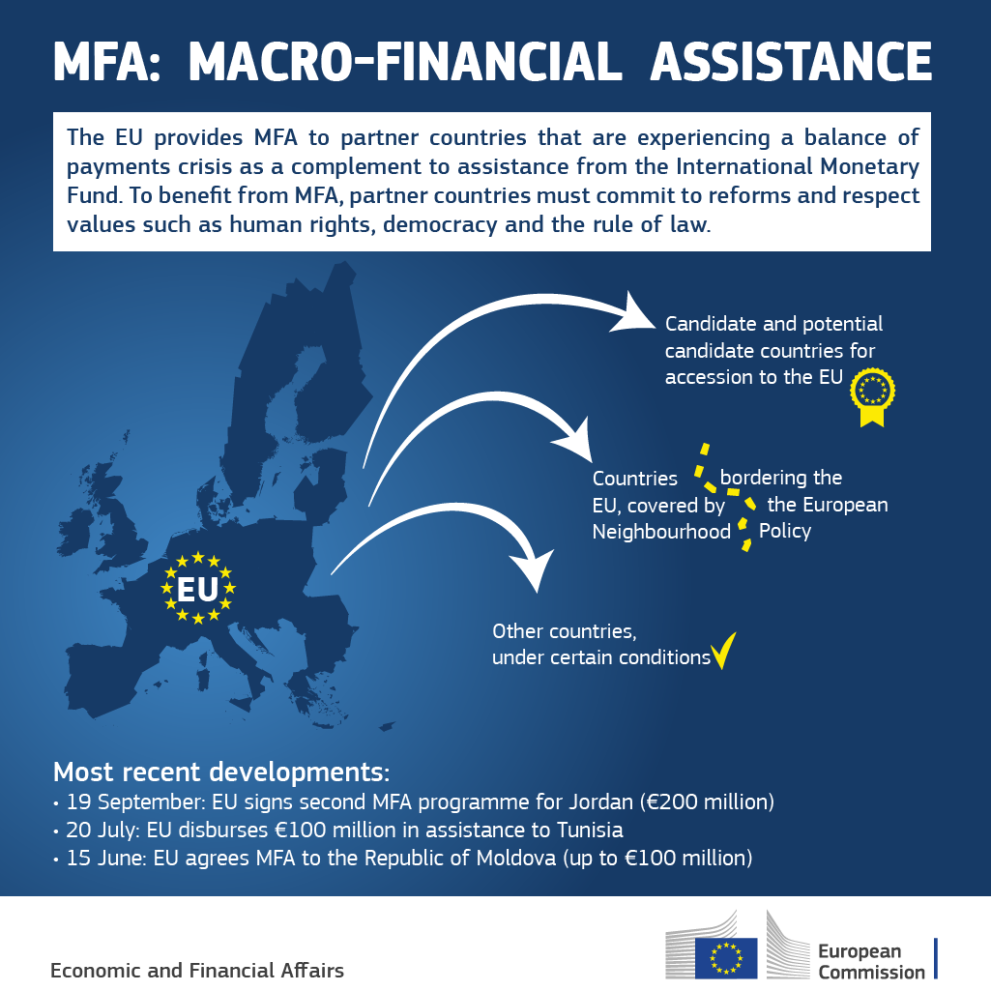

The aid package includes both grants and loans over the next three years for the Arab world's most populous country, according to the EU's mission in Cairo. Most of the funds − €5 billion − are macro-financial assistance, according to a document from the EU mission in Egypt.

The mission said that the two sides have promoted their cooperation to the level of a "strategic and comprehensive partnership," paving the way for expanding Egypt-EU cooperation in various economic and non-economic areas.

3 possible scenarios for Egypt’s inflation rates after devaluation - Oxford Economics Africa

Getty Images/Westend61

The currency depreciation may not necessarily lead to significant inflationary pressures

In light of the recent devaluation of the local currency, Egypt might experience one of three possible scenarios, where inflation rates could go as high as 38% or as low as 24% by year-end, according to Oxford Economics Africa.

- 1 “Firstly, conventional economic wisdom would have one believe that the exchange rate weakness will result in further inflationary pressures,” the briefing released on Tuesday said.

- “A model taking into consideration interest rate differentials and real income differentials predicts that inflation will peak just below 38% [year-on-year] in Q4 2024.”

On March 6, the Central Bank of Egypt (CBE) announced the adoption of a market-based exchange rate, a move that weakened the official rate from 30.9/$ to around 50/$ in only a few hours.

The CBE’s move came days after the government had said that the annual urban inflation rate had jumped to 35.7% in February from 29.8% in January.

“The higher starting point, even before the devaluation and Ramadan that commenced in March, complicates the inflation outlook,” the briefing said.

- 2 Conversely, Oxford Economics suggested a second scenario, where inflation might slow down to reach 24% by year-end, based on the assumption that many goods and services had been already priced at the black market rate of nearly 60/$ for the last two quarters almost double the official rate long before the official devaluation.

Since December, the Egyptian pound had sharply weakened on the black market until it reached a record high of 72 against the greenback in late January.

- Assuming that the government and some companies had access to foreign currency at the official rate amid the country’s grinding currency crunch, Oxford Economics suggested a third scenario where some price hikes could occur as the aforementioned stakeholders start importing goods at the new 50/$ rate.

“In scenario three, we could see inflation end the year just below the 30% [year-on-year] level,” the briefing said.

(Reporting by Noha El Hennawy; editing by Seban Scaria seban.scaria@lseg.com)

RELATED

No comments:

Post a Comment