The catastrophe, or cat bonds, represent money borrowed by insurance companies from capital markets.

If the insurance company needs that money because a specific event has taken place, investors might lose their initial outlay, but if the catastrophe covered by the bond does not take place, the bond retains its value.

Bloomberg Opinion

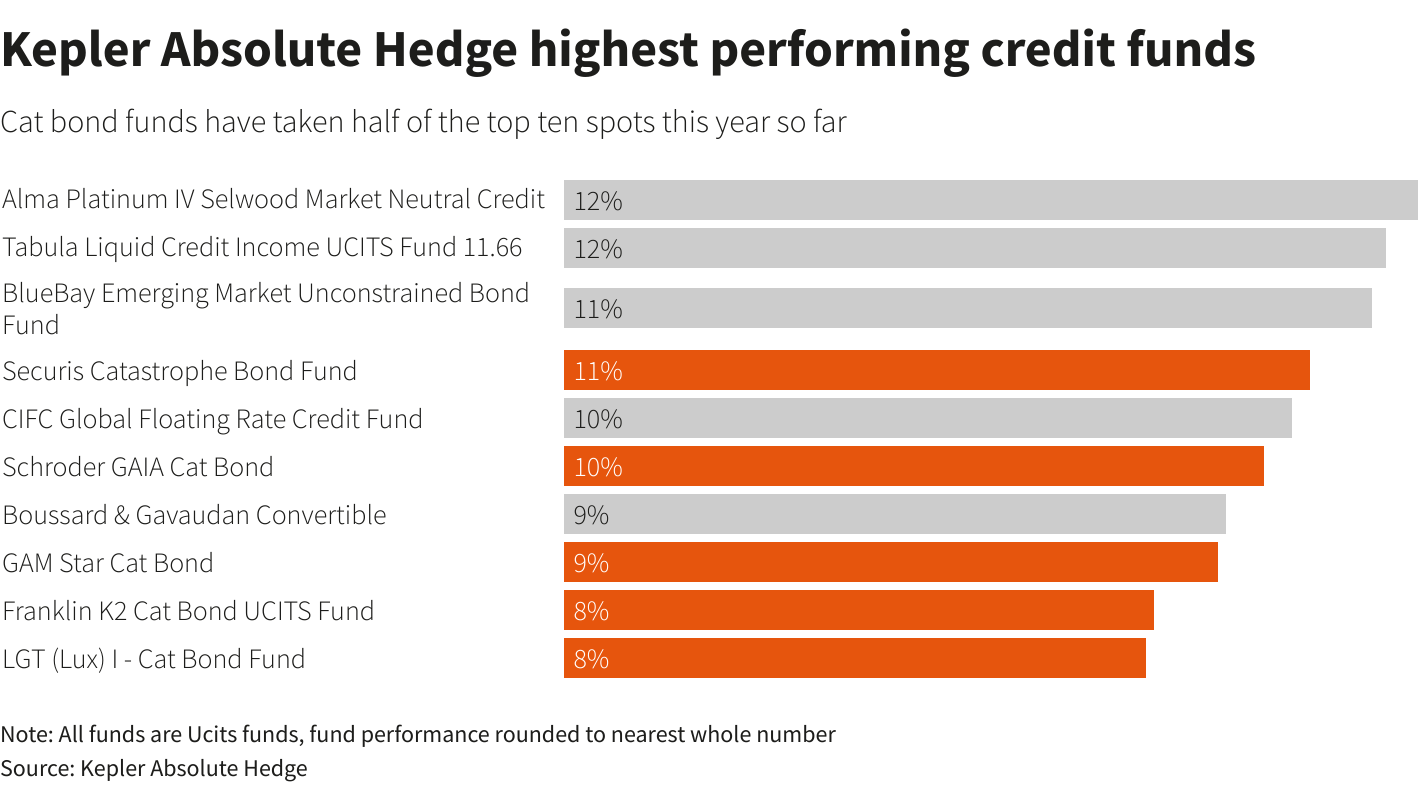

Kepler tracks Undertakings for Collective Investment in Transferable Securities (UCITS), which are regulated like mutual funds and serve investors that want quicker, more transparent access to their money.

“The fund’s performance year-to-date is mainly driven by the current attractive reinsurance rate environment following the last few loss-heavy years,” said LGT Capital Partners which oversaw one of the top performing funds.

It pointed to a lack of any “major insured events,” but added the fund held a diversified set of bonds with different categories of catastrophe and from different regions.

Hurricane Losses and Higher Yields

Peak hurricane season starts around September and U.S. hurricanes are one of the most common events covered by cat bonds, according to Morningstar.

- In a report last week, it also said the cat bond market is worth over $40 billion, compared with the more than $133 trillion global bond market.

- In the first half of 2023, insured losses hit their second highest since 2011, at over $50 billion and severe thunderstorms accounted for 70% of that total, Swiss Re said in a separate report on Wednesday.

- But events covered by cat bonds may still not have taken place, or been severe enough to generate payouts.

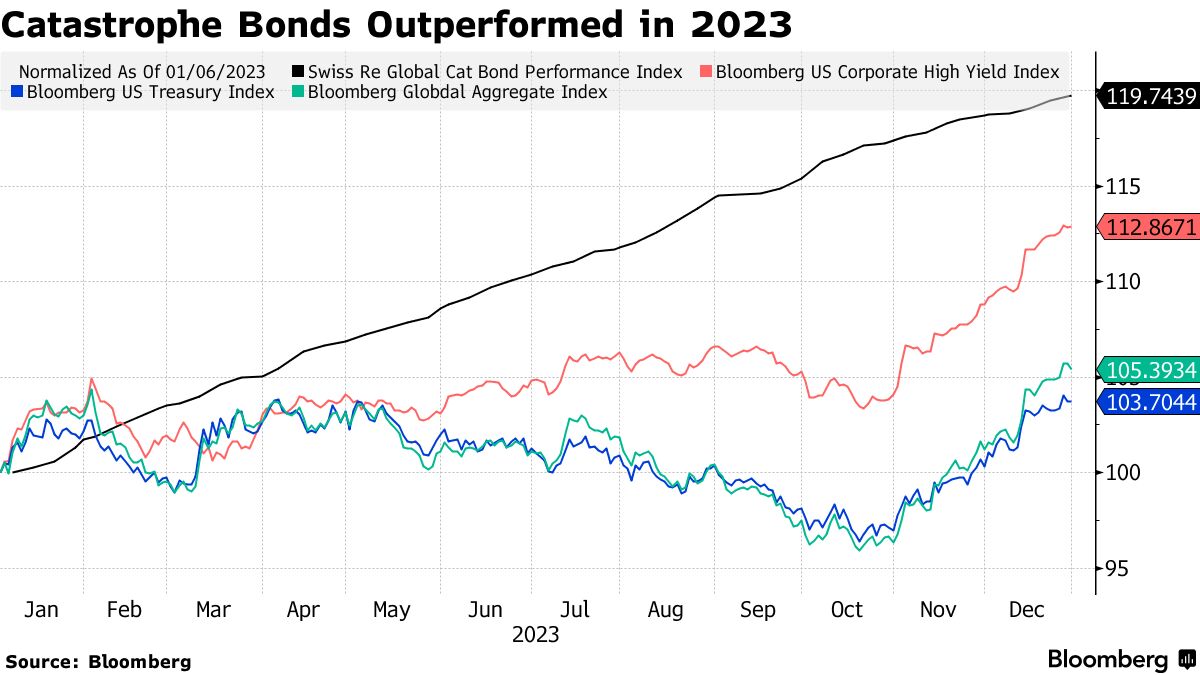

Another reason for the bonds’ strong performance is that many cat bonds are secured by collateral held in cash and inflation has helped to boost their value.

GAM investment specialist Ralph Gasser said cat bonds were no riskier than similarly yielding bonds.

“They provide a much better compensation of risk per unit of risk, which is largely a reflection of the supply/demand characteristics of the cat bond market,” Gasser said in an email to Reuters.

He said cat bonds averaged a 0.9% yearly loss for the last 20 years, while global corporate high-yield bonds lost about an average of 2% yearly, in that time.

Raphael Rayees, portfolio manager at Securis Investments linked the performance of their fund to trying to capture the upside of risk while reducing fund volatility.

Catastrophe bonds this year and in general, have benefited from their lack of correlation to the broader financial markets, he said.

Schroders declined to comment and Franklin Templeton did not immediately respond to a request for comment.

(Reporting by Nell Mackenzie; additional reporting Alessandro Parodi; editing by Amanda Cooper and Barbara Lewis)

Last year, everything came together for cat-bond investors. Brett Houghton, a managing director at Fermat, which looks after about $10.8 billion of assets, describes 2023 as a “unicorn year,” with “strong investor interest and the need for the insurance market to issue more and more.”

Niklaus Hilti, head of insurance-linked strategies at the investment arm of Credit Suisse, which is now part of UBS Group AG, says those eye-popping returns are feeding appetite for so-called cat bonds in circles beyond the domain of hedge funds.

“The interest has recently increased amongst institutional investors,” Hilti said. “Even if we believe that these returns won’t be reproduced in 2024, we think that small allocations to the asset class can make sense for investors in order to diversify investment portfolios.”

Catastrophe bonds are used by the insurance industry to shield itself from losses too big to cover. That risk is instead transferred to investors willing to accept the chance that they may lose part or even all of their capital if disaster hits. In exchange, they can garner outsize profits if a contractually pre-defined catastrophe doesn’t occur.

The cat bond market has existed for decades but has recently had a resurgence due to weather events fueled by climate change. Combined with decades-high inflation, which has added to the cost of rebuilding after natural disasters, cat bonds have attracted record levels of issuer and investor activity.

At the same time, some cat bonds have been written with tighter trigger clauses, an outcome that favors investors and cat bond funds because it reduces the likelihood of a payout.

Hedge funds that enjoyed bumper returns on cat bonds and other insurance-linked securities last year include Fermat Capital Management, Tenax Capital and Tangency Capital.

- These include Schroders Plc, GAM Holding AG and Credit Agricole SA.

- That’s coincided with growth in the supply of such securities, with insurers increasing issuance by 50% last year.

- He notes that a quarter of the investors seeking exposure to cat bonds at Schroders over the past six months are new to the firm’s catastrophe bond team.

- A Schroders cat bond fund targeting US investors that was launched in the middle of last year has already attracted $100 million, he said. “We have clearly seen that the flavor of the year was cat bonds” and “we see very attractive return patterns for 2024.”

- In July 2022, it set up an investment manager called Swiss Re Insurance-Linked Investment Advisors Corp., which oversees third-party capital and currently has about $1.5 billion of assets under management.

- Returns have been in the double digits and that’s attracting interest from a growing roster of non-ILS specialist investors, she said.

To be sure, investors moving into cat bonds are taking on highly complex and highly risky instruments that don’t move in tandem with the rest of the market. And when payment clauses are activated, losses can be considerable.

- Cat bond issuance alone hit an all-time high of more than $16 billion in 2023, including non-property and private transactions, bringing the total market for the securities to $45 billion, according to Artemis, which tracks the ILS market.

Last year, everything came together for cat-bond investors. Brett Houghton, a managing director at Fermat, which looks after about $10.8 billion of assets, describes 2023 as a “unicorn year,” with “strong investor interest and the need for the insurance market to issue more and more.”

The recent gains in cat bonds were buoyed by the fact that the hurricane season was milder than in 2022, meaning bondholders had to cover fewer losses. While the consensus view is it will be hard to achieve a repeat of those uniquely supportive circumstances, Houghton said investors are still seeing “attractive returns.”

Hilti said the gains of 2023 don’t need to be repeated this year for the securities to remain an attractive investment.

“We expect the market to relax from the widest spreads but to remain on very healthy levels,” he said. “The higher interest rates, which might stay higher for longer, also help to deliver positive returns.”

Cat bonds will always remain “a niche investment,” Hilti said. But those investors willing to take on the risks are trying to get a foothold after the “stronger momentum and higher risk premia” they’d been waiting for has now arrived, he said.

Most Read from Bloomberg

Stock Traders Bracing for Worst Shrug Off Hot CPI: Markets Wrap

Ex-Wall Street Banker Takes On AOC in New York Democratic Primary

One of the Most Infamous Trades on Wall Street Is Roaring Back

US Core Inflation Tops Forecasts Again, Reinforcing Fed Caution

Fermat Capital Management, the world’s biggest cat bond investor, has started “being a bit picky” about the kinds of cat bonds it’s allocating capital to, said Brett Houghton, a managing director at the hedge fund firm.

Catastrophe bonds reward buyers for taking on insurance-market risk linked to natural disasters such as hurricanes and earthquakes. If catastrophe strikes, bondholders pay out. If it doesn’t, they stand to reap outsized returns.

Tenax, Fermat and Tangency Capital, a Bermuda-based hedge fund manager, all delivered record returns in 2023 thanks to bets on insurance-linked securities. According to Preqin, a consultancy that provides data on the alternative asset management industry, ILS was the best performing of all hedge fund strategies last year, delivering more than 14% overall compared with an 8% benchmark. Cat bonds gained 20% in 2023, Swiss Re data show.

Houghton says the evolving market conditions mean there’s “a lot more choice” for investors like Fermat, which is known for deploying some of the most advanced cat bond models around.

Cat bond issuance this year is expected to rise by about 20% from 2023 to $20 billion, according to GAM Investments.

Professional investors in insurance-linked securities agree they’re unlikely to see the huge returns of 2023 continue into 2024. But Tenax is more wary than most.

It’s not a great time to be in cat bonds when “everyone is trying to buy, no one wants to sell,” Toby Pughe, an analyst at London-based Tenax, said in an interview.

Global Insured Losses $ Billion

Last year, everything came together in a uniquely profitable cocktail for investors in the securities. The number of catastrophes was down, while the supply of bonds with double-digit coupons was ample thanks to the panic that followed hurricane Ian in 2022.

.gif)

No comments:

Post a Comment