The US increases its lead in arms exports, France gains and Russia slips back

The dominance of the US defense industry, which accounts for 42% of global sales, increased between 2019 and 2023, mainly because of Ukraine, according to the latest Stockholm International Peace Research Institute report.

The Russian-Ukrainian war, going on for two years now, has profoundly altered the arms trade, strengthening the United States and marginalizing Russia, which is concentrating production on its own armies.

In its latest annual report on global arms exports, published on Monday, March 11, the Stockholm International Peace Research Institute (Sipri) reveals that arms imports into Europe have almost doubled (+94%) over the last five years (2019-2023) compared to the previous five years, while Russian foreign sales have been halved.

SIPRI studies the market over five-year periods to smooth out the sometimes significant fluctuations from one year to the next, and clearly identify trends.

Over 2019-2023, the world ranking of "cannon dealers" changed.

Since February 2022, some 30 countries – led by the US – have supplied weapons to Kyiv, now the world's fourth largest importer.

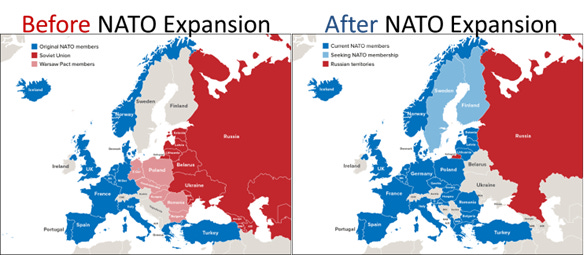

- Many European countries have acquired aircraft, helicopters, combat vehicles and air defense systems as part of a rearmament policy, which is also designed to meet their NATO commitment to devote at least 2% of their GDP to defense.

'Strategic imperative'

SIPRI Director Dan Smith pointed out that Europe, far from being marginalized, is "responsible for around a third of world exports, reflecting [its] strong military-industrial capacity."

The facts and figures speak for themselves.

On March 5, EU High Representative for Foreign Affairs Josep Borrell stressed that "a strong, resilient and competitive European defense industry is a strategic imperative."

The goal is a long way off.

- Over the last five years, 55% of European imports came from the US, compared with 35% over 2014-2018.

- They now account for 42% of global defense sales, exporting more weapons to more countries.

- This dynamism reinforces a military-industrial complex that includes the world's leading companies in the sector,

There were overall decreases in arms transfers to all other regions, but states in Asia and Oceania and the Middle East continued to import arms in much larger volumes than those in Europe.

Nine of the 10 biggest arms importers in 2019–23, including the top 3 of India, Saudi Arabia and Qatar, were in Asia and Oceania or the Middle East.

- Ukraine became the 4th biggest arms importer globally after it received transfers of major arms from over 30 states in 2022–23.

- Arms exports by the United States, the world’s largest arms supplier, rose by +17% between 2014–18 and 2019–23, while

- those by Russia fell by more than half (–53%)

- France’s arms exports grew by 47% and it moved just ahead of Russia to become the world’s second largest arms supplier.

Trends in International Arms Transfers, 2023

.gif)

No comments:

Post a Comment