World Bank issues Ukraine bankruptcy warning

Kiev is reliant on financial aid from its Western backers but foreign support has dwindled in recent months, while a $60 billion US aid package remains stalled in Congress.

The official, who spoke on condition of anonymity, was commenting on the latest $1.5 billion tranche of funding which Kiev received last week under a World Bank program. According to the source, the World Bank’s division representing Russia voted against the loan, citing the organization’s charter.

“If in 2025 Western creditors refuse to write off Kiev’s debts, including the debts of private companies and banks, the country could face bankruptcy,” he warned.

- The Ukrainian government expects a record budget deficit of $43.9 billion this year and plans to cover the bulk of it with financial aid from its Western backers.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

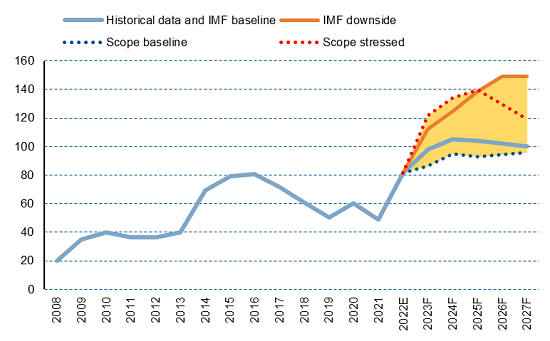

UKRAINE CLOSE TO DEFAULT: Sovereign credit rating and Foreign currency ratings close to default....not yet occurred, but almost inevitable

Official 2023 GDP data for Ukraine have not yet been published.

Danylo Hetmantsev, chairman of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy, believes that "there is no real sensation here."

Recently, the international rating agency S&P downgraded Ukraine's long-term sovereign and foreign currency issuer ratings from CCC to CC, leaving a negative forecast. According to the agency's scale, the rating has been downgraded to the category "issuer default has not yet occurred, but is almost inevitable".

He explained that Ukraine is preparing to continue the restructuring of its commercial external debt, with negotiations to be completed by August 2024.

- "After the legal completion of the exchange procedure and the entry into force of the new terms and conditions of the restructured issues, we can expect a certain increase in Ukraine's sovereign and foreign currency ratings.

- This is the basic scenario supported by the EFF program with the IMF.

- Under this scenario, in December, Ukraine successfully completed a debt restructuring, postponing the servicing and repayment of its external debt to the G7 countries and the Paris Club until March 2027.

- The restructuring of debt to external commercial creditors is also provided for under the umbrella of the EFF program," Hetmantsev added.

International rating agency S&P Global Ratings has updated its long-term sovereign credit rating and issuer's rating in foreign currency of Ukraine. Agency analysts downgraded to "CC" from "CCC" with a "negative" forecast.

This is stated in the message of the agency, Interfax-Ukraine reports.

Ukraine to default on its external commercial obligations - new S&P rating

"We expect that the Ukrainian government will begin formal negotiations on debt restructuring with private creditors in the short term and will complete this process by the middle of this year. We believe it is almost certain that Ukraine will default on its external commercial obligations," the statement said.

- At the same time, S&P confirmed short-term ratings of Ukraine in foreign currency "C," in national currency "CCC +/C" and according to the national scale "uaBB."

- The forecast for the rating in foreign currency is "negative," and for the rating in the national currency - "stable."

- In the absence of restructuring, the government faces debt servicing payments on Eurobonds of USD 4.5 billion in 2024 and approximately USD 3 billion on average annually in 2025-2027.

> The agency in the basic scenario expects that foreign grants and concessional loans will continue to cover most of the Ukrainian government's funding needs this year and likely in the next period.

- In particular, Ukraine will be able to raise USD 38 billion this year after USD 43 billion last year to finance the budget, despite the delay in allocating USD 8 billion from the United States.

______________________________________________________________________________________

end

___________________________________________________________________________________

PRESS RELEASE NO. 24/96

IMF Executive Board Completes the Third Review of the Extended Fund Facility Arrangement for Ukraine

March 21, 2024

- The IMF Board today completed the Third Review of the extended arrangement under the Extended Fund Facility (EFF) for Ukraine, allowing the authorities to draw the equivalent of about US$880 million (SDR 663.9 million), which will be channeled for budget support.

- The authorities continue to perform strongly under the EFF under challenging conditions, meeting all but one quantitative performance criteria for end-December, all structural benchmarks through end-February, and all indicative targets.

- The Ukrainian economy continued to show remarkable resilience in 2023, although war-related headwinds are re-emerging, and the outlook remains subject to exceptionally high uncertainty. Sustained reform momentum is necessary to safeguard macroeconomic stability, restore fiscal and debt sustainability, enhance institutional reforms, and lay the groundwork for reconstruction efforts and the path to European Union (EU) accession.

Washington, DC: The Executive Board of the International Monetary Fund (IMF) today completed the third Review of the EFF arrangement for Ukraine. The completion of the third review enables the authorities to immediately draw US$880 million (SDR 663.9 million), which will be channeled for budget support.

Ukraine’s 48-month EFF arrangement, with access of SDR 11.6 billion (equivalent to US$15.6 billion, or about 577 percent of quota), was approved on March 31, 2023, and forms part of a US$122 billion support package for Ukraine. The authorities’ IMF-supported program aims to anchor policies that sustain fiscal, external, price and financial stability at a time of exceptionally high war-related uncertainty, support the economic recovery, as well as enhance governance and strengthen institutions to promote long-term growth in the context of reconstruction and Ukraine’s path to EU accession.

- All but one quantitative performance criteria and all indicative targets for end-December were met.

- The Board approved the authorities’ request for a waiver for non-observance of the December performance criterion on tax revenues, which was missed by a minor amount.

- The outlook remains subject to exceptionally high downside risks arising from war-related factors, potential shortfalls in external financing and the socio-economic impact of policies that may be required if shocks materialize.

Following the Executive Board discussion on Ukraine, Ms. Kristalina Georgieva, Managing Director of the IMF, issued the following statement[1]: _______________ (see link above)

No comments:

Post a Comment