The government generally spends more than it raises in tax.

Public Finances: Key Economic Indicators - House of Commons Library

Why does the government borrow money?

The government gets most of its income from taxes. For example, workers pay income tax, everyone pays VAT on certain goods, and companies pay tax on profits.

It could, in theory, cover all of its spending from taxes, and that sometimes happens.

But, if it can't, the government covers the gap by raising taxes, cutting spending or borrowing.

Higher taxes mean people have less money to spend, so businesses make less profit, which can be bad for jobs and wages. Lower profits also mean companies pay less tax.

So, governments often borrow to boost the economy. They also borrow to pay for big projects, like new railways and roads.

How does the government borrow money?

The government borrows money by selling financial products called bonds.

A bond is a promise to pay money in the future. Most require the borrower to make regular interest payments.

UK government bonds - known as "gilts" - are normally considered very safe, with little risk the money will not be repaid.

Gilts are mainly bought by financial institutions in the UK and abroad, such as pension funds, investment funds, banks and insurance companies.

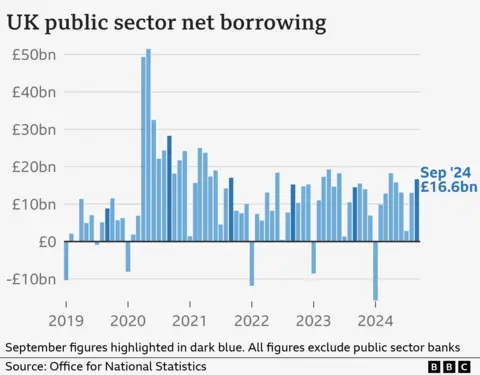

How much is the UK government borrowing?

For instance, it tends to borrow less in January, when many people pay a large chunk of their annual tax bill in one go.

So, it is more helpful to look at the whole year, or the year-to-date.

In the last financial year, to March 2024, the government borrowed £121.9bn.

Borrowing was £16.6bn in September 2024, an increase of £2.1bn from September 2023.

|

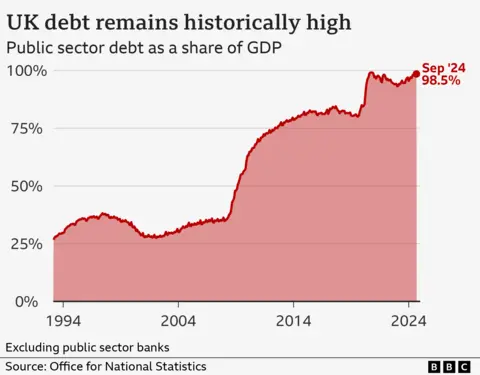

That is roughly the same as the value of all the goods and services produced in the UK in a year, known as the gross domestic product, or GDP.

The current level is more than double what was seen from the 1980s through to the financial crisis of 2008.

The combination of the financial crash and the Covid pandemic pushed the UK's debt up.

- But, in relation to the size of the economy, UK debt figures are low compared with much of the last century.

- They are also low compared with some other leading economies.

How much money does the government pay in interest?

- That cost was not as great when interest rates were low through the 2010s, but became more noticeable after the Bank of England raised interest rates.

If the government has to set aside more cash for paying debts, it may mean it has less to spend on public services.

Why does it matter if governments borrow more?

Some economists fear the government is borrowing too much, at too great a cost.

- The Office for Budget Responsibility has previously warned that public debt could soar as the population ages and tax income falls.

- In an ageing population, the proportion of people of working age drops, meaning the government takes less in tax while paying out more in pensions.

Other economists argue that big economies like the UK could borrow much more than they currently do, and the negative impact is greatly exaggerated.

The government has decided to stick to its current rule that debt - the total amount the government owes - must fall in five years' time.

However, Chancellor Rachel Reeves is expected to change the definition of debt to enable her to raise more money for investment.

The deficit is the gap between the government's income and the amount it spends.

When a government spends less than its income, it has what is known as a surplus.

Debt is the total amount of money owed by the government that has built up over years.

It rises when there is a deficit, and falls in those years when there is a surplus.

Reeves sympathetic towards 'mess' ministers face ahead of Budget | The Independent

BoE bond tinkering offers Labour a fiscal lifeline | Reuters

UK debt pile on course to rise above 100% of GDP

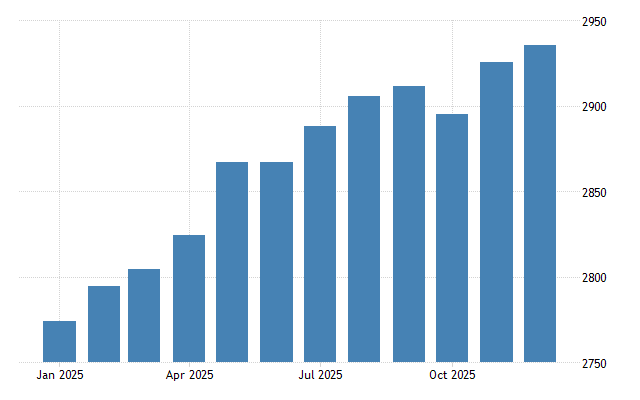

United Kingdom Public Sector Net Debt Ex Banks

Government Debt in the United Kingdom decreased to 2766.50 GBP Billion in September from 2768.10 GBP Billion in August of 2024. Government Debt in the United Kingdom averaged 1007.23 GBP Billion from 1975 until 2024, reaching an all time high of 2768.10 GBP Billion in August of 2024 and a record low of 52.10 GBP Billion in March of 1975. source: Office for National Statistics

| Related | Last | Previous | Unit | Reference |

|---|---|---|---|---|

| Fiscal Expenditure | 105888.00 | 102110.00 | GBP Million | Sep 2024 |

| Public Sector Net Borrowing Ex Banks | -16613.00 | -13022.00 | GBP Million | Sep 2024 |

| Government Debt | 2766.50 | 2768.10 | GBP Billion | Sep 2024 |

| Government Revenues | 89275.00 | 89088.00 | GBP Million | Sep 2024 |

| Government Spending | 135192.00 | 133714.00 | GBP Million | Jun 2024 |

| Interest Payments on Government Debt | 5556.00 | 6179.00 | GBP Million | Sep 2024 |

| Public Sector Net Borrowing | -16613.00 | -13022.00 | GBP Million | Sep 2024 |

| Public Sector Net Debt to GDP | 98.50 | 98.80 | percent of GDP | Sep 2024 |

| Tax Revenue | 60452.00 | 60811.00 | GBP Million | Sep 2024 |

No comments:

Post a Comment