Moving away from 2%

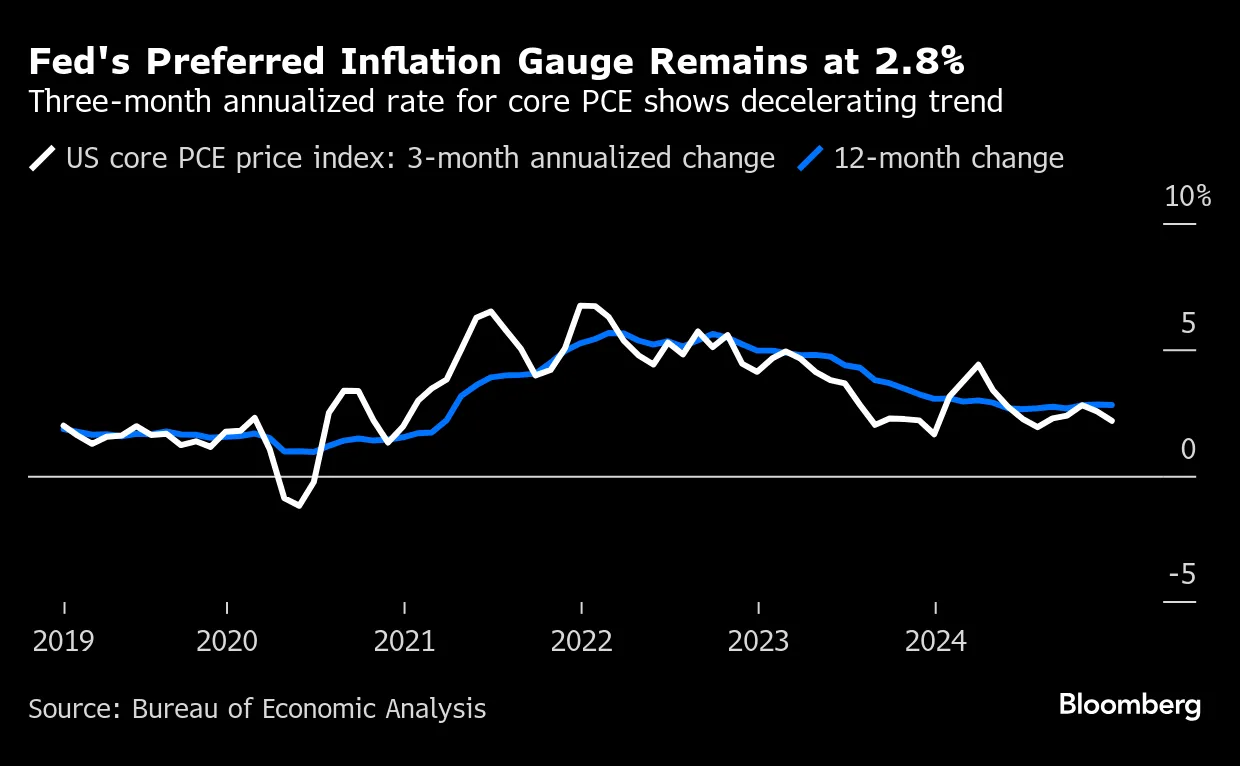

Headline inflation has been moving away from the Fed's long-term target of two percent since September, causing issues for policymakers at the US central bank.

The Fed has a dual mandate to tackle inflation and unemployment, and does so mainly by raising and lowering short-term lending rates, which then trickle through into consumer and producer borrowing costs.

On Wednesday, the Fed voted unanimously to pause rate reductions following three consecutive cuts, holding the bank's benchmark lending rate at between 4.25 and 4.50 percent.

While headline inflation has accelerated, economic growth has been strong, and the labor market has remained resilient, with the unemployment rate ticking down to 4.1 percent last month.

"There's still more work to be done to bring inflation closer to our two percent goal," Fed governor Michelle Bowman told a conference in New Hampshire on Friday.

"I would like to see progress in lowering inflation

resume before we make further adjustments to the target range," added

Bowman, who is a permanent voting member of the Fed's rate-setting

Federal Open Market Committee FOMC). . .

December Inflation Data Won't Show the Progress Fed Officials Want to See | Barron's

US Core PCE December 2024: Fed's Favored Inflation Gauge Stays Muted - Bloomberg

Inflation finishes 2024 well above Fed's 2% target, PCE shows. Rate cuts on hold. - MarketWatch

Inflation Festers in Core Services, No Progress in 12 Months. PCE Price Index Accelerates for 3rd Month: Justifies Fed's Pivot to Wait-and-See | Wolf Street

No comments:

Post a Comment