The US soft versus hard data puzzle deepens:

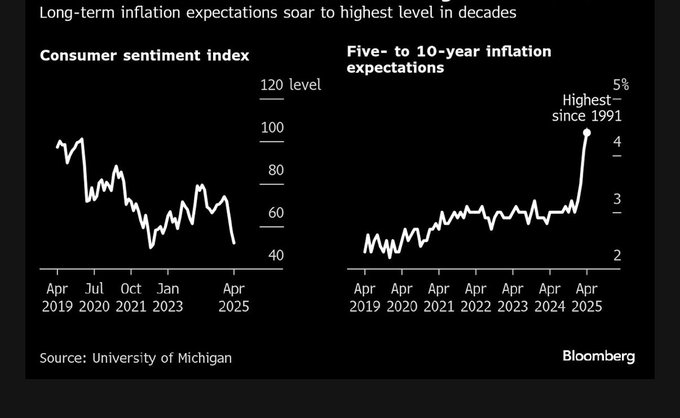

Today’s UMich consumer survey shows that, driven by plunging forward-looking expectations, consumer sentiment fell to one of the lowest readings on record, AND both short- and longer-term anticipation of inflation marched even higher to a level last seen in 1991 (Bloomberg chart below).

As discussed earlier, the growing gap between awful soft data and sound hard data could well reflect one or a combination of the following:

A lag in the transmission channel between the two, a bring-forward of consumption ahead of higher prices, consumers saying one thing and doing another, and data issues.

I suspect, and fear, that it may be mainly a combination of the first two factors.

No comments:

Post a Comment