European banks are shifting their focus to highlight their relationships with defense companies, a sector previously seen as a reputational risk, and are changing guidelines and policies to work with weapons manufacturers.1 hour ago

Europe's Banks Drop Restraints to Profit From Armaments Boom

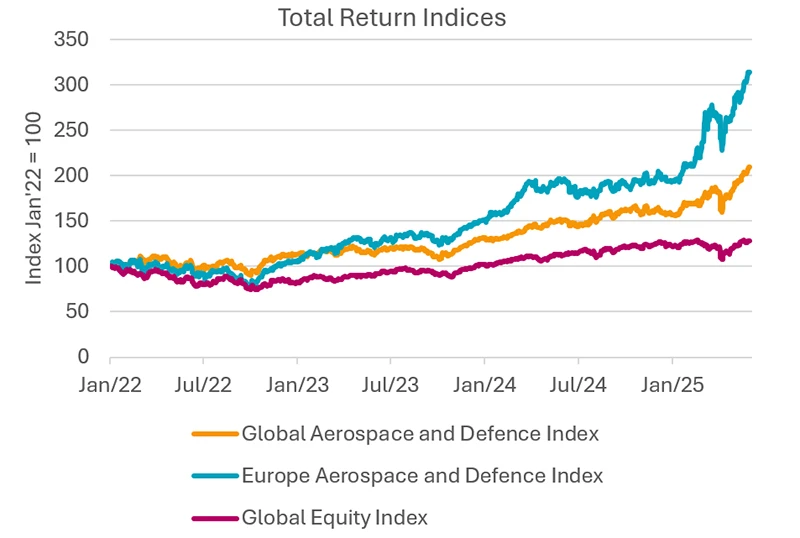

Deal-hungry equity investors eye Europe's potential defense industry boom

BERLIN, June 4 (Reuters) -

Global investors and advisers gathered at their annual conference in Berlin are looking at channelling funds into Europe's defence industry, seeking to profit from governments' ramped-up military spending and revive a sluggish private equity market.

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

Private

equity and venture capital-backed investment in Europe's aerospace and

defence sector is dwarfed by that funnelled into the U.S. and Canada,

which have absorbed 83% of all such investment since 2020, according to

S&P.

No comments:

Post a Comment