Yellen, Powell to Discuss Financial Risks of Hot Housing Market

By Saleha Mohsin and Rich Miller- Duo will join other regulators in closed-door session Friday

- Yellen team said to think risks from housing are manageable

The aim of the closed-door session: To make sure the U.S. is not vulnerable to a crisis akin to the one it suffered more than a dozen years ago, when the bursting of a property-price bubble drove top banks to the brink of insolvency and the economy into a deep recession.

The meeting of the Financial Stability Oversight Council, or FSOC, that’s headed by Yellen will come on the heels of two days of testimony by Powell to Congress on the Fed’s semi-annual monetary policy report.

Friday’s session will be the first time that Yellen’s FSOC will discuss concerns about the housing market in a substantial way, according to people familiar with the matter. The issue was briefly raised in the previous two meetings, held in March and June, then temporarily set aside, they said.

"The Treasury is increasingly aware of the dangers that a sudden relapse in property prices could pose to the economy after a sharp run-up on the back of a low inventory of homes for sale, according to the people familiar with the matter.

But Yellen’s team is confident that any financial stability risks are manageable, the people said. .

Unlike during the housing bubble that crashed in the 2007-09 crisis, the quality of borrowers remains high. Powell has also sounded hopeful that another housing-centric catastrophe can be avoided.

“So many of the financial crackups in all countries, all western countries, that have happened in the last 30 years have been around housing,” he told reporters on April 28. “We really don’t see that here. We don’t see bad loans and unsustainable prices and that kind of thing.”

Caution Warranted

Yellen, in a hearing before a House committee last month, highlighted the challenge of housing affordability, without speaking specifically to any financial risks to the run-up in prices.

The memory of the 2007 housing bust has convinced policy makers that it pays to be cautious, especially given all the uncertainties surrounding the economy’s performance coming out of a once-in-a century global pandemic.

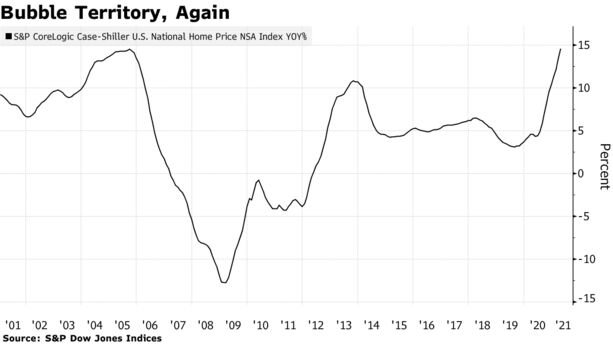

Fears of a housing bubble have been fueled by the biggest jump in prices in more than 30 years in the S&P CoreLogic Case-Shiller index of property values.

“This is scary,” former Treasury Secretary Lawrence Summers said on Bloomberg Television on July 2.

‘Low Risk’

Summers, a paid contributor to Bloomberg, also questioned why the Fed is continuing to buy mortgage-backed securities while home prices are skyrocketing.

Some housing experts have played down concerns of another property-driven financial breakdown.

“There are just pockets of high-risk lending around the country,” said Edward Pinto, director of the American Enterprise Institute’s Housing Center. “The rest of the neighborhoods around the country have, relatively speaking, low risk -- much lower than it was” prior to the financial crisis, he said.

But that doesn’t mean there aren’t some financial stability issues associated with housing, said Laurie Goodman, founder of the Housing Finance Policy Center at the Urban Institute. . .Besides housing markets, the multi-agency regulatory council is scheduled to discuss the Fed’s stress tests of the nation’s biggest banks and a proposed report on climate-related financial risks on Friday, according to a Treasury Department statement ahead of the FSOC meeting. The session will be the third FSOC meeting since Yellen was sworn in as Treasury chief.

READ MORE > Hit the link with the Bloomberg headline

RELATED CONTENT ON THIS BLOG

YES The Housing Market is "On Fire"

The Real Lender on Your Mortgage Could Be the Federal Reserve

". . .When you get a loan from a bank or a nonbank lender, there’s a good chance it will be packaged into a mortgage-backed security and sold to investors, and there’s a good chance the ultimate holder will be the Federal Reserve. Which means the Fed could be financing your mortgage.

In the week ended June 23, the Federal Reserve owned $2.35 trillion in MBS, according to the Fed’s H.4.1 statistical release. The Securities Industry and Financial Markets Association (Sifma) reports there were $8.44 trillion in the securities guaranteed by Fannie Mae, Freddie Mac, or Ginnie Mae at the end of 2020, meaning the Fed owns more than a quarter of the MBS market.

The Fed bought 47% of the net issuance of MBS in the fourth quarter, if you go by its $120 billion quarterly increase in holdings and Sifma figures showing that the total of outstanding MBS grew by $257 billion. True, not all mortgages are packaged into agency securities the Fed buys. The government-sponsored enterprises’ share of first-lien mortgage originations in the third quarter of 2020 was 61.9%. That share fluctuates, as does total issuance. Back of the napkin, though, multiplying 47% by 62% gives you about 30% of the overall U.S. mortgage market being financed by the Federal Reserve.

On June 29, Federal Reserve Governor Christopher Waller said it might be time to start cutting back on the Fed’s support for housing. . .“I think it’s an easy sell to the public,” he told Bloomberg Television. “The housing market is on fire. We should think carefully about doing MBS purchases, and if we were to taper those first that wouldn’t necessarily be a big issue.”

Fed Chair Jerome Powell is trying to keep the Federal Open Market Committee united behind continuing to buy MBS and Treasuries as a way to hold down interest rates and promote economic growth. The recovery, he says, is incomplete. . .But he hasn’t done a wonderful job of articulating why buying MBS is the right medicine for the economy. It is not, he says—not—a way to support the housing market

No comments:

Post a Comment