Biden Fires Trump-Appointed Social Security Commissioner

The White House claimed in a statement that Saul had “undermined and politicized Social Security disability benefits, terminated the agency’s telework policy that was utilized by up to 25 percent of the agency’s workforce, not repaired SSA’s relationships with relevant Federal employee unions including in the context of COVID-19 workplace safety planning, reduced due process protections for benefits appeals hearings, and taken other actions that run contrary to the mission of the agency and the President’s policy agenda.”

The Washington Post adds that:

Saul’s firing came after a tumultuous six-month tenure in the Biden administration during which advocates for the elderly and the disabled, and Democrats on Capitol Hill pressured the White House to dismiss him. He had clashed with labor unions that represent his 60,000 employees, who said he used union-busting tactics. Angry advocates say he dawdled while millions of disabled Americans waited for him to turn over files to the Internal Revenue Service to release their stimulus checks — and accused him of an overzealous campaign to make disabled people reestablish their eligibility for benefits.

Saul’s Trump-appointed deputy, David Black, did resign at the request of the White House on Friday. Biden named the agency’s deputy commissioner for retirement and disability policy, Kilolo Kijakazi, as acting SSA commissioner to replace Saul. She will fill the role until a permanent replacement can be nominated and confirmed...

_____________________________________________________________________________

Approximately 65 million Americans receive a monthly social security benefit, with the majority of payments going to retired workers and their dependents.

Senior citizens and disabled Americans who rely on benefits for the majority of their income are pushing for expansion of social security. Calls for reforms include increasing benefits in line with the cost of living, as employers are providing fewer retirement pensions to workers and the US population at retirement age of 65 is expected to grow from 56 million to 78 million in 2035.

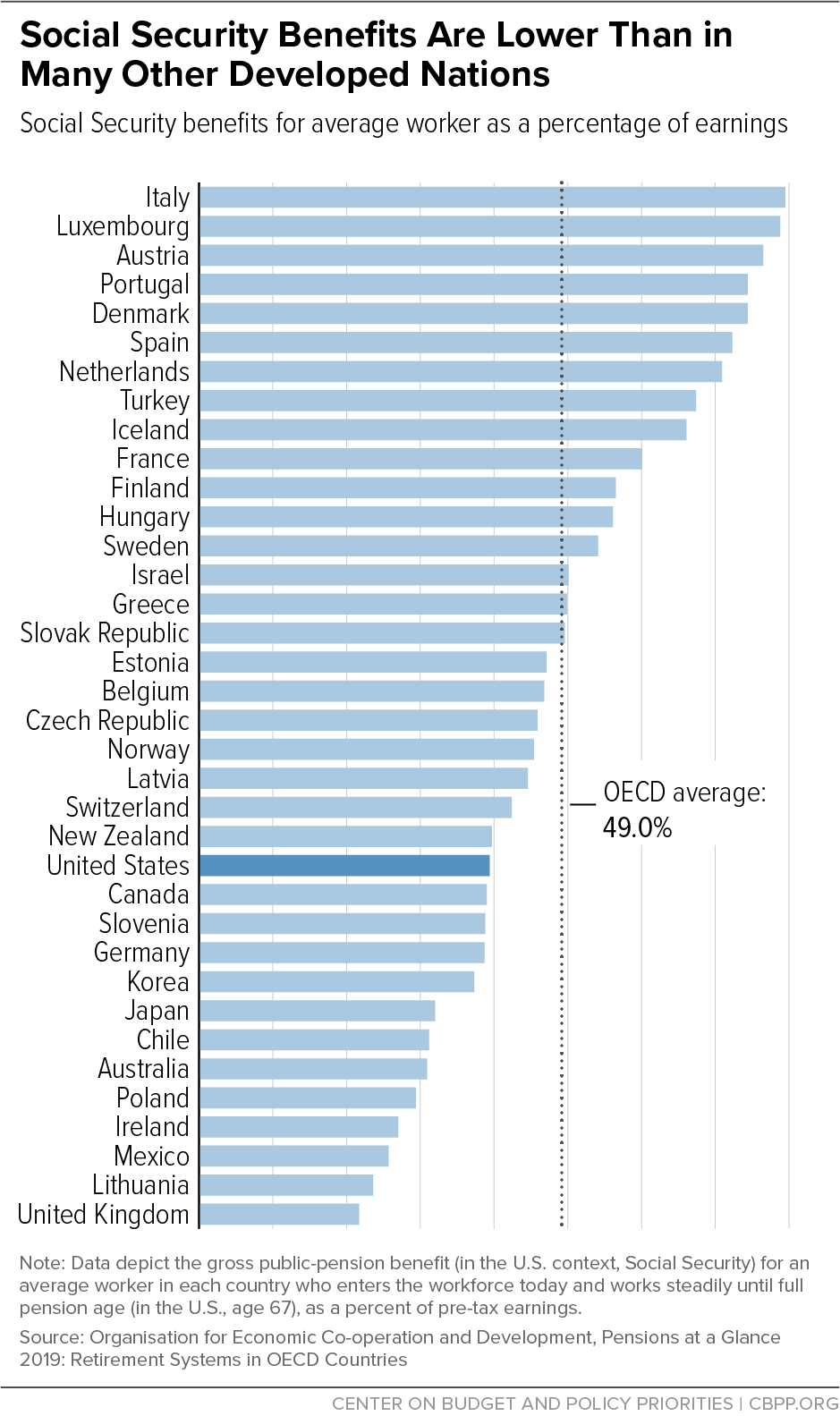

“The nation is really facing a retirement income crisis, where too many people aren’t going to be able to retire and maintain savings to live on,” said Nancy Altman, president of Social Security Works, an advocacy organization for expanding the program. “It’s a very strong system, but its benefits are extremely low by virtually any way you measure them.”

Altman argued an expansion of the program is long overdue, noting that payouts haven’t increased since 1972.

=========================================================================

Fact #10: Relatively modest changes would place Social Security on sound financial footing.

Source: https://www.cbpp.org/

Since the mid-1980s, Social Security has collected more in taxes and other income each year than it pays out in benefits and has amassed combined trust funds of nearly $2.9 trillion, invested in interest-bearing Treasury securities. But Social Security’s costs will grow in coming years as baby boomers retire.

The trustees estimate that, if policymakers took no further action, Social Security’s combined Old-Age and Survivors Insurance (OASI) and Disability Insurance trust funds will be exhausted in 2035. (It is important to understand, however, that the report does not reflect the effects of the COVID-19 pandemic and the resulting recession on the programs’ trust funds, and so doesn’t provide an up-to-date picture of Social Security’s financial status.) After the trust fund reserves are exhausted, even if policymakers took no further action, Social Security could still pay three-fourths of scheduled benefits, relying on Social Security taxes as they are collected. Alarmists who claim that Social Security won’t be around when today’s young workers retire either misunderstand or misrepresent the projections. The long-term gap between Social Security’s projected income and promised benefits is estimated at 1 percent of gross domestic product (GDP) over the next 75 years (and 1.4 percent of GDP in the 75th year).

Policymakers should address Social Security’s long-term shortfall primarily by increasing Social Security’s tax revenues. Social Security will require an increasing share of our nation’s resources in the coming decades as the population ages, and polls show a widespread willingness to support it through higher tax contributions. Recent trends also justify boosting Social Security’s payroll tax revenue: Social Security’s tax base has eroded since the last time policymakers addressed solvency in 1983, largely due to increased inequality and the rising cost of non-taxed fringe benefits, such as health insurance.

=========================================================================

INSERT:

Fact #4: Social Security benefits are modest.

Social Security benefits are much more modest than many people realize; the average Social Security retirement benefit in June 2020 was about $1,514 a month, or about $18,170 a year. (The average disabled worker and aged widow received slightly less.) For someone who worked all of their adult life at average earnings and retires at age 65 in 2020, Social Security benefits replace about 40 percent of past earnings. This “replacement rate” will slip to about 35 percent for a medium earner retiring at 65 in the future, chiefly because the full retirement age, which has already risen to 66, and is gradually climbing to 67 over the 2017-2022 period.

Moreover, most retirees enroll in Medicare’s Supplementary Medical Insurance (also known as Medicare Part B) and have Part B premiums deducted from their Social Security checks. As health care costs continue to outpace general inflation, those premiums will take a bigger bite out of their checks.

Social Security benefits are modest by international standards, too. The United States ranks just outside the bottom third of developed countries in the percentage of an average worker’s earnings replaced by the public pension system.

Fact #5: Children have an important stake in Social Security.

Fact #6: Social Security lifts millions of elderly Americans out of poverty.

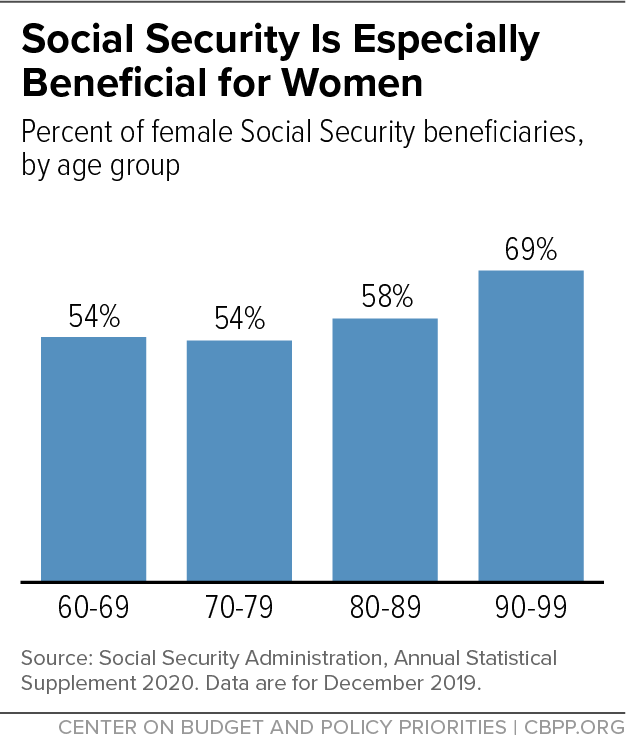

Fact #9: Social Security is especially beneficial for women

No comments:

Post a Comment