"At least four states paid back money in the last week they borrowed from the federal government to cover unemployment benefits—narrowly avoiding additional interest on the loans.

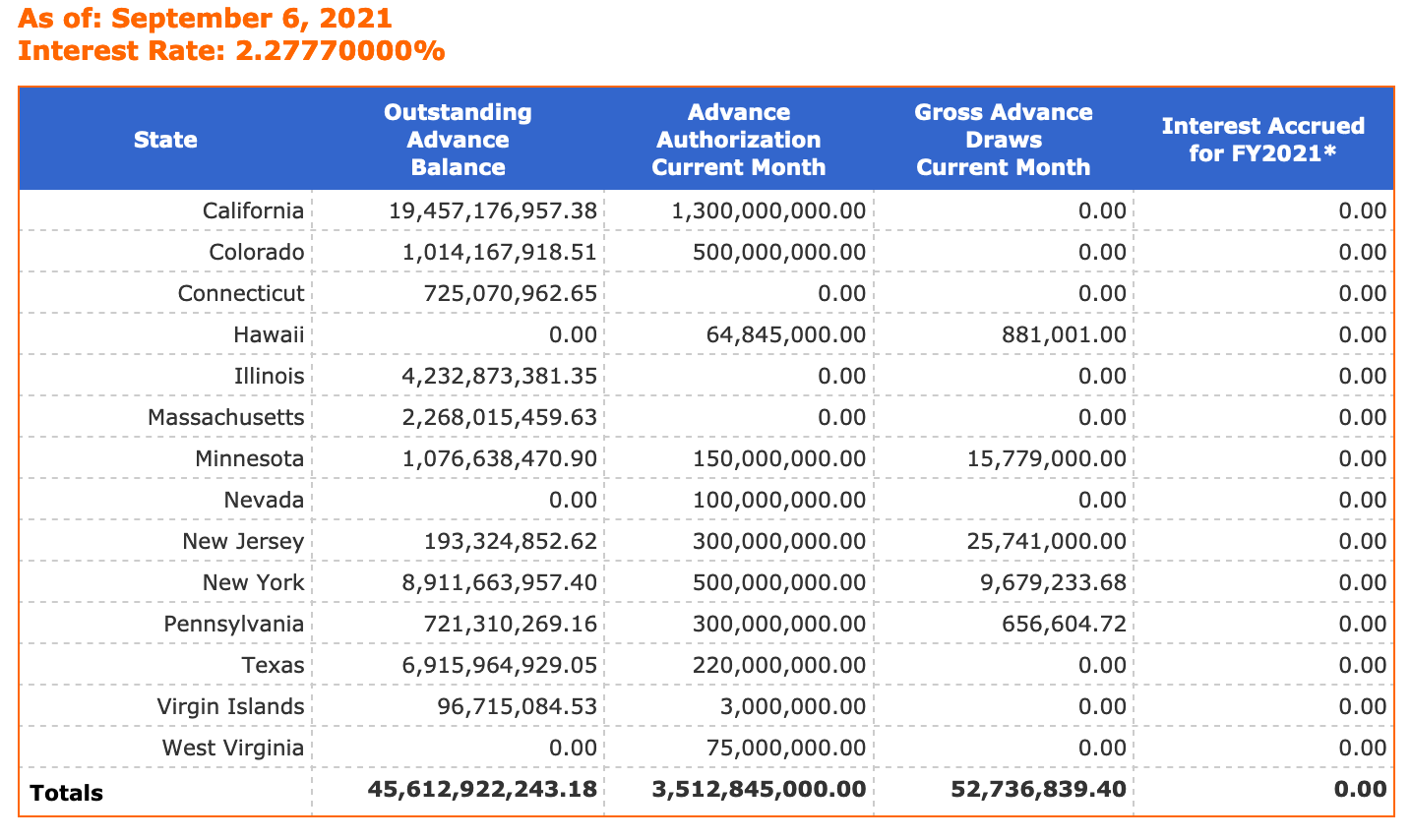

Hawaii, Nevada, Ohio and West Virginia announced the loan repayments within the last week. A remaining 10 states have a combined outstanding balance of more than $45 billion that they will now begin to accrue interest on, according to the Treasury Department.

When states exhaust their unemployment trust funds, they are allowed to borrow money from the federal government to ensure benefits continue to be paid. Twenty-two states took out what are referred to as Title XII advances during 2020. The loans were initially interest free, but starting Monday, states with outstanding loans began to accrue 2.3% interest on the borrowed sums.

The states that announced repayments are:

- Ohio repaid $1.5 billion.

- Hawaii repaid $700 million.

- Nevada repaid $335 million.

- West Virginia repaid $185 million.

Officials from those states said they acted before Monday’s deadline to prevent negative economic impacts on businesses. Several states said they used federal funding allocated through the American Rescue Plan Act to repay the borrowed funds.

Hawaii used a combination of federal funding—$39 million in CARES Act funding and $700 million in ARPA funding—to fully pay back the amount borrowed. The state, where the tourism industry was hard hit during the coronavirus pandemic, paid out more than $6.4 billion in unemployment insurance benefits, officials with the Department of Labor and Industrial Relations said.

Unemployment benefits are paid for through taxes that states levy on businesses. When unemployment trust funds are depleted, state and federal laws trigger higher business tax rates on employers to replenish the funds. The 10 states that have outstanding loan balances California, Colorado, Connecticut, Illinois, Massachusetts, Minnesota, New Jersey, New York, Pennsylvania and Texas—could be poised to see significant tax hikes on employers next year if they do not pay the money back before increases are triggered.

In Nevada, lawmakers approved using $335 million in Coronavirus State and Local Recovery Funds allocated through ARPA to pay down the borrowed unemployment funds.

Paying off the loan before interest began to accrue put the state in a good fiscal position, said Heidi Saucedo, a spokeswoman for the state’s Department of Employment, Training and Rehabilitation.

Ohio similarly sought to avoid a tax hike on employers by putting off repayment. Gov. Mike DeWine said the state used $1.5 billion in ARPA funds to pay back the loans.

“By repaying this loan in full, we ensure that Ohio businesses won't see increases in their federal unemployment payroll taxes,” DeWine said in a statement. “Without this added tax burden, our employers can invest more money into their businesses and hire more staff.”

Employers in the state would have faced a 50% hike in federal unemployment payroll taxes next year had the loan not been repaid, according to Steve Stivers, President of the Ohio Chamber of Commerce.

West Virginia used a combination of CARES funding and employer payments to pay off the $185 million it borrowed. The state was also able to put $220 million back into its unemployment trust fund, a move that state officials said would reduce employer contributions by 25%.

No comments:

Post a Comment