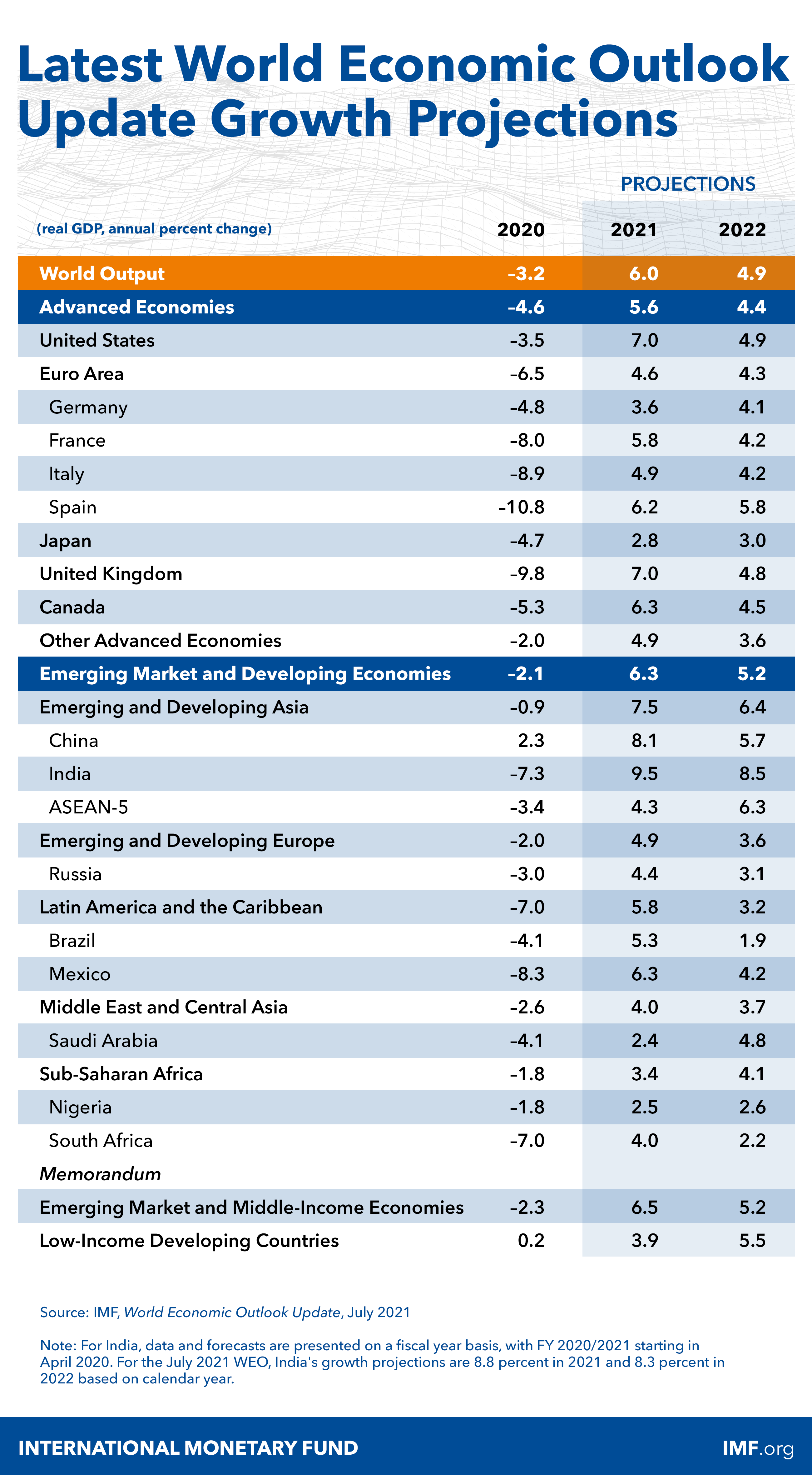

A PROGNOSIS: Slowdowns in the world’s two biggest economies — the United States and China — are likely to be larger than expected this year, dragging down output on every continent and reducing global growth, a new report warned on Tuesday. . .

The fund emphasized that the forecast was subject to a high level of uncertainty — about the course of Covid, the prospects of climate-related natural disasters, supply chain disruptions and rising political tensions, particularly around Ukraine. With the pandemic entering its third year, a note of pessimism underlay the report. “Risks overall are to the downside, . ."

International Monetary Fund Lowers Global Economic Growth Forecast

"The continuing global recovery faces multiple challenges as the pandemic enters its third year. The Omicron variant has led to renewed mobility restrictions in many countries and increased labor shortages.

Supply disruptions still weigh on activity and are contributing to higher inflation, adding to pressures from strong demand and elevated food and energy prices.

Moreover, record debt and rising inflation constrain the ability of many countries to address renewed disruptions.

We project global growth this year at 4.4 percent, which is 0.5 percentage point lower than previously forecast, mainly because of downgrades for the United States and China.

> Now, in the case of the United States, this reflects lower prospects of legislating the Build Back Better fiscal package and earlier withdrawal of extraordinary monetary accommodation, and continued supply disruptions.

> China’s downgrade reflects continued retrenchment of the real estate sector and a weaker than expected recovery in private consumption.

We expect global growth to slow to 3.8 percent in 2023. Now the forecast is subject to high uncertainty and risks overall are to the downside.

> The emergence of deadlier variants could prolong the crisis.

China’s zero-Covid strategy could exacerbate global supply disruptions, and a financial stress in the country’s real estate sector spreads through the broader economy. The ramifications would be felt widely.

> Higher inflation surprises in the U.S. could elicit aggressive monetary tightening by the Federal Reserve and sharply tightened global financial conditions.

Rising geopolitical tensions and social unrest also pose risks to the outlook. . ."

DO READ MORE INTO THE REPORT: DETAILS

No comments:

Post a Comment