"U.S. equity-index futures fell amid concerns the nation’s inflation accelerated for a sixth successive month and that the Russian attack on Ukraine will continue. Bonds rallied as investors turned to the European Central Bank to gauge policy makers’ response to the war in Ukraine.

Contracts expiring this month on the S&P 500 and Nasdaq 100 indexes slid at least 0.8% each after U.S. stocks rallied on Wednesday by the most since June 2020. Europe’s Stoxx 600 gauge dropped for the fifth time in six days, and the euro slid, before the ECB’s policy decisions due this afternoon. Treasuries and the dollar advanced, while oil recovered. . ."

======================================================================

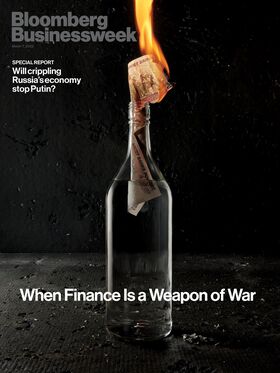

To Punish Putin, the World Turned Finance Into a Weapon of War

Russia’s central bank became the main target on a front that could crater the country’s economy.

Illustration: Daphne Geisler

In the first week of the conflict, Russia’s central bank was struggling to contain the fallout on its own side of the border, while Ukraine’s was able to maintain a semblance of stability even as it rallied global financial resources around its defense effort. . ."

==============================

No comments:

Post a Comment