Investors Grow More Fearful Amid High Rates and Political Uncertainty

1 in 4 respondents say they’re investing less due to recent market moves

Investopedia’s latest investor survey shows nearly one in four respondents say they’re investing less due to recent market moves.

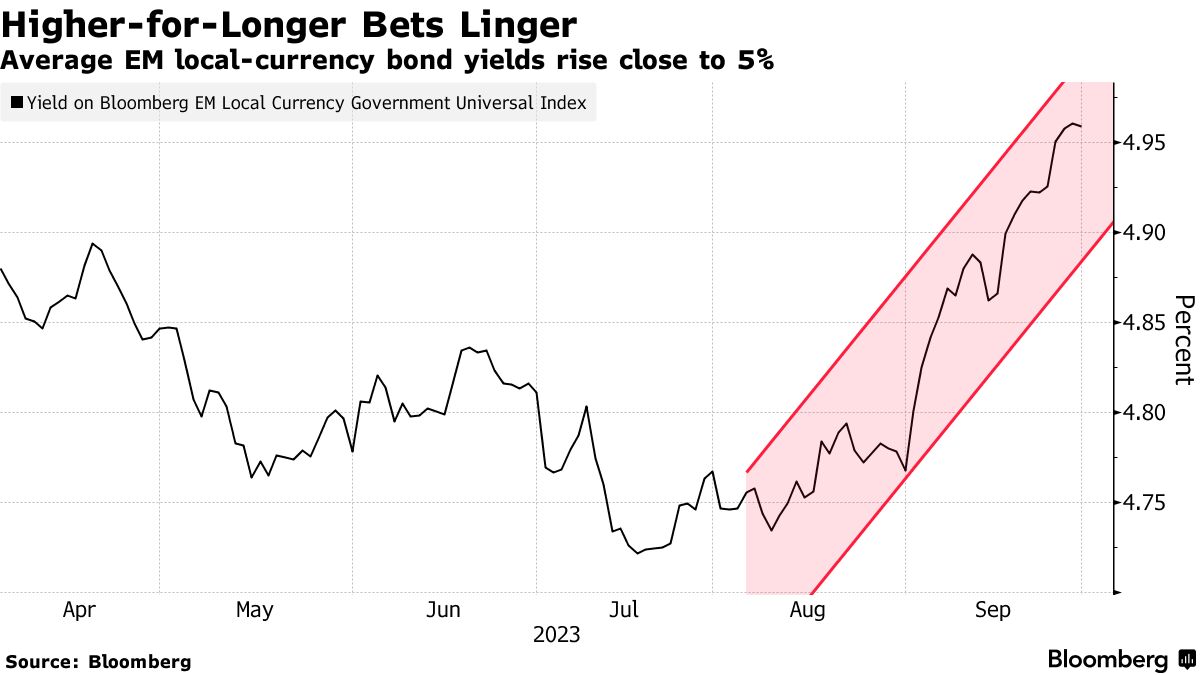

Spiking bond yields, a rise in oil prices, lingering inflation and political uncertainty are creating the perfect storm for individual investors, driving them to seek shelter in the bank and avoid stocks. According to our latest investor sentiment survey of our newsletter readers, nearly one third of respondents say they are investing less lately due to recent market turbulence. Nearly two-thirds of those reticent investors believe the stock market has further to fall—a near 20 percentage point increase from our last survey in August.

KEY TAKEAWAYS

- Investopedia's latest investor survey shows nearly 1 in 4 respondents say they're investing less because of recent market moves.

- Nearly two-thirds of those reticent investors believe the stock market has further to fall—a near 20 percentage point increase from our last survey in August.

- While respondents are not as worried about market declines as they were last year when fear peaked, 45% say they are making safer investments with their money, favoring CDs and money market funds in lieu of stocks.

- According to the survey, inflation is still readers' number one concern.

Investors Searching for More Safety

- In fact, money has been flowing out of stock mutual funds and ETFs, and into banking products like money market funds, where over $5.6 trillion is piled up on the sidelines, according to the Investment Company Institute.

Fed chief Powell has warned of economic pain. In York, Pa., he heard all about it

YORK, Pennsylvania, Oct 2 (Reuters) - After helping build a floor under the economy during the pandemic only to put a squeeze on it as inflation soared, Federal Reserve Chair Jerome Powell on Monday faced a public he'd warned would go through painful times as the central bank hiked interest rates.

On a day tour of York, Pennsylvania, once a thriving manufacturing town about 100 miles west of Philadelphia that local officials tout as undergoing a "fledgling renaissance," Powell got an earful from residents and community and business leaders fretful about inflation and eager for greater certainty about what lies ahead.

Families are "squeezing to make ends meet," caught between rising prices and a lack of accessible child care, Kim Bracey, chief executive of the YWCA York, told Powell. Families are often paying for child care, when it is available, on credit cards, and for those families, "there's no retirement fund."

"It is a new phenomenon," she said. "They don't have savings to dip into."

Julie Keene, owner of Flinchbaugh’s Orchard, zeroed in on inflation, and pressed Powell on the uncertain environment businesses have having to navigate.

Inflation "is the biggest word of the whole year," Keene told him.

"Predictability is just gone. It is very hard to operate a business in a world where there is not predictability ... We were a little blindsided."

Powell sought to assure Bracey, Keene and others he met with that central bank officials are acutely aware of the pressures that households are under and are intent on taking the steps they believe are needed to shore up the economy, safeguard the job market and bring inflation to heel.

"We're very focused on restoring price stability," Powell said, emphasizing - as he has done repeatedly in more official settings - that taming inflation in his view offers the best path to a sound economy and strong job market.

'PAIN' AND 'DISSATISFACTION'

- That included, he has said, taking steps that would involve "pain," potentially in the form of unemployment for some and higher interest rates for anyone buying a home or car or financing a business.

- But Monday offered a more intimate, face-to-face discussion between Powell and the people who have lived with rising prices and have navigated the fallout from the Fed's rate-hiking response.

A Gallup poll last spring found that confidence in Powell, after rising alongside the Fed's support for the economy in 2020 to a level not seen since the tenure of former Fed chief Alan Greenspan, had fallen to a record low as inflation spiked and the central bank began raising interest rates at a historic pace.

Inflation has slowed since peaking in June 2022, but that hasn't improved a public mood that Powell said last month showed "dissatisfaction" with an economy judged to be "terrible" - in spite of rising wages, a low unemployment rate and a continuing propensity by consumers to keep spending.

It was a contradiction on display in Powell's interactions with people on a tour with Philadelphia Fed President Patrick Harker, his first in-person sit down and walking tour since the pandemic, an event occurring in markedly different circumstances from his last one in 2019, when low inflation and interest rates were still the norm.

'FACING CHALLENGES'

The economy in this county of 458,000 residents in many ways has performed well, with unemployment at 3.6% and roughly as many people in the labor force now as before the pandemic. The population has continued growing, and the manufacturing sector, the source of eponymous products from mint-flavored candy to dumbbells and air conditioners, is still responsible for about 18% of jobs. Health care is closing in at 17%.

Powell first met with local business people at the Yorktowne Hotel, opened in 1925 and at nine floors - including the rooftop bar - is still the tallest building in town.

It was a wide-ranging conversation, touching on inflation and access to capital as well as issues around access to child care, worker shortages, and efforts to sustain entrepreneurship through the pandemic and, more recently, inflation. . .

Reporting by Howard Schneider; Editing by Dan Burns

No comments:

Post a Comment