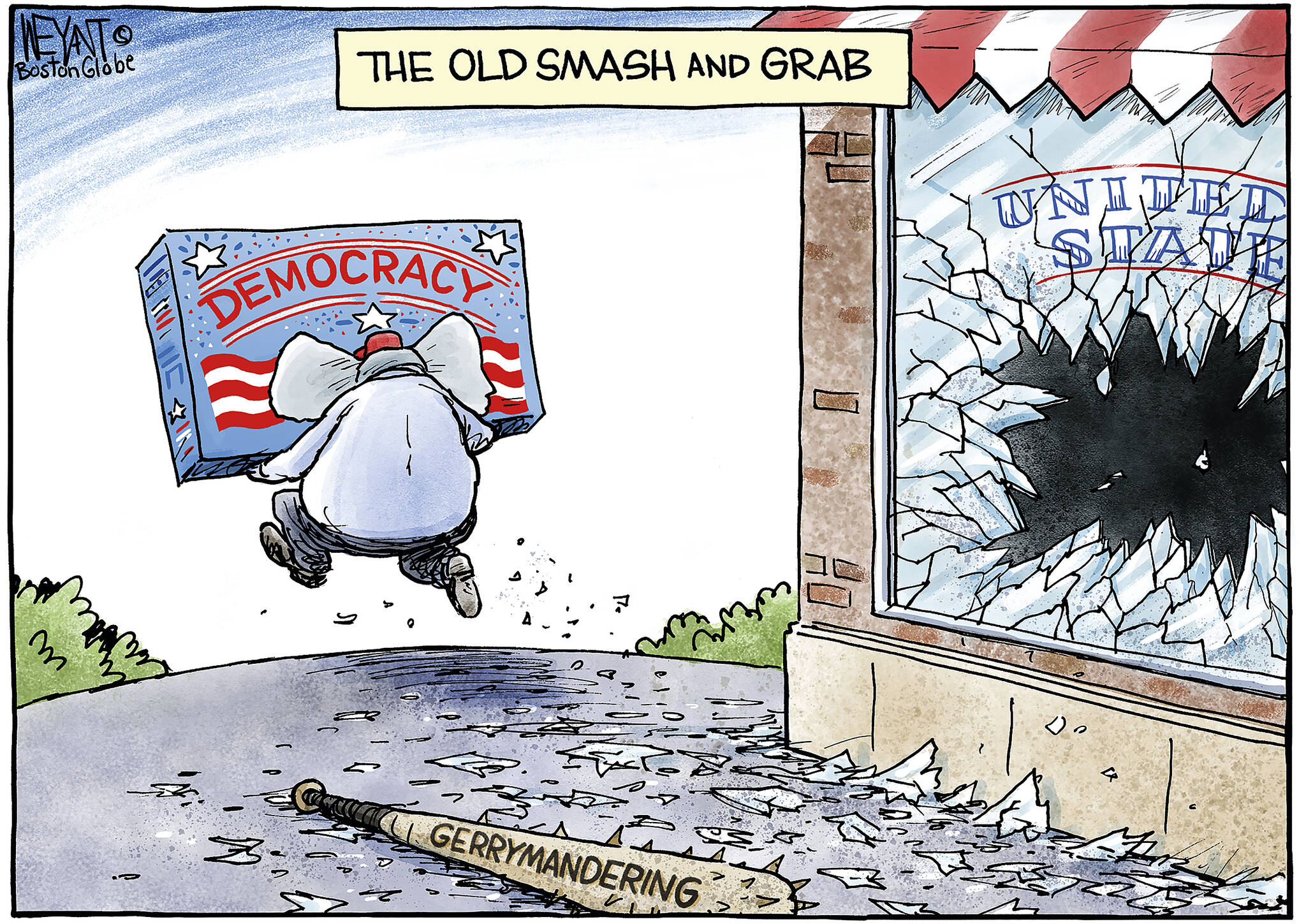

The financial-secrecy system is making democratic societies across the West less stable.

The Dirty Secrets of Capitalism Are Undermining Democracy

The West’s growing culture of tax avoidance is taking a political toll.

- A metastasizing culture of tax avoidance by corporations and the wealthy has weakened national values, institutions, and goals across the West while fueling inequality and empowering the enemies of democracy at home and abroad.

- Governments need to take dramatic action to close down this parallel financial system, criminalize its enablers, and reassert their sovereignty.

- The totality of these revelations shows massive tax avoidance, the concealment of kleptocratic loot, and the systemic avoidance of the rule of law.

- To achieve their ends, wealthy elites and corporations create complexity through intricate webs of shell companies and incite competition between tax jurisdictions to offer the lowest rates.

- They then capture politicians by offering financial incentives to look the other way.

- When necessary, the rich and powerful use coercion—threatening any politicians who might act against secrecy. These methods stop national governments from curbing the industry.

The United Kingdom has seen similar absurdities. . .

- Fifty-eight percent of Americans tell pollsters that they are dissatisfied with the way democracy is going, while a shocking 85 percent believe that the U.S. political system either needs a major or complete overhaul.

- The basis of the social contract, the principle that all are subject to the law, has been broken.

- Across the European continent, populist parties have been gaining vote share.

- The rise of populism has seen the far right come to power in Italy under Prime Minister Giorgia Meloni, and the far right is polling well in Germany and France

- Not one of these policy goals will be met if secrecy is permitted to rob every value or technological chain of transparency.

- Without transparency, U.S. sanctions for, say, the theft of computer chip intellectual property will become an instrument that is clumsy and full of holes.

- Similarly, the U.S.-China Economic and Security Review Commission has warned that it will be unable to detect and properly scrutinize Chinese investments in U.S. technology firms if the identities of these firms’ true owners are obscured.

Western governments are lagging. Despite the Biden administration’s December 2021 launch of the U.S. Strategy on Countering Corruption and Congress’s passage of the Corporate Transparency Act, U.S. action is still insufficient (and mostly a failure so far). British officials have promised that the three crown dependencies and the 14 British overseas territories will be required to set up beneficial-ownership registries, but the deadlines have been pushed back. And the EU has taken a step backward, with the European Court of Justice issuing a recent opinion limiting the accessibility of beneficial-ownership registries.

Reclaiming Western sovereignty will require a concerted campaign to reject the financial-secrecy system. First, the existence and malign consequences of financial secrecy must be explained and broadcast as widely as possible. Then, systematic financial secrecy—its ills put on display—must be rendered unacceptable. The United States anchors global capitalism, and it must take a leading role. So must the United Kingdom, whose far-flung network of tax satellites has been estimated to account for 40 percent of all tax losses faced by other countries. Finally, there must be EU buy-in since Brussels wields immense regulatory power and the EU includes such notorious financial-secrecy hotspots as Luxembourg.

Capitalism with secrecy—in other words, capitalism without transparency, integrity, and accountability—is undermining liberal democracy. What is at stake is not only whether capitalism and democracy can be restored to a mutually reinforcing dynamic, but whether the West will continue to succeed as states and societies.

A full version of this essay appears in the October issue of the Journal of Democracy.

___________________________________________________________________________________

_____________________________________________________________________________________

No comments:

Post a Comment