The backstop was set up in July 2021 to support money markets after interest rate spikes there led to worries about financial stability

(Reuters) - Banks are finally signing up for a U.S. Federal Reserve funding backstop that has been lying nearly dormant for more than two years, putting them in a stronger position to deal with any stress. But it is unclear whether they will want to use it in a crisis.

(Reuters) - Banks are finally signing up for a U.S. Federal Reserve funding backstop that has been lying nearly dormant for more than two years, putting them in a stronger position to deal with any stress. But it is unclear whether they will want to use it in a crisis.

In the Market: Repo market may throw a fit, spur Fed to action

Jan 22 (Reuters) - Some Wall Street executives feel a tantrum coming in U.S. short-term financing markets, perhaps as soon as March. It could put pressure on the Federal Reserve to ease policy.

A series of events are expected between March and May, some of which will reduce the amount of cash in the financial system, while others increase the demand for liquidity, according to interviews with four banking executives.

A Fed lending facility that was put in place after the regional banking crisis last year will expire on March 11, with $129 billion outstanding.

- That will remove what has become an attractive source of funding for banks.

- Another market backstop, called the standing repo facility (SRF), that Fed officials have held up as a safety net has seen only a few banks sign up so far.

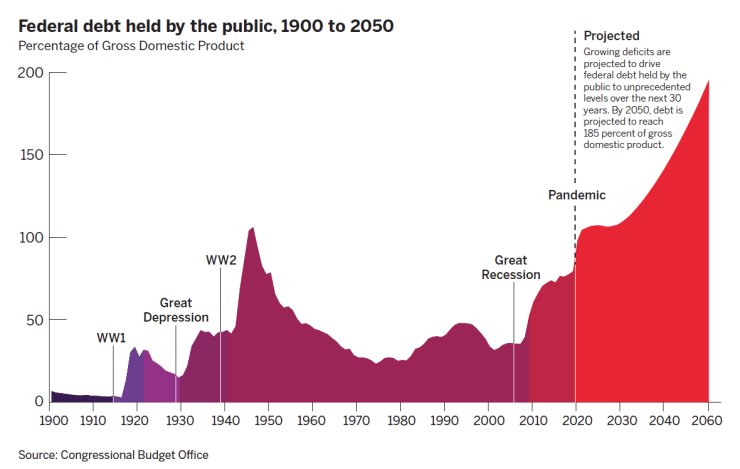

At the same time, the demand for cash is likely to increase, with the issuance of massive quantities of U.S. government debt and quarterly tax payments due on March 15 and annual payments due on April 15. In addition, a move in May toward faster settlement of trades could increase demand for short-term funding as firms that are not fully prepared to make the transition would need more overnight financing.

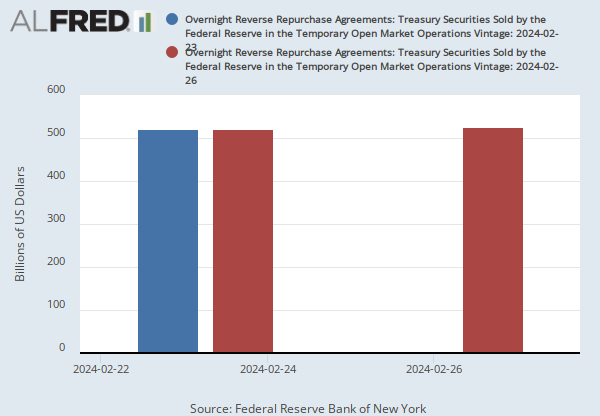

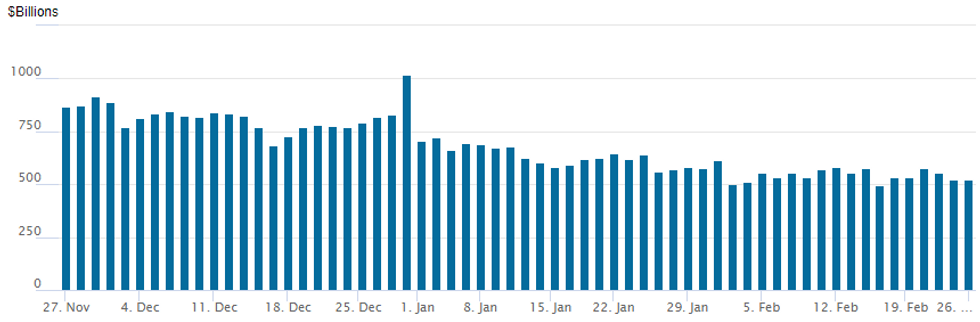

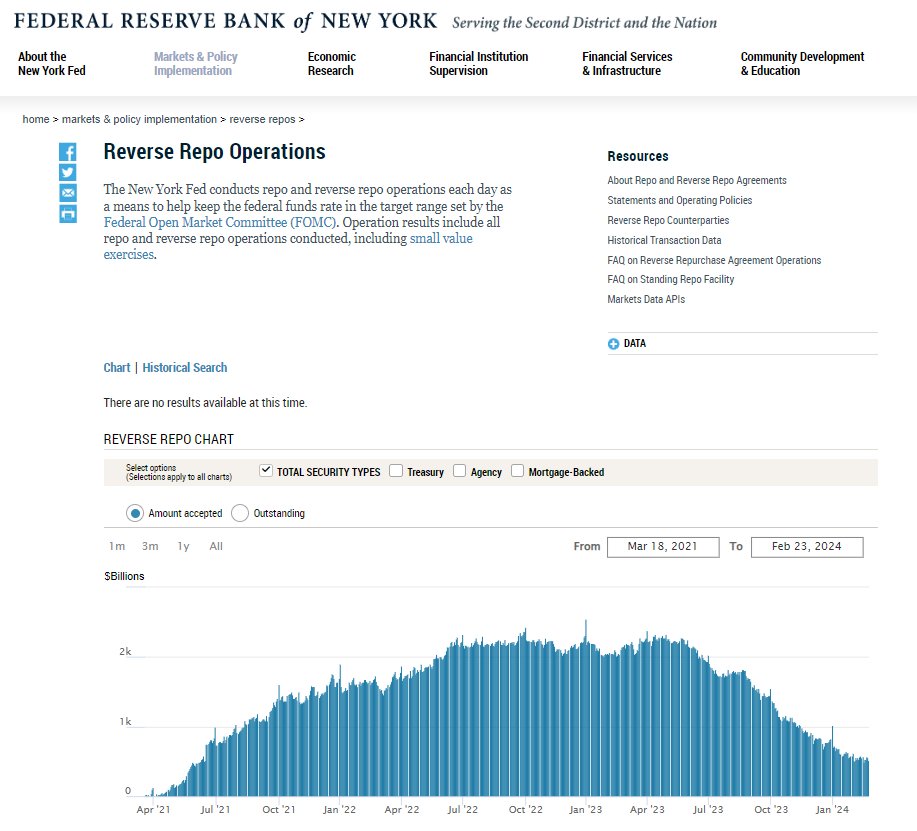

All this is happening as the Fed has been steadily draining cash from the financial system by offloading bonds from its balance sheet, unwinding its pandemic-era support to the economy. BNY Mellon strategists estimate the amount of cash parked overnight with the Fed by money market funds and others – funds seen as excess liquidity – could dip below $200 billion by May, a tenth of what it was in June last year. Some expect this facility, called overnight reverse repurchase agreements, could drain to zero by mid-year. . .the Fed's Bank Term Funding Program, the facility that expires in March, to a modest extent and is considering rolling over a loan that matures before the deadline for another year to take advantage of its terms.

In September 2019 repo rates spiked due to lack of liquidity, forcing the Fed to act. John Velis, forex and macro strategist for the Americas at BNY Mellon, said the repo blow up at the time "really started to hit home" as quarterly corporate taxes came due that month.

"We don't know when we get to that point from abundant" to insufficient liquidity, Velis said. "The market will tell us."

=======================================================================

In the Market: Banks warily warm up to Fed repo backstop

The Standing Repo Facility allows banks to borrow emergency overnight cash from the Fed through a repurchase agreement, or repo, using Treasury and agency mortgage securities as collateral. Firms that act as the New York Fed's trading counterparties, called primary dealers, have access, but other banks have to apply for it.

The backstop was set up in July 2021 to support money markets after interest rate spikes there led to worries about financial stability. Banks have been slow on the uptake.

Other market experts also pointed to growing concerns that liquidity could get scarce in the coming months as the Fed drains hundreds of billions of dollars of excess cash from the financial system as it removes pandemic-era stimulus.

The backstop was set up in July 2021 to support money markets after interest rate spikes there led to worries about financial stability. Banks have been slow on the uptake.

- Some market participants and researchers said the reluctance stemmed in part from worries that a stigma might be attached to it, as borrowing from the Fed in a crisis could be seen by investors and bank examiners as a sign of liquidity issues or other problems.

- While that apprehension persists in some quarters, interviews with two of the market experts and a recent Fed survey show banks are signing up for the facility.

Other market experts also pointed to growing concerns that liquidity could get scarce in the coming months as the Fed drains hundreds of billions of dollars of excess cash from the financial system as it removes pandemic-era stimulus.

In his conversations with banks over the past couple of months, Nelson said he had found that many were signing up.

"The latest indications are that it's getting greater acceptance and interest," said Nelson, who flagged bankers' worries about the repo facility two years ago.

"The latest indications are that it's getting greater acceptance and interest," said Nelson, who flagged bankers' worries about the repo facility two years ago.

- So far seven U.S. regional banks have signed up – all after the March bank collapses.

==========================================================================

Units: Frequency:

(+ more) Updated: 1:01 PM CST

This series is constructed as the aggregated daily amount value of the RRP transactions reported by the New York Fed as part of the Temporary Open Market Operations.

- Temporary open market operations involve short-term repurchase and reverse repurchase agreements that are designed to temporarily add or drain reserves available to the banking system and influence day-to-day trading in the federal funds market.

For these transactions, eligible securities are

- U.S. Treasury instruments,

- Federal agency debt

- Mortgage-backed securities issued or fully guaranteed by federal agencies.

___________________________________________________________________________________

___________________________________________________________________________________

Fed RRP Lowest since 2021

x

No comments:

Post a Comment