Updated 12:59 PM PDT, March 20, 2024

In remarks after the tour, Biden pivoted to the impact his policies could have on the U.S. economy as he tries to translate his policy wins into a political boost ahead of November’s election.

- “This isn’t just about investing in America,” Biden said,

- “It’s about investing in the American people as well.”

Commerce Secretary Gina Raimondo said the deal reached through her department would put the United States in a position to produce 20% of the world’s most advanced chips by 2030, up from zero.

The United States designs advanced chips, but its inability to make them domestically has emerged as a national security and economic risk.

- His message is a direct challenge to former President Donald Trump, the presumptive Republican nominee, who raised tariffs while in the White House and wants to do so again on the promise of protecting U.S. factory jobs from China.

Biden narrowly beat Trump in Arizona in 2020 by a margin of 49.4% to 49.1%.

When pushing for the investment, lawmakers expressed concern about efforts by China to control Taiwan, which accounts for more than 90% of advanced computer chip production.

- About 25% of that total would involve building and land, while roughly 70% would go to equipment, said Pat Gelsinger, CEO of Intel.

- Intel funding would lead to a combined 30,000 manufacturing and construction jobs.

- The company also plans to claim tax credits from the Treasury Department worth up to 25% on qualified investments.

The company will also turn two of its plants in Rio Rancho, New Mexico, into advanced packaging facilities. And Intel will also modernize facilities in Hillsboro, Oregon.

19 August 2021

From The Verge: Water shortages loom over future semiconductor fabs in Arizona

In Arizona: Maricopa, northern Pinal, southern Gila, La Paz, and Yuma counties

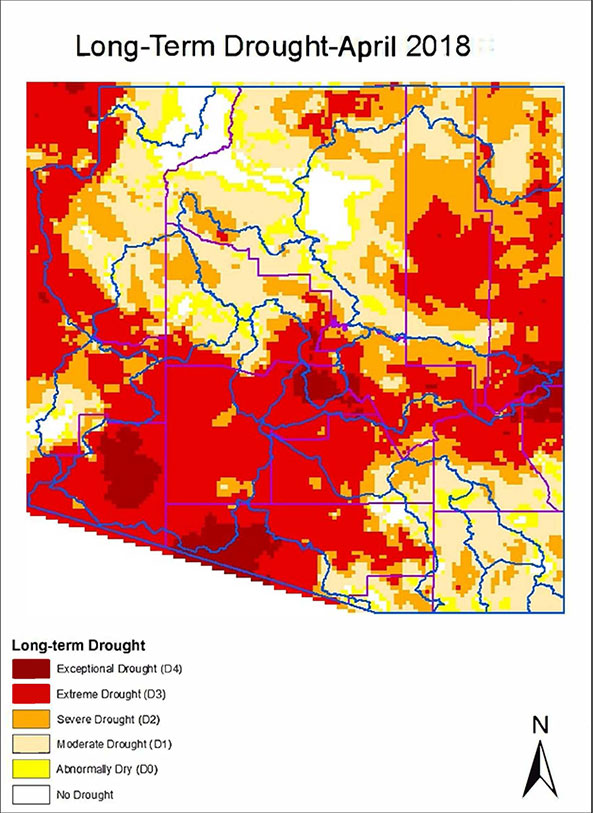

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22649983/usdroughtmonitor_weekly_ndmc__web__2021_06_01.png)

Water shortages loom over future semiconductor fabs in Arizona

Chipmakers are setting up shop in Arizona as drought worsens

Industries in the state used up 6 percent of Arizona’s water in 2019, but that could grow as chipmakers and other manufacturers move in. In March, Intel announced that it will spend $20 billion to build two new semiconductor factories in Chandler, Arizona, an expansion of its existing campus there.

Last year, the company pledged that by 2030 it will restore and return more freshwater than it uses. It’s nearing that benchmark in Arizona, where Intel says it cleaned up and returned 95 percent of the freshwater it used in 2020. It has its own water treatment plant at its Ocotillo campus in Chandler that’s similar to a municipal plant. There’s also a “brine reduction facility,” a public-private partnership with the city of Chandler, that brings 2.5 million gallons of Intel’s wastewater a day back to drinking standard. Intel uses some of the treated water again, and the rest is sent to replenish groundwater sources or be used by surrounding communities.

Chip manufacturing giant TSMC also has its eye on Arizona. In May 2020, the company announced plans to build a $12 billion new fab near Phoenix, which would be its first in Arizona and its second in the US (its first is in Washington state). TSMC could be planning to build up to six new fabs in Arizona over the next 10 to 15 years, Reuters reported earlier this year.

TSMC said in an email to The Verge that for now it doesn’t expect the water shortage to have “any impact” on its plan to build a new fab in Arizona, although it says it will “continue to monitor the water supply situation closely.”

Most of TSMC’s fabs are in Taiwan, where earlier this year the worst drought in more than 50 years threatened the already stressed supply chain for chips. TSMC plans to finish construction this year of a new water treatment plant in Taiwan that could eventually recycle enough water to supply half of the company’s daily needs, Nikkei Asia reported in April.

While Taiwan still dominates semiconductor manufacturing, Arizona is emerging as a new hub. The Biden administration has prioritized building up a domestic supply of semiconductor chips as the current shortage affects everything from cars to phones and game consoles. Two other companies, NXP and Microchip Inc., have fabs in the state also. NXP didn’t immediately respond to a request for comment from The Verge, and Microchip declined to comment.

While Intel recycles much of its water, more fabs will mean it will need to send even more water through its systems. The company says that Arizona has been “vital” to Intel’s operations for more than four decades. The state is already home to its first “mega-factory network” and its newest semiconductor fab. Intel used more than 5.2 billion gallons of water in Arizona in 2020 — roughly 20 percent of which was reclaimed water, according to its most recent corporate responsibility report.

Arizona is notoriously dry, which leaves it dependent on water-sharing agreements with other states. Arizona gets a hefty 38 percent of its water from the Colorado River, and with water from the river running low, the state is expected to face some tough choices in the future. The state has been in a drought since 1994, and climate change is making things worse. Now, the vast majority of Arizona faces a “severe” drought, according to the US Drought Monitor. "

18 September 2021

Zero-Trust for Semiconductor Industry 'Green-Washing' Pledges for Net-Zero Pledges to Reach Net Zero Emssions by 2050

The computer chip industry has a dirty climate secret

As demand for chips surges, the semicondutor industry is trying to grapple with its huge carbon foot print

> It requires huge amounts of energy and water – a chip fabrication plant, or fab, can use millions of gallons of water a day – and creates hazardous waste.

> It requires huge amounts of energy and water – a chip fabrication plant, or fab, can use millions of gallons of water a day – and creates hazardous waste.

No comments:

Post a Comment