1 Overview of results

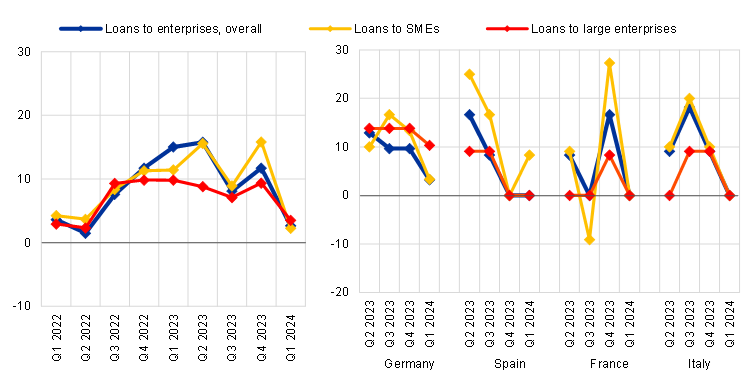

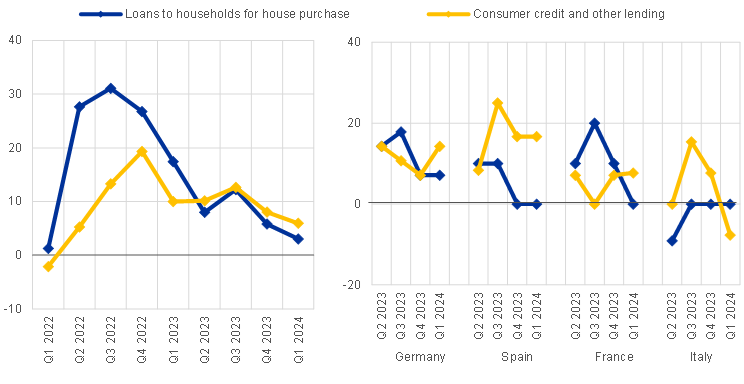

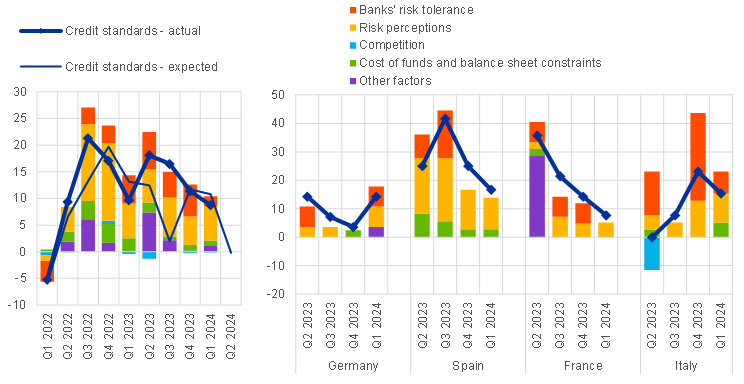

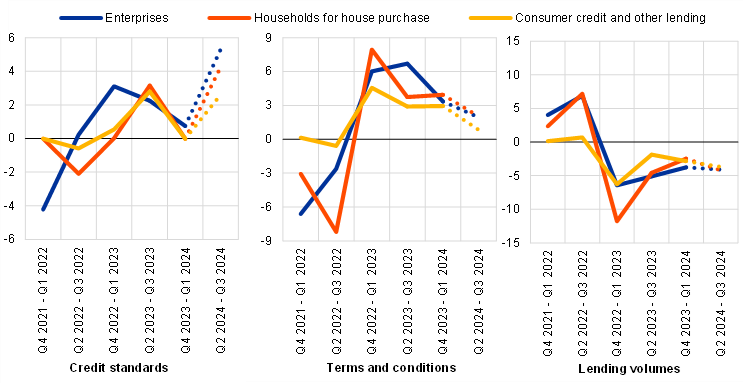

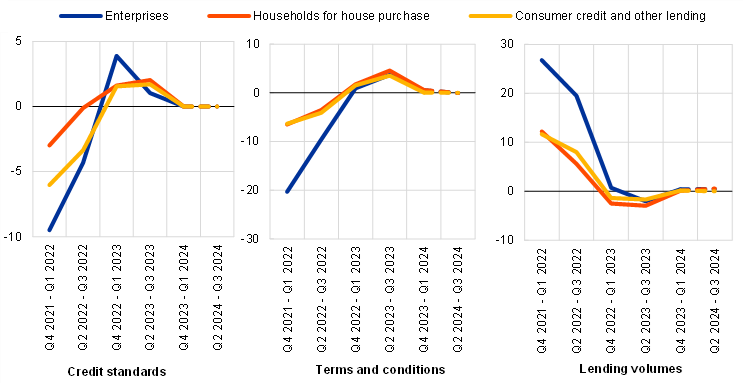

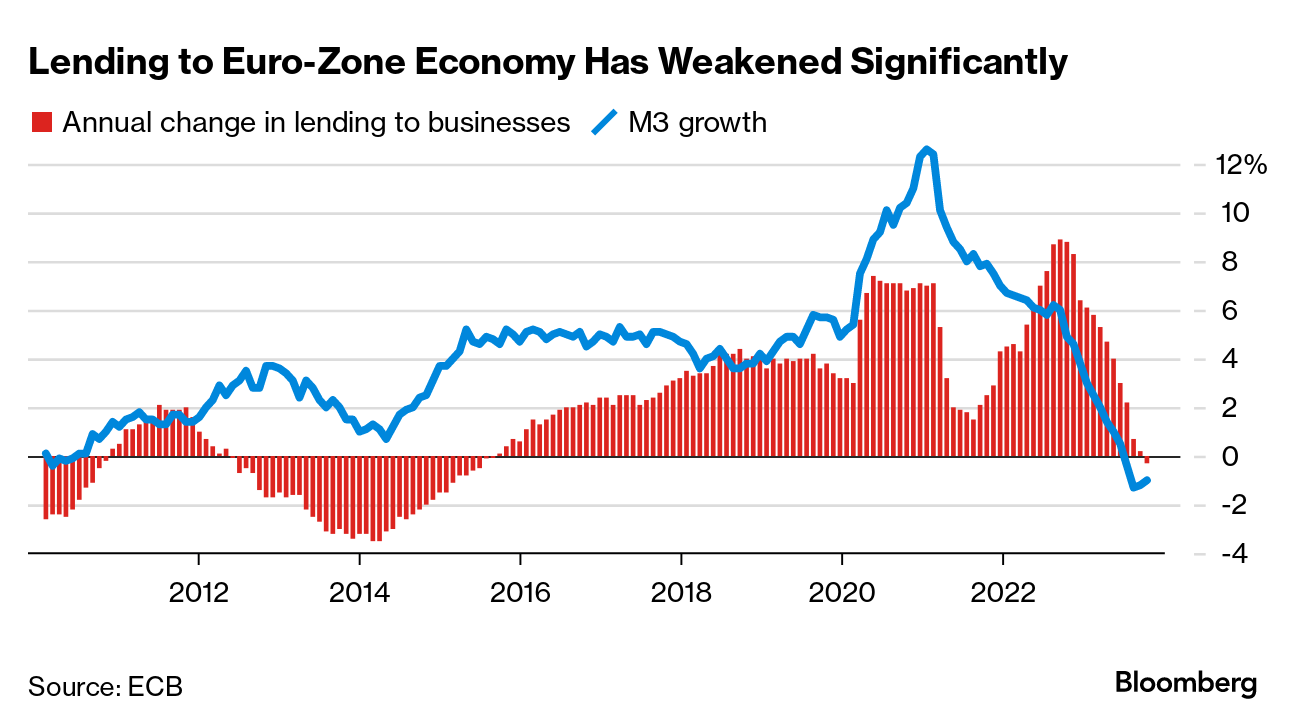

In the April 2024 bank lending survey (BLS), euro area banks reported a small further tightening of their credit standards for loans or credit lines to enterprises in the first quarter of 2024 (net percentage of banks of 3%; see Overview table). This was less than banks had expected in the previous round (9%).[1] The net tightening figure reflected tightening in Germany and a few smaller countries, while all other jurisdictions reported net unchanged credit standards. The substantial cumulative tightening since 2022 has contributed, together with a prolonged weakening in loan demand (see below), to the strong fall in the growth of loans to firms. Expectations are for a moderate net tightening for the second quarter of 2024 (6%).

For the first time since the fourth quarter of 2021, banks reported a moderate net easing of credit standards for loans to households for house purchase (net percentage of -6%), whereas credit standards for consumer credit were tightened further (net percentage of 9%). Competition and bank risk tolerance were the main drivers behind the easing of housing loan credit standards, while risk perceptions and risk tolerance drove the further tightening in consumer credit. The easing of credit standards on housing loans was largely driven by French banks. The tightening in credit standards for consumer credit was, instead, observed across the four largest economies. The observed net easing for housing loans contrasts with the tightening that banks had anticipated in the previous quarter (8%), while the net tightening in consumer credit was broadly in line with prior expectations (11%). Banks expect credit standards to remain unchanged in both loan categories (net percentages of 0% for both) for the second quarter of 2024.

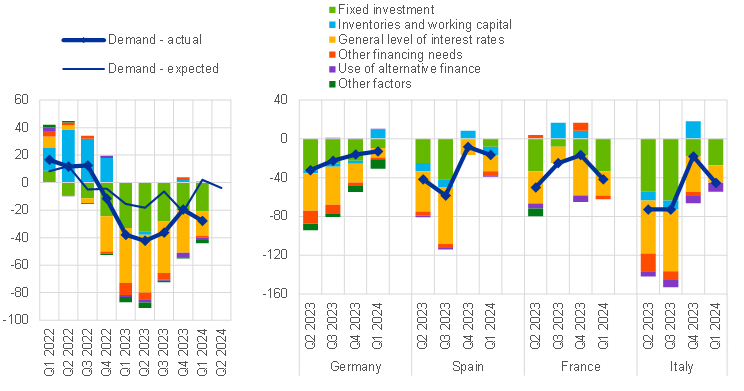

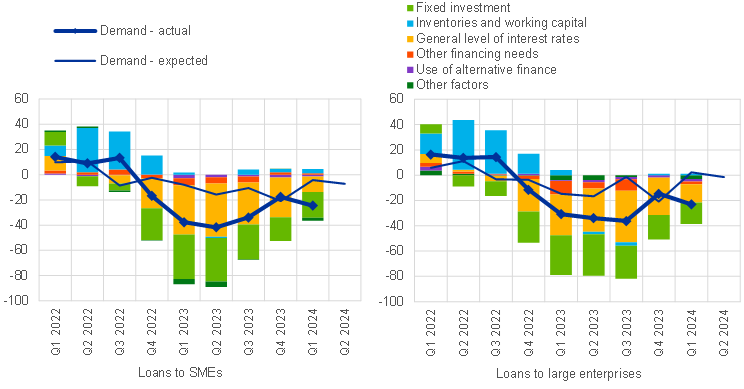

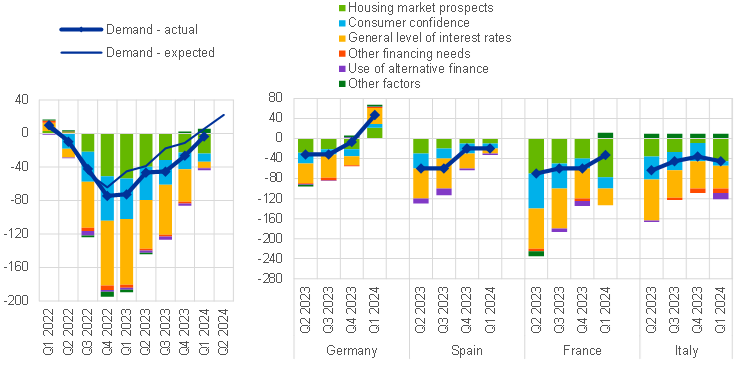

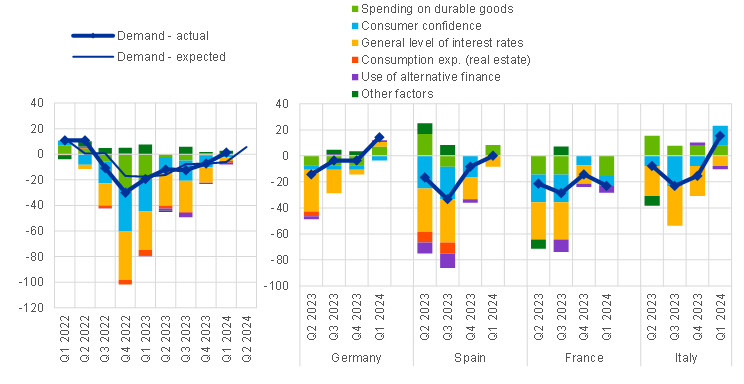

Firms’ net demand for loans continued to decline substantially in the first quarter of 2024, in contrast to the expectations of stabilisation reported in the previous round (net percentage of -28%; see Overview table). The decline in loan demand was mainly driven by higher interest rates reported by banks in all four large euro area countries, and lower fixed investment. The latter is consistent with the reported renewed weakening in demand for long-term loans. At the same time, financing needs for inventories and working capital had a neutral impact on loan demand. While the net percentage of banks reporting a decrease remained smaller than its all-time low in the second quarter of 2023 (-42%), the decline added to the substantial net decreases in loan demand since the fourth quarter of 2022. The strong decline in net demand contrasted with banks’ expectations of a slight increase. Banks expect a small net decrease in demand for loans to firms for the second quarter of 2024.

Net demand for housing loans saw a small decline, while net demand for consumer credit was broadly stable (net percentages of -3% and 1% respectively; see Overview table). Housing market prospects, the general level of interest rates and consumer confidence were the main drivers of the decline in housing loan demand. Banks in three out of the four largest countries reported a net decline in housing loan demand, whereas banks in Germany reported a net increase. Changes in demand for consumer credit were more heterogeneous. The net demand for housing loans was weaker than banks had expected in the previous quarter (net increase of 5%), while it was stronger for consumer credit (net decrease of 6%). In the second quarter of 2024, banks expect demand to increase in both categories – more substantially for housing loans than for consumer credit.

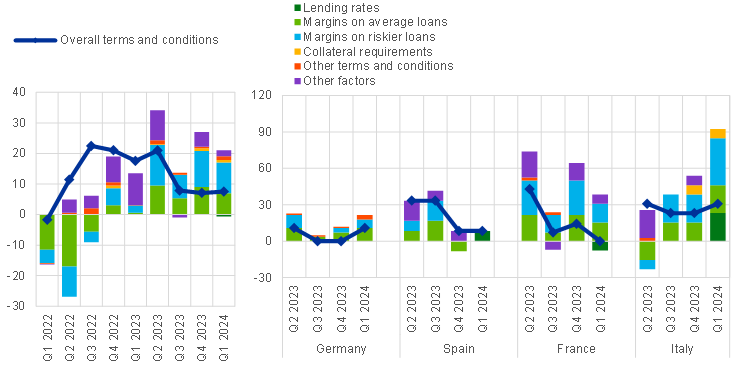

Overall credit terms and conditions eased for housing loans, while they remained broadly unchanged for loans to firms and tightened for consumer credit. Lending rates were the main driver of the net easing in terms and conditions for housing loans, while their impact was broadly neutral for loans to enterprises and consumer credit. Margins on average and riskier loans were the main drivers of tighter consumer credit terms and conditions.

Banks reported a further net increase in the share of rejected applications across all loan segments in the first quarter of 2024. The net increases were smaller for housing loans and loans to firms (3%) and somewhat larger for consumer credit (6%).

The April 2024 BLS contained a number of ad hoc questions.

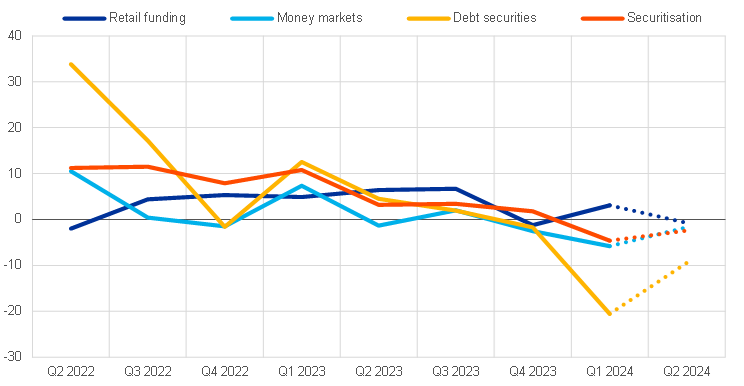

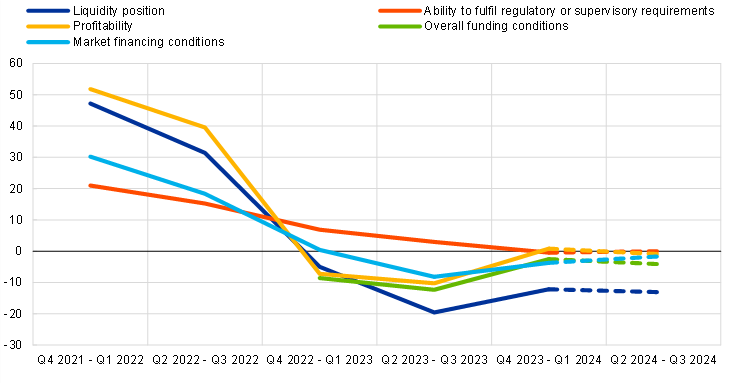

- Euro area banks’ access to funding improved for debt securities and for money markets, while access to retail funding deteriorated in the first quarter of 2024. Access to funding improved, in particular, for debt securities (-21%). The deterioration in retail funding was driven by the short-term segment (7%). Over the next three months, access to debt securities funding, money markets and securitisation is expected to improve further, while access to retail funding is expected to remain broadly unchanged.

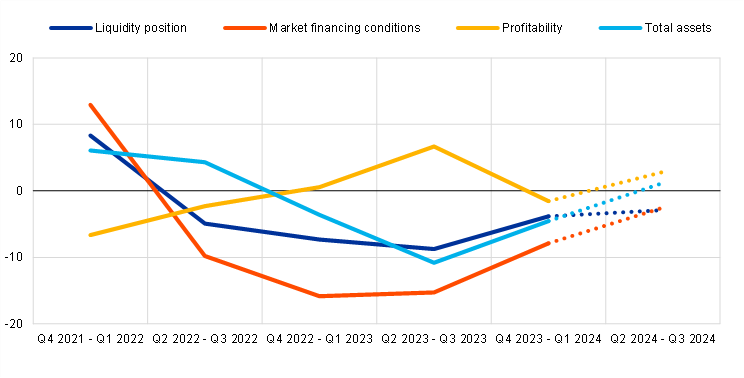

- The reduction of the ECB’s monetary policy asset portfolio had a further negative impact on banks’ financing conditions (-8%) and liquidity position (-4%) over the past six months, resulting in a moderate tightening of terms and conditions and a negative effect on lending volumes. The impact on credit standards was seen as broadly neutral, although banks expect further tightening pressure in the next six months.

- The phase-out of TLTRO III continued to negatively affect banks’ liquidity positions (-12%). However, in the light of the very significant repayments made since November 2022 and the comparatively small remaining outstanding amounts of TLTRO III, banks reported only a small tightening impact on their overall funding conditions (-3%) and a neutral effect on lending conditions (0%).

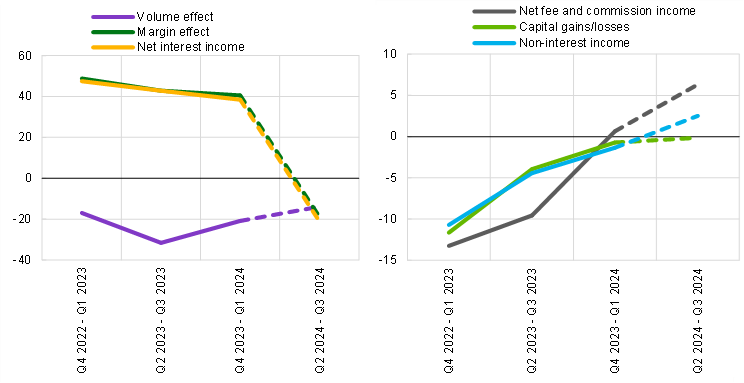

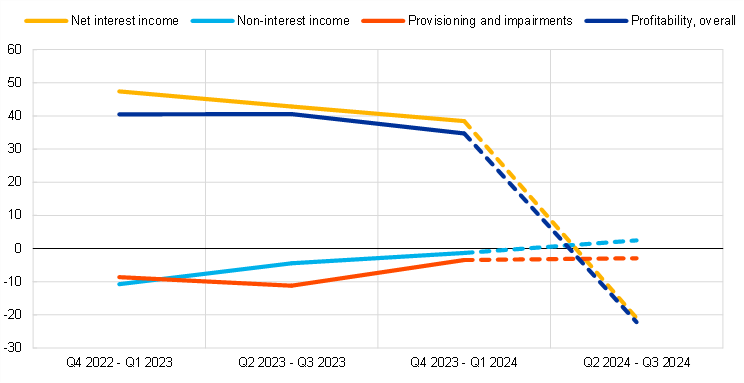

- Euro area banks reported that the ECB’s key interest rate decisions had a further markedly positive impact on their net interest margins over the past six months (40%), although the cumulative impact is expected to diminish over the next six months (-19%). Banks indicated a dampening impact via their net volumes (-21%), and this is also expected to persist over the next six months (-14%). The dampening impact of the ECB’s interest rate decisions expected over the next six months also extends to overall bank profitability (from +35% to -22%), with a moderately negative contribution from provisioning and impairment and a positive contribution from net fee and commission income.

Overview table

Latest BLS results for the largest euro area countries

(net percentages of banks reporting a tightening of credit standards or an increase in loan demand)

Country | Enterprises | House purchase | Consumer credit | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Credit standards | Demand | Credit standards | Demand | Credit standards | Demand | |||||||||||||

Q4 23 | Q1 24 | Avg | Q4 23 | Q1 24 | Avg | Q4 23 | Q1 24 | Avg | Q4 23 | Q1 24 | Avg | Q4 23 | Q1 24 | Avg | Q4 23 | Q1 24 | Avg | |

Euro area | 4 | 3 | 9 | -20 | -28 | -1 | 2 | -6 | 7 | -26 | -3 | 0 | 11 | 9 | 5 | -7 | 1 | -1 |

Germany | 6 | 6 | 4 | -16 | -13 | 5 | 0 | 7 | 3 | -7 | 46 | 5 | 4 | 14 | 1 | -4 | 14 | 6 |

Spain | 0 | 0 | 9 | -8 | -17 | -6 | 0 | 0 | 14 | -20 | -20 | -10 | 25 | 17 | 11 | -8 | 0 | -8 |

France | 0 | 0 | 7 | -17 | -42 | -4 | 0 | -22 | 4 | -60 | -33 | 2 | 14 | 8 | 0 | -14 | -23 | -2 |

Italy | 0 | 0 | 12 | -18 | -45 | 4 | 0 | 0 | 1 | -36 | -45 | 9 | 23 | 15 | 4 | -15 | 15 | 9 |

Notes: “Avg” refers to historical averages, which are calculated over the period since the beginning of the survey, excluding the most recent round. Owing to the different sample sizes across countries, which broadly reflect the differences in the national shares in lending to the euro area non-financial private sector, the size and volatility of the net percentages cannot be directly compared across countries.

Box 1

General notes

The BLS is addressed to senior loan officers at a representative sample of euro area banks, representing all euro area countries and reflecting the characteristics of their respective national banking structures. The main purpose of the BLS is to enhance the Eurosystem’s knowledge of bank lending conditions in the euro area.[2]

Detailed tables and charts based on the responses provided can be found in Annex 1 for the standard questions and Annex 2 for the ad hoc questions. In addition, BLS time series data are available on the ECB’s website via the ECB Data Portal.

Detailed explanations on the BLS questionnaire, the aggregation of banks’ replies to national and euro area BLS results, the BLS indicators and information on the BLS series keys are available on the ECB’s website in the BLS user guide. A copy of the BLS questionnaire and a glossary of BLS terms can also be found on the ECB's website.

2 Loans to enterprises

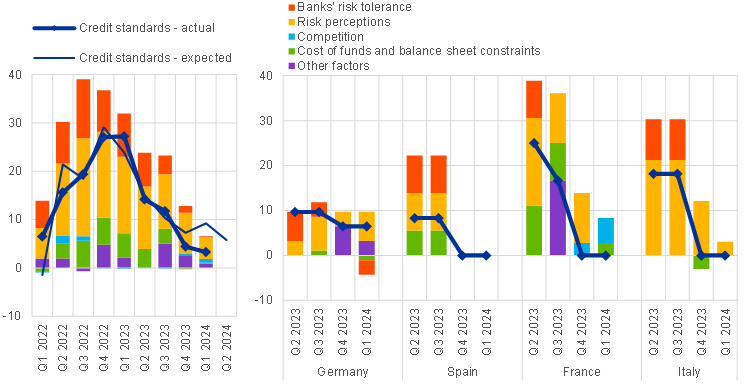

2.1 Credit standards showed slight further tightening

Euro area banks reported a small further net tightening of their credit standards for loans or credit lines to enterprises in the first quarter of 2024 (net percentage of banks of 3%; see Chart 1 and Overview table). This was smaller than banks had expected in the previous round (9%).[3] The net tightening figure reflected tightening in Germany and a few smaller countries, while all other jurisdictions reported net unchanged credit standards. The substantial cumulative tightening since 2022 has contributed, together with weak demand, to the strong fall in the growth of loans to firms. The net tightening of credit standards was similar for loans to small and medium-sized enterprises (SMEs) and for loans to large firms (net percentages of 6% and 5% respectively; see Chart 2). It was slightly stronger for long-term loans (5%) than for short-term loans (3%).

Banks’ risk perceptions were the main driver of the net tightening, whereas cost of funds and balance sheet constraints, competition and risk tolerance had a broadly neutral impact (see Chart 1 and Table 1).[4] The weak economic situation and outlook, together with credit risk for firms related to their financial situation, remained the main underlying reasons for the tightening impact of risk perceptions. Among the largest euro area countries, the greater risks were perceived by banks in Germany and Italy. Relatedly, some banks mentioned regulatory changes as an additional tightening factor (included in “other factors”).[5] Similarly to the previous quarter, risk tolerance and competitive pressures did not have a significant impact on credit standards, according to banks. Banks’ own financial situations in respect of their capital and liquidity positions as well as their market financing costs continued to have a neutral impact at the euro area level, with only banks in France, among the largest countries, reporting a slight tightening impact.

Chart 1

Changes in credit standards applied to the approval of loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: “Actual” values are changes that have occurred, while “expected” values are changes anticipated by banks. Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for responses to questions related to contributing factors are defined as the difference between the percentage of banks reporting that a given factor contributed to a tightening and the percentage of banks reporting that it contributed to an easing. “Cost of funds and balance sheet constraints” is the unweighted average of “banks’ capital and the costs related to banks’ capital position”, “access to market financing” and “liquidity position”; “Risk perceptions” is the unweighted average of “general economic situation and outlook”, “industry or firm-specific situation and outlook/borrower’s creditworthiness” and “risk related to the collateral demanded”; and “Competition” is the unweighted average of “competition from other banks”, “competition from non-banks” and “competition from market financing”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards.

Chart 2

Changes in credit standards applied to the approval of loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Note: See the notes to Chart 1.

In the second quarter of 2024, euro area banks expect a further moderate net tightening for loans to firms (net percentage of 6%). Banks expect a similar moderate net tightening for loans to SMEs (net percentage of 8%) and for loans to large firms (net percentage of 6%).

Table 1

Factors contributing to changes in credit standards for loans or credit lines to enterprises

(net percentages of banks)

Country | Cost of funds and balance sheet constraints | Pressure from competition | Perception of risk | Banks’ risk tolerance | ||||

|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | 0 | 0 | 0 | 1 | 9 | 4 | 1 | 0 |

Germany | 0 | -1 | 0 | 0 | 3 | 6 | 0 | -3 |

Spain | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

France | 0 | 3 | 3 | 6 | 11 | 0 | 0 | 0 |

Italy | -3 | 0 | 0 | 0 | 12 | 3 | 0 | 0 |

Note: See the notes to Chart 1.

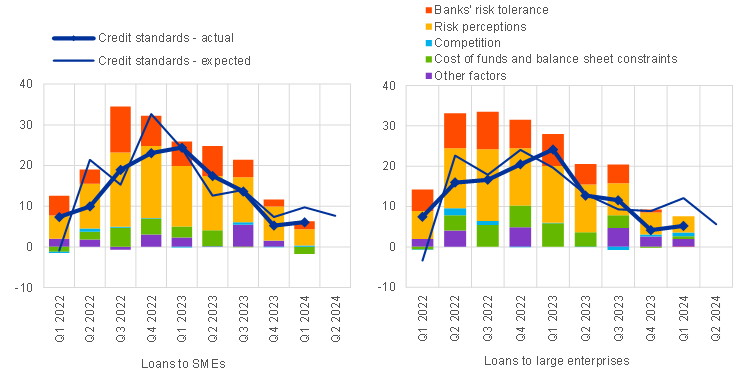

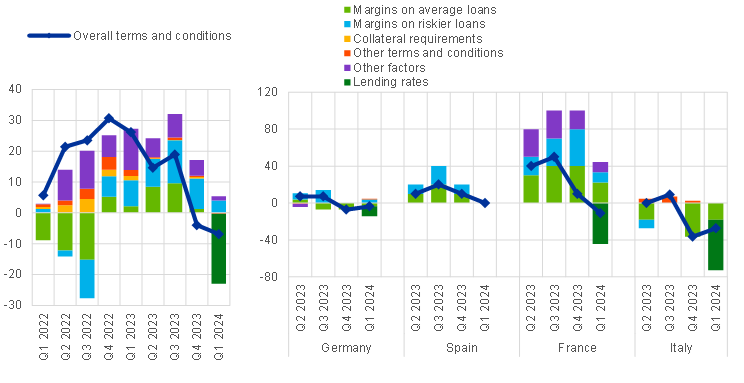

2.2 Terms and conditions remained broadly unchanged

Banks’ overall terms and conditions for new loans to enterprises remained broadly unchanged (net percentage of 1%; see Chart 3 and Table 2).[6] Margins on average loans (defined as the spread over relevant market reference rates) narrowed slightly for the first time since the fourth quarter of 2021, while margins on riskier loans continued to widen. At the same time, lending rates on new loans remained broadly unchanged in net terms.[7] This development is consistent with the broad stability in lending rates on new loans observed in recent months, amid some country heterogeneity. Margins on average loans remained unchanged in net terms in all countries except for Italy, where these were reported to have narrowed, mainly due to competition by other banks. Margins on riskier loans continued to widen further in Germany and Italy. Banks reported broadly unchanged overall terms and conditions for loans both to SMEs and to large firms (net percentage for both of 1%; see Chart 4). Other terms and conditions had a broadly neutral impact.

Chart 3

Changes in terms and conditions on loans or credit lines to enterprises

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Lending rates” was introduced in April 2024. “Margins” are defined as the spread over relevant market reference rates. “Other terms and conditions” is the unweighted average of “non-interest rate charges”, “size of the loan or credit line”, “loan covenants” and “maturity”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in terms and conditions.

Banks’ higher risk perceptions continued to be the main factor having a tightening impact on the terms and conditions of loans to firms, which was largely counterbalanced by an easing impact from competition (see Table 3). The net easing impact of competition was mainly related to competition with other banks (net percentage of -9%), especially in Italy and Germany. Banks’ risk tolerance had a neutral impact on terms and conditions in the first quarter of 2024.

Table 2

Changes in terms and conditions on loans or credit lines to enterprises

(net percentages of banks)

Country | Overall terms and conditions | Banks’ lending rates | Banks’ margins on average loans | Banks’ margins on riskier loans | ||||

|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | 4 | 1 | - | -2 | -1 | -3 | 4 | 4 |

Germany | 10 | 3 | - | -3 | 3 | 0 | 6 | 6 |

Spain | 8 | 0 | - | 0 | 8 | 0 | 8 | 0 |

France | 8 | 0 | - | -8 | 8 | 0 | 0 | 0 |

Italy | -27 | 9 | - | 18 | -36 | -9 | -9 | 18 |

Note: See the notes to Chart 3. The sub-item for banks’ lending rates was introduced in April 2024.

Chart 4

Changes in terms and conditions on loans or credit lines to SMEs and large enterprises

(net percentages of banks reporting a tightening of terms and conditions)

Note: See the notes to Chart 3.

Table 3

Factors contributing to changes in overall terms and conditions on loans or credit lines to enterprises

(net percentages of banks)

Country | Cost of funds and balance sheet constraints | Pressure from competition | Perception of risk | Banks’ risk tolerance | |||||

|---|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | ||

Euro area | 1 | 0 | -2 | -4 | 10 | 6 | 5 | 1 | |

Germany | 1 | -1 | 1 | -2 | 9 | 6 | 3 | 0 | |

Spain | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

France | 0 | 0 | -3 | 0 | 17 | 8 | 8 | 0 | |

Italy | 0 | 3 | -12 | -6 | 3 | 9 | 0 | 0 | |

Notes: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage of banks reporting that it contributed to an easing. See the notes to Chart 1.

2.3 Rejection rates continued to increase

Banks reported a further net increase in the share of rejected loan applications for firms (net percentage of 3%; see Chart 5). While substantially lower than in the previous quarter (12%), the net increase in the first quarter of 2024 added to the increases seen since the first quarter of 2022. The net increase was similar for loans to SMEs and to large firms (net percentages of 2% and 4% respectively). At the same time, the cumulative increase in the share of loan rejections has been higher for SMEs since 2022. The further increase in the share of rejected loan applications was driven by Germany.

Chart 5

Changes in the share of rejected loan applications for enterprises

(net percentages of banks reporting an increase)

Notes: Share of rejected loan applications relative to the volume of all loan applications in that loan category. The breakdown by firm sizes was introduced in the first quarter of 2022.

2.4 Net demand for loans continued to decline substantially

Net demand by firms for loans continued to decline substantially in the first quarter of 2024 (net percentage of -28%; see Chart 6), in contrast to expectations of stabilisation reported in the previous round (net percentage of 2%). While the net percentage of banks reporting a decrease remained smaller than its all-time low in the second quarter of 2023 (-42%), the decline added to the substantial net decreases in loan demand since the fourth quarter of 2022. Banks in all four large euro area countries reported a further net decrease in demand. The strong decline contrasted with banks’ expectations of a slight increase. The net decreases in demand for loans to SMEs (-24%) and large firms (-23%) were similar and were both larger than in the fourth quarter of 2023 (-17% and -15% respectively; see Chart 7). Similarly to previous quarters, demand for long-term loans (net percentage of -29%; see next paragraph) declined more strongly than demand for short-term loans (net percentage of -11%).

Chart 6

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Notes: “Actual” values are changes that have occurred, while “expected” values are changes anticipated by banks. Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The net percentages for responses to questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to increasing demand and the percentage of banks reporting that it contributed to decreasing demand. “Other financing needs” is the unweighted average of “mergers/acquisitions and corporate restructuring” and “debt refinancing/restructuring and renegotiation”; and “Use of alternative finance” is the unweighted average of “internal financing”, “loans from other banks”, “loans from non-banks”, “issuance/redemption of debt securities” and “issuance/redemption of equity”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand.

Chart 7

Changes in demand for loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Note: See the notes to Chart 6. Changes to the factors having an impact on loan demand across firm sizes were added in the first quarter of 2022.

The general level of interest rates and declining fixed investment remained the main drivers of the net decrease in loan demand (see Chart 6 and Table 4). The decline in loan demand was mainly driven by the general level of interest rates, as reported by banks in all four large euro area countries, and lower fixed investment, consistent with the net decrease in demand for long-term loans. Several banks in Germany also referred to uncertainty about the domestic economic outlook and geopolitics more generally. At the same time, financing needs for inventories and working capital had a neutral impact on loan demand. Alternative sources of financing, such as internal financing and market-based financing via debt securities and corporate equity, dampened loan demand in the euro area only slightly in the first quarter of 2024. Similarly to total net demand for loans to firms, the general level of interest rates and firms’ financing needs for fixed investment were the main drivers of the decline in demand for loans to both SMEs and large firms (see Chart 7).

Table 4

Factors contributing to changes in demand for loans or credit lines to enterprises

(net percentages of banks)

Country | Fixed investment | Inventories and working capital | Other financing needs | General level of interest rates | Use of alternative finance | |||||

|---|---|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | -20 | -21 | 2 | 1 | 2 | -1 | -31 | -18 | -3 | -2 |

Germany | -23 | -10 | -3 | 10 | -3 | -2 | -19 | -10 | 1 | 1 |

Spain | 0 | -8 | 8 | -8 | 0 | -4 | -17 | -17 | 0 | -2 |

France | -17 | -33 | 8 | 0 | 8 | -4 | -42 | -25 | -7 | 0 |

Italy | -18 | -27 | 18 | 0 | -5 | 0 | -36 | -18 | -7 | -9 |

Note: See the notes to Chart 6.

Banks expect a moderate net decrease in demand for loans to firms in the second quarter of 2024 (net percentage of -4%). Expected net loan demand has mostly been higher than actual net demand since the fourth quarter of 2022, with the exception of the fourth quarter of 2023. Nonetheless, banks are expecting the net decrease of loan demand to become less pronounced in the second quarter, more so for short-term loans than for long-term loans (net percentages of -2% and -5% respectively).

3 Loans to households for house purchase

3.1 Credit standards eased moderately

For the first time since the fourth quarter of 2021, euro area banks reported a (moderate) net easing of credit standards on loans to households for house purchase (net percentage of banks of -6%; see Chart 8 and Overview table). Considering the historical leading indicator properties of credit standards for loans for house purchase (about two quarters ahead of actual loan developments), actual growth in lending to households for house purchase may show the first signs of picking up from its currently low levels over the next months. The net easing came after banks reported a slight tightening of credit standards in the previous quarter (2%) and is in contrast to the tightening that banks had expected (8%). The net easing was mainly driven by developments in France, although it also materialised in several smaller countries. Of the three other large economies, German banks reported a net tightening and Spanish and Italian banks reported unchanged credit standards.

Chart 8

Changes in credit standards applied to the approval of loans to households for house purchase, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Notes: See the notes to Chart 1. “Cost of funds and balance sheet constraints” is the unweighted average of “banks’ capital and the costs related to banks’ capital position”, “access to market financing” and “liquidity position”; “Risk perceptions” is the unweighted average of “general economic situation and outlook”, “housing market prospects, including expected house price developments” and “borrower’s creditworthiness”; and “Competition” is the unweighted average of “competition from other banks” and “competition from non-banks”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards.

Competition and banks’ risk tolerance were the main factors driving the net easing of credit standards on housing loans (see Chart 8 and Table 5). Banks primarily reported competition from other banks (rather than from non-banks) as exerting easing pressure. Risk perceptions and cost of funds and balance sheet constraints had a broadly neutral impact at the euro area level. Some German banks linked the tightening of credit standards (in “Other factors”) to increased costs of living, which in turn has led to a deterioration in borrower debt-servicing capacity and creditworthiness. At the other end of the spectrum, French banks reported that exercising greater flexibility within the leeway allowed by prudential guidance, as well as competitive pressures, contributed to the net easing of housing loan credit standards.[8]

In the second quarter of 2024, euro area banks expect credit standards on loans to households for house purchase to remain unchanged (net percentage of 0%). Nevertheless, some heterogeneity remains: German banks expect a further net tightening, while French banks expect a further net easing.

Table 5

Factors contributing to changes in credit standards for loans to households for house purchase

(net percentages of banks)

Country | Cost of funds and balance sheet constraints | Pressure from competition | Perception of risk | Banks’ risk tolerance | ||||

|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | 1 | 0 | -1 | -5 | 3 | 1 | 1 | -4 |

Germany | 2 | 0 | -2 | 0 | -1 | 1 | 0 | 0 |

Spain | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

France | 0 | 0 | 0 | -11 | 0 | -4 | 0 | -11 |

Italy | 0 | 0 | 0 | -5 | 3 | 6 | 0 | 0 |

Note: See the notes to Chart 8.

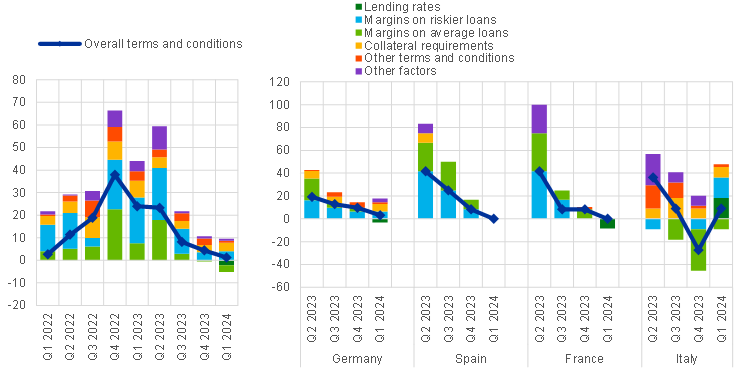

3.2 Terms and conditions showed further moderate easing

Banks reported a moderate easing of their overall terms and conditions for new housing loans in the first quarter of 2024 for a second time in a row (net percentage of -7%; see Chart 9 and Table 6). The net easing consisted mainly of lower lending rates (net percentage of -23%), arguably driven by developments in reference rates. Consistent with this interpretation, margins on average loans remained unchanged and margins on riskier loans continued to tighten moderately. Banks in Germany, France and Italy reported a net easing in terms and conditions, while banks in Spain reported unchanged terms and conditions.

Chart 9

Changes in terms and conditions on loans to households for house purchase

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Lending rates” was introduced in April 2024. “Margins” are defined as the spread over relevant market reference rates. “Other terms and conditions” is the unweighted average of “loan-to-value ratio”, “other loan size limits”, “non-interest rate charges” and “maturity”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in terms and conditions.

Table 6

Changes in terms and conditions on loans to households for house purchase

(net percentages of banks)

Country | Overall terms and conditions | Banks’ lending rates | Banks’ margins on average loans | Banks’ margins on riskier loans | ||||

|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | -4 | -7 | - | -23 | 1 | 0 | 10 | 4 |

Germany | -7 | -4 | - | -11 | -7 | -4 | 0 | 4 |

Spain | 10 | 0 | - | 0 | 10 | 0 | 10 | 0 |

France | 10 | -11 | - | -44 | 40 | 22 | 40 | 11 |

Italy | -36 | -27 | - | -55 | -36 | -18 | 0 | 0 |

Note: See the notes to Chart 9. The sub-item for banks’ lending rates was introduced in April 2024.

Competition was the main driver of the net easing of overall terms and conditions (see Table 7). Banks’ risk perceptions, risk tolerance and cost of funds and balance sheet constraints had a broadly neutral impact. Competition was cited as the primary reason behind the easier terms and conditions across three out of the four largest euro area economies that saw an easing. Risk perceptions, however, did have a moderate tightening impact in Germany.

Table 7

Factors contributing to changes in overall terms and conditions on loans to households for house purchase

(net percentages of banks)

Country | Cost of funds and balance sheet constraints | Pressure from competition | Perception of risk | Banks’ risk tolerance | ||||

|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | 7 | -1 | -13 | -11 | 0 | 1 | 1 | 0 |

Germany | 0 | 1 | -7 | -7 | 0 | 4 | 4 | 0 |

Spain | 10 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

France | 20 | -4 | -20 | -11 | 0 | 0 | 0 | 0 |

Italy | 0 | 0 | -45 | -45 | 9 | 0 | 9 | 0 |

Note: See the notes to Chart 8. The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage of banks reporting that it contributed to an easing.

3.3 Rejection rates continued to increase

Banks reported a further net increase in the share of rejected applications for housing loans (net percentage of 3%; see Chart 10). The increase was lower than in the previous quarter (6% in the fourth quarter of 2023) and the lowest since the first quarter of 2022, coming after seven consecutive quarters of net increases in the share of rejected applications. Among the four largest euro area economies, only German banks reported an increase in the share of rejections, whereas banks in the other three countries reported unchanged rejection rates.

Chart 10

Changes in the share of rejected loan applications for households

(net percentages of banks reporting an increase)

Note: Share of rejected loan applications relative to the volume of all loan applications in that loan category.

3.4 Net demand for loans decreased slightly

Banks reported a small decline in net demand for housing loans in the first quarter of 2024 (net percentage of -3%, see Chart 11 and Overview table). The net decrease was much smaller than in the preceding quarter (-26%) but fell short of banks’ expectations of a net increase (5%). Among the four largest euro area economies, German banks reported a strong net increase in loan demand, after the substantial net decline reported in previous quarters, while strong net decreases were reported elsewhere.

Chart 11

Changes in demand for loans to households for house purchase, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Notes: See the notes to Chart 6. “Other financing needs” is the unweighted average of “debt refinancing/restructuring and renegotiation” and “regulatory and fiscal regime of housing markets”; and “Use of alternative finance” is the unweighted average of “internal finance of house purchase out of savings/down payment”, “loans from other banks” and “other sources of external finance”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand.

Housing market prospects were the main factor exerting downward pressure on demand for loans for house purchase (see Chart 11 and Table 8). The level of interest rates and consumer confidence also contributed, although their contribution was smaller than in previous quarters. The contribution of housing market prospects, meanwhile, was similar to that of the previous quarter. The use of alternative finance had only a small negative impact, while bank-specific idiosyncratic “other factors” made a moderate positive contribution to loan demand. German banks reported the increase in demand as the result of improved housing market prospects and lower interest rates. This is consistent with the improved affordability of housing in Germany, with residential real estate prices having dropped substantially throughout 2023 and with new business lending rates on loans for house purchase in Germany declining faster between November 2023 and February 2024 than the euro area average.

In the second quarter of 2024, banks expect a strong increase in housing loan demand (net percentage of banks of 23%), which – if it were to materialise – would be the first net increase since the second quarter of 2022. The increase in housing loan demand is expected across banks in all the four largest euro area economies.

Table 8

Factors contributing to changes in demand for loans to households for house purchase

(net percentages of banks)

Country | Housing market prospects | Consumer confidence | Other financing needs | General level of interest rates | Use of alternative finance | |||||

|---|---|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | -23 | -24 | -20 | -10 | -2 | -1 | -39 | -7 | -3 | -3 |

Germany | -21 | 21 | -14 | 7 | -2 | 2 | -18 | 32 | 2 | 1 |

Spain | -10 | -10 | -20 | -10 | 0 | 0 | -30 | -10 | -3 | -3 |

France | -40 | -78 | -20 | -22 | -5 | 0 | -60 | -33 | -10 | 0 |

Italy | -9 | -45 | -36 | -9 | -9 | -9 | -55 | -45 | 0 | -12 |

Note: See the notes to Chart 11.

4 Consumer credit and other lending to households

4.1 Credit standards tightened further

Banks reported a further net tightening of credit standards on consumer credit and other lending to households (net percentage of 9%; see Chart 12 and Overview table). The net tightening in credit standards was similar to the net tightening in the preceding quarter, broadly in line with banks’ expectations (net percentage of 11% for both). The net percentage remained above the historical average (5%) and added to the tightening which had accumulated since the start of the hiking cycle. Credit standards tightened across the four largest economies.

Increased risk perceptions and, to a lesser extent, banks’ lower risk tolerance mainly contributed to the net tightening of credit standards for consumer credit (see Chart 12 and Table 9). The increased risk perceptions were mostly related to banks’ perceptions of the economic outlook and consumers’ creditworthiness. Banks’ cost of funds and balance sheet constraints, as well as competition, had a broadly neutral impact.

In the second quarter of 2024, euro area banks expect credit standards for consumer credit and other lending to households to remain unchanged (net percentage of 0%). If current expectations were to materialise, it would be the first quarter without further net tightening since the second quarter of 2022.

Chart 12

Changes in credit standards applied to the approval of consumer credit and other lending to households, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Notes: See the notes to Chart 1. “Cost of funds and balance sheet constraints” is the unweighted average of “banks’ capital and the costs related to banks’ capital position”, “access to market financing” and “liquidity position”; “Risk perceptions” is the unweighted average of “general economic situation and outlook”, “creditworthiness of consumers” and “risk on the collateral demanded”; and “Competition” is the unweighted average of “competition from other banks” and “competition from non-banks”. The detailed sub-factors under “Cost of funds and balance sheet constraints” were introduced in April 2024. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards.

Table 9

Factors contributing to changes in credit standards for consumer credit and other lending to households

(net percentages of banks)

Country | Cost of funds and balance sheet constraints | Pressure from competition | Perception of risk | Banks’ risk tolerance | ||||

|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | 1 | 1 | 0 | 0 | 5 | 6 | 6 | 2 |

Germany | 2 | 0 | 0 | 0 | 0 | 7 | 0 | 7 |

Spain | 3 | 3 | 0 | 0 | 14 | 11 | 0 | 0 |

France | 0 | 0 | 0 | 0 | 5 | 5 | 7 | 0 |

Italy | 0 | 5 | 0 | 0 | 13 | 10 | 31 | 8 |

Note: See the notes to Chart 12.

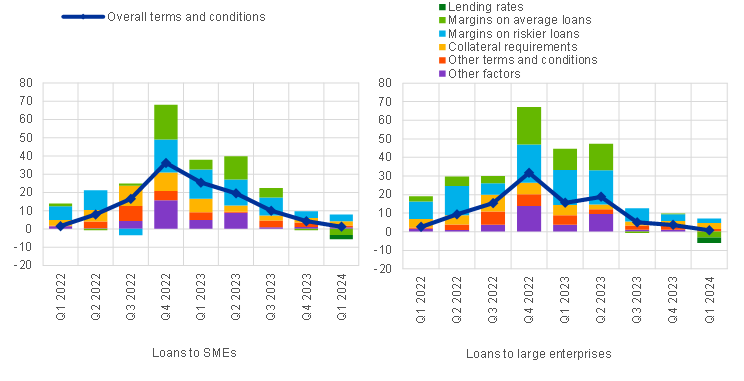

4.2 Terms and conditions tightened further

Banks’ overall terms and conditions applied when granting consumer credit and other lending to households tightened further in net terms (net percentage of 8%, see Chart 13 and Table 10). Banks primarily referred to widening margins on both average and riskier loans. This was particularly the case for French and Italian banks. At the same time, lending rates remained broadly unchanged for euro area banks, although Italian and Spanish banks reported a net increase. The net tightening of terms and conditions was similar to that of the previous quarter (7%).

Perceptions of risk and banks’ risk tolerance contributed most to the net tightening of banks’ overall terms and conditions (see Table 11). Cost of funds and balance sheet constraints had a small additional tightening impact. The impact from competitive pressure was broadly neutral. The factors contributing to changes in the terms and conditions varied across the four largest economies, with risk tolerance or risk perception being most important in Germany, France and Italy, and cost of funds and balance sheet constraints being the only important factor in Spain.

Chart 13

Changes in terms and conditions on consumer credit and other lending to households

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Lending rates” was introduced in April 2024. “Margins” are defined as the spread over a relevant market reference rate. “Other terms and conditions” is the unweighted average of “size of the loan”, “non-interest rate charges” and “maturity”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in terms and conditions.

Table 10

Changes in terms and conditions on consumer credit and other lending to households

(net percentages of banks)

Country | Overall terms and conditions | Banks’ lending rates | Banks’ margins on average loans | Banks’ margins on riskier loans | ||||

|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | 7 | 8 | - | -1 | 9 | 7 | 12 | 10 |

Germany | 0 | 11 | - | 0 | 7 | 11 | 4 | 7 |

Spain | 8 | 8 | - | 8 | -8 | 0 | 0 | 0 |

France | 14 | 0 | - | -8 | 21 | 15 | 29 | 15 |

Italy | 23 | 31 | - | 23 | 15 | 23 | 23 | 38 |

Note: See the notes to Chart 13. The sub-item for banks’ lending rates was introduced in April 2024.

Table 11

Factors contributing to changes in overall terms and conditions on consumer credit and other lending to households

(net percentages of banks)

Country | Cost of funds and balance sheet constraints | Pressure from competition | Perception of risk | Banks’ risk tolerance | ||||

|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | 8 | 2 | -3 | -1 | 4 | 9 | 5 | 7 |

Germany | 0 | 1 | 0 | 0 | 4 | 11 | 4 | 14 |

Spain | 8 | 3 | -8 | 0 | 0 | 0 | 0 | 0 |

France | 14 | 0 | -7 | 0 | 7 | 23 | 7 | 0 |

Italy | 23 | 8 | 0 | 8 | 8 | 0 | 15 | 23 |

Note: See the notes to Chart 12. The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage of banks reporting that it contributed to an easing.

4.3 Rejection rates continued to increase

Euro area banks reported a further net increase in the share of rejected applications for consumer credit (6%; see Chart 10 above). The net increase was lower than in the previous quarter (8%) and is the lowest since the second quarter of 2022. The net increase was observed in three out of the four largest economies, with only Italy reporting a net decrease (-8%). Similarly to the other loan categories, the net share of rejected loan applications for consumer credit and other lending to households has increased every quarter since the start of the rate hiking cycle in July 2022.

4.4 Net demand for loans was broadly stable

Banks reported a broadly unchanged demand for consumer credit and other lending to households (net percentage of banks of 1%, see Chart 14 and Overview table). Banks expected a further net decrease in the previous quarter (-6%), following six quarters of declining demand. The change in loan demand was heterogenous across countries, with German and Italian banks reporting a net increase (14% and 15% respectively), French banks reporting a net decrease (-23%) and net loan demand remaining unchanged in Spain. For the next three months, banks expect a moderate increase in loan demand (6%).

Chart 14

Changes in demand for consumer credit and other lending to households, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Notes: See the notes to Chart 6. “Use of alternative finance” is the unweighted average of “internal financing out of savings”, “loans from other banks” and “other sources of external finance”. “Consumption exp. (real estate)” denotes “consumption expenditure financed through real estate-guaranteed loans”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand.

The stabilisation of loan demand came despite small negative contributions from the level of interest rates and low consumer confidence (see Chart 14 and Table 12). This was in contrast to the driving role of these two factors in previous quarters. Spending on durable goods, consumption expenditure financed through real-estate guaranteed loans and the use of alternative finance had a (broadly) neutral impact on loan demand.

In the second quarter of 2024, banks expect a net increase in demand for consumer credit and other lending to households (net percentage of 6%).

Table 12

Factors contributing to changes in demand for consumer credit and other lending to households

(net percentages of banks)

Country | Spending on durable goods | Consumer confidence | Consumption exp. (real estate) | General level of interest rates | Use of alternative finance | |||||

|---|---|---|---|---|---|---|---|---|---|---|

Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | Q4 2023 | Q1 2024 | |

Euro area | -1 | 0 | -9 | -2 | 1 | -1 | -12 | -3 | -1 | -1 |

Germany | -7 | 7 | -4 | -4 | 0 | 0 | -4 | 4 | 0 | 1 |

Spain | 0 | 8 | -17 | 0 | 0 | 0 | -17 | -8 | -3 | 0 |

France | 0 | -15 | -7 | -8 | 0 | 0 | -14 | 0 | -2 | -5 |

Italy | 8 | 8 | -8 | 15 | 0 | 0 | -23 | -8 | 3 | -3 |

Note: See the notes to Chart 14.

5 Ad hoc questions

5.1 Banks’ access to wholesale funding improved, while access to retail funding deteriorated[9]

Banks’ access to funding improved for debt securities and – to a lesser extent – for money markets and securitisation, while banks’ access to retail funding deteriorated (Chart 15 and Table 13). Consistent with declines in longer-term yields, access to debt securities funding improved substantially (-21%), particularly in medium to long-term debt securities markets. Access to short-term retail funding continued to deteriorate (7%), reflecting lower overnight deposit volumes amid high deposit rates, while access to long-term retail funding remained broadly unchanged. Access to money markets and securitisation also improved in net terms.

Chart 15

Changes in banks’ access to retail and wholesale funding

(net percentages of banks reporting a deterioration in access)

Note: The net percentages are defined as the difference between the sum of the percentages of banks responding “deteriorated considerably” and “deteriorated somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The last period denotes expectations indicated by banks in the current round.

Table 13

Changes in banks’ access to retail and wholesale funding

(net percentages of banks reporting a deterioration in access)

Retail funding | Money markets | Wholesale debt securities | Securiti-sation | |||||

|---|---|---|---|---|---|---|---|---|

Total | Short-term | Long-term | Total | Short-term | Medium to long-term | |||

Q4 2023 | -1 | 2 | -5 | -3 | -2 | -1 | -3 | 2 |

Q1 2024 | 3 | 7 | -1 | -6 | -21 | -14 | -27 | -5 |

Q2 2024 | -1 | 1 | -3 | -2 | -9 | -8 | -11 | -2 |

Note: See the notes to Chart 15. The last period denotes expectations indicated by banks in the current round.

Over the next three months, access to debt securities funding, money markets and securitisation is expected to improve further. The improvement in medium to long-term debt securities is expected to be more substantial than the improvement in short-term debt securities. Access to retail funding is expected to remain broadly unchanged.

5.2 The reduction in the ECB’s monetary policy asset portfolio contributed to a moderate tightening of lending conditions[10]

The reduction in the ECB’s monetary policy asset portfolio had a further negative impact on euro area banks’ financing conditions (-8%) and liquidity positions (-4%) over the last six months (see Chart 16 and Table 14). In addition, banks continued to report a negative impact on their total assets due to the discontinuation of reinvestments under the ECB’s asset purchase programme, as well as the December 2023 announcement of a reduction of the reinvestments under the ECB’s pandemic purchase programme. The net percentages were, however, smaller than in the preceding six months. After the previous positive contribution on their profitability, in the past six months banks saw a very small negative impact on profitability, which was mostly driven by developments in the reported impact on net interest income. The impact on the valuation of sovereign bond holdings was reported to be broadly neutral.

Chart 16

Overview of the impact of the ECB’s monetary policy asset portfolio on euro area banks’ financial situation

(net percentages of banks reporting an increase/improvement)

Notes: The net percentages are defined as the difference between the sum of the percentages for “increased/improved considerably” and “increased/improved somewhat” and the sum of the percentages for “decreased/deteriorated somewhat” and “decreased/deteriorated considerably”. The last period denotes expectations indicated by banks in the current round.

Over the next six months, euro area banks expect, on balance, changes to the ECB’s monetary policy asset portfolio to have a small negative impact on their market financing conditions and liquidity positions, but a small positive impact on their profitability. The impact on total assets is expected to be broadly neutral which, in a context of weak lending dynamics and mechanical reductions in banks’ excess liquidity, is consistent with banks’ expectations of a small positive impact on their sovereign bond holdings.

Table 14

Impact of the ECB’s monetary policy asset portfolio on banks’ financial situation

(net percentages of banks reporting an increase or improvement)

Total assets | Liquidity position | Market financing conditions | Profitability | |||

|---|---|---|---|---|---|---|

Total | Owing to: net interest income | Owing to: capital gains/losses | ||||

Q2 2023 – Q3 2023 | -11 | -9 | -15 | 7 | 9 | -4 |

Q4 2023 – Q1 2024 | -5 | -4 | -8 | -2 | -1 | -1 |

Q2 2024 – Q3 2024 | 1 | -3 | -2 | 3 | 5 | 0 |

Note: See the notes to Chart 18. The last period denotes expectations indicated by banks in the current round.

Over the past six months, euro area banks continued to report that changes in the ECB’s monetary policy asset portfolio had a moderate net tightening impact on terms and conditions and a negative effect on bank lending volumes (see Chart 17 and Table 15). The impact on bank lending volumes was somewhat stronger for loans to enterprises than for loans for house purchase and consumer credit. The impact on credit standards was (broadly) neutral across all loan categories.

Over the next six months, banks expect the ECB’s monetary policy asset portfolio to continue to have a tightening impact on bank lending conditions across all categories of lending.

Chart 17

Impact of the ECB’s monetary policy asset portfolio on bank lending

(net percentages of banks reporting a tightening or increase)

Notes: The net percentages are defined as the difference between the sum of the percentages for “tightened/increased considerably” and “tightened/increased somewhat” and the sum of the percentages for “eased/decreased somewhat” and “eased/decreased considerably”. The last period denotes expectations indicated by banks in the current round.

Table 15

Impact of the ECB’s monetary policy asset portfolio on banks’ credit standards, terms and conditions and lending volumes

(net percentages of banks reporting a tightening/an increase)

Credit standards | Terms and conditions | Lending volumes | |||||||

|---|---|---|---|---|---|---|---|---|---|

Q2 23 – Q3 23 | Q4 23 – Q1 24 | Q2 24 – Q3 24 | Q2 23 – Q3 23 | Q4 23 – Q1 24 | Q2 24 – Q3 24 | Q2 23 – Q3 23 | Q4 23 – Q1 24 | Q2 24 – Q3 24 | |

Loans to enterprises | 2 | 1 | 5 | 7 | 3 | 2 | -5 | -4 | -4 |

Loans to households for house purchase | 3 | 0 | 4 | 4 | 4 | 2 | -5 | -2 | -4 |

Consumer credit and other lending to households | 3 | 0 | 3 | 3 | 3 | 1 | -2 | -3 | -4 |

Note: See the notes to Chart 17. The last period denotes expectations indicated by banks in the current round.

5.3 There was a moderate negative impact of the phase-out of TLTRO III on banks’ financial situation[11]

Banks continued to indicate a negative impact of the phase-out of TLTRO III on their overall liquidity position over the past six months, with only a small tightening impact on their funding conditions (see Chart 18 and Table 16). Maturing TLTRO III funds and their early voluntary repayment continued to have a moderate negative impact on banks’ liquidity positions. Given the very significant repayments made since November 2022 and the comparatively small remaining outstanding amounts of TLTRO III, the impact on banks’ overall funding conditions, including market financing conditions, was only moderately negative. The impact on profitability, as well as the impact on banks’ ability to fulfil regulatory or supervisory requirements, were reported to be broadly neutral, with the latter also reflecting the increasingly shorter residual maturity of the remaining TLTRO funds.

Over the next six months, banks expect the phase-out of TLTRO III to have a further negative impact, primarily on their liquidity situation and, to a lesser extent, on their overall funding conditions. As repayments continue, banks expect TLTRO III to exert only a small negative impact on their market financing conditions, and a broadly neutral impact on their profitability.

Banks reported a neutral impact of TLTRO III on lending conditions and loan volumes across all lending segments over the last six months, which is expected to continue over the next six months (see Chart 19 and Table 17). The muted impacts on credit standards, terms and conditions and lending volumes reflect the significant repayments and the comparatively small remaining outstanding TLTRO III funds. Over the next six months, euro area banks expect the phase-out of TLTRO III to have a neutral impact on their lending conditions. Banks also expect a broadly neutral impact on loan volumes across all categories of lending.

Chart 18

Impact of TLTRO III on banks’ financial situation

(net percentages of banks reporting an improvement)

Notes: The signs for these net percentages have been inverted to show net improvements. The net percentages are defined as the difference between the sum of the percentages for “contributed considerably to an improvement” and “contributed somewhat to an improvement” and the sum of the percentages for “contributed somewhat to a deterioration” and “contributed considerably to a deterioration”. “Overall funding conditions” was added in the first quarter of 2023. The last period denotes expectations indicated by banks in the current round.

Table 16

Impact of TLTRO III on banks’ financial situation

(net percentages of banks reporting an improvement)

Liquidity position | Financing conditions | Profitability | Ability to fulfil regulatory or supervisory requirements | |||

|---|---|---|---|---|---|---|

Overall | Market financing conditions | |||||

Q2 2023 – Q3 2023 | -20 | -12 | -8 | -10 | 3 | |

Q4 2023 – Q1 2024 | -12 | -3 | -4 | 1 | 0 | |

Q2 2024 – Q3 2024 | -13 | -4 | -2 | -1 | 0 | |

Note: See the notes to Chart 18. The last period denotes expectations indicated by banks in the current round.

Chart 19

Impact of TLTRO III on bank lending conditions and lending volumes

(net percentages of banks reporting a tightening or increase)

Notes: Net percentages are defined as the difference between the sum of the percentages for “contributed considerably to a tightening or increase” and “contributed somewhat to a tightening or increase” and the sum of the percentages for “contributed somewhat to an easing or decrease” and “contributed considerably to an easing or decrease”. The last period denotes expectations indicated by banks in the current round.

Table 17

Impact of TLTRO III on banks’ credit standards, terms and conditions and lending volumes

(net percentages of banks reporting a tightening/an increase)

Credit standards | Terms and conditions | Lending volumes | |||||||

|---|---|---|---|---|---|---|---|---|---|

Q2 23 – Q3 23 | Q4 23 – Q1 24 | Q2 24 – Q3 24 | Q2 23 – Q3 23 | Q4 23 – Q1 24 | Q2 24 – Q3 24 | Q2 23 – Q3 23 | Q4 23 – Q1 24 | Q2 24 – Q3 24 | |

Loans to enterprises | 1 | 0 | 0 | 4 | 1 | 0 | -2 | 0 | 0 |

Loans to households for house purchase | 2 | 0 | 0 | 5 | 1 | 0 | -3 | 0 | 1 |

Consumer credit and other lending to households | 2 | 0 | 0 | 4 | 0 | 0 | -2 | 0 | 0 |

Note: See the notes to Charts 19. The last period denotes expectations indicated by banks in the current round.

5.4 The positive impact of the ECB’s key interest rate decisions on bank margins is expected to diminish in the next six months[12]

Euro area banks reported a further markedly positive impact of the ECB’s key interest rate decisions on their net interest margins over the past six months (net percentage of 40%, see Chart 20 and Table 18). At the same time, a substantial net share of banks (21%) continued to report a negative net impact via volumes. The increase in margins outweighed the volume effect, yielding a high share of banks reporting a positive impact on their net interest income and overall profitability. Banks reported broadly unchanged impacts on net fee and commission income and capital losses, which were echoed by a similar development in banks’ non-interest income. The positive impact on net interest income continued to be the driving factor behind the overall positive impact in net terms on bank profitability. Banks also indicated a small net dampening impact of the ECB’s rate decisions on profitability via higher provisioning needs and impairments, although this was lower than that reported for the previous six months.

Chart 20

Impact of the ECB’s interest rate decisions on euro area bank profitability

(net percentages of banks; over the past six months and the next six months)

Notes: The net percentages refer to the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably". The last period denotes expectations indicated by banks in the current round.

Chart 21

Impact of the ECB’s interest rate decisions on net interest income and non-interest income

(net percentages of banks; over the past six months and the next six months)

Notes: The net percentages refer to the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably". Net percentages are inverted in the case of provisioning and impairments. The last period denotes expectations indicated by banks in the current round.

Euro area banks expect the cumulative net impact of the ECB’s key interest rate decisions on bank profitability to diminish over the next six months (-19%).[13] Banks also expect a further, albeit lower, negative impact of the ECB’s interest rate decisions on volumes. The impact of the ECB’s interest rate decisions via higher provisioning needs and impairments is expected to remain slightly negative, while a positive impact is expected for non-interest income, driven by net fee and commission income.

Table 18

Impact of ECB interest rate decisions on bank profitability

(net percentages of banks reporting an increase)

Q2 2023 – Q3 2023 | Q4 2023 – Q1 2024 | Q2 2024 – Q3 2024 | |

|---|---|---|---|

Profitability | 41 | 35 | -22 |

Net interest income | 43 | 38 | -21 |

Owing to: margin effect | 43 | 40 | -19 |

Owing to: volume effect | -32 | -21 | -14 |

Non-interest income | -4 | -1 | 3 |

Owing to: capital gains/losses | -4 | -1 | 0 |

Owing to: net fee and commission income | -10 | 1 | 6 |

Provisioning and impairments | -11 | -3 | -3 |

Notes: See the notes to Charts 20 and 21. The last period denotes expectations indicated by banks in the current round.

Annexes

c

end of last year

No comments:

Post a Comment