US missile deployment could push China to further militarize South China Sea

Mid-range launcher now in the Philippines is a ‘powerful weapon’ capable of retaliatory strikes on mainland China, analysts say.

South China Sea: will Beijing ramp up militarisation after US missile system deployed in the Philippines?

- Mid-range launcher is ‘powerful weapon’ capable of striking mainland China, analysts say

- ‘Growing threat’ from US could justify even more PLA forces in disputed waters, expert says

Listen to this article

Beijing may further militarise the South China Sea, analysts said, after the “surprising” deployment of a US mid-range missile launcher in the Philippines, putting mainland China and Taiwan in striking distance.

The US Army Pacific said on Monday the service “successfully” deployed its Mid-Range Capability (MRC) missile system, also known as the Typhon Weapon System, on the northern Philippine island of Luzon on April 11.

RELATED

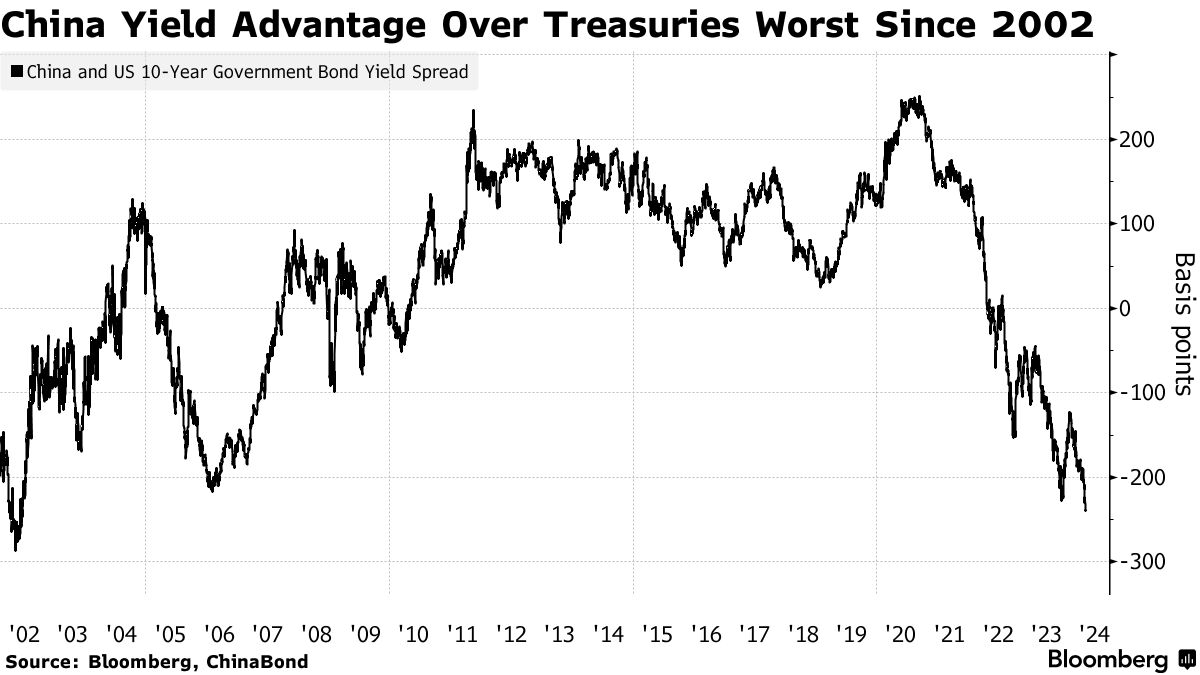

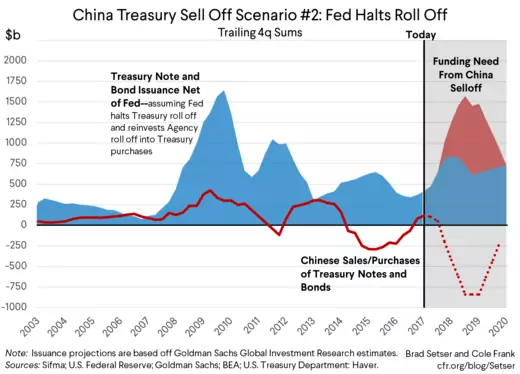

China sells more US Treasury bills as Fed signals low interest in rate cuts

China has continued to sell its holdings in US debt as the likelihood of expected interest rate cuts grows more remote and Beijing looks to widen the diversity of its foreign asset pool.

China unloads more US Treasury bills as odds of Fed rate cuts grow slim | South China Morning Post

China unloads more US Treasury bills as odds of Fed rate cuts grow slim

- With the Federal Reserve suggesting interest rate cuts are unlikely in the immediate future, China has unloaded more of its US Treasury holdings

- Beijing’s foreign holdings have grown more diverse as country moves to reduce its stake in US debt and minimise the impact of geopolitics on its assets

Worries over security and a further delay to expected interest rate cuts by the Federal Reserve have depleted Beijing’s appetite for US Treasury bills, and its position as the second-largest foreign holder of the financial instruments could be taken by the UK in coming months, analysts warned.

The world’s second-largest economy offloaded US$22.7 billion of the bills in February, with its total holdings adding up to US$775 billion as of the end of that month, according to figures released by the US Treasury Department on Wednesday.

Japan consolidated its place as top buyer with an addition of US$16.4 billion in bills to its coffers in February for a total US$1.168 trillion of US debt, while the holdings of the United Kingdom rose to US$700.8 billion from US$691.2 billion during the same period.

“China’s overseas investment has been concentrated on US Treasuries in the past, [but] there is space for the Chinese government to further cut back its holdings in the future,” said Zhao Xijun, a finance professor at Renmin University in Beijing. . ."

The world’s second-largest economy offloaded US$22.7 billion of the bills in February, with its total holdings adding up to US$775 billion as of the end of that month, according to figures released by the US Treasury Department on Wednesday.

Japan consolidated its place as top buyer with an addition of US$16.4 billion in bills to its coffers in February for a total US$1.168 trillion of US debt, while the holdings of the United Kingdom rose to US$700.8 billion from US$691.2 billion during the same period.

“China’s overseas investment has been concentrated on US Treasuries in the past, [but] there is space for the Chinese government to further cut back its holdings in the future,” said Zhao Xijun, a finance professor at Renmin University in Beijing. . ."

RELATED

.png)

No comments:

Post a Comment