|

| 3 months later and into the 1st Quarter. . . |

May 25, 2022

Is the Fed’s Soft Landing Realistic?

Is the Fed’s Soft Landing Realistic?

The Fed has declared its intention to create a soft landing as it pulls the inflation-addled US economy to the curb. But a brief look at the history of Fed monetary policy, plus today's unusual global economic conditions, suggest that might not be possible. Here are two reasons why the Fed’s soft landing may not be possible

(Bloomberg) -- Wall Street was rattled by data that showed exactly what traders did not want to hear: a significant slowdown in the world’s largest economy and persistent inflation pressures.

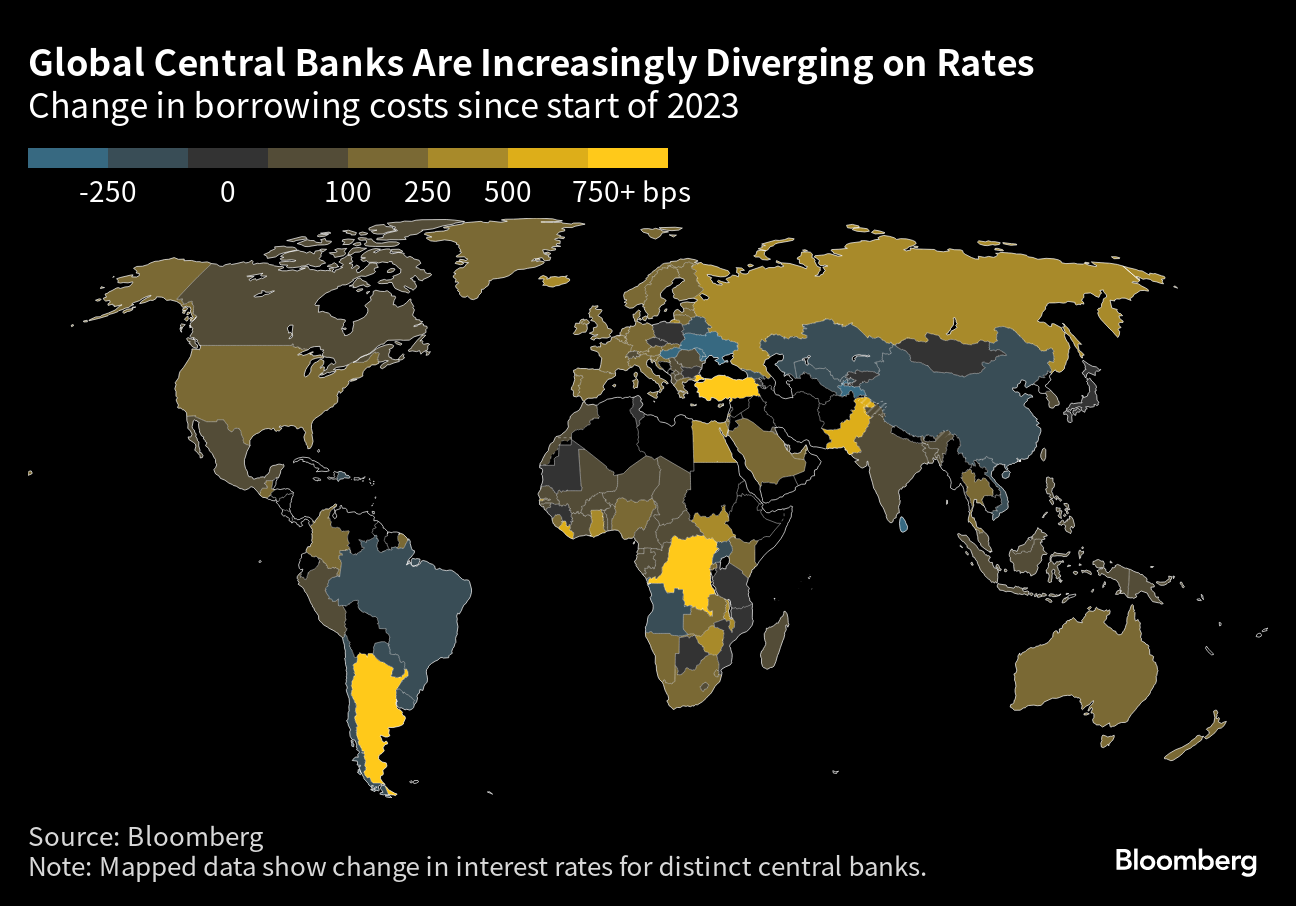

Treasuries sold off, with two-year yields hovering near 5% after economic figures that fueled “stagflation” jitters — bringing even more uncertainty to the path of Federal Reserve policy. Swap traders reacted accordingly — pushing back the timing of the first rate cut to December. Equities remained lower, but trimmed most of an earlier slide amid a rally in two heavyweights: Nvidia Corp. and Tesla Inc.

Fed’s Goolsbee Says Central Bank Needs to ‘Recalibrate’ Policy

The latest economic data interrupted a run of strong demand and muted price pressures that had fueled optimism for a “soft landing.”

Treasuries sold off, with two-year yields hovering near 5% after economic figures that fueled “stagflation” jitters — bringing even more uncertainty to the path of Federal Reserve policy. Swap traders reacted accordingly — pushing back the timing of the first rate cut to December. Equities remained lower, but trimmed most of an earlier slide amid a rally in two heavyweights: Nvidia Corp. and Tesla Inc.

Fed’s Goolsbee Says Central Bank Needs to ‘Recalibrate’ Policy

The latest economic data interrupted a run of strong demand and muted price pressures that had fueled optimism for a “soft landing.”

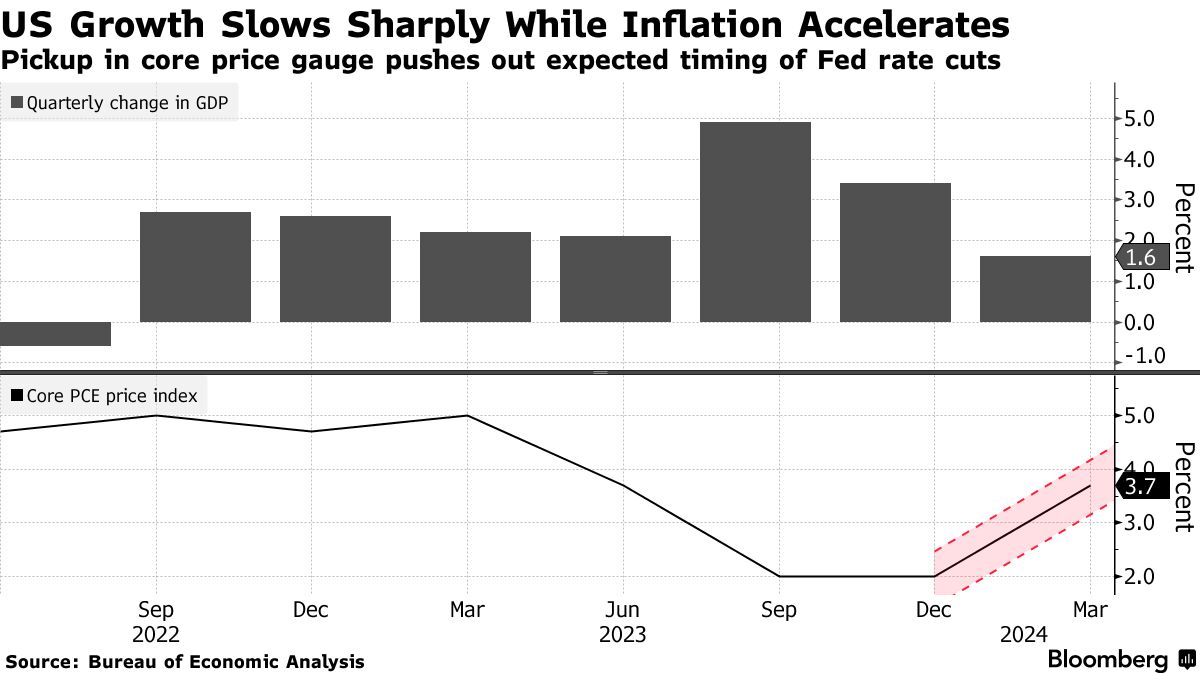

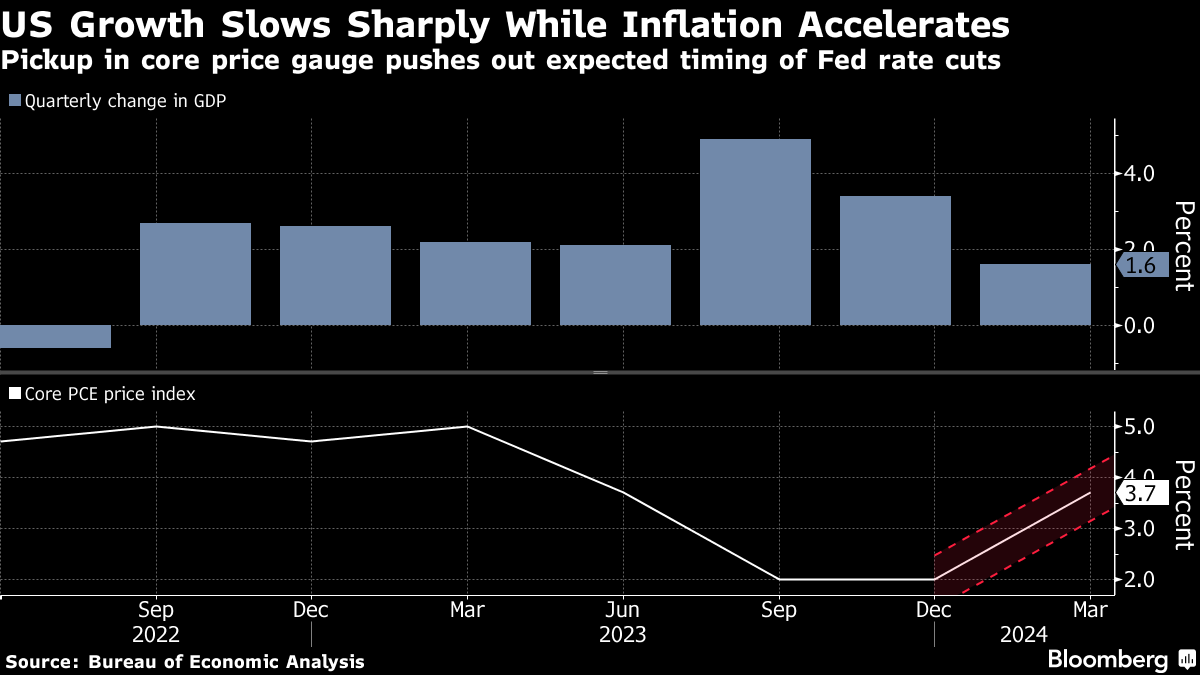

Gross domestic product increased at a 1.6% annualized rate, trailing forecasts.

A closely watched measure of underlying inflation advanced at a greater-than-expected 3.7% clip.

The S&P 500 hovered near 5,050, with Microsoft Corp. and Alphabet Inc. due to report results after the closing bell. Meta Platforms Inc. tumbled on plans to spend more than previously anticipated. Ten-year yields rose six basis points to 4.70%.

Cantor Fitzgerald Chief Executive Officer Howard Lutnick expects the Fed to cut rates a single time this year, just ahead of the US presidential election.

- “This report was the worst of both worlds: economic growth is slowing and inflationary pressures are persisting,” said Chris Zaccarelli at Independent Advisor Alliance.

- “The Fed wants to see inflation start coming down in a persistent manner, but the market wants to see economic growth and corporate profits increasing.”

The S&P 500 hovered near 5,050, with Microsoft Corp. and Alphabet Inc. due to report results after the closing bell. Meta Platforms Inc. tumbled on plans to spend more than previously anticipated. Ten-year yields rose six basis points to 4.70%.

- “The day the music died,” Bill Gross, the co-founder of Pacific Investment Management Co., posted on X.

- “10 year Treasury moving to 4.75%.

- own bonds?”

- He also said: “Stick to value stocks, avoid tech for now.”

Cantor Fitzgerald Chief Executive Officer Howard Lutnick expects the Fed to cut rates a single time this year, just ahead of the US presidential election.

___________________________________________________________________________________

.gif)

No comments:

Post a Comment