Macron Puts French Banks in Play With Plan to Transform Europe

The French President signals he’d be open to cross-border bank M&A as he sets out the case for a transformative shift in the continent’s economic model

(Updates with market reaction in 13th paragraph)

(Bloomberg) — President Emmanuel Macron said he would be open to seeing a major French bank being taken over by a European Union rival in order to spur the deeper financial integration he sees as critical for the bloc’s future prosperity.

“Dealing as Europeans means you need consolidation as Europeans,” Macron said in an interview with Bloomberg Editor-in-Chief John Micklethwait on the sidelines of the Choose France investment summit in Versailles near Paris. “We have now to open this box and to deliver a single-market approach which is much more efficient.”

Lire en français. | Lesen Sie es auf deutsch.

As Europe comes to terms with Russia’s war in Ukraine and the steady deterioration of the global trading system, Macron has been trying to persuade his EU partners to embrace what he sees as a transformative program of reforms to turn the EU into a more united and powerful economic force. Only by getting smarter about protecting its interests, cutting back on regulation inside the single market and unlocking the bloc’s financial firepower, Macron argues, does the EU have a chance of going toe-to-toe with China and the US.

- With €15 billion ($16 billion) of new foreign investment announced at Monday’s conference underlining the sea change from the days when his predecessor, Francois Hollande, declared that finance was the country’s enemy,

- Macron is trying to demonstrate that there is more to his vision than rhetoric.

- “We clearly bridged a gap with the others and now we are frontrunners in Europe,” he said, after spending the morning discussing Microsoft Corp.’s plans for expansion in France.

Failure, according to the French leader, would lock Europe on a path to long-term economic decline and irrelevance. Aides paint a bleak picture of what that would look like, with industrial decline, falling productivity, and crushing public debts made ever-heavier by the burden of a broad welfare state and aging population.

Watch the full interview here. Read the full transcript here.

“We’ve chosen France — it’s a very, very important hub for us here on the continent,” Goldman Sachs Group Inc. Chief Executive Officer David Solomon said in a television interview with Bloomberg’s Jonathan Ferro in Versailles. “I’d also say our people like living here,” he added.

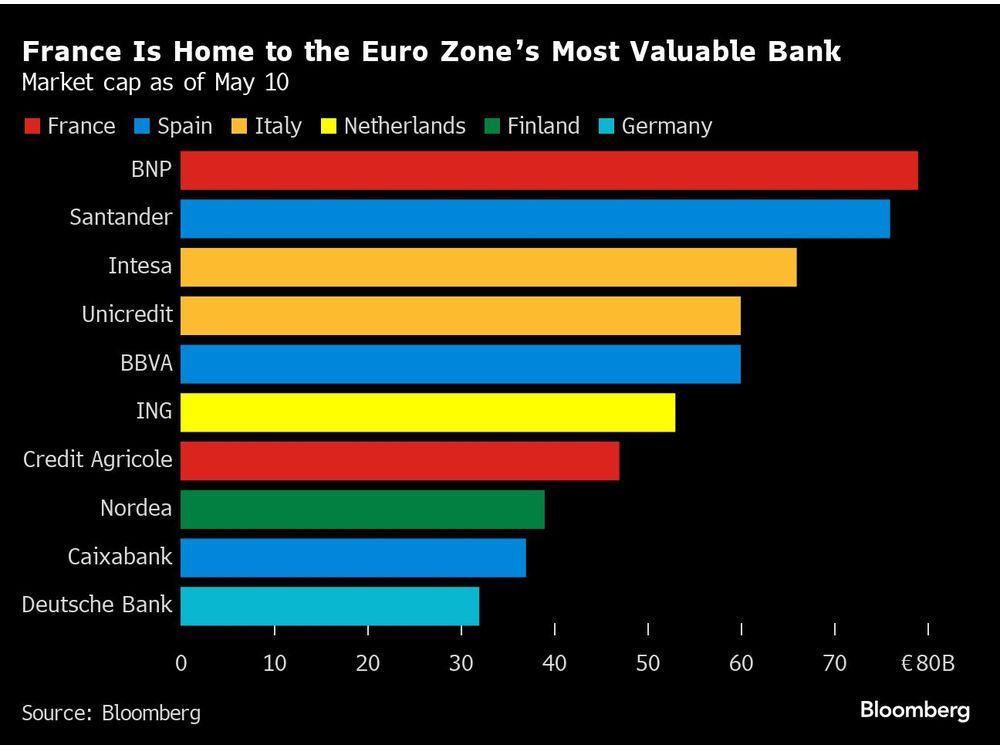

France is home to several of the biggest banks in the euro area, including BNP Paribas SA with a €2.7 trillion balance sheet that’s enough to rival the GDP of several countries.

- The bank has been called the JPMorgan Chase & Co. of Europe, yet its €80 billion market value is dwarfed by that of the top US banks.

“We do need a consolidation,” Macron said, so that BNP could buy smaller competitors. Asked if that could also include European rivals acquiring a French lender such as Societe Generale SA, he said, “Yes, for sure.”

Societe Generale shares rose as much as 3.1% on Tuesday, while Credit Agricole SA gained as much as 0.6%. BNP slipped as much as 0.4%.

Sign up for the Paris Edition newsletter to make sense of what’s happening in the city and what’s next for French business.

One reason for the problem dates back to the financial crisis, when individual governments had to step in and rescue their domestic banks, exposing the fractures in the European market. The region’s political leaders have made some progress in forging closer ties as a response to the subsequent sovereign debt crisis, handing oversight powers to the European Central Bank and establishing a joint authority for winding down failed lenders.

But the final piece of Europe’s so-called banking union — joint deposit insurance — is missing. Germany and like-minded countries have blocked efforts to move ahead, arguing that savers in their country shouldn’t be on the hook for losses at banks in other countries.

Bankers frequently say this hinders cross-border mergers in the bloc because funds in one country aren’t deemed to be as safe as those in another.

There’s also that fundamental European problem, that member states are reluctant to see their national champions bought up by bigger rivals, even if it helps to add muscle for the European economy as a whole.

“This is a totally new world and we do need this new business model for the Europeans,” Macron told Bloomberg on Monday.

The French leader set out the geopolitical framework of his thinking in a speech at Sorbonne University in Paris last month, where he argued that the world faces “an unprecedented moment of upheaval” and that the EU must act urgently to avoid being left behind.

In response, he said the EU needs to be less naive about adopting protectionist measures when its interests are threatened, since neither China nor the US is respecting the World Trade Organization rules any more. In addition, the EU’s budget should be increased by €1 trillion to accompany the rise in private investment by creating a single market in financial products and savings.

“We need much more investment based on common budget,” Macron said Monday. “We need 1 trillion more.”

Macron has established his credentials as a reformer since coming to power in France seven years ago.

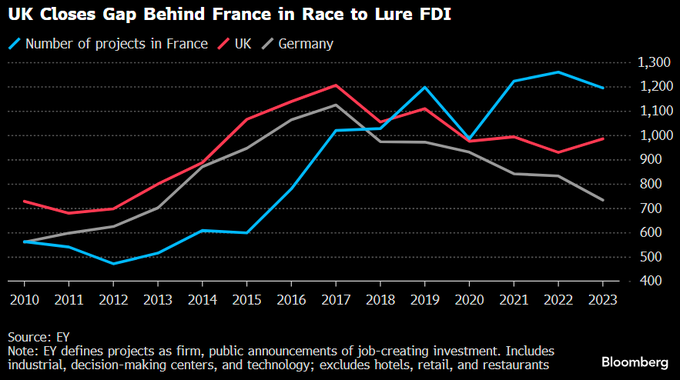

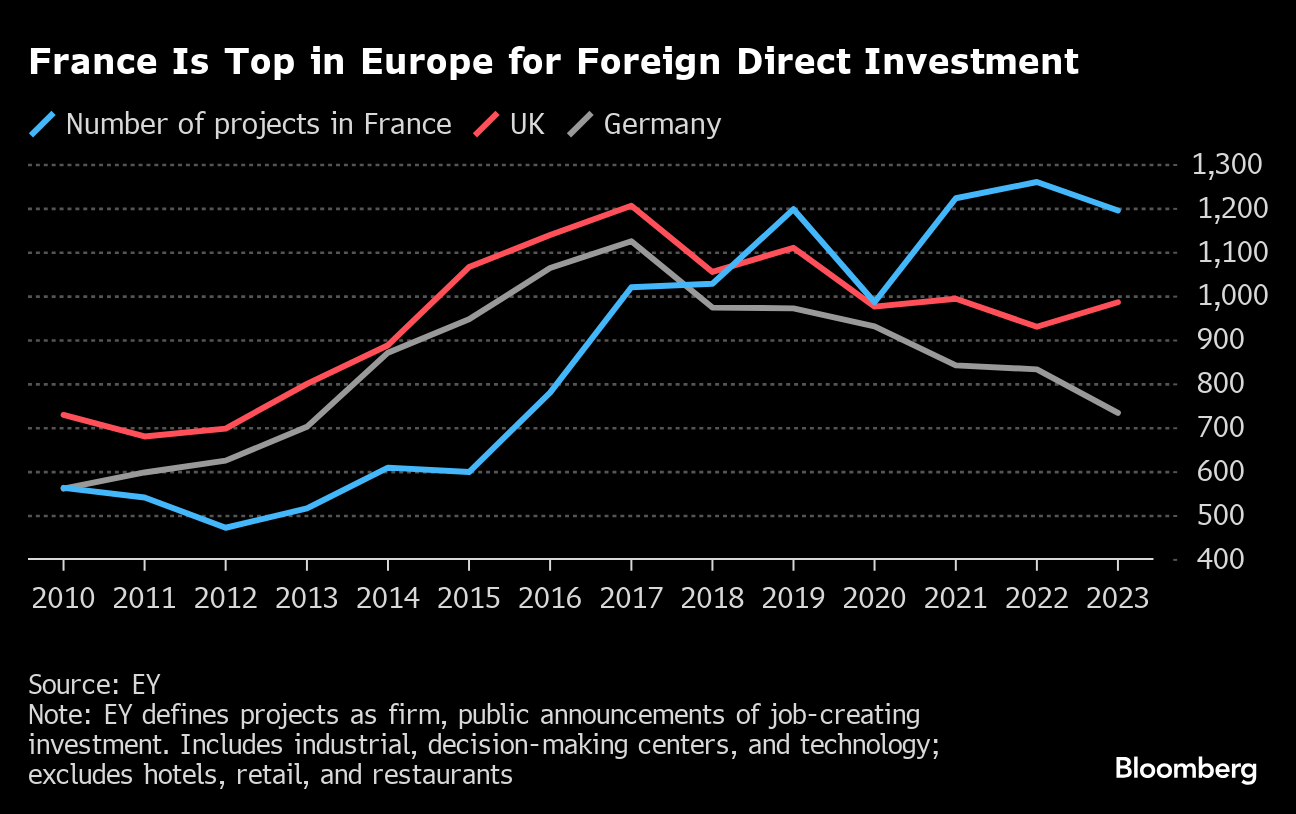

He rebuilt French credibility at the start of his term by taking steps to bring the budget deficit within EU limits — albeit briefly — and pushing through pro-business labor reforms that echoed Germany’s efforts from the early 2000s. The charm offensive has paid dividends, helping propel France to the top of rankings for attracting large investment projects.

Combined with tax cuts for businesses and labor overhauls to make it easier to hire and fire, that drove unemployment to near 40-year lows and pushed France’s growth rate above European peers.

But Macronomics is fraying at the edges now as the economy struggles to pick up from the inflation crisis and the jobless rate has stopped falling at a level well above Macron’s self-set target of full-employment. The president is struggling to rein in the budget deficit and debt is on an upward trajectory. All of that adds to the urgency of his appeal.

It’s not just in the energy industry where Macron’s grand vision comes face-to-face with the complexities of Europe’s existing economic framework.

TotalEnergies SE, another French company with the potential to become a European champion, is threatening to shift its primary listing to New York citing the burdensome climate regulation in Europe which CEO Patrick Pouyanne says restricts the oil producer’s access to capital and depresses its valuation. Total’s €165 billion market capitalization would be 40% bigger if its earnings were valued on the same basis as US rivals like Exxon Mobil Corp, according to Bloomberg calculations.

Macron said he would not be happy if Pouyanne eventually decided to move Total’s main listing. “And I would be very surprised,” he added. “The US regulation in terms of climate change should be more serious and realign on the European ones.”

While other European banks closed businesses in order to save on costs or capital, BNP Paribas stepped in to fill the breach.

- Notably in equities trading, the French lender prides itself on being the last firm in the European Union to operate a prime brokerage business.

- BNP Paribas became a clear candidate for acquiring banks across Europe when it freed up billions of euros with the well-timed sale of a US unit at the start of last year.

- Yet the French bank’s executives held off on big deals and instead used the capital to buy back shares, invest in its business and make so-called bolt-on acquisitions.

Big banks getting bigger also brings a set of regulatory complications. BNP Paribas could face higher capital surcharges as a result of the larger risks it could pose if its balance sheet were to swell or become more complex.

Read More:

The JPMorgan of Europe? French Giant BNP Paribas Is on a Roll

BNP Eyes Top European Equity Spot After Deutsche Bank Deal

Europe’s Banking Champion Has €7.6 Billion to Spend

EU Proposes Smoother Path for Winding Down Smaller Banks

- “As long as it’s not implemented by the US competitors, it should not be implemented by the European competitors,” he said.

- “This is a killer for risk taking because these regulations prevent our banks from investing in equity. Which is exactly what you need.”

- One major obstacle to Macron’s ambitions for Europe is France’s neighbor across the Rhine.

In 2018, the two countries began initiatives to support key sectors including electric batteries and hydrogen. When Covid struck, rules on state aid were also suspended and the ECB’s vast quantitative easing program gave governments the margin to adopt what Macron called a ‘whatever it takes’ approach to public spending.

- Most significantly, Merkel finally embraced a long-standing French proposal to launch a massive joint-debt program to invest in driving a long-term economic recovery.

Like-minded Europeans greeted that 2020 agreement as a breakthrough moment that laid to rest the German taboo over common financing.

But Olaf Scholz as chancellor has refused to engage with appeals from Macron and others in the bloc to discuss another round of joint bond issuance in order to build up Europe’s military capabilities, with the lack of chemistry between Europe’s essential leaders adding to the political divergence between their countries. German Finance Minister Christian Lindner last month told Bloomberg in Washington that for him it makes more economic sense for EU nations to remain responsible for their own budgets.

Macron is betting that as the economic and geopolitical pressure on Europe continue to mount, a degree of enlightened self-interest will help to bring the Germans around.

“The German economy’s interest is totally aligned with the French economy’s interest, meaning creating jobs, creating value, but just protecting your business and your people when they are attacked by unfair measures. And it’s normal, it’s part of the business,” he said. “For me it’s just a no-brainer.”

—With assistance from Nicholas Comfort, Caroline Connan, Phil Serafino, Zoe Schneeweiss and Arne Delfs.

(Updates with market reaction in 13th paragraph)