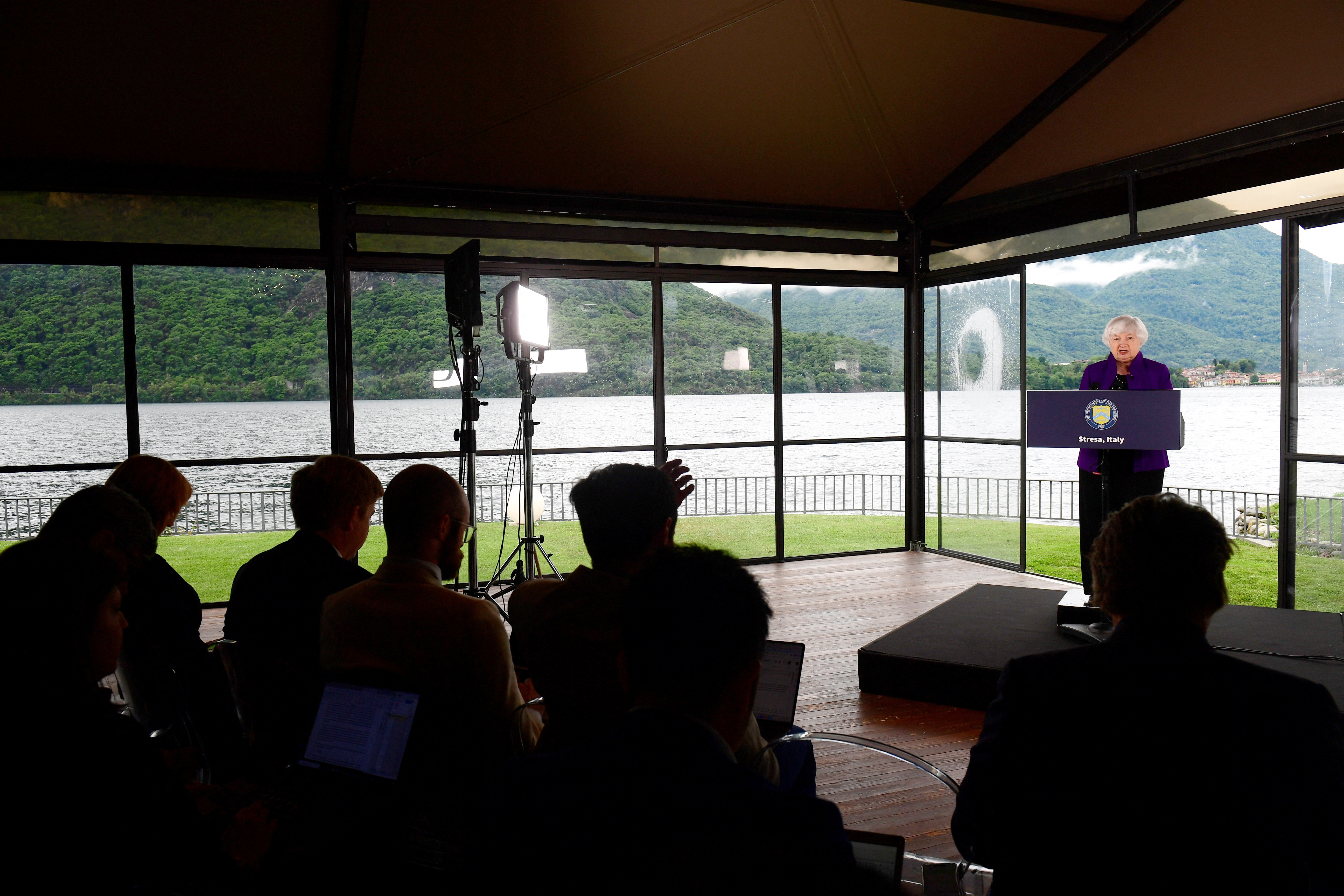

Remarks by Secretary of the Treasury Janet L. Yellen at Press Conference Ahead of the G7 Finance Ministers and Central Bank Governors Meetings

As Prepared for Delivery

Thank you to Italy for its leadership throughout this year and to Minister Giorgetti and his team for hosting us this week. And thank you to all of you for being here.

- U.S. GDP growth over the past year has been strong.

- Our labor market is healthy.

- And inflation has come down significantly from its peak, though we continue to take action to address the high costs of key household expenses.

- In brief, the U.S. economy is in far better shape than many predicted this time last year, and I believe continued progress on inflation will benefit both the American people and the global economy.

That said, we know that the recovery has been uneven across our countries and that there are risks to the global outlook.

This week, the G7 will discuss financial stability, macroeconomic policies, and how to prevent geopolitical issues from derailing economic growth. The United States will seek to drive progress on three priority areas: sustainable development, ongoing conflicts, and China’s industrial overcapacity.

SUSTAINABLE DEVELOPMENT

- As we look at a world with geopolitical uncertainty, it is essential that G7 countries work constructively with low- and middle-income countries and focus on how best to support them.

- The United States continued advancing the MDB evolution agenda at the Spring Meetings last month, including by joining ten other countries to announce new resources that could enable up to $70 billion in additional lending over 10 years to support projects addressing global challenges like climate change.

- Our recent national security supplemental included $250 million for the IDA Crisis Response Window, showcasing our commitment to supporting the poorest countries when they face grave challenges.

- And earlier this month, the United States and other donors concluded the $5 billion record 14th replenishment of the Asian Development Fund, which will incentivize addressing global and regional public goods and enable increased support to small island developing states in the Pacific and to the people of Afghanistan and Myanmar.

- For low-income countries, external debt service has risen to a level not seen in nearly two decades.

- official bilateral creditors,

- private actors, and

- the international financial institutions.

I look forward to maintaining momentum this week, and I’m glad Italy invited several emerging market countries to these meetings.

CONFLICTS

- Turning to ongoing conflicts, as we meet this week, our price cap policy continues to restrict Russian revenues while helping keep global energy markets stable.

- We’ve imposed coordinated sanctions to further diminish Russia’s revenues and restrict its access to technology and material, with the United States sanctioning nearly 300 individuals and entities just this month.

- As Putin spends more on his senseless war and draws resources away from other productive sectors, structural weaknesses are building up in the Russian economy.

- The U.S. will continue to press firms and financial institutions in China and other countries to cease their support for Russia’s military-industrial base, such as through supplying key inputs like optics and semiconductors.

- We will continue our efforts to make sure financial institutions are aware of the increased risks of sanctions since President Biden’s December Executive Order, which I believe has had a meaningful impact in disrupting Russian military-industrial supply chains.

- Even Putin’s spokesperson has acknowledged new difficulties.

- We will also use every tool at our disposal to disrupt Iran and North Korea supplying lethal aid to Russia.

- I’m heartened that the U.S. Congress approved over $60 billion in much needed military, economic, and humanitarian support for Ukraine last month.

- And I commend the EU’s progress on moving forward its 50 billion euro Ukraine Facility.

- But securing Ukraine’s position in the medium- to long-term requires unlocking the value of immobilized Russian sovereign assets.

- We support the EU’s decision to utilize the windfall profits from these assets, but we must also continue our collective work on more ambitious options, considering all relevant risks and acting together.

- Failure to take additional action is not an option—not for Ukraine’s future and not for the stability of our own economies and the security of our peoples.

- The United States and our strong global coalition are currently engaged in a battle of wills with Putin.

- We must be resolute and united in sending a message that he cannot simply wait out our coalition.

- We’ve recently worked with some G7 members to strengthen our coordinated efforts, including taking multiple joint sanctions actions.

- I urge other G7 members to join us in this effort to send a strong signal to Iran and its proxies that there will be severe consequences for its role in perpetrating violence and destabilizing the region.

- And we call on firms and financial institutions to cease their support to Iran through the supply and transshipment of the critical components for Iran’s advanced weapons programs.

- We’ve issued public guidance and conducted outreach to humanitarian groups to make sure that U.S. sanctions do not stand in the way of legitimate humanitarian assistance to Palestinians in Gaza.

- And my team and I have also engaged directly with the Israeli government to urge action that would bolster the Palestinian economy and, I believe, Israel’s own security.

- These banking channels are critical for processing transactions that enable almost $8 billion a year in imports from Israel, including electricity, water, fuel, and food, as well as facilitating almost $2 billion a year in exports on which Palestinian livelihoods depend.

- Israel’s withholding of revenues that it collects on behalf of the Palestinian Authority also threatens economic stability in the West Bank.

CHINA’S OVERCAPACITY AND UNFAIR TRADE PRACTICES

Finally, we’ll be focused here on China’s industrial overcapacity.

- As I’ve communicated directly to my Chinese counterparts, China’s macroeconomic imbalances are being aggravated by Chinese direct and indirect government support to the manufacturing sector.

- This is currently leading to production in some industries that significantly exceeds not only China’s domestic demand but also what the global market can bear.

- Without a new policy direction, including to lift Chinese demand instead of just boosting supply, this can lead to large volumes of exports at depressed prices.

This is not a bilateral issue between the U.S. and China.

- German Chancellor Scholz raised this issue in his April trip to China, and

- Macron and President von der Leyen emphasized the need for balanced trade relations with China earlier this month.

- The G7 has collectively recognized the need to protect our workers and businesses from unfair practices.

- And overcapacity threatens the viability of firms around the world, including in emerging markets. I believe it also poses a challenge to China’s growth.

President Biden has made clear that he will take action to stand up for American workers and companies, and last week the United States announced strategic and targeted steps in key sectors to respond to unfair trade practices by the PRC as a result of the Section 301 review.

The EU and other countries are already using their authorities to investigate and consider remedies to China’s actions with regard to electric vehicles, and many emerging market countries have launched anti-dumping investigations in a range of sectors.

- This week will be a key opportunity to discuss how China’s macroeconomic imbalances and industrial overcapacity can affect our economies.

- We’ll also discuss our responses and the approaches that we’re taking to raise these concerns directly with China.

- It’s critical that we and the growing numbers of countries who have identified this as a concern present a clear and united front.

I’ll now take your questions. . .

No comments:

Post a Comment