Trade deficits are on the back of America, creating higher domestic costs

Roach told a dialogue held by the Center for China and Globalization on Friday that while China’s contribution to global economic growth is slowing, the country remains the most powerful engine in the world.

Tariffs of more than $350 Billion on Chinese imports ...Claims of Overcapacity are Over done.

We need all the capacity we can get!

Stephen Roach, Senior Fellow at Yale Law School and former Morgan Stanley Asia chairman

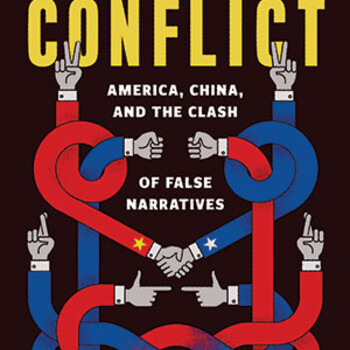

The misguided forces driving conflict escalation between America and China, and the path to a new relationship

“A timely, fluid, readable assessment of a testy and rapidly changing global relationship.”

— Kirkus Reviews (starred review)

In the short span of four years, America and China have entered a trade war, a tech war, and a new Cold War.

- This conflict between the world’s two most powerful nations wouldn’t have happened were it not for an unnecessary clash of false narratives.

- America falsely blames its trade and technology threats on China yet overlooks its shaky saving foundation.

- China falsely blames its growth challenges on America’s alleged containment of market-based socialism, ignoring its failed economic rebalancing.

Outlining the disastrous toll of conflict escalation between China and America, Roach offers a new road map to restoring a mutually advantageous relationship.

__________________________________________________________________

__________________________________________________________________

Consumption in focus

after ‘biased’ recovery

Analysts: Stronger supply side needs

efforts to expand domestic demand

By Ouyang Shijia

ouyangshijia@chinadaily.com.cn

China’s factory activity shrank

for the first time in three months

while the services sector expanded

at a faster pace in May, pointing to

a mixed picture amid uneven

recovery among sectors, analysts

said.

The latest economic indicators

point to an unbalanced recovery

with the supply side stronger than

the demand side, and the economy

still faces challenges from the moderation in private consumption

and the potential deceleration

across housing activity, they said.

Despite the pressures and difficulties ahead, the economic recovery will still be on track in the

following months, driven by a

ramp-up in fiscal stimulus, more

monetary easing and further

moves to tackle structural issues,

they said.

Their comments came as data

from the National Bureau of Statistics showed on Friday that China’s

official purchasing managers index

for the manufacturing sector stood

at 49.5 in May versus 50.4 in April,

below the 50-point mark that separates growth from contraction.

Zhou Maohua, a researcher at

China Everbright Bank, said the

manufacturing activity shrank

in May due to the impact of the

May Day holiday, while China’s

nonmanufacturing activity

remained in the expansionary

territory amid improvement in

the services sector.

- China’s services PMI grew to 50.5 in May from 50.3 in April.

- The country’s official composite PMI, which includes both manufacturing and nonmanufacturing activities, dropped from 51.7 in April to 51 in May, the NBS said.

“More efforts should be

made to spur consumption and

expand domestic demand. The

focus should be placed on speeding

up the implementation of key projects and better implementing the

announced property easing policies in accordance with various cities’ local conditions.”

Robin Xing, chief China economist at Morgan Stanley, said

China

has made incremental progress in

containing the risk of a debt-deflation loop, including a push for a

faster budget rollout and increasing efforts to support housing

inventory digestion.

- “We expect the augmented fiscal deficit to widen by 0.5 percentage point of GDP in both 2024 and 2025, though the focus may gradually shift from manufacturing upgrades this year to housing stabilization next year,” he said.

- “Meanwhile, there could be a 25- to 50-basis-point reserve requirement ratio cut in the next couple of months to facilitate government bond issuance, followed by a 20-basis-point policy rate cut in the second half of the year.”

Stephen Roach, senior research

scholar of the Paul Tsai China

Center at Yale Law School, said:

“China’s recent initiatives (to deal

with the property downturn) are

steps in the right direction.

- The property sector package has the right focus aimed at absorbing the inventory overhang of unsold housing units.”

- “It’s going in the right direction, but it needs far more funding support to really make a major dent in the overhang of unsold housing units.”

- “Without the Chinese consumer, I think economic growth is going to remain a big question mark in the years ahead.”

- He said it is advisable for the government to inject much more funding into the social safety net, healthcare and retirement.

- “I think that is the biggest impediment to discretionary consumption because it keeps families who are aging rapidly predisposed toward precautionary saving in providing for the future,” he said.

No comments:

Post a Comment