Watch: China Latest: Politburo Pledges Spending, Rate Cuts

The effort to jolt growth is more of a shotgun approach than the bazooka the market has been waiting for.

4 min readChina’s long-term focus still the same despite stimulus measures

Easing by China’s central bank will stabilise the economy for now, but the country is looking for a paradigm shift in its overall strategy

Having confounded expectations it would immediately follow a benchmark interest rate cut in the United States, China has now announced a whole bunch of measures in one go intended to have maximum effect in boosting a flagging economy.

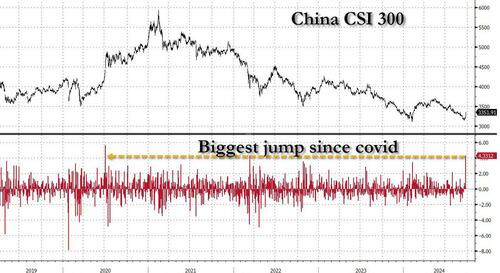

They amount to the most significant stimulus package since the pandemic.

- But it remains to be seen whether it is enough on its own. . .

RELATED

China’s central bank throws a lifeline to the struggling stock marketThe PBOC plans to set up a swap facility that would give financial institutions access to at least US$71 billion in funding to buy shares.

24 Sep 2024 - 6:18PM

- However, some analysts called for more drastic action to shore up investor confidence following more than three years of market declines.

Breakfast Bites: PBoC opens the taps for the markets

In an emergency press conference, China announces sweeping stimulus measures

Rise and shine everyone.

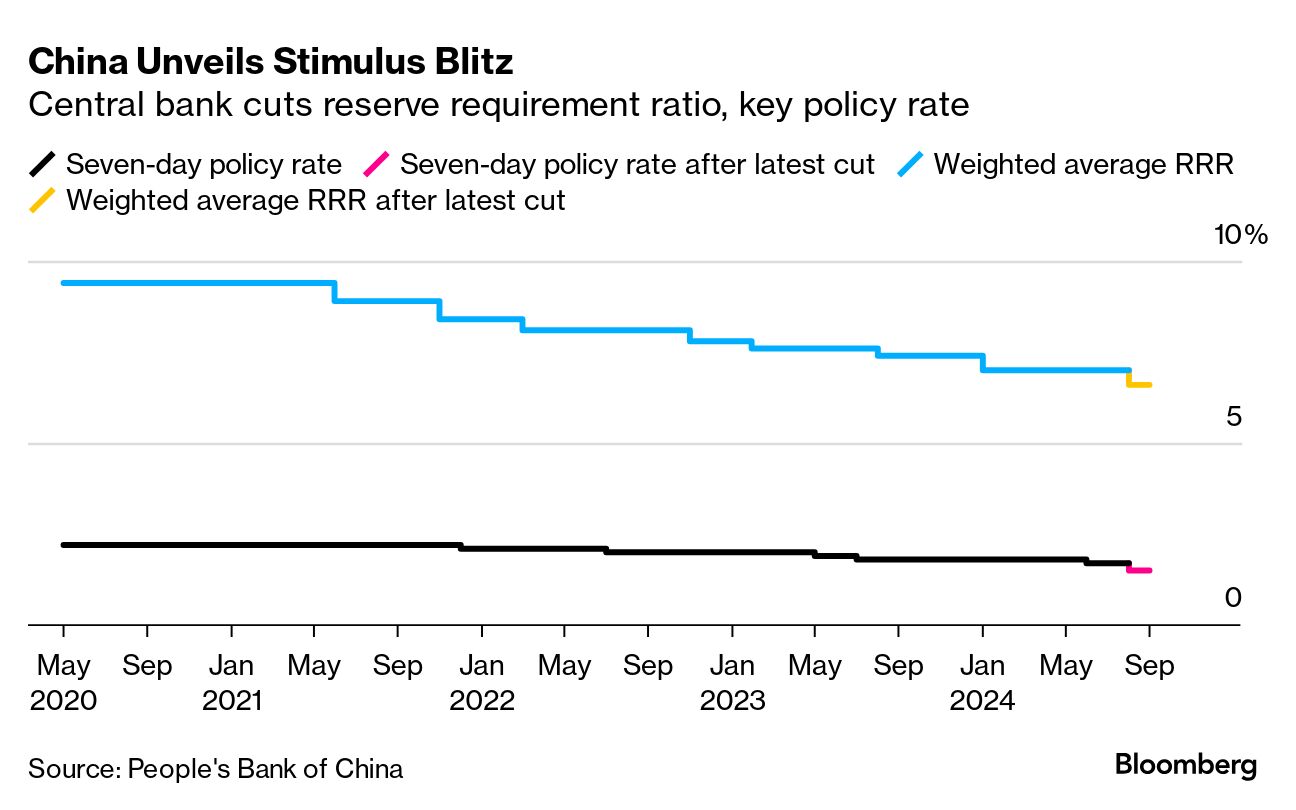

The big news this morning is the surprise press briefing at 9 am Beijing called by the PBoC and financial regulators to announce a host of cuts and stimulus announcements. A few of the measures are:

Cut 50bps - RRR broad reserve requirement to improve liquidity with a potential 25-50bps later in the year

Cut 20bps - 7-day Repo policy rate

LPR and Deposit Rate to be guided lower

Will cut 20-30bps - MLF (Medium Term Lending Facility)

Support mortgage market. Outstanding mortgage rates to be cut. Second home purchases min downpayment from 25% to 15%.

Funding support to be increase from 60% to 100% for property. Central support will increase for unsold homes.

Will establish new monetary policy rules to support the stability and development of the stock market. We will establish swap services. Companies to have increased access to liquidity.

A new monetary policy tool for the equity market

Special re-lending program to increase the holding of shares

Support share buybacks

This is as close to a bazooka stimulus package, as we have seen. The PBoC is definitely opening the taps for the stock market, and to a large extent the property market.

The main aim of this is to stimulate growth. The Government has a 5% GDP growth target, and all signs point to a miss. While we think these measures could certainly help the stock market, and to a large extent the commodity markets, it remains to be seen whether the measures are enough for the property market.

Shanghai Composite - 1Hour Chart

Stocks reacted positively to the news. Interestingly enough, even the CNH strengthened. Commodities are also bid this morning - Copper, Iron Ore and Crude Oil. Gold is pulling back as uncertainty subsides, somewhat.

USD/CNH - 1 Hour Chart

In other news, Australia’s Central bank RBA left rates unchanged, reiterating that they need to reach confidence on inflation. AUD/USD continue to climb.

Japan’s Manufacturing PMI say it’s third straight contraction, while Service PMI saw its third straight expansion. Governor Ueda spoke again this morning about not being in a rush to cut rates, and waiting to see how the economy evolves. The JPY weakened this morning.

Tax Cuts, Tax Levies and Incentives

Lots of news coming out of the Trump campaign around further tax cuts. The proposed cuts could amount to about $11T and there is some confusion as to how this could be managed in terms of government revenue and spending.

On the other hand, Trump also talked about levying taxes for US companies moving manufacturing overseas - if Deere moves manufacturing to Mexico, they will be hit by tariffs and taxes.

And finally, Trump also talked about personally recruiting foreign manufacturers to move to the US to create more domestic jobs.

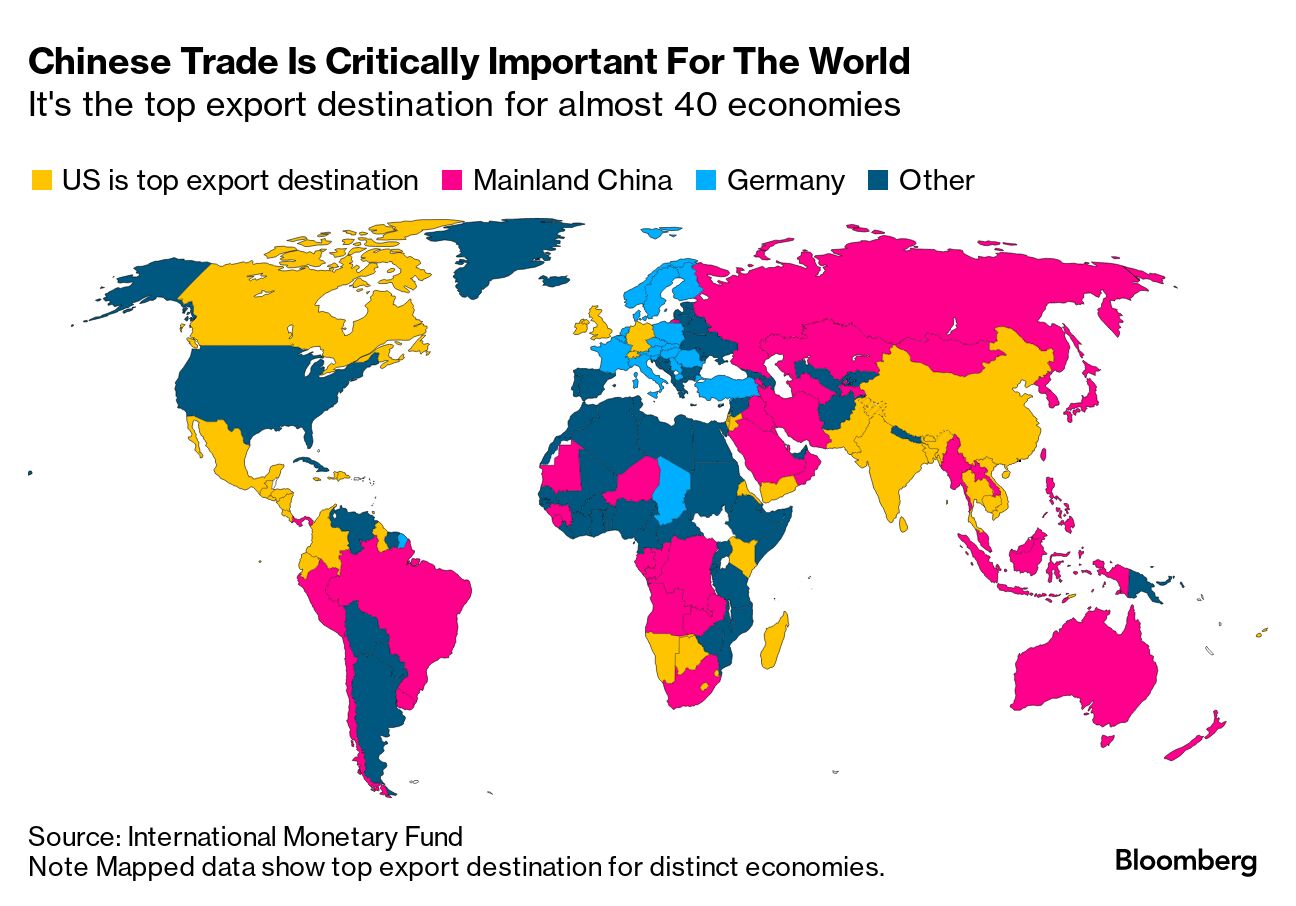

Europe’s China-Reliant Sectors Surge as Stimulus Fuels Optimism

(Bloomberg) -- European stocks at the forefront of concerns over a slowdown in China rallied strongly on Tuesday, after Beijing announced a package of stimulus measures to revive the world’s second-largest economy.

Miners, luxury goods makers, automobile manufacturers and financial firms notched gains. Miner Anglo American Plc, Gucci-owner Kering SA and insurer Prudential Plc were among the top performers in the Stoxx Europe 600 Index, all rising by around 5%.

China’s sluggish economy has been a concern for investors, given the influence of its consumers on demand for goods spanning pricey cognacs to luxury vehicles.

The second-quarter earnings season was marred by a string of profit warnings as a slowdown in the economic giant hit companies’ bottom lines.

However, Klement questioned whether the measures would ultimately be enough to create a sustained recovery.

German automakers remain heavily exposed to China’s downturn. Just this month, BMW AG and Mercedes-Benz Group AG slashed profit forecasts, sending shares in both tumbling. The two companies said the country’s protracted real estate crisis is weighing on consumer spending decisions. Both stocks were higher Tuesday.

The property troubles have dragged down metal prices. Iron ore, the biggest driver of profits for miners, has been among the worst-performing commodities this year, leading steel mills to curb output.

Futures jumped more than 5% on Tuesday, while copper and aluminum also advanced. Shares of BHP Group, Rio Tinto Group and Glencore Plc all gained at least 4% following Beijing’s package to shore up the real estate sector.

Luxury fashion groups LVMH and Hermes International SA, as well as premium distillers Diageo Plc and Pernod Ricard SA, have keenly felt the impact of weaker consumer demand in China.

Analysts have been growing more bearish on the sector as a demand recovery remains elusive.

“Consumer and industrial firms in Europe have been dealing with a double-whammy of weaker demand, both from inside Europe and from China. So, these measures at least help to alleviate some part of that problem,” said Michael Field, European market strategist at Morningstar.

Whether the package will be enough to help turn the economy around is debatable, Field added, noting already-low interest rates leave the People’s Bank of China with less room to maneuver.

“We have been there before, but given how depressed sentiment /positioning is on China exposure, latest stimulus headlines may provide a lift to the space, at least short-term,”

said Emmanuel Cau, head of European equity strategy at Barclays, in written comments.

--

With assistance from James Cone, Thomas Biesheuvel, Allegra Catelli, Michael Msika, Elisabeth Behrmann and Dasha Afanasieva.

:max_bytes(150000):strip_icc()/FCX_2024-09-24_16-36-28-95e84e16fb78475ab0cc675e1f785a85.png)

No comments:

Post a Comment