Note: This report was prepared at the Federal Reserve Bank of Cleveland based on information collected on or before August 26, 2024. This document summarizes comments received from contacts outside the Federal Reserve System and is not a commentary on the views of Federal Reserve officials.

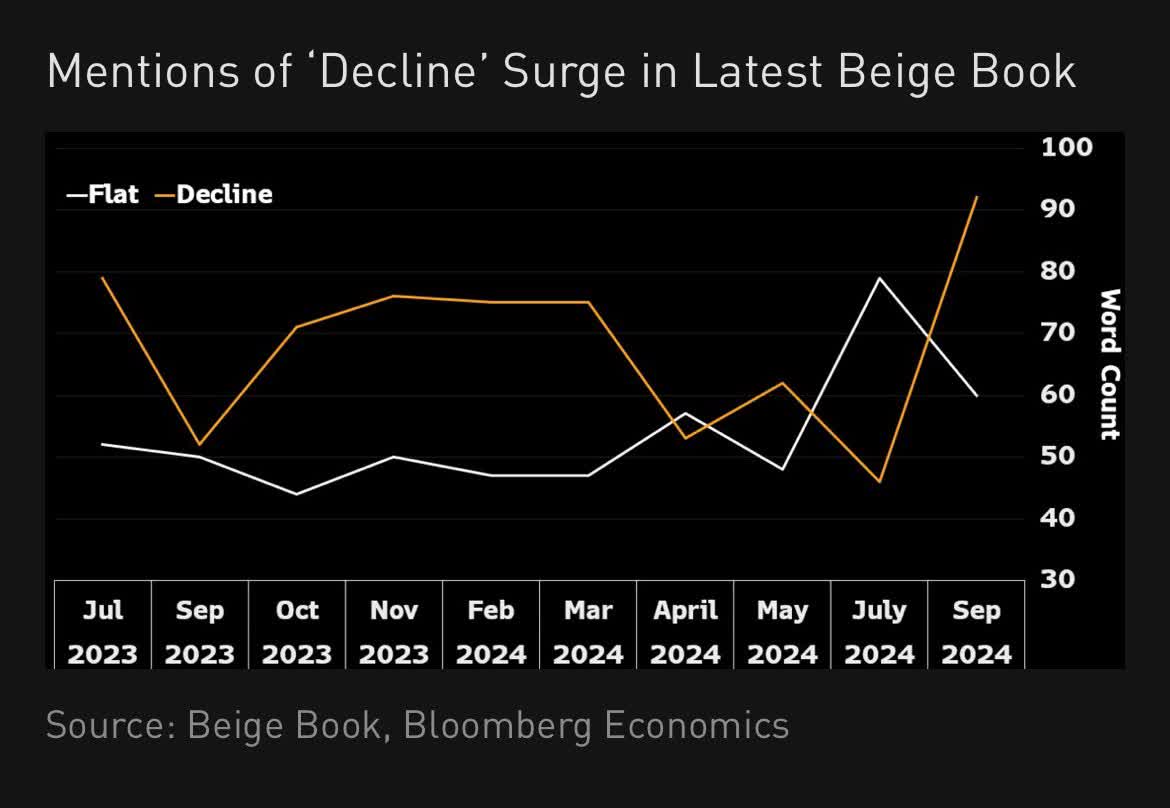

Fed Beige Book Shows Flat or Declining Economy in 9 of 12 Fed Districts

The economy is cooling must faster than most recognize. The Fed’s Beige Book provides more evidence.

The report is produced ahead of FOMC meetings. The Fed’s next monetary policy meeting is on September 18.

Overall Activity

- Economic activity grew slightly in three Districts, while the number of Districts that reported flat or declining activity rose from five in the prior period to nine in the current period.

- Employment levels were steady overall, though there were isolated reports that firms filled only necessary positions, reduced hours and shifts, or lowered overall employment levels through attrition. Still, reports of layoffs remained rare.

- On balance, wage growth was modest, while increases in nonlabor input costs and selling prices ranged from slight to moderate.

- Consumer spending ticked down in most Districts, having generally held steady during the prior reporting period.

Labor Markets

- Employment levels were generally flat to up slightly in recent weeks. Five Districts saw slight or modest increases in overall headcounts

- A few districts reported that firms reduced shifts and hours, left advertised positions unfilled, or reduced headcounts through attrition—though accounts of layoffs remained rare.

- Employers were more selective with their hires and less likely to expand their workforces, citing concerns about demand and an uncertain economic outlook.

- Candidates faced increasing difficulties and longer times to secure a job.

- As competition for workers has eased and staff turnover has fallen, firms felt less pressure to increase wages and salaries. On balance, wages rose at a modest pace, in line with the slowing trend described in recent reports.

- Skilled tradespeople and other workers with specialized skills remained in short supply and continued to see stronger wage increases, as did those in unions

By District

- Increased Modestly: Boston and Dallas

- Increased Slightly: Chicago

- Flat, Unchanged, Stable: New York, Kansas City, San Francisco, St. Louis

- Decline Slightly: Philadelphia, Atlanta, Minneapolis, Cleveland, Richmond

Last Month

On July 17, I noted 5 out of 12 Fed Districts Show Flat or Declining Economic Growth

This looks very recessionary because it is very recessionary. I think within 2-3 months a majority will be in decline.

Last month only Cleveland and Minneapolis showed any decline. Today, five of 12 districts do.

Nearing the Point Where Unemployment Is Greater Than Job Openings

Yesterday, I noted Nearing the Point Where Unemployment Is Greater Than Job Openings

The labor market softens again. Job openings drop and quits are below the pre-Covid level.

I am confident, unfortunately, that the majority of districts will be in contraction by then. Recession may be obvious.

Recession Discussion

August 2: The McKelvey (Sahm) Unemployment Rate Recession Rule Just Triggered

August 9: Recession Debate: Citing the Sahm Rule, WSJ’s Greg Ip Says No Recession

August 20: Improving the McKelvey Recession Indicator, No False Negative or Positive Signals

100 percent of the time since then, the economy has been in recession with the current conditions.

I will provide an update on Friday.

----

National Summary

Overall Economic Activity

Economic activity grew slightly in three Districts, while the number of Districts that reported flat or declining activity rose from five in the prior period to nine in the current period. Employment levels were steady overall, though there were isolated reports that firms filled only necessary positions, reduced hours and shifts, or lowered overall employment levels through attrition. Still, reports of layoffs remained rare. On balance, wage growth was modest, while increases in nonlabor input costs and selling prices ranged from slight to moderate. Consumer spending ticked down in most Districts, having generally held steady during the prior reporting period. Auto sales continued to vary by District, with some noting increases in sales and others reporting slowing sales because of elevated interest rates and high vehicle prices. Manufacturing activity declined in most Districts, and two Districts noted that these declines were part of ongoing contractions in the sector. Residential construction and real estate activity were mixed, though most Districts' reports indicated softer home sales. Likewise, reports on commercial construction and real estate activity were mixed. District contacts generally expected economic activity to remain stable or to improve somewhat in the coming months, though contacts in three Districts anticipated slight declines.

Labor Markets

Employment levels were generally flat to up slightly in recent weeks. Five Districts saw slight or modest increases in overall headcounts, but a few Districts reported that firms reduced shifts and hours, left advertised positions unfilled, or reduced headcounts through attrition—though accounts of layoffs remained rare. Employers were more selective with their hires and less likely to expand their workforces, citing concerns about demand and an uncertain economic outlook. Accordingly, candidates faced increasing difficulties and longer times to secure a job. As competition for workers has eased and staff turnover has fallen, firms felt less pressure to increase wages and salaries. On balance, wages rose at a modest pace, in line with the slowing trend described in recent reports. Skilled tradespeople and other workers with specialized skills remained in short supply and continued to see stronger wage increases, as did those in unions.

Prices

On balance, prices increased modestly in the most recent reporting period. However, three Districts reported only slight increases in selling prices. Nonlabor input cost increases were largely described as modest to moderate and as generally easing, though one District described input cost increases as ticking up. A number of Districts observed that both freight and insurance costs continued to increase. By contrast, some Districts noted that cost pressures moderated for food, lumber, and concrete. Looking ahead, contacts generally expected price and cost pressures to stabilize or ease further in the coming months.

Highlights by Federal Reserve District

Boston

Economic activity increased modestly, but results varied widely. Residential real estate led recent activity, with strong increases in single-family home sales. Consumers' increased budget consciousness showed up in slightly softer retail and restaurant sales, and retailers perceived pressure to lower their prices. Job creation slowed. The outlook was mixed between optimism and increased caution.

New York

On balance, regional economic activity remained flat. Labor market conditions continued to moderate, with ongoing cooling in labor demand and increased worker availability. Consumer spending was unchanged. Housing markets remained solid, with home prices edging up. Selling price increases remained modest.

Philadelphia

Business activity declined slightly in the current Beige Book period after rising slightly last period. Employment appeared to decline slightly, while consumer spending fell modestly. Nonmanufacturing activity held steady. Wage growth continued at a modest pace, as did reported rises in input costs and prices. Expectations for future growth remained slightly positive overall—growing more widespread for manufacturers but waning for others.

Cleveland

District business activity declined slightly in recent weeks, though contacts expected activity to increase slightly in the near term. Demand for manufactured goods softened further, and consumer spending declined moderately. Employment levels were stable to slightly up. On balance, wages and nonlabor costs increased modestly, while selling prices grew slightly.

Richmond

The regional economy contracted slightly this cycle after increasing slightly last period. Consumers pulled back on spending on goods and services, including travel and vehicles and other big-ticket items. Manufacturing activity also declined slightly while nonfinancial services firms reported flat demand in recent weeks. Employment continued to grow at a mild pace amid modest wage growth. Year-over-year price growth remained somewhat elevated.

Atlanta

Economic activity in the Sixth District declined slightly. Employment increased modestly and wages grew slowly. Prices grew modestly, and pricing power lessened. Consumer spending declined. Leisure travel slowed, but business travel improved. Housing activity declined. Demand for transportation services weakened. Loan volumes increased. Manufacturing activity fell. Energy activity expanded.

Chicago

Economic activity increased slightly. Employment and business spending rose slightly; manufacturing activity and consumer spending were flat; nonbusiness contacts saw little change in activity; and construction and real estate activity edged down. Prices were up modestly, wages rose moderately, and financial conditions were little changed. Prospects for 2024 farm income declined some.

St. Louis

Economic activity has remained unchanged since our previous report. Contacts reported weakening of household finances and overall lower demand. Employment has been stable and wage growth continued to moderate back toward longer-run trends. Prices to consumers have increased modestly, production costs have increased and are expected to be more persistent. The economic outlook has remained slightly pessimistic since our previous report.

Minneapolis

District economic activity fell slightly. Employment was flat and hiring softened, while wage growth was moderate. Price pressures eased as overall prices increased slightly but at a slower pace. Consumer spending was slightly lower, but tourism held up and vehicle sales increased. Manufacturing and construction activity declined. Agricultural conditions remained weak.

Kansas City

Economic activity in the Tenth District remained stable. Many contacts indicated they recently reduced hiring activity relative to their plans at the beginning of the year. Contacts reported particular weakness in demand for entry-level work. In housing markets, both brokers and homebuilders indicated activity is poised to rise if borrowing costs decline even slightly.

Dallas

The Eleventh District economy expanded modestly over the reporting period. Employment was stable, and wage growth remained moderate. Selling price growth continued below average in the service sector but was more typical in manufacturing. Outlooks were somewhat mixed, though most businesses expect demand to stay the same or increase over the next six months.

San Francisco

Economic activity remained stable, employment levels and prices rose slightly. Wages grew modestly, while retail sales were stable. Activity in consumer services and manufacturing ticked down a bit. Conditions in the agriculture, residential, and commercial real estate markets continued to soften slightly. Activity in the financial services sector remained muted.

No comments:

Post a Comment