Investors are

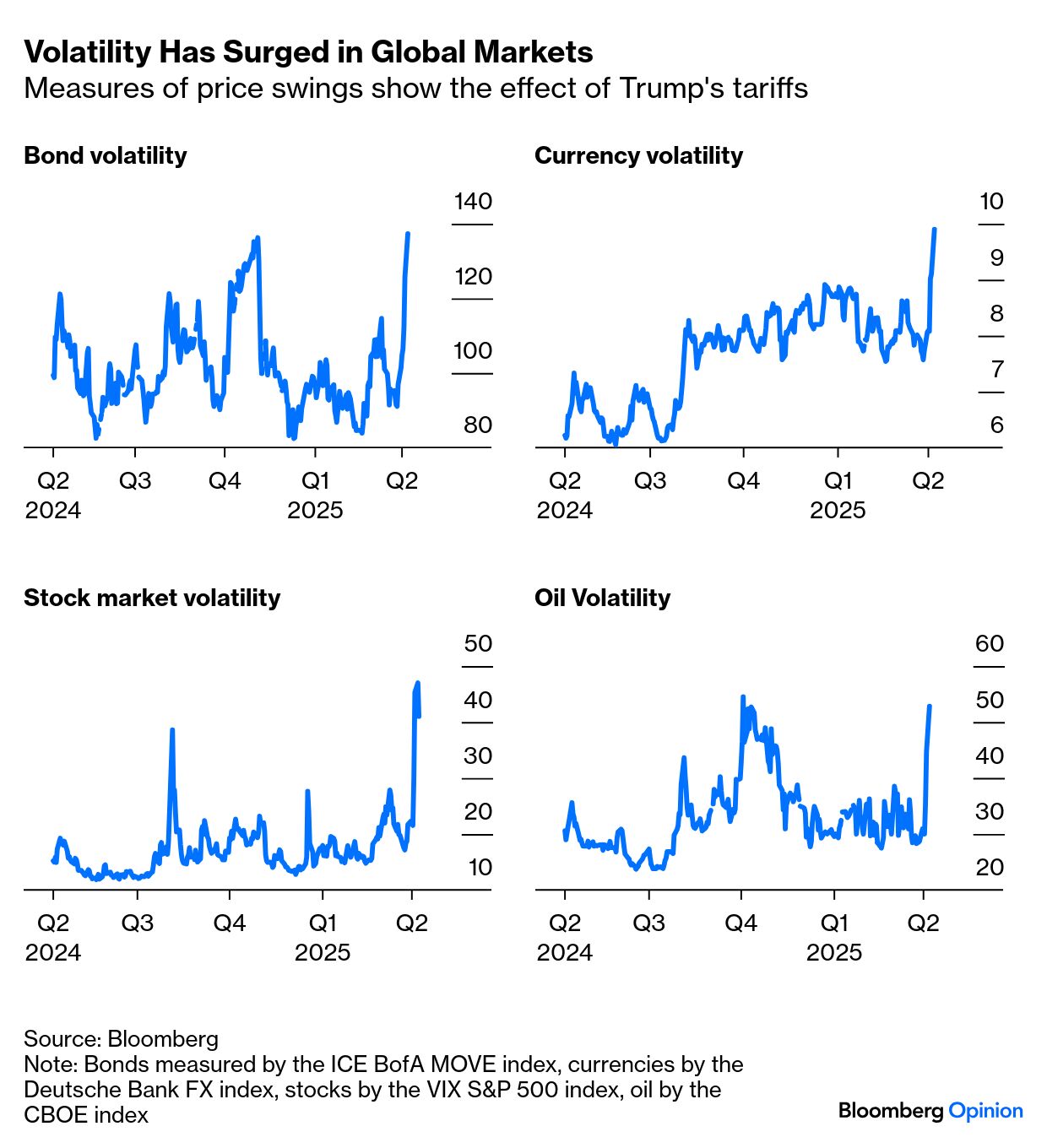

liquidating assets in a dash for cash as US President Donald Trump's

tariff war upends expectations for growth and spending around the world

Live

Bond Markets Crater Amid Dash for Cash on Tariff Fears

TOP STORIES

Bonds

Treasuries ‘Fire Sale’ Sends Long-Term Yields Soaring Worldwide

Have a confidential tip for our reporters? Get in Touch

Before it’s here, it’s on the Bloomberg Terminal

Takeaways NEW

The exodus from longer-dated US Treasuries accelerated, fueling the biggest selloff since 2020 in what are supposed to be the world’s safest assets.

The yield on 30-year Treasuries briefly soared above 5% with investors increasingly worried President Donald Trump’s tariffs, which kicked into effect today, will send the economy into recession and limit the Federal Reserve’s ability to respond by also igniting inflation. While the selling eased into the European trading day, speculation continued to swirl about the reasons investors were turning their backs on US sovereign debt.

No comments:

Post a Comment