US Risks Losing ‘Reliable Investment’ Status, Allianz GI Manager Says

“Project economics, supply-chain commitments, and capital flows may now pivot toward more stable jurisdictions like Canada or the EU, unless clarity is quickly restored,” he said.

It’s the latest wedge dividing Europe, where emissions reductions are anchored in law, and the US, where the Trump administration has mounted a full-throated attack on net zero policies. The bill agreed by House Republicans is even “worse than feared” for investors committed to energy transition strategies, according to equity analysts at Jefferies.

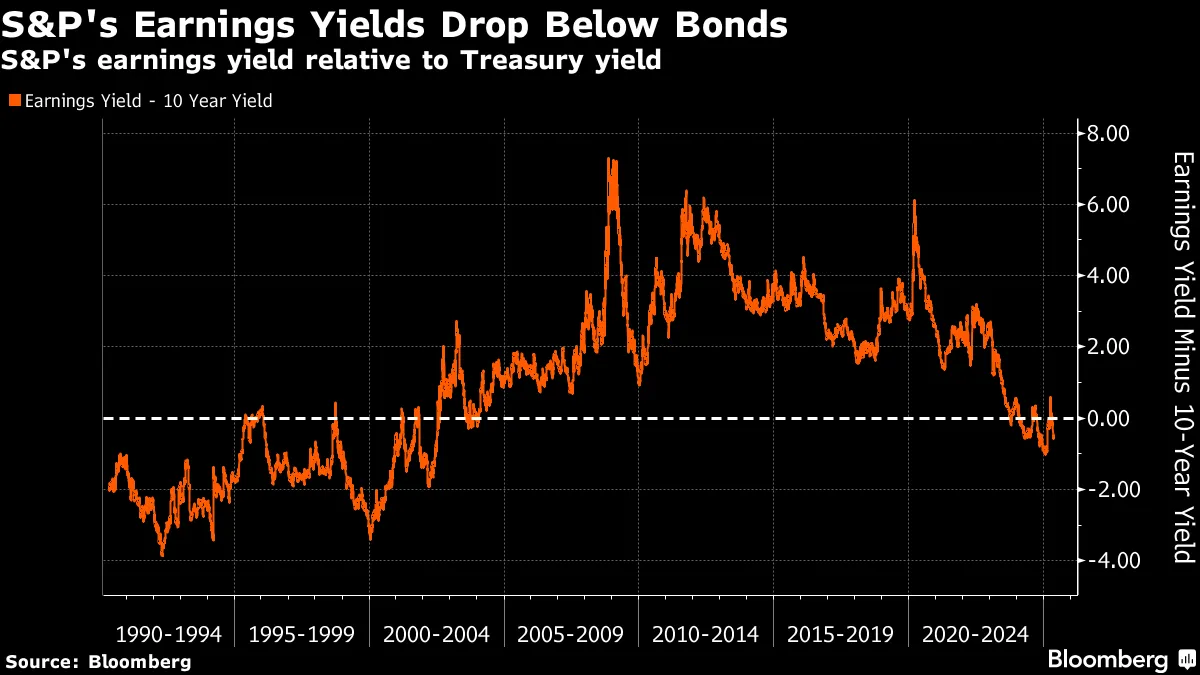

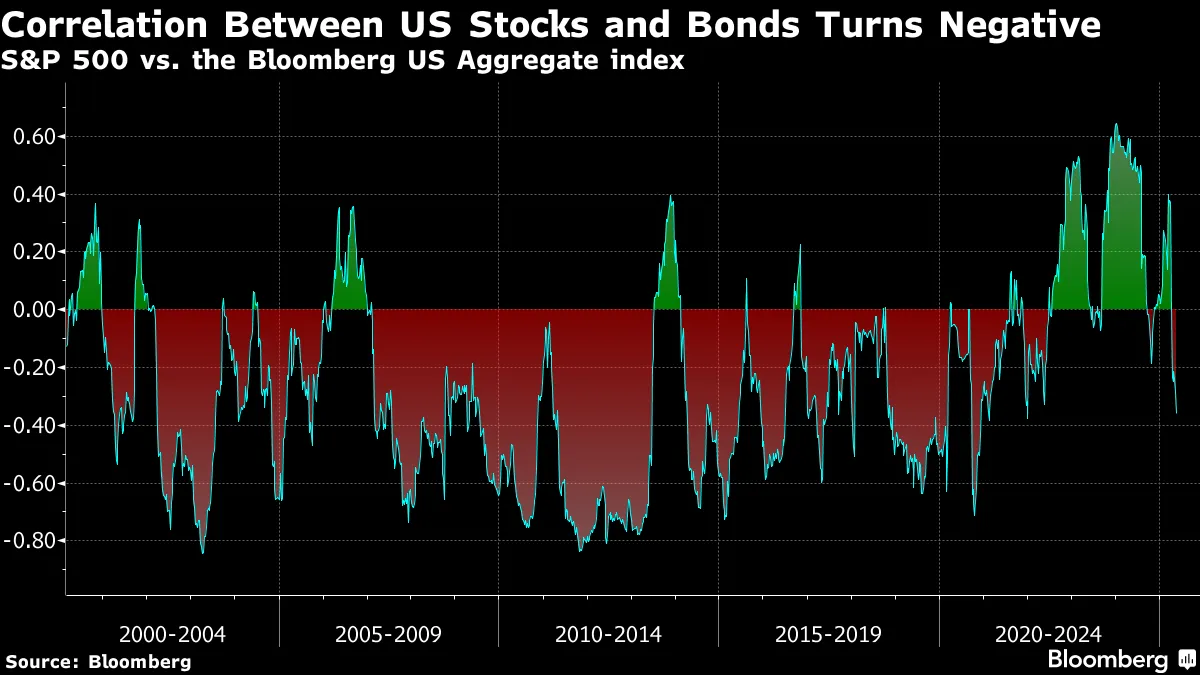

...The S&P 500 Index fell last week, while the yield on 30-year US Treasuries rose as high as 5.1% as markets digested news of the Republican bill, amid estimates it will add trillions of dollars to the deficit. President Donald Trump then ended the week by injecting further uncertainty into markets as he escalated the tariff war with the European Union, even declaring he’s “not looking for a deal.” The dollar fell.US hostility toward energy-transition policies has already sent a chill through European investing circles, where such strategies are a major driver of flows.

- Amundi SA, Europe’s largest asset manager, said last month it was seeing evidence that clients had “massively repositioned” to avoid the US market, amid concerns over everything from a lack of stewardship to a degradation of key climate policies.

- UBS Group AG also said it was aware of sizeable flows out of US equity exchange-traded funds.

No comments:

Post a Comment