Watch out for dollar FX fall more than 'de-dollarization'

European Central Bank boss Christine Lagarde recently put a spotlight on this shift in market thinking, noting "highly unusual cross-asset correlations" involving simultaneous drops in the dollar, Treasuries and U.S. stocks after Trump's import tariffs announcement in April.

But

despite all of the de-dollarization noise, there are still no clear

indications of a mass withdrawal from dollar assets at large.

- In fact, some investors dismiss these fears altogether given the pattern of the past 10 years.

Bank

of America strategist Ralph Axel argues that despite all of the

speculation, the world has actually been "rapidly dollarizing" over the

past decade - at least in the sense that dollar liabilities have

expanded enormously.

In

a research report on Thursday, Axel points in particular to the growth

of the so-called shadow banking system, otherwise known as "Non-Bank

Financial Intermediation", or NBFI, and refers to the universe of

investment funds, private credit firms and even crypto funds that exist

outside the regulated banking system.

- All dollar liabilities are effectively "money" in the sense that they can be sold for dollar cash and are thus ultimately claims on the Federal Reserve.

- Some of these liabilities are direct claims, such as U.S. Treasuries, but there are a blizzard of indirect claims through uninsured deposits, mortgage and corporate debt and investment fund shares.

Dollar

liabilities have clearly ballooned in the past decade. The U.S. federal

debt has increased four-fold in less than 10 years to some $36

trillion, while bank deposits have more than doubled to $18 trillion

since 2008.

And,

as Axel points out, the total size of "shadow banks" has also more than

doubled since 2009 to roughly $63 trillion, according to S&P Global

data. While much of this expansion simply reflects asset price

appreciation, Axel notes that "the NBFI system can only grow because of

demand for its liabilities."

The

point of all this number-crunching is to undermine the simplistic

de-dollarization narrative. If de-dollarization were truly accelerating

then fewer, not more, U.S. liabilities could be created, whether from

the government, traditional lenders or shadow banks. And the trend has

clearly been the other way.

"A

big selling wave can move prices and exchange rates temporarily but

does not de-dollarize," he wrote. "As a result, we think the

de-dollarization theme is less threatening, especially given what

appears to be a stronger trend of global dollarization over time."

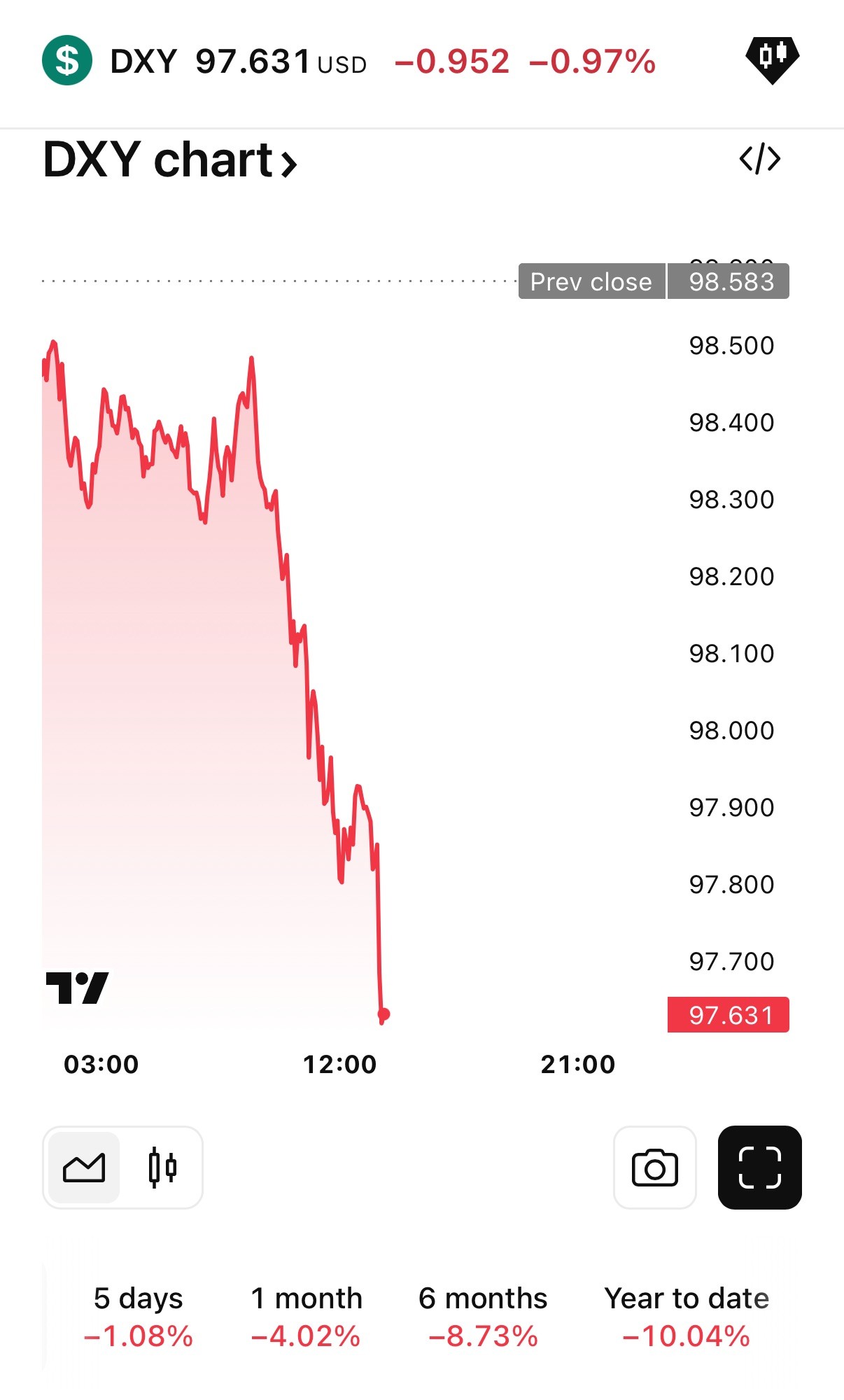

Dollar Falls to Lowest Since 2022 as Economic Outlook Dims

Another Day of U.S. Dollar Weakness

Today, June 12, 2025, marks another day where the U.S. dollar is experiencing weakness,

continuing a trend seen throughout the first half of the year. The U.S.

Dollar Index (DXY), which measures the dollar's performance against a

basket of other currencies, fell to 97.9029, down 0.74% from the

previous session. This puts the index at its lowest level in three

years.

Several factors are contributing to this decline:

- Anticipation of Federal Reserve Rate Cuts: While the Federal Reserve has not yet formally cut interest rates this year, market expectations of potential easing later in 2025 are applying downward pressure on the dollar. Data suggesting slowing inflation and a weakening labor market increase the likelihood of future rate cuts. Lower interest rates make U.S. assets less attractive to foreign investors seeking yield, reducing demand for the dollar.

- Persistent Trade Uncertainty: Renewed concerns over the fragility of a trade truce between the U.S. and China, fueled by potential new tariffs, are unsettling markets and weighing on the dollar. The risk of renewed price pressure is increasing.

- Geopolitical Risk and De-dollarization: Ongoing geopolitical instability, including trade conflicts and rising international tensions, contributes to global market volatility and encourages diversification away from the dollar.

- US Fiscal Concerns: Large government deficits and increasing national debt raise concerns about the long-term fiscal sustainability of the U.S., eroding confidence in the dollar.

- Weakening Economic Data: Data indicating a softening labor market and a pullback in service sector activity paint a less optimistic picture for the U.S. economy, further dimming the outlook for the dollar.

Impact of a Weaker Dollar:

- Precious Metals Rally: Gold and silver, traditionally viewed as safe-haven assets, are benefiting from the dollar's weakness. As the dollar declines, precious metals priced in dollars become more attractive globally, boosting demand.

- Shift in Investor Sentiment: The weakening dollar has led investors to adjust their strategies, with many opting for alternative investments and hedging their dollar exposure.

In

summary, the dollar's weakness is a result of a combination of factors,

including anticipated Fed rate cuts, trade policy uncertainty,

geopolitical risks, and economic concerns. This trend is impacting other

asset classes, notably boosting the value of precious metals

What market pricing near mid-year suggests is that even if de-dollarization fears are overblown, the dollar's exchange rate may be a necessary safety valve.

No comments:

Post a Comment