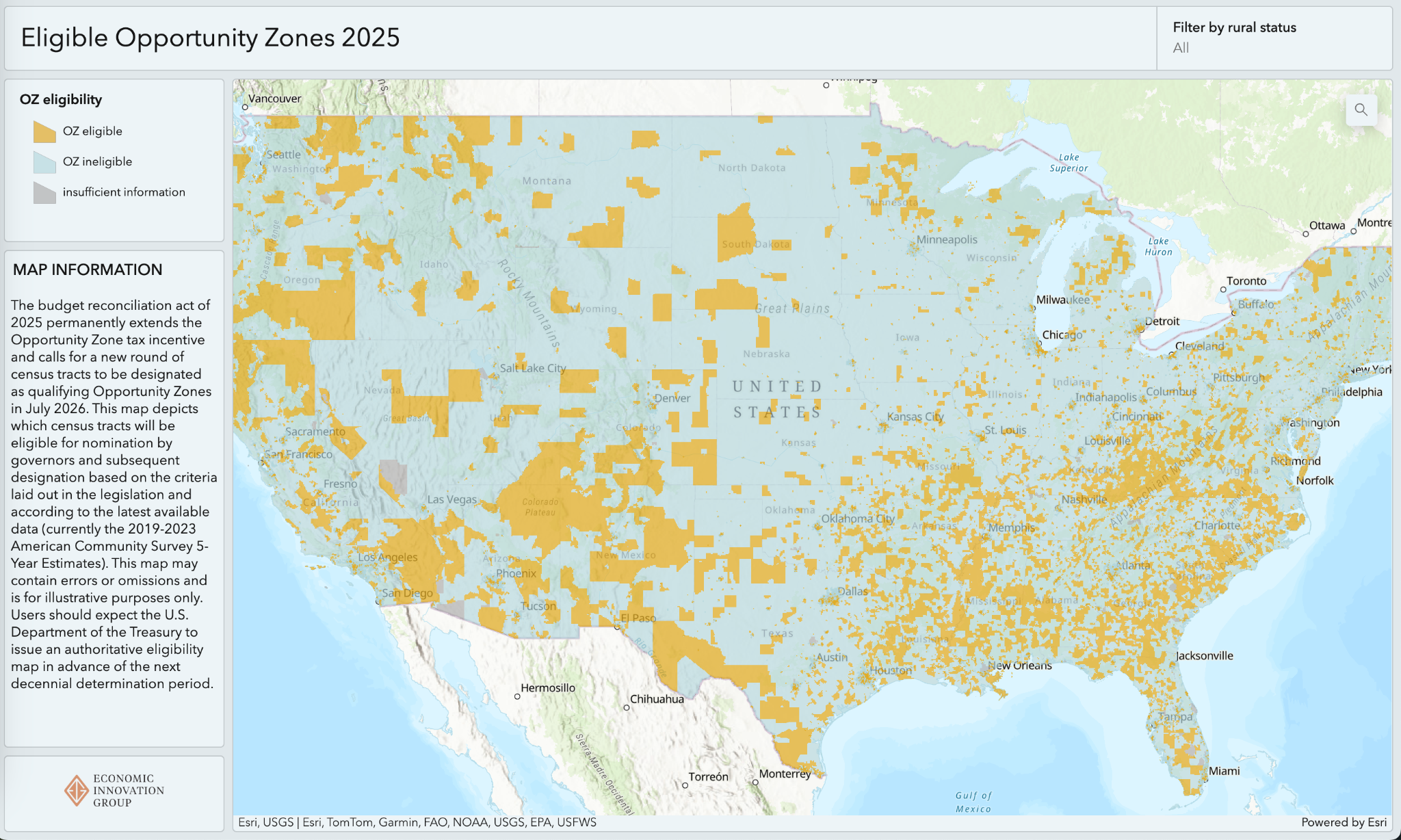

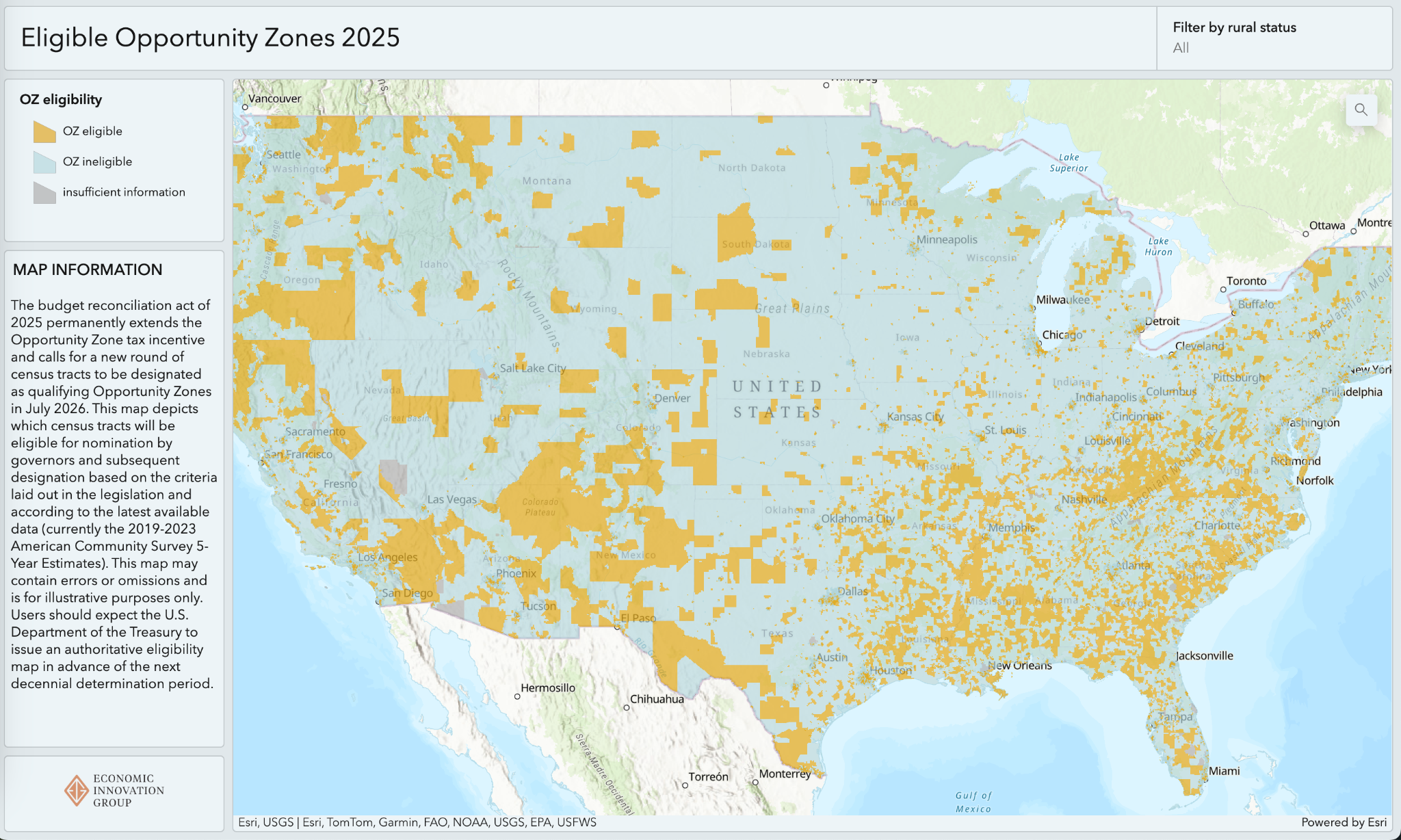

Opportunity Zones are now a permanent part of the U.S. tax code.

EIG

launched in 2015 with an ambitious goal: to revolutionize the way

federal policy supports investment and growth in distressed communities.

The idea for Opportunity Zones — first laid out in a white paper

coauthored by Kevin Hassett and Jared Bernstein — became EIG’s flagship

initiative and was soon enacted in the 2017 Tax Cuts and Jobs Act.

In

the years since, Opportunity Zones have driven more private investment

to more low-income communities — and delivered greater economic impact —

than any federal initiative of its kind over such a short period.

Now, with the passage of the One Big Beautiful Bill Act, Opportunity Zones have gone from a successful policy experiment to a permanent feature of the federal economic development toolkit.

- But

the OBBBA does more than simply make the OZ incentive permanent: it

incorporates a suite of EIG’s recommendations to enhance the policy’s

simplicity, certainty, targeting, and transparency, laying a strong

foundation for the decades ahead.

This

legislative milestone marks the culmination of years of work to expand

and strengthen the place-based policy toolkit in America. EIG is

immensely grateful to the dedicated network of practitioners throughout

the country whose insights have shaped our work, and to the lawmakers in

Congress whose leadership made this day possible.

— John Lettieri, President and CEO, Economic Innovation Group

No comments:

Post a Comment