To date, 17% of the companies in the S&P 500 have reported actual results for Q3 2017. In terms of earnings, more companies (76%) are reporting actual EPS above estimates compared to the 5-year average. In aggregate, companies are reporting earnings that are 0.6% above the estimates, which is below the 5-year average.

In terms of sales, more companies (72%) are reporting actual sales above estimates compared to the 5-year average. In aggregate, companies are reporting sales that are 1.0% above estimates, which is above the 5-year average.

The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth rate for the third quarter is 1.7% today, which is lower than the earnings growth rate of 2.0% last week. The downside earnings surprise reported by General Electric was mainly responsible for the decrease in the earnings growth rate for the index during the past week. Overall, six sectors are reporting earnings growth, led by the Energy and Information Technology sectors. Five sectors are reporting or are projected to report a year-over-year decline in earnings, led by the Financials sector. . . Overall, ten sectors are reporting or are projected to report year-over-year growth in revenues, led by the Energy, Materials, and Information Technology sectors. The only sector reporting a year-over-year decline in revenues is the Telecom Services sector.

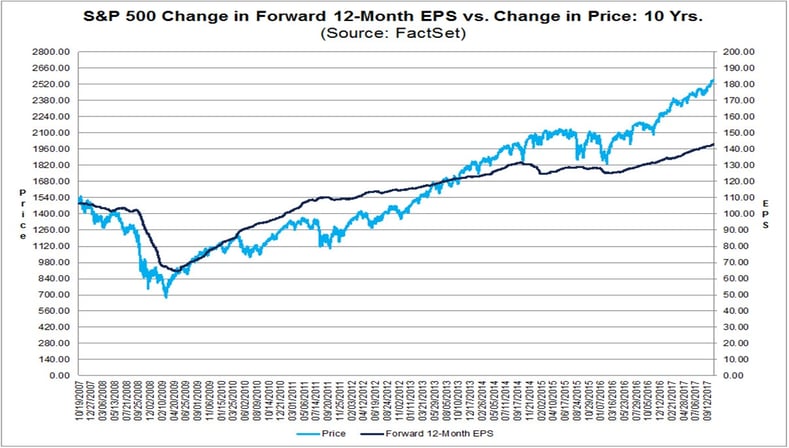

The forward 12-month P/E ratio is 17.9, which is above the 5-year average and the 10-year average.

No comments:

Post a Comment