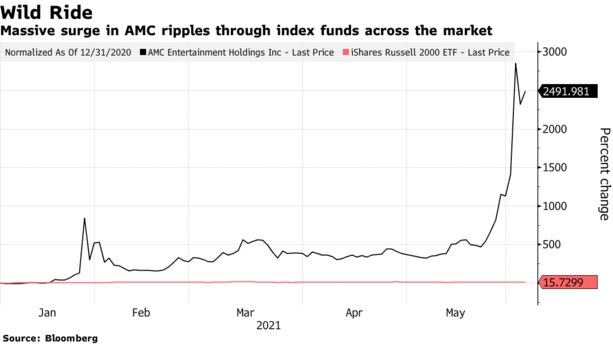

AMC Drama Is Exposing Risks in $11 Trillion World of Indexing

By and- Wild moves in meme shares are roiling the ETF market

- Scale of swings, fund plumbing lead to unintended exposures

“For index investing, the appeal is that human decision-making, human emotions are taken out of it,” said Tom Essaye, a former Merrill Lynch trader who founded “the Sevens Report” newsletter. . .

AMC shares currently stand at almost 10 times the level analysts see it trading a year from now: $5.25. The premium tops all Russell 3000 stocks that have enough of an analyst following to generate a price target, according to Bloomberg data, and more than double that of GameStop -- the next over-valued stock.

AMC will likely remain in many value funds until their rebalancing comes around.

“Research tells premiums such as those associated with small cap and value stocks are generally delivered by a subset of the asset class,” said Wes Crill at Dimensional Fund Advisors, a pioneer of quant investing which has $637 billion under management. “Style drift can reduce the odds of capturing the premiums when they appear.”

The obvious solution would be to rebalance more often. But that would bring more transactional costs to funds, which can be a big problem for passive vehicles charging rock-bottom fees.

AMC Stock Sale Comes With Warning to Traders: Be Prepared to Lose It All

By and- Company said entire investment may be lost in offering

- It’s uncommon to see such a dire warning in stock sale

Investing in AMC Entertainment Holdings Inc. comes with the promise of free popcorn, special screenings -- and the chance you’ll lose all your money.

That last part is a warning the movie chain and its lawyers made in a regulatory filing on Thursday announcing its intention to sell more than 11 million shares to a market dominated by frenzied retail traders.

While companies commonly use cautionary language when making share offerings, the extent of AMC’s was uncommon. It included an acknowledgment that the stock is at the mercy of the retail mania, with fundamentals playing little role in determining valuation.

“We believe that the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last,” AMC said in its filing Thursday. “Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.”

The movie-theater chain revealed that it plans to capitalize on the rally by selling up to 11.55 million shares to trim its debt load and finance future acquisitions. The tone in Thursday’s filing is starkly different than the one in its announcement a day earlier, when it said it would offer retail shareholders special perks as a reward for their loyalty.

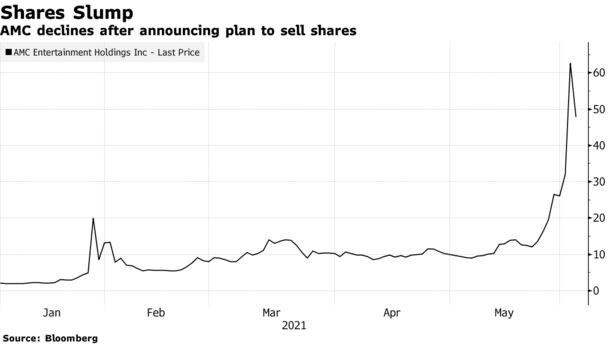

Shares of AMC plunged more than 30% as trading kicked off on Thursday, triggering a halt. They’re are still up more than 2,000% since the beginning of the year. This would be the company’s fourth stock sale of 2021. It sold shares this week to Mudrick Capital, which flipped them on the same day for a profit.

“When a company files to sell more than 11 million shares of stock, you wouldn’t expect to see the above statement connected to the offering,” Paul Hickey, co-founder of Bespoke Investment Group, wrote in a note.

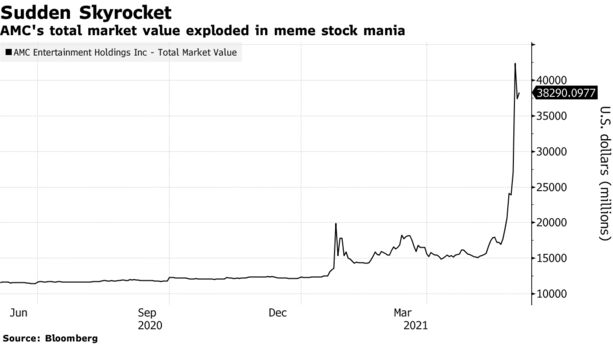

At its recent share price of around $60, AMC could raise $693 million as part of its offering, Hickey said. For perspective, AMC’s total market value at the start of 2021 was around $434 million.

No comments:

Post a Comment