UK offshore wind will be “more valuable” than North Sea oil ever was

"When the UK first began extracting oil and gas from the North Sea seabed in the 1970s, it was hoped that the resulting revenues could turbocharge a stagnating industrial economy into the modern age.

However, that is not quite what happened: not only did sterling’s status as a “petro-pound” further damage industrial communities by inflating the currency and pushing up the prices of UK exports, but successive governments have failed to wisely invest oil tax receipts.

While Norway has built up a $1.3trn sovereign wealth fund with its North Sea oil revenues, which will help pay for an ageing population for decades to come, the UK has only ever spent its profits on cutting national borrowing and keeping down taxes. This allowed Margaret Thatcher’s chancellor, Nigel Lawson, to cut top rate tax from 60p to the pound to 40p during the 1980s oil boom years. But such an approach has failed to give anything to future generations.

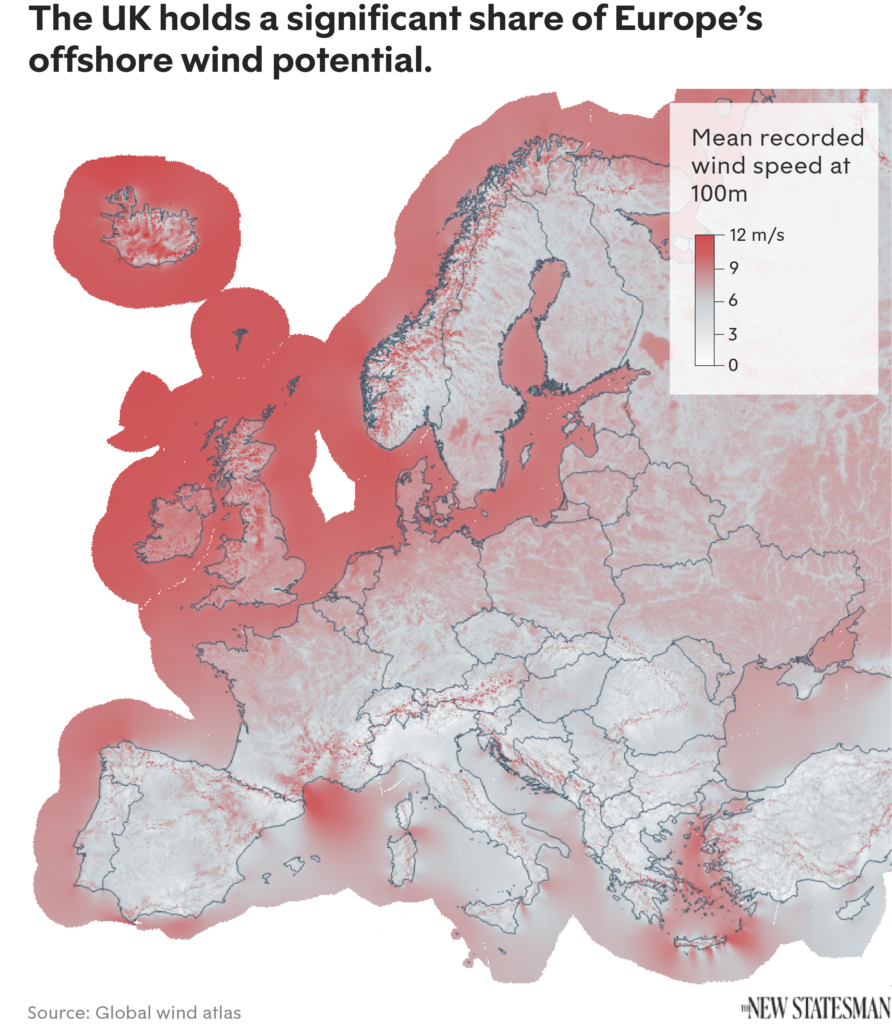

There is now, however, a second chance for a UK North Sea energy boom. Oil production is in rapid and terminal decline, irrespective of any new extraction plans being put forward by the UK government. Instead, future energy sovereignty and wealth will not come from fossil fuels, but from renewables, and the North Sea holds the majority of Europe’s offshore wind resources.

The UK is already the European leader for offshore wind and the sector is expected to grow considerably. Large offshore land leasing rounds by the Crown Estate and the Crown Estate Scotland have increased the UK offshore wind pipeline by 60 per cent in the past year, says industry group RenewableUK. The government recently announced its energy security strategy, which outlined an ambition for 50GW of wind power by 2030 – more than enough to power every home in the UK, and an indicator that yet more capacity is to be announced.

No comments:

Post a Comment