No doubt that many factors that influence consumer confidence are outside of our control.

Falling consumer confidence is a symptom rather than the cause of the recession. Consumer confidence is only a survey and people may become pessimistic for reasons not related to a change in economic fundamentals. Consumer confidence is based on qualitative surveys, where people carrying out research ask a sample of the population questions, . . .

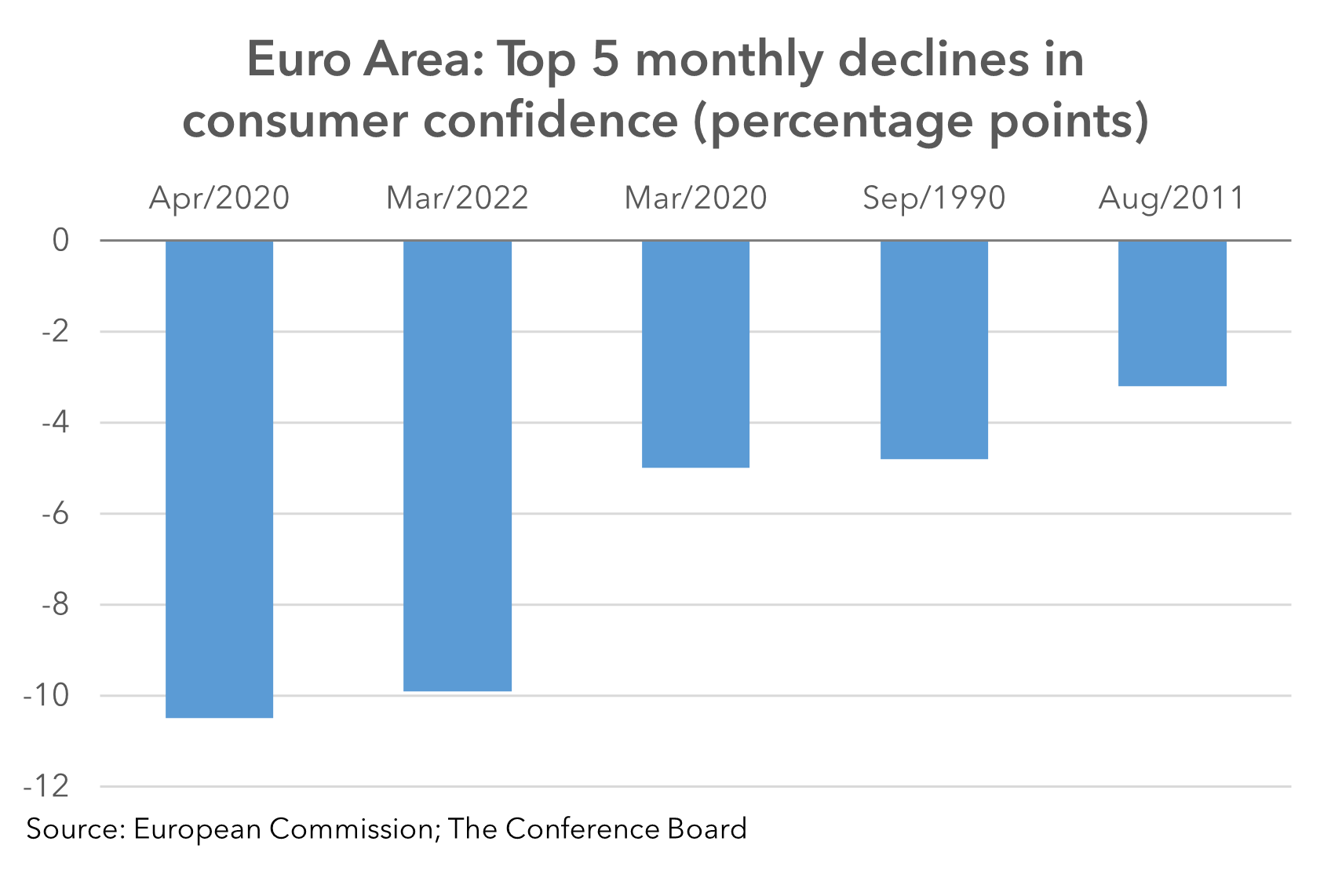

Early read on impact of war in Ukraine: Consumer Confidence in Europe plummets, but not uniformly

April 01, 2022 | Charts

Consumer confidence can influence the effectiveness of economic policy.

In theory, it is possible for consumers to ‘talk themselves into a recession‘. If people expect a recession, confidence drops, spending drops, creating a negative multiplier effect of lower growth and higher unemployment. This, in turn, causes more falls in consumer spending. Though in reality, consumers don’t expect a recession without some good reason. Recessions have more causes than an unexplained fall in confidence. However, the drop in confidence strengthens the underlying negative factors

The Political (And Economic) Origins of Consumer Confidence

US Consumer Confidence Hits 16-Month Low on Drag From Inflation

- Conference Board index sags to 98.7, lowest since February ‘21

- Expectations index plummets to worst in nearly a decade

> US consumer confidence dropped in June to the lowest in more than a year as inflation continues to dampen Americans’ economic views.

The Conference Board’s index decreased to 98.7 from a downwardly revised 103.2 reading in May, data Tuesday showed. The median forecast in a Bloomberg survey of economists called for a decline to 100.

=======================================================================

The monthly Consumer Confidence Survey®, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was June 22.

The Conference Board publishes the Consumer Confidence Index® at 10 a.m. ET on the last Tuesday of every month. Subscription information and the technical notes to this series are available on The Conference Board website: https://www.conference-board.org/data/consumerdata.cfm.

Latest Press Release

Updated: Tuesday, June 28, 2022

Consumer Confidence Falls Again in June

Index Drops to Lowest Level Since February 2021 as Expectations Continue to Decline

The Conference Board Consumer Confidence Index® decreased in June, following a decline in May. The Index fell to 98.7 (1985=100)—down 4.5 points from 103.2 in May—and now stands at its lowest level since February 2021 (Index, 95.2).

The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—declined marginally to 147.1 from 147.4 last month.

The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—decreased sharply to 66.4 from 73.7 and is at its lowest level since March 2013 (Index, 63.7). . .

Present Situation

Consumers’ appraisal of current business conditions was less favorable in June.

- 19.6% of consumers said business conditions were “good,” down slightly from 19.8%.

- 23.0% of consumers said business conditions were “bad,” up from 21.7%.

Consumers’ assessment of the labor market was mixed.

- 51.3% of consumers said jobs were “plentiful,” down from 51.9%.

- Conversely, 11.6% of consumers said jobs were “hard to get,” down from 12.4%.

Expectations Six Months Hence

Consumers grew more pessimistic about the short-term business conditions outlook in June.

- 14.7% of consumers expect business conditions will improve, down from 16.4%.

- 29.5% expect business conditions to worsen, up from 26.4%.

Consumers were more pessimistic about the short-term labor market outlook.

- 16.3% of consumers expect more jobs to be available, down from 17.5%.

- 22.0% anticipate fewer jobs, up from 19.5%.

Consumers were also more pessimistic about their short-term financial prospects.

- 15.9% of consumers expect their incomes to increase, down from 17.9%.

- 15.2% expect their incomes will decrease, up from 14.5%.

No comments:

Post a Comment