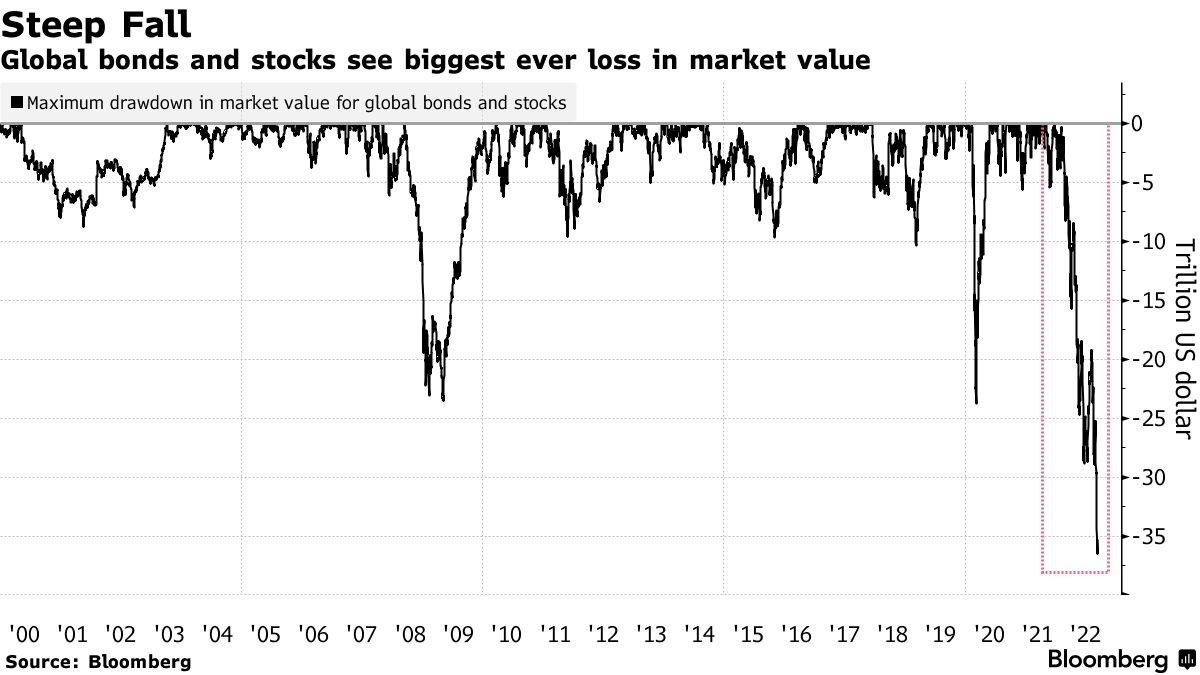

Reeling from a record $18 trillion wipeout, global stocks must surmount several hurdles if they are to escape a second straight year in the red.

After $18 Trillion Rout, Global Stocks Face More Hurdles in 2023

"More tech tantrums. China’s Covid surge. And above all, no central banks riding to the rescue if things go wrong. Reeling from a record $18 trillion wipeout, global stocks must surmount all these hurdles and more if they are to escape a second straight year in the red.

With a drop of more than 20% in 2022, the MSCI All-Country World Index is on track for its worst performance since the 2008 crisis, as jumbo interest rate hikes by the Federal Reserve more than doubled 10-year Treasury yields — the rate underpinning global capital costs.

Bulls looking ahead at 2023 might take solace in the fact that two consecutive down years are rare for major equity markets — the S&P 500 index has fallen for two straight years on just four occasions since 1928. The scary thing though, is that when they do occur, drops in the second year tend to be deeper than in the first.

History Favors S&P 500 Rally in 2023, But Any Drop Could Be Big

Here are some factors that could determine how 2023 shapes up for global equity markets:

Central Banks

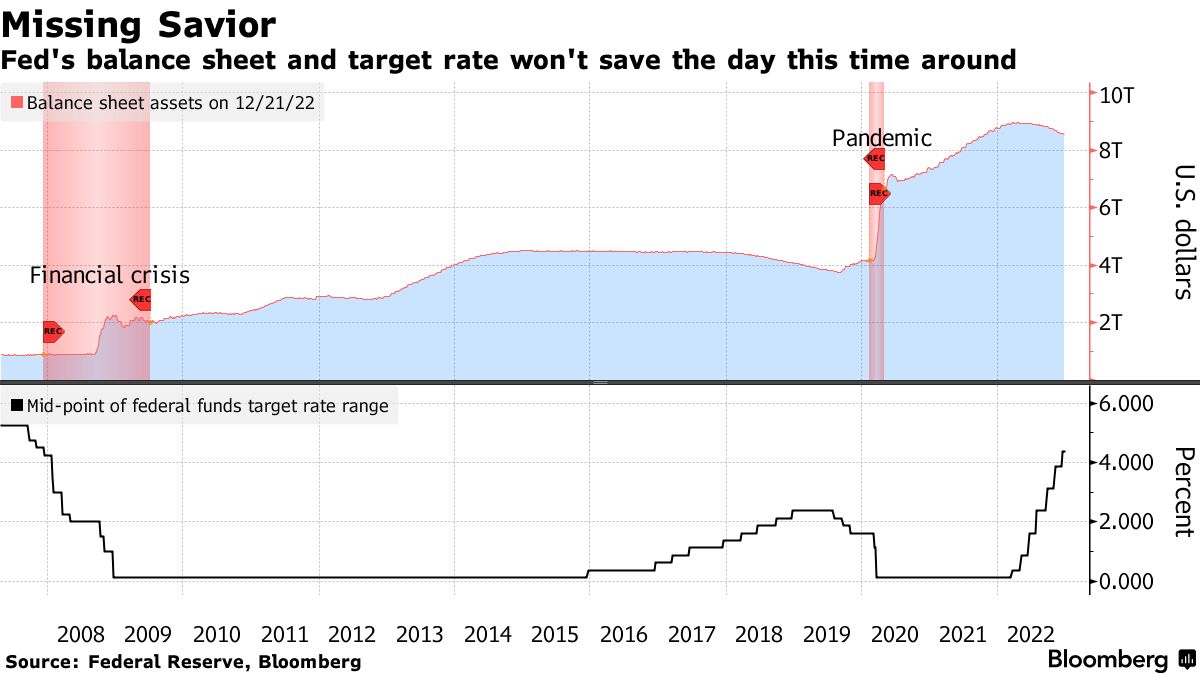

Optimists may point out that the rate-hiking peak is on the horizon, possibly in March, with money markets expecting the Fed to switch into rate-cutting mode by the end of 2023. A Bloomberg News survey found 71% of top global investors expect equities to rise in 2023.

Vincent Mortier, chief investment officer at Amundi, Europe’s largest money manager, recommends defensive positioning for investors going into the New Year. He expects a bumpy ride in 2023 but reckons “a Fed pivot in the first part of the year could trigger interesting entry points.”

But after a year that blindsided the investment community’s best and brightest, many are bracing for further reversals.

One risk is that inflation stays too high for policymakers’ comfort and rate cuts don’t materialize. A Bloomberg Economics model shows a 100% probability of recession starting by August, yet it looks unlikely central banks will rush in with policy easing when faced with cracks in the economy, a strategy they deployed repeatedly in the past decade.

“Policymakers, at least in the U.S. and Europe, now appear resigned to weaker economic growth in 2023,” Deutsche Bank Private Bank’s global chief investment officer Christian Nolting told clients in a note. Recessions might be short but “will not be painless,” he warned.

Big Tech Troubles

A big unknown is how tech mega-caps fare, following a 35% slump for the Nasdaq 100 in 2022. Companies such as Meta Platforms Inc. and Tesla Inc. have shed some two-thirds of their value, while losses at Amazon.com Inc. and Netflix Inc. neared or exceeded 50%.

Expensively-valued tech stocks do suffer more when interest rates rise. But other trends that supported tech’s advance in recent years may also go into reverse — economic recession risks hitting iPhone demand while a slump in online advertising could drag on Meta and Alphabet Inc.

From Amazon.com to Zoom

Technology stocks across the board suffered a market value meltdown

Source: Bloomberg

Note: Performance as of Dec. 28

In Bloomberg’s annual survey, only about half the respondents said they would buy the sector — selectively.

“Some of the tech names will come back as they have done a great job convincing customers to use them, like Amazon, but others will probably never reach that peak as people have moved on,” Kim Forrest, chief investment officer at Bokeh Capital Partners, told Bloomberg Television.

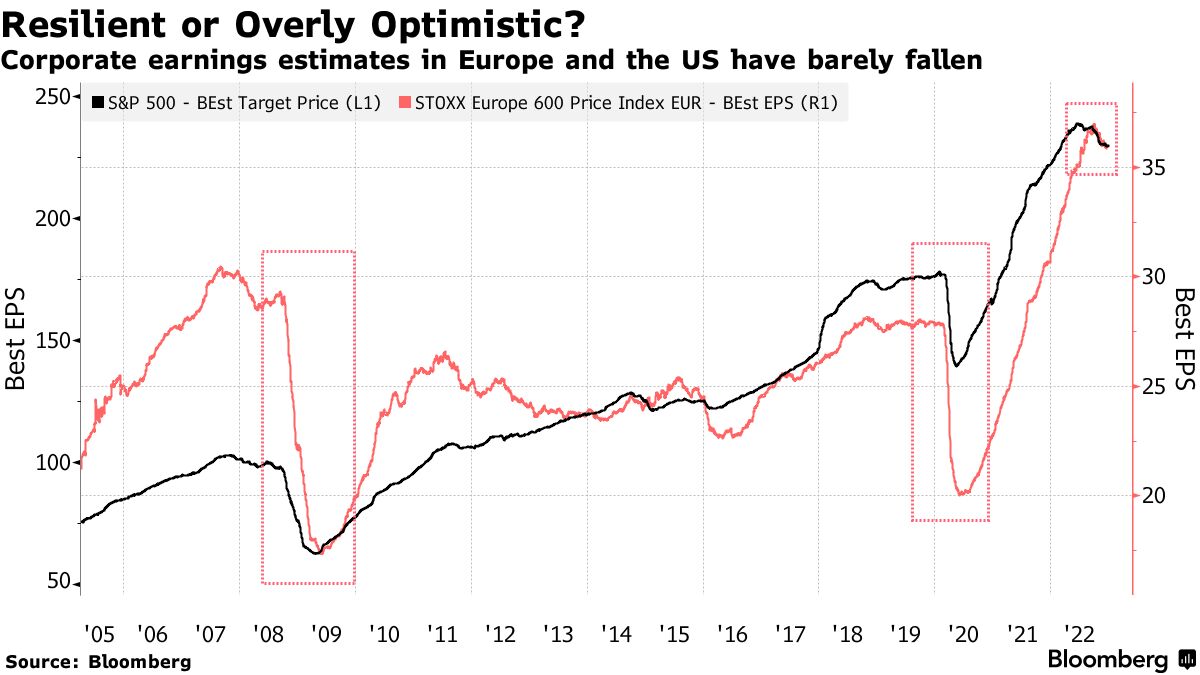

Earnings Recession

Previously resilient corporate profits are widely expected to crumble in 2023, as pressure builds on margins and consumer demand weakens.

“The final chapter to this bear market is all about the path of earnings estimates, which are far too high,” according to Morgan Stanley’s Mike Wilson, a Wall Street bear who predicts earnings of $180 per share in 2023 for the S&P 500, versus analysts’ expectations of $231.

The upcoming earnings recession may rival 2008, and markets are yet to price it in, he said.

Delicate China

Beijing’s early-December decision to dismantle stringent Covid curbs seemed like a turning point for MSCI’s China Index, whose 24% drop was a major contributor to global equity market losses in 2022.

But a month-long rally in mainland and Hong Kong shares has petered out as a surge in Covid-19 infections threatens economic recovery. Many nations are now demanding Covid testing for travelers from China, a negative for global travel, leisure and luxury stocks.

Options Boom

Technicals are increasingly driving day-to-day equity moves, with the S&P 500 witnessing below-average stock turnover in 2022, but explosive growth in very short-term options trading.

Professional traders and algorithmic-powered institutions have piled into such options, which were until recently dominated by small-time investors. That can make for bumpier markets, causing sudden volatility outbreaks such as the big intraday swing after October’s hot US inflation print.

Finally, with the S&P 500 failing to break out from its 2022 downtrend, short-term speculation remains skewed to the downside. But should the market turn, it will add fuel to the rebound."

— With assistance by Ryan Vlastelica and Ishika Mookerjee

READ MORE

Stocks still have one more hurdle before the ‘bullish promised land,’ Cramer says

- CNBC's Jim Cramer highlights trade as a lingering obstacle for Wall Street's bulls.

- The Federal Reserve may have walked back its interest rate hike plans, but now, investors have to keep an eye on the G-20 summit, the "Mad Money" host says.

- Many people are hoping for a resolution on U.S.-China trade as President Donald Trump prepares to meet with China's leader.

Even though the Federal Reserve has now acknowledged the importance of data-dependent interest rate policy, CNBC's Jim Cramer said Wednesday that the stock market isn't quite out of the woods yet.

Stocks soared after Fed Chair Jerome Powell's Wednesday speech, in which the central bank chief said interest rates were "just below" neutral, a reversal from his October stance that they were "a long way" from the Fed's goal.

But for Cramer, there's a more complicated hurdle that "we need to jump to reach the bullish promised land," he said on "Mad Money."

"We've checked off the Jerome Powell box. He won't be the cause of the major slowdown, not after today," he said. "However, we still have the G-20 summit - China - and this is actually a much tougher nut to crack."

President Donald Trump and Chinese President Xi Jinping are expected to meet at G-20 to discuss U.S-China trade policy. The summit of the world's economically developed nations will take place in Buenos Aires, Argentina.

The two countries have traded tariffs on each other's exports in the latter half of 2018, leaving investors unsure of what will become of U.S.-China relations. U.S tariffs on roughly $200 billion worth of Chinese goods are set to rise from 10 percent to 25 percent at the end of the year, and Trump has threatened further rounds of tariffs.

"We don't know what the president's going to do" at the summit, Cramer said. "My educated guess? Trump will say that he's not satisfied with what the Chinese are doing so far, so he's going to ... increase [the tariffs] from 10 to 25 percent. However, he'll also extend an olive branch, which is that he'll be willing to hold off on applying his tariffs to the other half of China's U.S.-bound exports."

Cramer, who agrees that China's unfair trading practices warrant some sort of retaliation but doesn't necessarily think the Trump administration's plan is the best bet, said a no-deal result at G-20 would only create a small "hiccup" in the rally.

But "if I put my stock hat on, I want to see some sort of deal with China because that's good for business," he said. "Maybe they lift a lot of their trade restrictions and we don't need to raise the tariff to 25 percent. Wouldn't that be great for the market? But I don't think the Chinese will bite."

But with the Fed issue now at bay, Cramer said the most toxic issue for the stock market was now gone and, depending on G-20, stocks could see brighter days from here.

"Regardless of what the president's saying about him, Powell is a rigorous thinker, a flexible leader, a good guy, and today, he may have given both the economy and the stock market a new lease on life, provided that the president's G-20 foray doesn't end with the White House getting even more bellicose on China," the "Mad Money" host said. "The last thing the stock market needs is an iPhone tariff. Today, though, was a win. A big, fat W. Enjoy it."

From CNBC

READ More

Top Stories

Most Recent

White Papers View All

Webinars View All

Actionable ideas for a volatile world

Presented by: Derek Hamilton, Daniela Mardarovici, CFA, Kimberly A. Scott, CFA & Gregory A. Gizzi

January 11, 2023 at 02:00 PM EST – Length: 60 Minutes

approved for 1.0 CE credits

Charting Disruption 2023

Presented by: Mayuranki De & Tejas Dessai

January 31, 2023 at 02:00 PM EST – Length: 60 Minutes

approved for 1.0 CE credits

.jpg)

.jpg)

.jpg)

No comments:

Post a Comment