Recession Risk Looms Large as Bond Markets Price in Steeper Rate Hikes Globally

Resilient economies, stubborn inflation reshaped the outlook

Some central banks in pause mode, gauging lagged effects

"Forget about interest-rate cuts. The bond market is now pricing in a steeper path for monetary tightening by central banks around the world, raising the danger of recessions as policymakers struggle to bring inflation under control.

Just weeks ago, traders were expecting almost every developed-market central bank to cut benchmark rates within a year, the swaps market showed."

Emerging-market central banks have tried to strike a difficult balance, and are largely looking for the opportunity to pause tightening. For the major central banks in the US and Europe, however, the only way is up.

“We think central banks have more work to do,” Luigi Speranza, BNP Paribas SA chief economist, said in a report Tuesday. “We continue to believe that rate cuts by major central banks remain off the table for the rest of the year.”

Europe’s Surging Inflation Bets Undercut Lagarde’s Rate Campaign

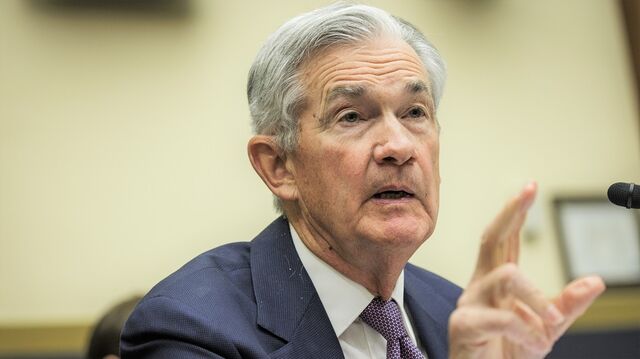

. . .Prompting the shift: a raft of developments that showed Federal Reserve Chair Jerome Powell and a number of his counterparts may need to step up efforts to contain the worst cost-of-living surge in decades. Central banks again appear on the back foot as a resilient US job market, China’s post-pandemic reopening and a mild European winter combine to keep price pressures hot.

“It feels at this juncture that many central banks are still behind the curve and there’s a lot of catching up to do,” Catherine Yeung, Hong Kong-based investment director at Fidelity International, told Bloomberg Radio Wednesday."

RELATED CONTENT

Schwab Market Update: Stocks Reversing Earlier Gains

Looking to the Futures: Powell Scares the Market with his Words of Wisdom

Day Two of Powell's Testimony Keeps Fed Uncertainty High

.jpg)

.jpg)

.jpg)

.jpg)

No comments:

Post a Comment