History Suggests Defense Stocks Will Surge In 2022

Summary

- Historical cycles in the sector indicate that aerospace and defense stocks are positioned for a major, multi-year rebound.

- A mounting list of geopolitical and economic items appear on our Wall of Worry.

- Goldman Sachs called defense one of their top sector plays for 2022.

Shutter2U/iStock via Getty Images

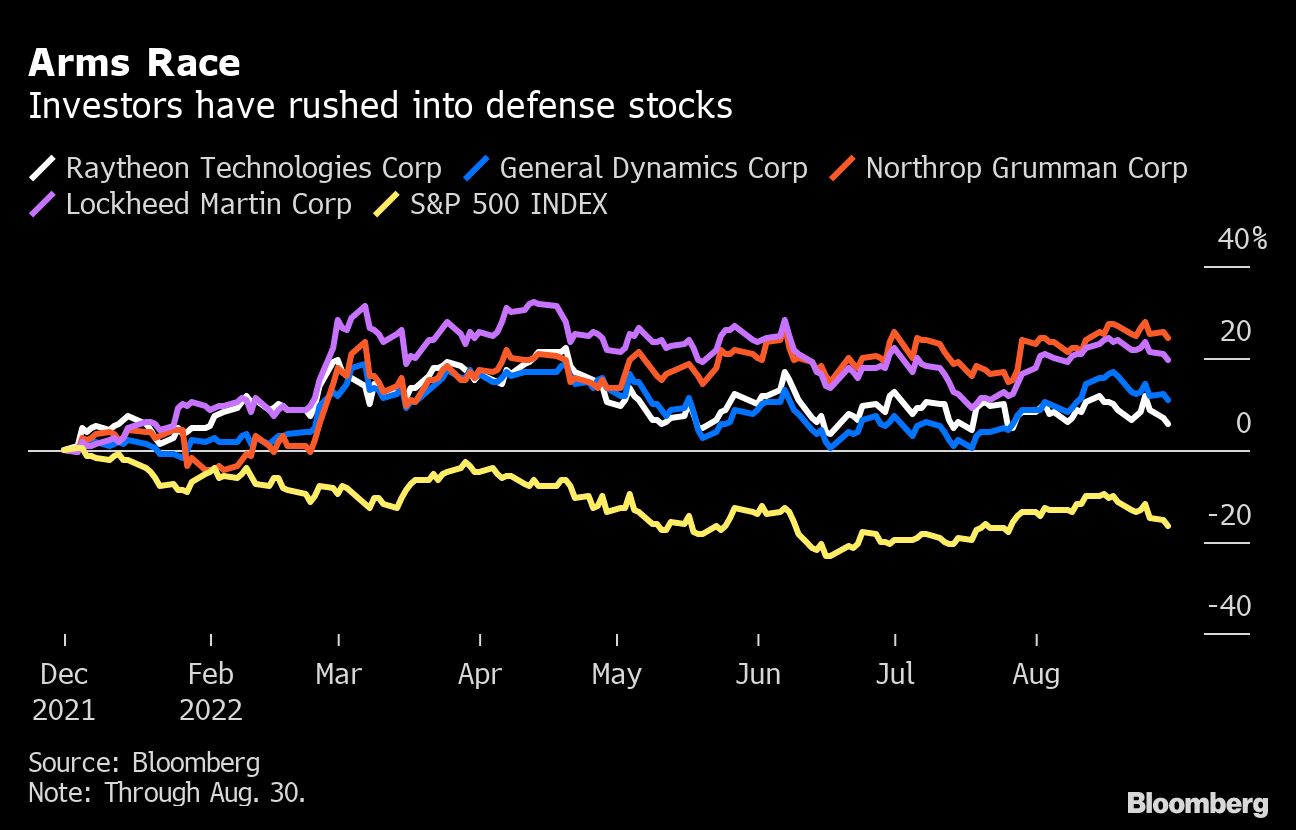

Investors in defense stocks have continued to see their portfolio grow but compared to those investing in the broader market, they have underperformed. Our thesis maintains that defense stocks are set to surge in 2022 and investors should consider going long. We've begun to see an uptick in the volume for the Invesco Aerospace and Defense ETF (NYSE: PPA) in recent months. And looking at the various ETF products in this thematic space, it is interesting that AUM (asset under management) levels have plateaued and been stable at these levels. It is perhaps a sign that everyone who wanted to sell, has done so. The sector appears to be just waiting for buyers to rediscover it. Goldman Sachs agrees and just called it one of their top sector plays for 2022.

A Mounting Geopolitical and Economic Wall of Worry

(in no particular order)

- China annexes Taiwan

- Russia invades Ukraine

- Russia invades Kazakhstan

- Russian submarines disrupt undersea communications cables (a concern raised by the UK)

- Mid-East conflagration (pick your combatants)

- A worsening China-US cold war relationship expands to debt / currency issues

- Joe Biden takes ill

- US social unrest leads to armed conflicts

- North Korea saber rattling to generate attention

- Iran's nuclear development

- Afghanistan: The crisis after the conflict. What direction does it take?

- A significant cyber war incident traced to a nation/state

- Congress targets defense spending to pay for social programs

- New variant of COVID has Omicron-like spread but more deadly

- Inflation (how fast, how high)

- Rise of fascist-leading political leaders worldwide

- Terrorist incidents delayed by COVID travel restrictions targeting Western nations return

Before discussing why 2022 could be the year for defense stocks, it's important to understand the reasons why the prior year was comparably lackluster. In 2021, the SPADE Defense Index returned more than 7% including dividends. To put that in perspective, it was a down year for defense relative to the broader market but consistent with the historical return for equities.

Over the past couple of years, the attention of most investors, and people in general, centered on the pandemic, and rightly so. Focusing on the disruptions to the economy and the technologies that would enable us to work and interact more remotely proved to be highly profitable. As did investments that tried to time the recovery. However, market gains have been uneven with a few companies driving the broader markets higher. Many investors today are wondering how much growth is left in these stocks. When it came to the defense, since 2020 there were few events to really drive it higher. Additionally, the sector faced headwinds that they might have been able to overcome more rapidly were it not for the pandemic.

To address this in more detail…over the past several years, defense budgets in the United States have remained strong and stable but there was little positive news to provide fuel to the sector after eight consecutive years of returns that beat the market. Right before the pandemic, Boeing was investigating the flight worthiness of its new 737 MAX 8 aircraft following two crashes that put deliveries on hold. Were it not for the pandemic, the review, testing, engineering changes, and approval for the plane to return-to-flight might have happened more quickly. But with a dramatic reduction in the need for commercial air travel and cargo transport due to a slowing global economy-and the key word here is need-the approval stretched on for months. The impact of this was felt hard across the sector as many defense contractors and suppliers participate in the production of aircraft, helicopters, and related vehicles. This led to sporadic supply chain issues and, with Boeing holding off on delivering commercial aircraft, manufacturing activity slowed. The latter half of 2021 saw the return to more normal production levels, the delivery of aircraft, and new orders coming in from airlines. As we begin to emerge, or at least get used to, living life under a pandemic, air travel is making progress toward a return to normal. While still far from pre-pandemic levels, a growing air traffic market will solidify the balance sheets of world's airlines-providing them with the resources needed to modernize and upgrade their air fleets.

One benefit of the pandemic was that nations around the globe were more focused on managing the internal medical and societal issues related to COVID-19 and less interested in border and international conflicts. Or at least, the mainstream media covered these less. Even the pullout of US troops from Afghanistan quickly left the news cycle. But the trade statistics are consistent with a quiet period for military action and planning. According to the US State Department, sales of US military equipment to foreign governments during FY20 fell 21% to $138 billion after rising for the past decade.

However, as we venture into the early part of 2022, this is changing. Tensions in areas around the world are beginning to rise. Russia has moved troops to the Ukrainian border and supplied peacekeepers to Kazakhstan. China and the US appear to be expanding their cold war rhetoric and there are rising concerns that 2022 could be the year that China annexes Taiwan. And the stress of pandemic inequalities is seeing increasing unrest in the Middle East as well as social unrest here in the United States. This return to fear and uncertainty is a business environment that should directly impact defense firms, translating into a return of the international sales growth that the sector has seen in recent years. The reaction by France to an announced partnership between the US and the United Kingdom with Australia on submarine development highlights just how important international defense sales are to maintaining a healthy industrial base.

With stable military budgets in the United States, expanding international defense sales, and a return to an expansion phase for commercial aircraft deliveries, we see 2022 being a great one for defense stocks.

Historical data back this thesis

The SPADE Defense Index has performance data on the sector back to 1997 and using this we have identified two previous cycles. In 1998 and 1999, defense stocks underperformed the return of the S&P500 by more than 24%- though it produced a positive return of 23% over those two years. What followed was a nine-year run higher which saw the defense sector outperform the market by several hundred percent. This was followed by a three-year period of underperformance of around 8%-but which saw the SPADE Defense Index gain 30%. This was subsequently followed by eight consecutive years in which the defense sector gained more than 200%, outperforming the market by more than 70% before the current 2020-2021 underperformance-during which time, the index still rose more than 13%.

DXS Return | DXS vs. SPY500 | |

1998-1999 | 22.96% | 51.41% |

2000-2008 | 61.92% | [38.53%] |

2009-2011 | 29.75% | 39.22% |

2012-2019 | 284.84% | 156.90% |

2020-2021 | 5.83% | 47.53% |

A lot of numbers, but what the pattern says is after a 2-3-year decline, defense stocks have historically come roaring back and produced outsized returns for a number of years. Even during the years that defense stocks underperformed the market, those who invested in a portfolio of aerospace and defense stocks still managed a positive return most of the time. In 19 of the past 25 years, the SPADE Defense Index has been positive-with half the years providing double digit gains. And of the five calendar years that the Index levels declined, three were by less than 3%. Growth while waiting for a reversion to the historical mean could be a winning strategy.

So, what can derail it?

There are of course a number of external factors that bear watching. A broad stock market drop due to a declining economy or rising interest rates could pull all securities lower in the short-term. However, over the long term, defense stocks as a whole tend to be less sensitive as (A) its largest customer-government-can literally print new money; (B) defense firms typically maintain low debt ratios, which should protect them from rising interest rates; and (C) many defense contracts come with inflation escalation clauses. As to what would derail the sector over a longer period, the key is political will and whether Congress would reduce spending on defense and security in order to fund new social programs. While a minority in office favor doing just this, they are still just a small minority. Yet as US politics has revealed, sometimes a minority can direct the agenda and rule. Security and the safety of the nation has importantly, never been out of favor for long.

How to Play It

Investors should consider the Invesco Aerospace & Defense ETF (PPA), which tracks the benchmark SPADE Defense Index or one of the 53 companies that comprise the index-including defense prime contractors Lockheed Martin (LMT), Raytheon Tech (RTX), Northrop Grumman (NOC), and Boeing (BA). An ETF competitor from iShares (ITA) holds more than 40% of its assets in just two stocks-a concentration that can either juice or significantly limit performance.

Conclusion

There are a number of trends that indicate that defense investors are about to rewarded for their patience.

____________________________________________________________________________________

__________________________________________________________________________________

Uncle Sam Is Going to Hand Us a 13% Winner

Postcards from the florida republic: An independent and profitable state of mind.

You’ve got to hand it to the Keynesian economists. Every chance they get, they’ll spend money we don’t have and praise themselves for doing it. Last week, it was these White House economists writing a paper to celebrate record government spending.

This week, it’s Treasury Secretary Janet Yellen.

- 0In a recent “trip” to China, Yellen reportedly dined on jian shou qing psychedelic mushrooms, a Yunnanese delicacy.

- Of course, she said that it would be great to end the war - but the war is good for the economy.

- It’s a never-ending commitment to the “broken window” fallacy of her economic ideology. Break things, replace things, then brag about economic growth (despite the glaring inefficiencies of resource use).

- This war will extend into 2024.

- It will be used as an excuse to keep pumping money to Ukraine, even while the streets of Philadelphia look more and more like actual warzones.

There’s money in this ugly side of humanity - the things that Yellen and our government continue to embrace.

War: A For-Profits Industry

The United States has been in a perpetual state of war and conflict since the 1960s.

Even though many people want world peace, we have yet to achieve it.

Money’s always involved in war, defense, and other unpleasant things happening worldwide. Right now, the United States is engulfed in a series of rising geopolitical tensions.

In 2023, the U.S. military supported Ukraine in a proxy war against Russia. The U.S. has shipped billions of dollars in military equipment, including arms, missiles, and tanks. If Yellen had her way, we’d double the money we’re sending to Europe. Meanwhile, the Pentagon just called up reservists in what could be a signal for further escalation.

But those are not the only theaters in which the U.S. operates.

We maintain heightened tensions with North Korea… and we

remain on heightened guard in the Middle East after a 20-year occupation in Afghanistan ended in fiasco in 2021.

Over the last 20 years, the United States military budget has increased by hundreds of billions. Although military spending represents a smaller share of GDP than in 2010 (3.5% today compared to 5% then), investors should anticipate the Pentagon will continue to spend a hefty amount of taxpayer dollars next year… and in the decades ahead.

Over the last 20 years, the United States military budget has increased by hundreds of billions. Although military spending represents a smaller share of GDP than in 2010 (3.5% today compared to 5% then), investors should anticipate the Pentagon will continue to spend a hefty amount of taxpayer dollars next year… and in the decades ahead.The chart above shows how the annual U.S. military spending has roughly doubled over the last 15 years. Don’t expect this trend to subside in the future.

$68 Billion in Revenue… Another $180 Billion in the Back Pocket

- The product of a 2017 merger between Raytheon and United Technologies, the company generates more than $68 billion in annual revenue.

- RTX maintains a massive backlog of projects worth $180 billion.

- As previously noted, the Pentagon is seeking a big boost to global defense spending—a whopping $886 billion in taxpayer money. Many of the products that the Pentagon is seeking to increase spending around are Raytheon designs.

- To put into perspective how lucrative this contract is, consider that the F35 program doesn’t sunset until the year 2070.

- The company also produces the Javelin Weapon System, which has been essential in the ground war in Ukraine to target Russian tank systems.

Raytheon Technologies (RTX) is one of those stocks that you might hold your nose and buy under $95. Wall Street maintains a price target of roughly $110, representing a nearly 13% upside from today’s current price.

Stay alert,"

Country ETFs and ETNs Seeking Alpha

Today column is in real-time. Otherwise as of previous close.

MARKET DATA Seeking Alpha

U.S. Sector

U.S. Sector - Small Cap

Global Sector

Today column is in real-time. Otherwise as of previous close.

No comments:

Post a Comment