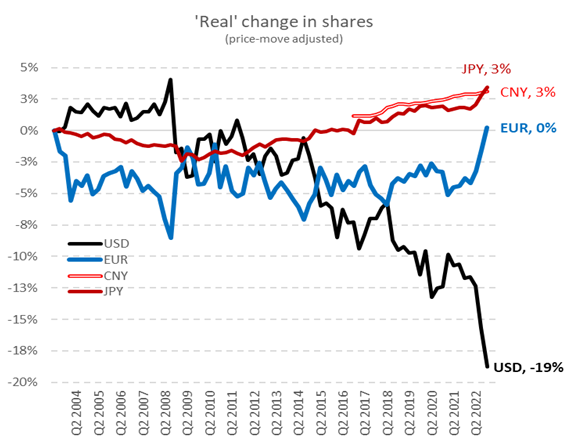

- The dollar's share of global foreign-exchange reserves has slumped from 72% to 59% over the past 23 years, according to data from the International Monetary Fund, heightening fears that the US could see a massive source of economic power slip away.

- While the US today accounts for only 25% of global output, the dollar remains involved in nearly 90% of all foreign-exchange transactions.

- Despite its central role in cross-border trade and borrowing, however, the greenback’s share of central-bank foreign-exchange reserves has fallen from 72% in 2000 to 59% today.

The biggest threat to the dollar is the US itself, top economist Benn Steil warns

- De-dollarization talk has gathered steam this year, with China and Russia both trying to undermine the greenback.

- But the US itself poses the biggest threat to the buck's dominance, according to Benn Steil.

- Debt-ceiling standoffs and “growing weaponization” could undermine the currency, he said.

In an op-ed for Project Syndicate Wednesday, the economist warned that political deadlocks and the "growing weaponization" of currencies will help to fuel dedollarization, which refers to a co-ordinated effort by other countries to chip away at the greenback's dominance.

"The biggest threat to the dollar's dominance comes not from competitive alternatives, but from the US government itself," Steil, who's the director of international economics for the Council on Foreign Relations, wrote.

- In late May, the Biden administration and House of Representatives reached an 11th-hour deal to prevent the US government from defaulting on its debts – and ratings agency Fitch responded to the deadlock by slashing the US's credit score earlier this month.

- The dollar's share of global foreign-exchange reserves has slumped from 72% to 59% over the past 23 years, according to data from the International Monetary Fund, heightening fears that the US could see a massive source of economic power slip away.

Instead, the economist is more worried about political issues diminishing the buck's appeal.

Earlier this month, ratings agency Fitch slashed the US's credit score after warning the first-half debt-ceiling standoff exemplified a "steady deterioration in standards of governance".

Meanwhile, the Biden administration has also worked the currency into its efforts to aid Ukraine, cutting Russia's banks out of the SWIFT payments system and freezing Moscow's dollar reserves after Vladimir Putin invaded the country in February 2022 – a so-called "weaponization" that's earned rebukes from figures ranging from Steil to Elon Musk.

"Just as the overuse of antibiotics fuels antimicrobial resistance, excessive use of sanctions prompts targeted countries, as well as potential targets, to reduce their engagement with the US financial system," Steil wrote.

___________________________________________________________________________________

The Real Cost of De-Dollarization

Despite its current challenges, the US dollar’s status as the world’s main reserve currency remains integral to the multilateral trade system as we know it. While there are currently no viable alternatives that could usurp the greenback, the biggest threat to its hegemony comes from the US government itself.

- Given recent harsh criticism of US currency policy by officials in China, Russia, Brazil, Saudi Arabia, and elsewhere, it may therefore appear that the dollar’s uncontested reign is coming to an end, with far-reaching global economic consequences.

- The prospect of endless repetition of such reckless partisan conflict prompted Fitch Ratings to downgrade the country’s credit rating from AAA to AA+, highlighting doubts about whether global investors can continue to trust the “full faith and credit of the US government.”

- But an even more immediate threat to the greenback’s dominance is its growing weaponization. Whereas US-led sanctions have been largely ineffective in changing the behavior of autocratic regimes in North Korea, Iran, and Russia, they have inflicted considerable economic pain. And just as the overuse of antibiotics fuels antimicrobial resistance, excessive use of sanctions prompts targeted countries, as well as potential targets, to reduce their engagement with the US financial system. Although this avoidance is costly, the costs are trivial compared to those of, say, having one’s central-bank reserves frozen, or even seized. Prominent US commentators have advocated such seizures in the case of Russia, in order to compensate Ukraine for the horrific costs of Russia’s invasion.

- Its appeal, however, is undermined by the fragmentation of Europe’s national sovereign-debt markets, as well as lingering doubts about the European Union’s long-term viability in the wake of the UK’s departure. . .

To be sure, countries can sidestep the dollar through barter trade, using commodities such as gold or oil. Iraq, for example, swaps oil with Iran in exchange for natural gas.

- But governments will not accumulate currencies for which they and their citizens have no practical use.

- Thus, the greenback’s fading dominance could mark the demise of a highly efficient structure of global commerce in which the flow of goods and services is determined by cost and quality.

- Instead, this flow would reflect whether a bit more or less of a given foreign currency is wanted in an exporting country.

Once countries abandon the practice of stockpiling currency through current-account surpluses, they are compelled to implement trade restrictions and other distortive measures to maintain flat bilateral trade balances.

- That is why the dollar, despite its drawbacks as a global reserve currency, remains integral to the multilateral trade system built up under the 1947 General Agreement on Tariffs and Trade and its successor, the World Trade Organization. Although this regime is often criticized in the US for helping China rise through mercantilist means, it has played a critical role in spurring global innovation, reducing costs, and lifting hundreds of millions out of poverty.

Although the US can and should do more, through better education and job training, and stronger social safety nets, to support its citizens left behind by globalization, it must also ensure that its currency remains reliable enough to continue supporting world trade. That means putting an end to periodic partisan default brinkmanship, and exercising greater prudence and restraint in the use of unilateral financial sanctions.

No comments:

Post a Comment